MASSIVE #BITCOIN PUMP SOON?? 🔥🔥🔥

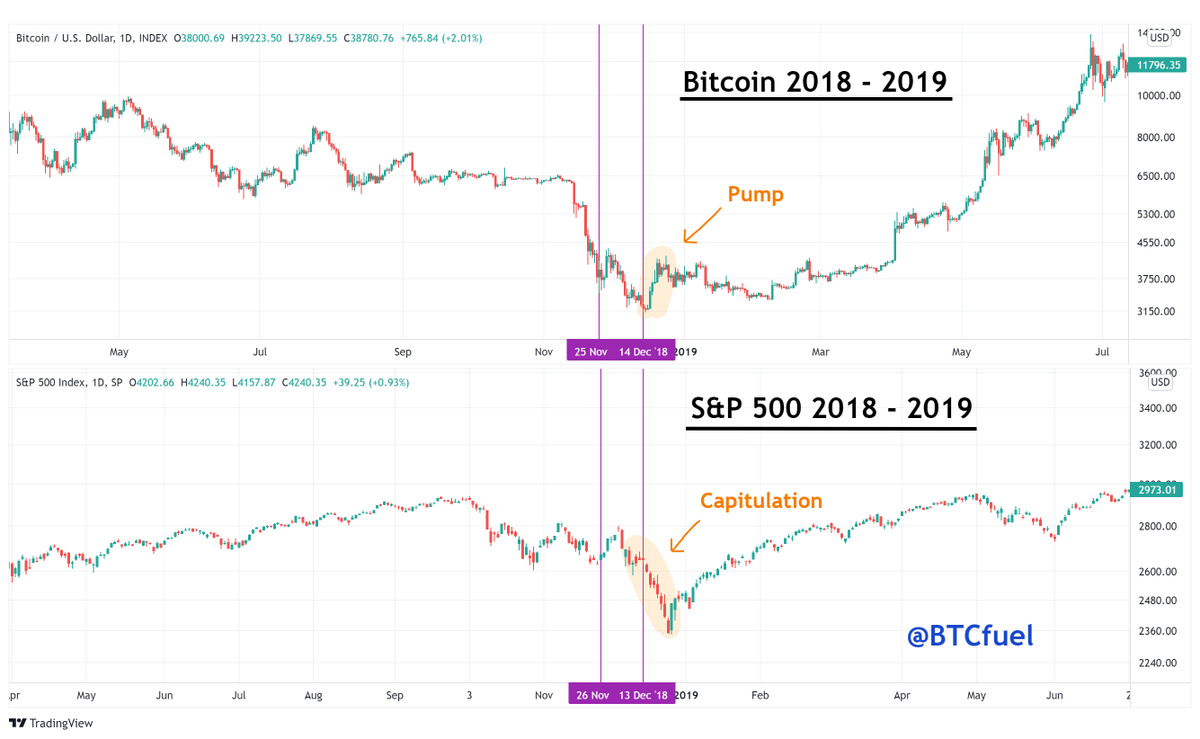

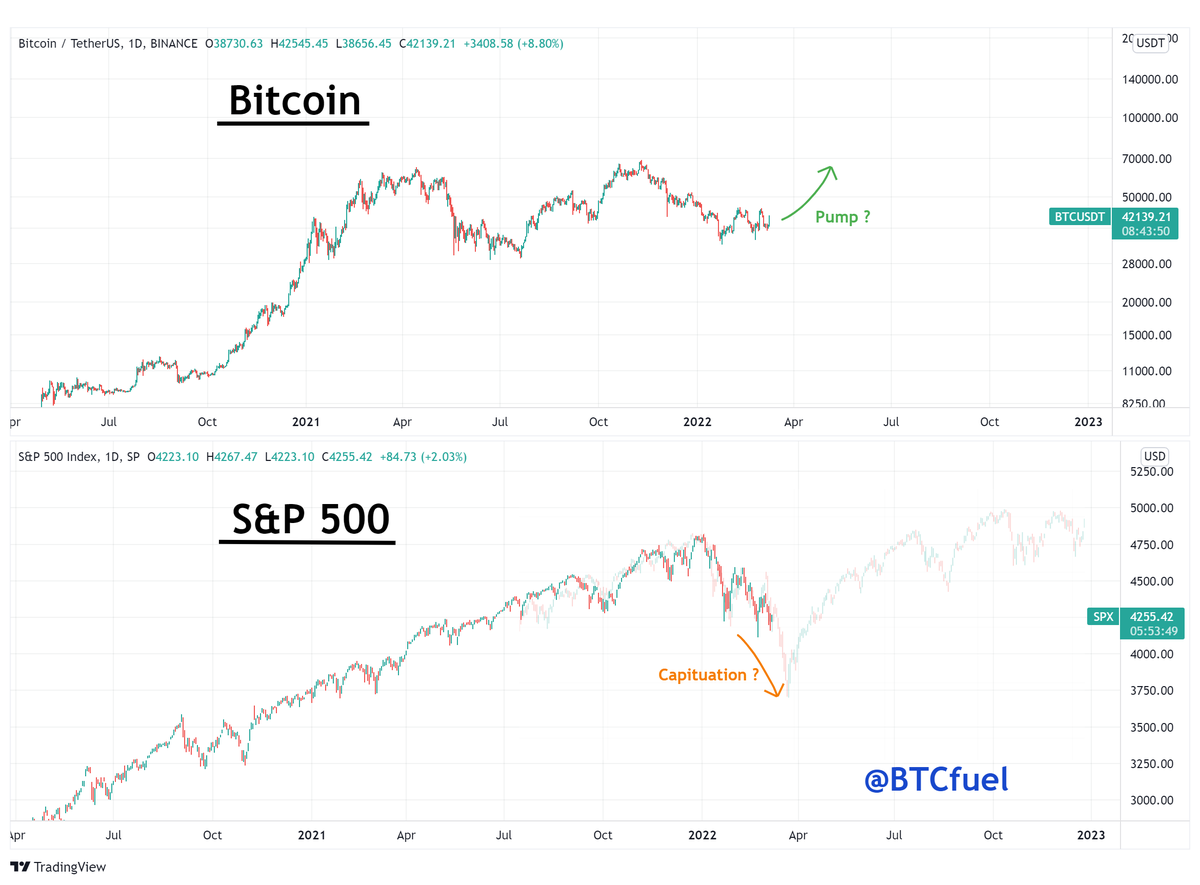

Bitcoin and the stock markets are both in a similar structure and macro-economic situation as in 2018 - 2019. Back then this led to a #Bitcoin pump when stocks were capitulating. A new Bitcoin pump soon?

A THREAD on this comparison 👇

(1/9)

Bitcoin and the stock markets are both in a similar structure and macro-economic situation as in 2018 - 2019. Back then this led to a #Bitcoin pump when stocks were capitulating. A new Bitcoin pump soon?

A THREAD on this comparison 👇

(1/9)

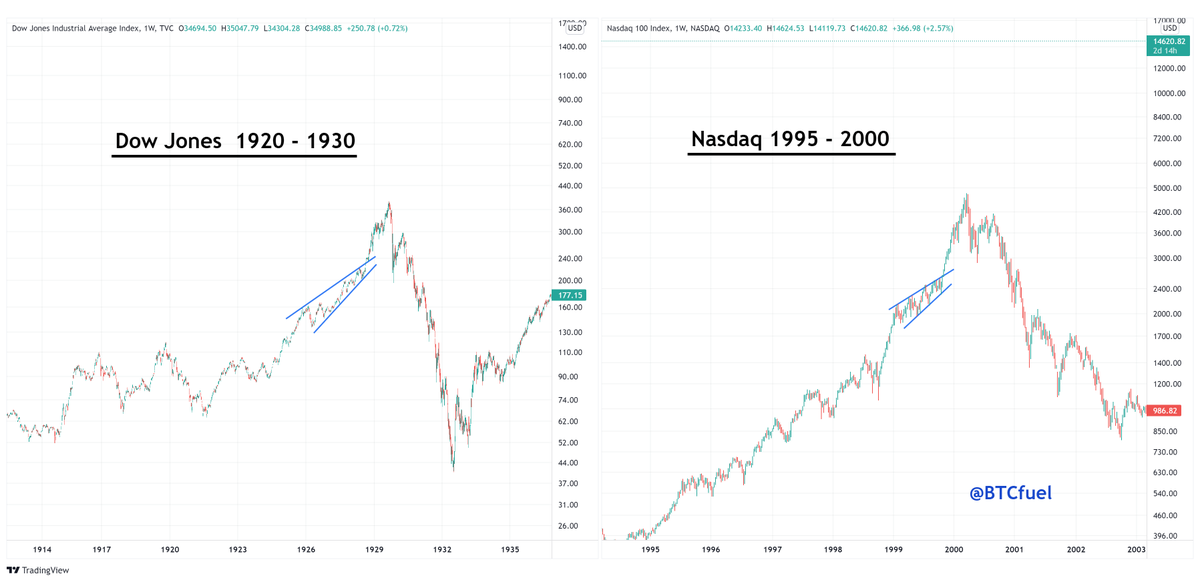

Yesterday a tweet caught my attention. Apparently stocks are following a same pattern right now as in 2018. A similar setup led to a capitulation in the stock markets. Lots of indicators are also the same. This capitulation could happen again soon

(2/9)

(2/9)

https://twitter.com/chamath/status/1500913653297549312

I already made remarks too that this #Bitcoin correction also looks very similar to the 2018-2019 bear market

(3/9)

(3/9)

https://twitter.com/BTCfuel/status/1499794243262550020

The same goes for the #Bitcoin bear market bottom, very similar

(4/9)

(4/9)

https://twitter.com/BTCfuel/status/1499760694866198534

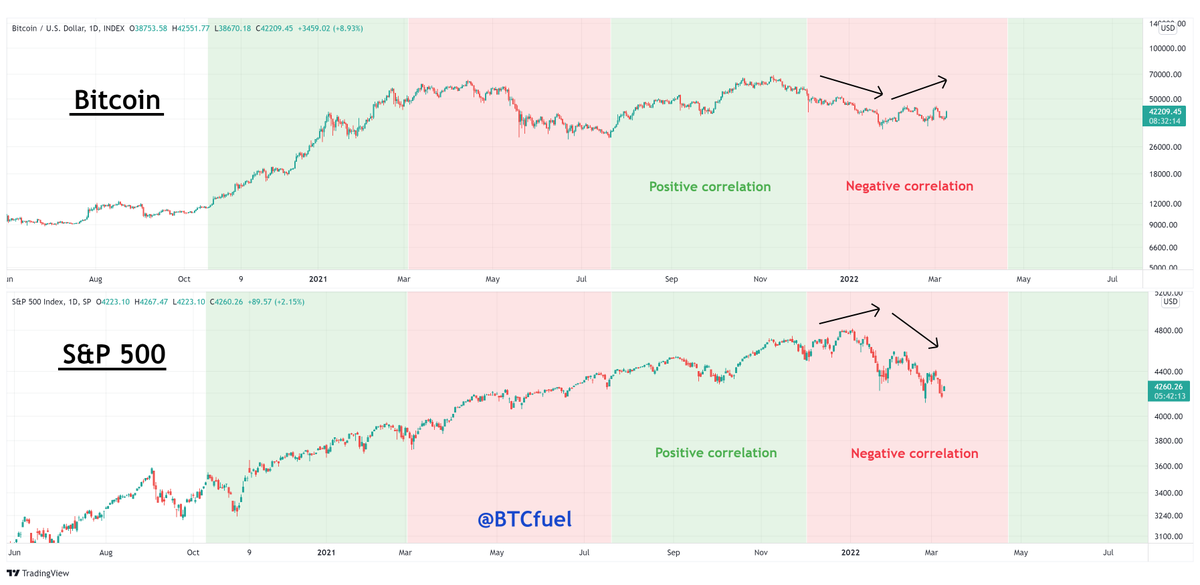

Right now #Bitcoin has a negative correlation with the stock markets. When the S&P 500 goes down, #Bitcoin goes up

(6/9)

(6/9)

https://twitter.com/BTCfuel/status/1500816527469293572

Are we going to see a big #Bitcoin pump soon when the stock market possibly capitulates in the upcoming weeks??

(7/9)

(7/9)

What's even more interesting if this setup plays out, #Bitcoin and stocks could possibly have again a positive correlation in the spring / summer when stocks try to recover again. This means #Bitcoin could keep on moving up

(8/9)

(8/9)

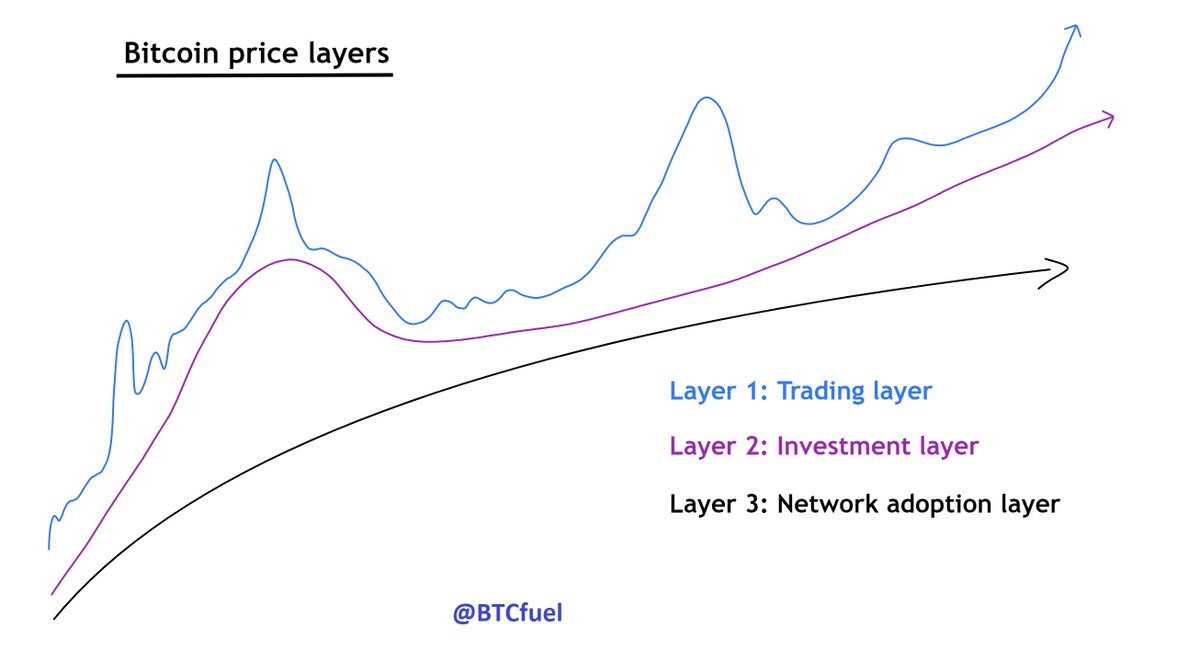

Finally I also wanted to share this remarkable onchain similarity

The end. Follow me @BTCfuel for more analysis

(9/9)

The end. Follow me @BTCfuel for more analysis

(9/9)

https://twitter.com/BTCfuel/status/1501269661089947648

• • •

Missing some Tweet in this thread? You can try to

force a refresh