One result of the @LME_news #nickel madness has been people questioning the wisdom of hedging in nascent derivative markets like #cobalt & #lithium if the risks of wipeout margin calls could undermine any risk mitigation. It's a fair concern, but one that's broadly unfounded...🧵

2/ The key distinction is between physically-settled & cash-settled futures. The meme move on Ni was the result of a short squeeze on a contract requiring physical delivery of expiring positions - "he who sells what is'n his'n must pay the price or go to prisn" as they say

3/ Co & Li on @LME_news, @CMEGroup & soon @SGX are cash-settled basis @Fastmarkets prices, & it's infinitely more difficult to squeeze & move an open spot market assessed by a PRA than it is an exchange delivery point based system (see also Apr 2020 WTI example)

4/ That's not a knock on phys-settled futures. For amendable commodities they're the gold standard - transparent activity all can see & verify. But for those that aren't suited due to market size, material fungibility or qualification requirements, cash-settled is the alternative

5/ E.g. participants in the battery supply chain have exact requirements on the Li & Co they're sourcing (same for Co in aerospace) as well as its ESG-credentials so can't simply collect material (even if meeting spec thresholds) delivered into an exchange warehouse.

6/ So while cash-settled contracts do require trust in a 3rd party PRA index methodology (we do our very best, believe me!), they are essential where price risks need managing in markets unsuitable for physical futures.

7/ And the fact that participants don't have to worry to the same extent about the kind of shenanigans that can result in flash crashes or flash rallies is an added bonus.

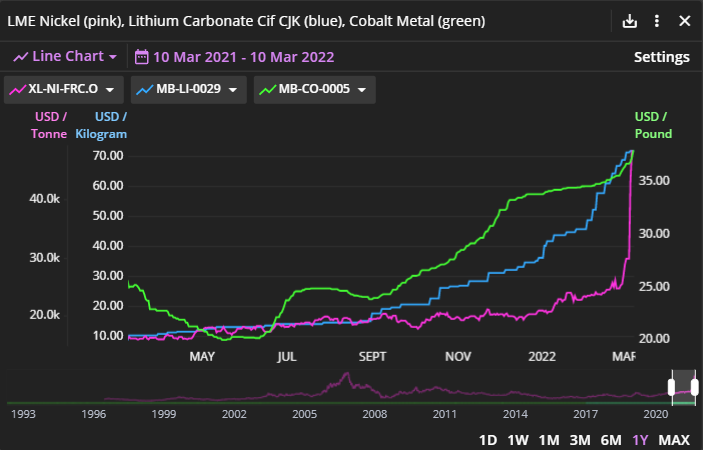

8/ Let's also be clear that Ni at 100k (before the day was arbitrarily cancelled) was an artifact of its specific contract mechanism (like WTI at -$37/bbl). Li at $70-80/kg is not. In fact, it's in large part a result of market prices being ignored for too long.

9/ The fact that LiCO3 & LiOH is still flowing under single digit $ contracts signed years ago & the average global price is probably somewhere ~$15-20/kg completely misleads as to the tightness of this market. There is a real shortage, and spot prices show it very clearly!

• • •

Missing some Tweet in this thread? You can try to

force a refresh