You've asked for it and here it is:

The COMPREHENSIVE GUIDE to @prism_protocol 📚📚📚

Every single functionality on prismprotocol.app explained in detail, enabling YOU to make the most of your $LUNA 👀

A thread 🧵.

The COMPREHENSIVE GUIDE to @prism_protocol 📚📚📚

Every single functionality on prismprotocol.app explained in detail, enabling YOU to make the most of your $LUNA 👀

A thread 🧵.

1/ The overview

This guide will be structured like @prism_protocol's functionality tabs:

1. Refract 🪞 (tweet no. 2)

2. Stake 🥩(tweet no. 9)

3. Swap💱(tweet no. 13)

4. Pools🏊 (tweet no. 15)

5. Govern🏛️(tweet no. 18)

This guide will be structured like @prism_protocol's functionality tabs:

1. Refract 🪞 (tweet no. 2)

2. Stake 🥩(tweet no. 9)

3. Swap💱(tweet no. 13)

4. Pools🏊 (tweet no. 15)

5. Govern🏛️(tweet no. 18)

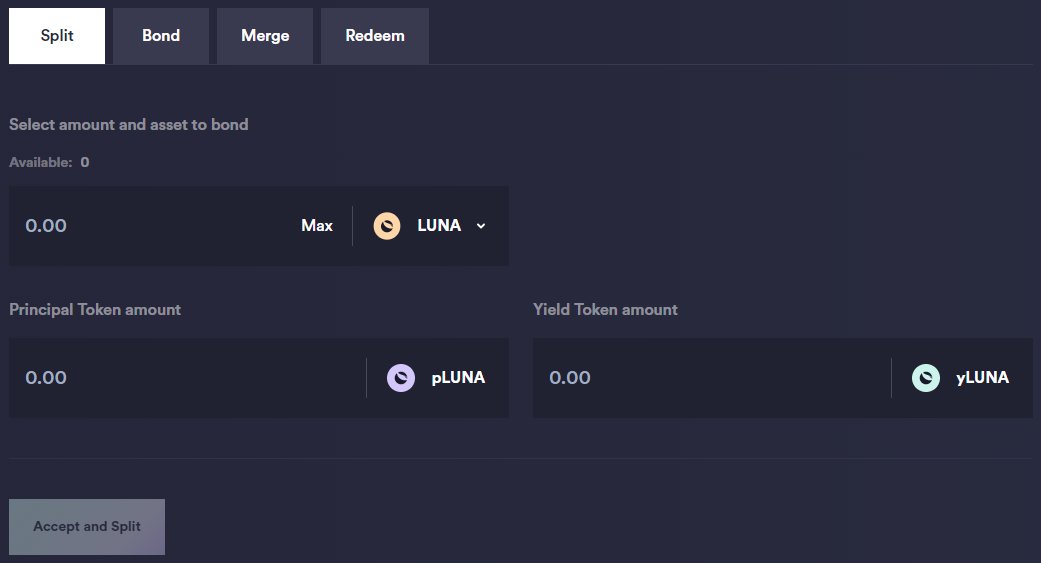

2/ Refract 🪞

Refracting is without doubt @prism_protocol's main functionality.

Within the "Refract" tab, you have the ability to:

a) Split

b) Merge

c) Bond

d) Redeem

Let's have a look!

Refracting is without doubt @prism_protocol's main functionality.

Within the "Refract" tab, you have the ability to:

a) Split

b) Merge

c) Bond

d) Redeem

Let's have a look!

3/ "Splitting" allows you to split your $LUNA into an equal amount of its two components:

- $yLUNA, representing the right to earn the underlying $LUNA's (staking & airdrop) yield and

- $pLUNA, representing the principal & #governance rights of the underlying $LUNA

- $yLUNA, representing the right to earn the underlying $LUNA's (staking & airdrop) yield and

- $pLUNA, representing the principal & #governance rights of the underlying $LUNA

4/ What's important to note here is that $pLUNA and $yLUNA tokens are separately tradeable - but we'll get there, don't worry!

5/ "Merging" is the counterpart to splitting. It allows you to combine an equal part of $yLUNA and $pLUNA back into it's original form: $LUNA.

Well, almost! See, for your $LUNA to be able to earn staking yield, they are automatically bonded by @prism_protocol behind the scenes.

Well, almost! See, for your $LUNA to be able to earn staking yield, they are automatically bonded by @prism_protocol behind the scenes.

6/ That means that when you merge your $yLUNA and $pLUNA you get $cLUNA. cLUNA represents a "C"omplete (easy way to remember) $LUNA and can be redeemed back for a $LUNA (see below).

Remember: $cLUNA is basically a $LUNA, just needs to be unbonded (like $bLUNA on other platforms)

Remember: $cLUNA is basically a $LUNA, just needs to be unbonded (like $bLUNA on other platforms)

7/ "Bonding"

Now that you know about $cLUNA, bonding is easily explained. It just turns your regular $LUNA into $cLUNA - and that's it.

Pro tip: $cLUNA usually trades at a little (2-3%) discount to $LUNA. If you want $cLUNA, don't bond, but trade! This way you'll get more😉💸

Now that you know about $cLUNA, bonding is easily explained. It just turns your regular $LUNA into $cLUNA - and that's it.

Pro tip: $cLUNA usually trades at a little (2-3%) discount to $LUNA. If you want $cLUNA, don't bond, but trade! This way you'll get more😉💸

8/ "Redeeming"

Looking to make your $cLUNA into $LUNA again? Just redeem it!

Instant Burn 🔥🔥🔥= Sell on PRISM #DEX

Slow Burn 🔥= Start 21-24 day unbonding period (like with $bLUNA)

And that's all you need to know about the "Refract" tab!📚

Looking to make your $cLUNA into $LUNA again? Just redeem it!

Instant Burn 🔥🔥🔥= Sell on PRISM #DEX

Slow Burn 🔥= Start 21-24 day unbonding period (like with $bLUNA)

And that's all you need to know about the "Refract" tab!📚

9/ Stake 🥩

The "Stake" tab is where you can put your $yLUNA to good use!

Farm #staking rewards by choosing either the "regular" $yLUNA staking, or the currently (for 12 months) incentivized PRISM farm.

Unsure what to choose? Let's have a look!

The "Stake" tab is where you can put your $yLUNA to good use!

Farm #staking rewards by choosing either the "regular" $yLUNA staking, or the currently (for 12 months) incentivized PRISM farm.

Unsure what to choose? Let's have a look!

10/ Regular yLUNA Staking

Just looking for a steady 9+ % APR? Then regular $yLUNA staking is for you and will pay your rewards in

- $pLUNA

- $yLUNA

- and respective airdrops!

You can also choose for them to be auto-converted to any of the above or $PRISM token.

Just looking for a steady 9+ % APR? Then regular $yLUNA staking is for you and will pay your rewards in

- $pLUNA

- $yLUNA

- and respective airdrops!

You can also choose for them to be auto-converted to any of the above or $PRISM token.

11/ PRISM Farm

PRISM Farm let's you exchange your regular $yLUNA yield for an incentivised yield paid out in @prism_protocol's $PRISM token.

The current base (!) APR is 38+ % (47 % APY at weekly compound) and it can be further raised with "AMPS" (we'll get there, don't worry!).

PRISM Farm let's you exchange your regular $yLUNA yield for an incentivised yield paid out in @prism_protocol's $PRISM token.

The current base (!) APR is 38+ % (47 % APY at weekly compound) and it can be further raised with "AMPS" (we'll get there, don't worry!).

12/ Which farm should you choose?

The answer is pretty obvious: 38 % > 9 %🤓

Keep in consideration that the $PRISM paid out are subject to a 30-day vesting period!

And that's all you need to know about the "Stake" tab!📚

The answer is pretty obvious: 38 % > 9 %🤓

Keep in consideration that the $PRISM paid out are subject to a 30-day vesting period!

And that's all you need to know about the "Stake" tab!📚

13/ Swap💱

In the "Swap" tab you'll find a #decentralized exchange that let's you swap between all of the assets relevant on the @prism_protocol. Those are:

- $yLUNA

- $pLUNA

- $cLUNA

- $LUNA

- $PRISM

- $xPRISM

In the "Swap" tab you'll find a #decentralized exchange that let's you swap between all of the assets relevant on the @prism_protocol. Those are:

- $yLUNA

- $pLUNA

- $cLUNA

- $LUNA

- $PRISM

- $xPRISM

14/ In this regard, it might be worth mentioning that @prism_protocol has casually become @terra_money's third biggest #DEX after the likes of @astroport_fi and @terraswap_io 👀

And that's all you need to know about the "Swap" tab!📚

And that's all you need to know about the "Swap" tab!📚

15/ Pools🏊

The "Pools" tab is where you can participate in #liquiditymining and let your token earn #APRs ranging up to 30+%!

It is these liquidity pools that fuel the #DEX and thus trading under the "Swap" tab. The more trading happens, the higher your APR! 🔥

The "Pools" tab is where you can participate in #liquiditymining and let your token earn #APRs ranging up to 30+%!

It is these liquidity pools that fuel the #DEX and thus trading under the "Swap" tab. The more trading happens, the higher your APR! 🔥

16/ Take note that when "providing" to a liquidity pool, @prism_protocol will only let you deposit an equal amount ($ value) of token into the pool (no single-sided entry).

As such, the UI will not show your tokens, if you do not have a corresponding amount of its trading pair.

As such, the UI will not show your tokens, if you do not have a corresponding amount of its trading pair.

17/ Of course, all the "normal" risks and rewards of #liquiditypools apply, and that includes #impermanentloss. Usually, it is very much negligible.

And that's all you need to know about the "Pools" tab!📚

And that's all you need to know about the "Pools" tab!📚

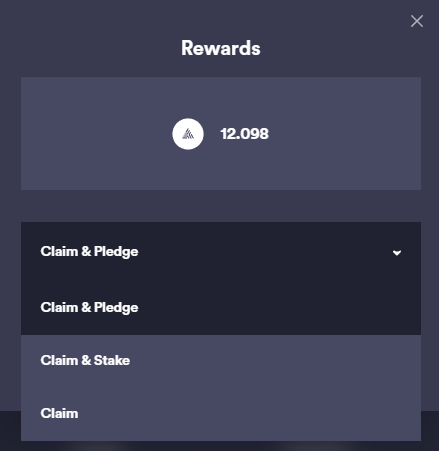

18/ Govern🏛️

The "Govern" tab's most important functionality, is staking your $PRISM for $xPRISM.

$xPRISM is a liquid staking token: it accrues value in real-time, without the need for you to claim your rewards. This also means the ratio of $PRISM/ $xPRISM is constantly rising.

The "Govern" tab's most important functionality, is staking your $PRISM for $xPRISM.

$xPRISM is a liquid staking token: it accrues value in real-time, without the need for you to claim your rewards. This also means the ratio of $PRISM/ $xPRISM is constantly rising.

19/ Protip: Instead of staking your $PRISM, swap them for $xPRISM on the market.

Currently, it still trades at a small discount, even though one $xPRISM already grants you almost 3 % more $PRISM after unstaking 👀

Always check current market prices, though!

Currently, it still trades at a small discount, even though one $xPRISM already grants you almost 3 % more $PRISM after unstaking 👀

Always check current market prices, though!

20/ You can correspondingly unstake your $xPRISM back to $PRISM in the "Govern" tab.

Take note: There is a 21 day unstaking period!

BTW, current $xPRISM APR = 62.88 %, all from organic protocol revenue🚀🚀

And that's all you need to - WAIT, there's more! Let's look at AMPS👀

Take note: There is a 21 day unstaking period!

BTW, current $xPRISM APR = 62.88 %, all from organic protocol revenue🚀🚀

And that's all you need to - WAIT, there's more! Let's look at AMPS👀

21/ Remember AMPS from the PRISM Farm under the "Staking" tab?

This is where you'll be able to earn them by "pledging" your $xPRISM to the AMPS vault. This process is free and does not lock your $xPRISM.

But...

- What are AMPS?

- Can I lose them?

- Are they tradeable?

This is where you'll be able to earn them by "pledging" your $xPRISM to the AMPS vault. This process is free and does not lock your $xPRISM.

But...

- What are AMPS?

- Can I lose them?

- Are they tradeable?

22/ What are AMPS?⚡

AMPS enable you to increase (amp it up!⚡) your yield from the PRISM farm, based on:

a) how many $xPRISM you pledge to the vault and

b) for how long they remain pledged.

Currently, AMPS can more than double your yield from PRISM farm 🔥

AMPS enable you to increase (amp it up!⚡) your yield from the PRISM farm, based on:

a) how many $xPRISM you pledge to the vault and

b) for how long they remain pledged.

Currently, AMPS can more than double your yield from PRISM farm 🔥

23/ If you're not participating in PRISM farm, you currently don't need AMPS.

...currently...

It might still make sense to build up a nice AMPS stack, who knows what's to come ⚡🔥⚡

...currently...

It might still make sense to build up a nice AMPS stack, who knows what's to come ⚡🔥⚡

24/ Can you lose AMPS?

Yes, if you unpledge, you lose all your AMPS.

Are AMPS tradeable?

No, they belong only to you!

And that's really all you need to know about the "Govern" tab and all of @prism_protocol !📚📚📚

If you enjoyed this, a follow is greatly appreciated ❤️🚀

Yes, if you unpledge, you lose all your AMPS.

Are AMPS tradeable?

No, they belong only to you!

And that's really all you need to know about the "Govern" tab and all of @prism_protocol !📚📚📚

If you enjoyed this, a follow is greatly appreciated ❤️🚀

• • •

Missing some Tweet in this thread? You can try to

force a refresh