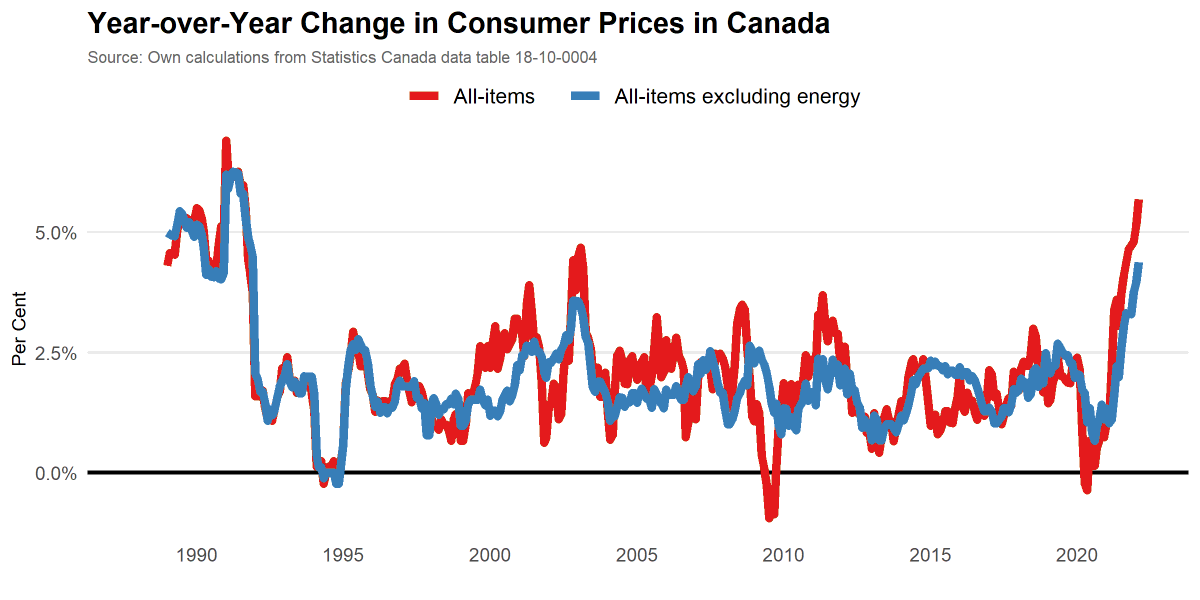

Today's data: inflation! 📈 CIP increased by 5.7 percent in February compared to one-year earlier; 4.4 percent if energy excluded. www150.statcan.gc.ca/n1/daily-quoti… #cdnecon

Price increases are also broad based across many product categories. Approximately two in three items within the CPI saw price increases above 3%.

What's behind the acceleration of inflation? Two years ago, the rate was close to 2% (near the target). The increase to 5% is due to just a few items: groceries, gasoline, home depreciation, fuel. Here's an illustration.

Here's another way to see the drivers behind recently high inflation in #cdnecon.

And with energy as the single largest contributor, it's worth remembering why that's the case: global oil prices. Feb 2022 gasoline contribution to inflation is precisely where you'd predict given the change in oil prices.

Some evidence of supply chain related pressure on CPI easing? New car prices are gradually declining in its contribution to CPI changes. Groceries, however, are increasing.

Last plot from today's inflation data: services price increases remain at the 2 percent target once one excludes shelter. This is relevant to watch to see extent to which wage pressures may contribute to inflation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh