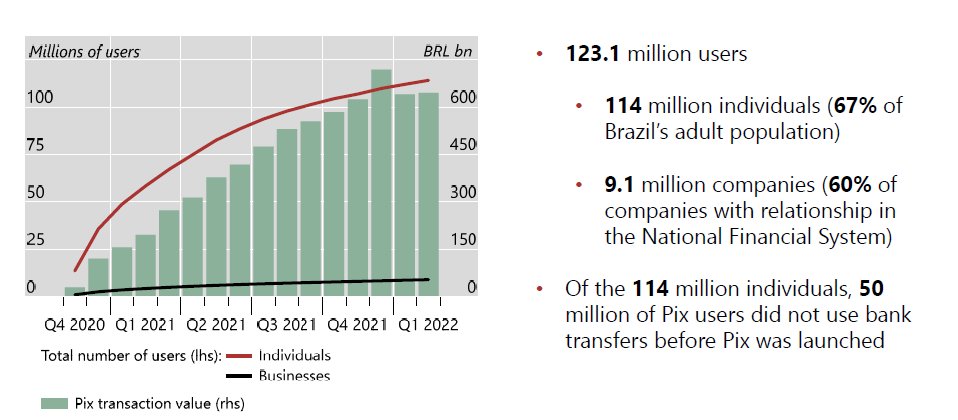

A quiet revolution in the monetary system started in November 2020, when Brazil launched its Pix instant payment system

In little over a year, it signed up two-thirds of Brazil's adult population

The latest #BIS_Bulletin tells the amazing story

A thread

bis.org/publ/bisbull52…

In little over a year, it signed up two-thirds of Brazil's adult population

The latest #BIS_Bulletin tells the amazing story

A thread

bis.org/publ/bisbull52…

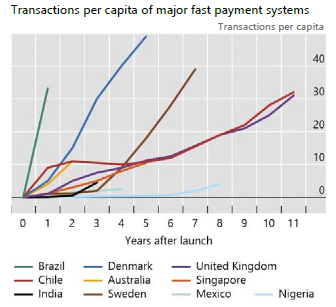

The trajectory is even clearer in this chart which shows the relative adoption by comparison to other retail fast payment systems

Technology is only part of the story; after all, technology is similar everywhere

Instead, the lessons are on the *economics*, especially the importance of an open payment architecture

Instead, the lessons are on the *economics*, especially the importance of an open payment architecture

The Central Bank of Brazil provides the payment infrastructure but also sets the rule book for service providers; digital ID and technical standards for data exchange (through APIs) ensure interoperability

Pix is free for individuals and virtually free for merchants (in yellow in the chart below)

The contrast with credit card fees is very stark

The contrast with credit card fees is very stark

In spite of rapid technological progress in information processing in recent decades the cost of payments has remained stubbornly high

Users don't always see these costs (they are levied on merchants) but users will bear the ultimate burden if they are passed on as higher prices

Users don't always see these costs (they are levied on merchants) but users will bear the ultimate burden if they are passed on as higher prices

Adoption of Pix has been very rapid; it overtook pre-paid cards within months, and is poised to overtake credit and debit cards

Two factors likely account for Pix's rapid growth

First is the mandatory participation of large banks, which set in motion network effects that drew in others

First is the mandatory participation of large banks, which set in motion network effects that drew in others

The second is the dual role of the central bank - as infrastructure provider and the overseer of the rule book

The data architecture (digital ID together with APIs that ensure interoperability) gives teeth to effective competition

The data architecture (digital ID together with APIs that ensure interoperability) gives teeth to effective competition

In fact, there are broader lessons for the roll-out of central bank digital currencies (CBDCs)

The data architecture consisting of digital IDs and APIs that ensure privacy has a lot in common with that for CBDCs

Pix gives a glimpse of what's possible

The data architecture consisting of digital IDs and APIs that ensure privacy has a lot in common with that for CBDCs

Pix gives a glimpse of what's possible

Some of you are asking in the comments section what all this means for advanced economies, especially the US

My panel at the #NABE with Nellie Liang covered some of this

Short answer is "a lot", especially on FedNow

My panel at the #NABE with Nellie Liang covered some of this

Short answer is "a lot", especially on FedNow

https://twitter.com/business_econ/status/1506351397809561600?s=20&t=eVH2XcNR2buElH4NFfGdMA

For more on the link between instant payment systems and CBDCs, the video of the #NABE conference session with US Treasury Undersecretary Nellie Liang and @jc_econ is posted on the conference site

nabe.com/NABE/Events/PC…

nabe.com/NABE/Events/PC…

It was a real pleasure to speak to Governor Roberto Campos Neto of the Central Bank of Brazil on Pix

Roberto described to me how Pix exemplifies the benefits of harnessing technology for the public good

Roberto described to me how Pix exemplifies the benefits of harnessing technology for the public good

My favorite part of this “fireside chat” was when Roberto discussed the reactions of the banking sector

At first, they were not happy; but they quickly realized the huge potential from having additional business lines

“Best way to persuade banks is to persuade their customers”

At first, they were not happy; but they quickly realized the huge potential from having additional business lines

“Best way to persuade banks is to persuade their customers”

Check out the other sessions of the #BIS_Innovation_Summit held earlier this week

bis.org/events/bis_inn…

bis.org/events/bis_inn…

• • •

Missing some Tweet in this thread? You can try to

force a refresh