1/ Among proponents of #bitcoin, one of the widely endorsed narratives is that of bitcoin or digital currencies being sound money.

2/ This idea of sound money stems from the fact that unlike government-issued fiat currencies, which rely on fractional reserves; with decentralised digital currencies, there is no individual or group with executive power who can change the fundamental attributes of the currency.

3/ In the case of #bitcoin, there is a hard limit of 21 million bitcoin that will ever be produced. This finite scarcity of the asset coupled with the lack of executive control enables many to view bitcoin as a very sound asset, akin to digital gold.

4/ Whilst the price of digital currencies are currently very volatile, the price volatility of the most popular assets such as bitcoin and Ether are likely to reduce over time.

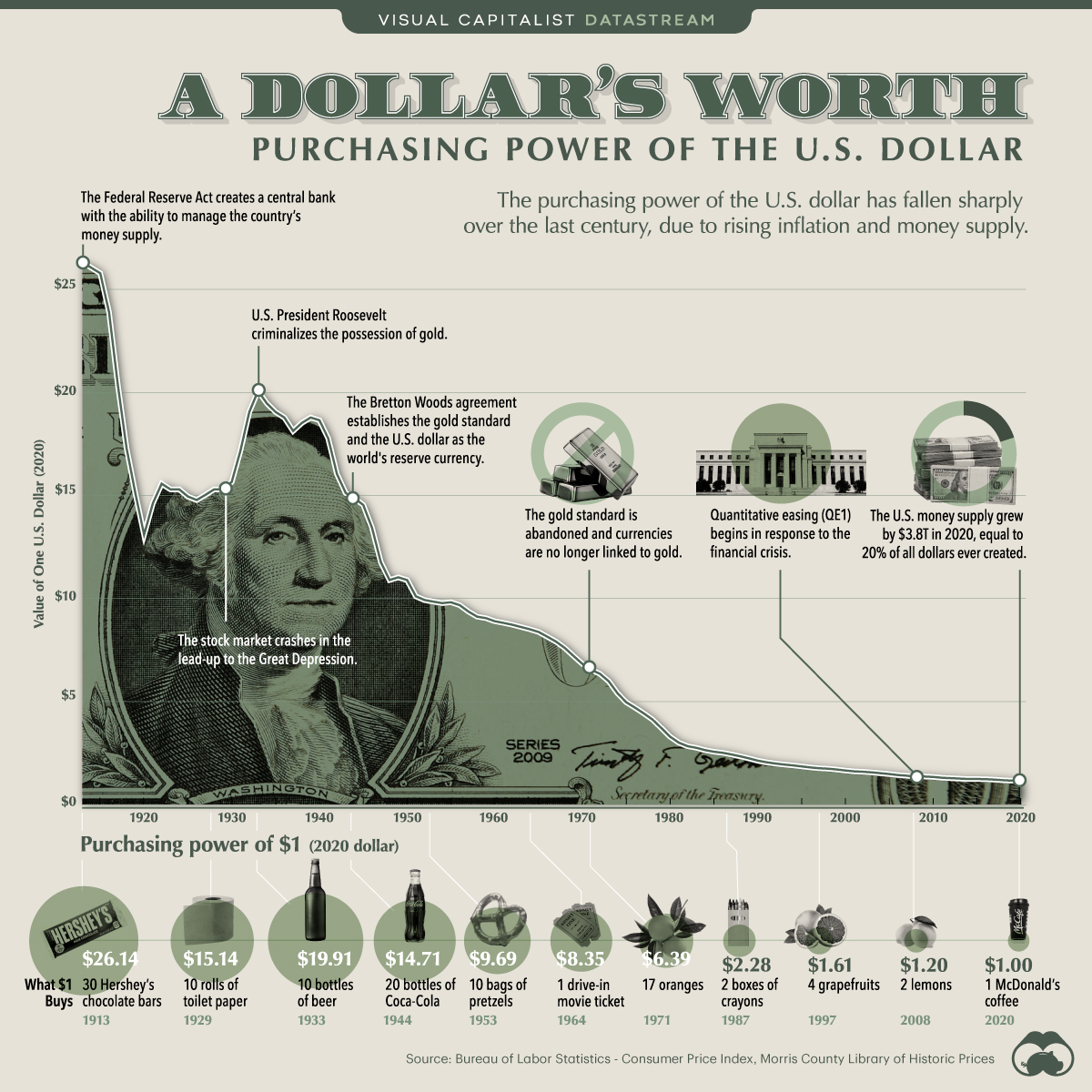

5/ Hence they are viewed as a useful hedge against inflation that is rife with fiat currencies. You could buy 15 coffees at McDonald's for the price of one dollar a hundred years ago.

Source @VisualCap

Source @VisualCap

6/ With this perspective on digital currencies, it's understandable why so many subscribe to the sound money narrative of #bitcoin.

7/ After all, as the US dollar is the world's reserve currency, its inflationary nature has far-reaching ramifications, and monetary policy changes are often divisive in nature.

8/ The bank bailouts of 2008, COVID-19, and potentially the war in Ukraine, are all events that affect monetary policy and resulted in larger government deficits increasing the money supply.

9/ If inflation is at 7%, and your fiat denominated investments are generating 7%, all you're doing is combating the effects of inflation and generating no alpha for yourself.

10/ Whilst moderate inflation itself is considered a good thing (@bankofengland's target rate is 2%) as it helps drive economic growth, people do want to obtain healthy risk-adjusted returns which is another reason why digital assets are so popular at present.

11/ The finite supply of #bitcoin is not something that has been widely adopted with other digital assets. This is in part because many digital assets are utility or governance tokens that are used to transact with blockchain protocols or govern them.

12/ #Bitcoin is the original decentralised digital asset, and given its intent of being a store of value, that is something it excels at with its fixed supply.

13/ Other digital assets are less fixed in their supply. For some, this is that they are pegged to an underlying asset as is the case with stablecoins.

14/ In others, it is to ensure that the supply can be reduced or increased to better support the goals of the protocol they were designed for.

15/ Whilst one could argue that these other currencies are being managed in a similar way to fiat currencies, this is not really the case as these digital assets are controlled by the communities that govern them, rather than a centralised entity.

16/ There are some exceptions to this, but for any Web3 currency to thrive it needs to incentivise its users and holders, and governance transparency is crucial here — users of digital assets are not forced to hold specific currencies in the same way that they are with fiat.

17/ It is against this backdrop that there are some really interesting narratives emerging. One of these is the notion of ultrasound money, which Justin Drake @drakefjustin, an @Ethereum researcher popularised.

18/ #Ether, the cryptocurrency of the #Ethereum network is the 2nd largest cryptocurrency after bitcoin with a market capitalisation of over 40% of #bitcoin's.

19/ Although #Ether was designed as a utility token that could be used to secure and pay for transactions on the Ethereum network, it is also widely invested in as a cryptocurrency asset due to the success of #Ethereum.

20/ Unlike #bitcoin, #Ether's supply is not fixed, however, there are changes to the network coming which make it very compelling as a digital asset, with some very sound properties.

21/ Historically miners of the #Ethereum network were paid two types of reward for validating transactions — gas fees, which were the cost of the transaction in #Ether paid for by the creator, and a block reward, where new Ether is minted.

22/ This meant mining #Ethereum could be a good income stream for miners. However, transaction fees were prioritised by price incentivising miners to process the more lucrative transactions.

23/ As a result, miners and other participants found ways to front-run transactions on the network, known as Maximal (originally Miner) Extractable Value (#MEV) ethereum.org/en/developers/….

24/ This misalignment of incentives led to a beneficial, but controversial change to #Ethereum named #EIP1559 which resulted in gas fees being set based on congestion of the network, and the removal or burning of the base transaction fee.

25/ This burning of the base transaction fee results in Ether becoming a scarcer asset, which is a good thing for holders of it — before it was only the miners benefitting from transactions taking place on the network.

26/ At present, more #Ether is still being created than burned resulting in it still being inflationary. However, this will change when #Ethereum moves off its energy-intensive proof of stake mining to proof of work in mid-2022.

27/ This change, known as #theMerge, will result in holders of Ether being able to stake their Ether for returns of 4-5%, and it's anticipated that the issuance of new Ether on the network will be less than the burn rate, resulting in Ether becoming deflationary.

28/ It is for this reason that many are getting behind the viewpoint of #Ether becoming ultrasound money, as whilst the supply is not finite, it will become scarcer over time.

29/ It's unknown if this change to the fundamentals of the #Ethereum network will be a tipping point for even wider adoption of #Ether.

30/ However, given Ether's position as the second-largest cryptocurrency, the Ethereum merge is going to be a pivotal moment in Web3 which is why it's worth paying close attention to.

31/ For some concrete metrics on the ultrasound money narrative, you can head here ultrasound.money.

32/ Like this thread? Please ❤️ & share. To get my latest thoughts on Web3 and where we’re headed you can subscribe to my newsletter at getrevue.co/profile/conors…

• • •

Missing some Tweet in this thread? You can try to

force a refresh