A Thread on Debt to GDP Ratio 🧵

The debt-to-GDP ratio compares a country's debt to its total economic output measure by GDP for the year.

This ratio tells how the economy is doing and allows comparison.

Lets Look at where the world stands

@sahilkapoor @dugalira

The debt-to-GDP ratio compares a country's debt to its total economic output measure by GDP for the year.

This ratio tells how the economy is doing and allows comparison.

Lets Look at where the world stands

@sahilkapoor @dugalira

What does % Mean

>100 : Country not producing enough to pay debt

100 : Just enough to pay off debt

<100: Enough economic output to make debt payments

>100 : Country not producing enough to pay debt

100 : Just enough to pay off debt

<100: Enough economic output to make debt payments

If The % > 100: Higher risk of default and country will get loan at higher interest rate.

That further perpetuates the cycle by increasing debt —> looming financial crisis

Like the Hedonic Treadmill

That further perpetuates the cycle by increasing debt —> looming financial crisis

Like the Hedonic Treadmill

World Bank in 2013

FM >77% for every 1% rise, Growth goes down by 0.017 points

EM are more sensitive to this. >64% for every 1% rise, Growth goes down by 0.02 points

As a country's debt-to-GDP ratio rises, it often signals that a recession is underway.

@WorldBank

FM >77% for every 1% rise, Growth goes down by 0.017 points

EM are more sensitive to this. >64% for every 1% rise, Growth goes down by 0.02 points

As a country's debt-to-GDP ratio rises, it often signals that a recession is underway.

@WorldBank

Comparison Between Countries

In 2017: Germany Ratio was 64%, Greece was 193%. Helped Germany Bail out Greece. (Germany GDP - 44.2 Trillion, Greece GDP - $299 Billion)

#Greece #Germany

In 2017: Germany Ratio was 64%, Greece was 193%. Helped Germany Bail out Greece. (Germany GDP - 44.2 Trillion, Greece GDP - $299 Billion)

#Greece #Germany

Why Did Greece Default ?

Foreign Govt & banks held Greece debt. As Greece banknotes became due > debt downgraded by S&P > Interest Rates rose > To raise revenue it increased taxes, decreased spending> further slowed economy, reducing revenue & its ability to pay down debt.

Foreign Govt & banks held Greece debt. As Greece banknotes became due > debt downgraded by S&P > Interest Rates rose > To raise revenue it increased taxes, decreased spending> further slowed economy, reducing revenue & its ability to pay down debt.

The Interesting Case of Japan

In 2020, its debt-to-GDP ratio was 257%.

But most Debt is held domestically + It has large foreign assets.

Making it at lesser risk of default

#Japan

In 2020, its debt-to-GDP ratio was 257%.

But most Debt is held domestically + It has large foreign assets.

Making it at lesser risk of default

#Japan

Bringing Bond yield Into the Picture

The best determinant of faith in a government's solvency is yield to debt.

When yields are low, there is a lot of demand for its debt.

It won't have to pay as high a return to attract investors.

#Bond

#yields

The best determinant of faith in a government's solvency is yield to debt.

When yields are low, there is a lot of demand for its debt.

It won't have to pay as high a return to attract investors.

#Bond

#yields

The United States had been fortunate in that regard, and it could offer bonds with relatively low yields.

Now Market is Spooked as Bond Yield is rising.

Now Market is Spooked as Bond Yield is rising.

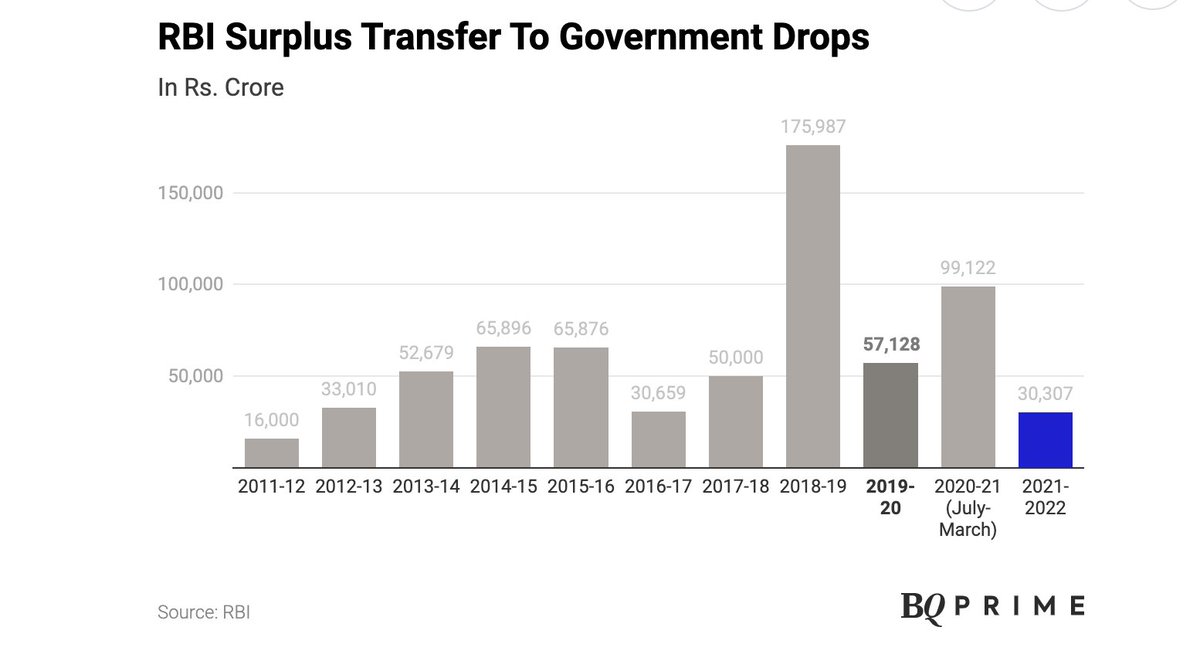

India

We are at 91% and growing. Signs of Concern

@FinMinIndia

@nsitharaman

End of Thread.

Do RT if you enjoyed reading this thread.

We are at 91% and growing. Signs of Concern

@FinMinIndia

@nsitharaman

End of Thread.

Do RT if you enjoyed reading this thread.

• • •

Missing some Tweet in this thread? You can try to

force a refresh