U.S. #drought conditions this week versus the previous 3 years. Dryness expanded considerably in Nebraska this past week, but other Corn Belt areas are slightly improving. More than half of North Dakota is now drought-free for the first time since Aug. 4, 2020.

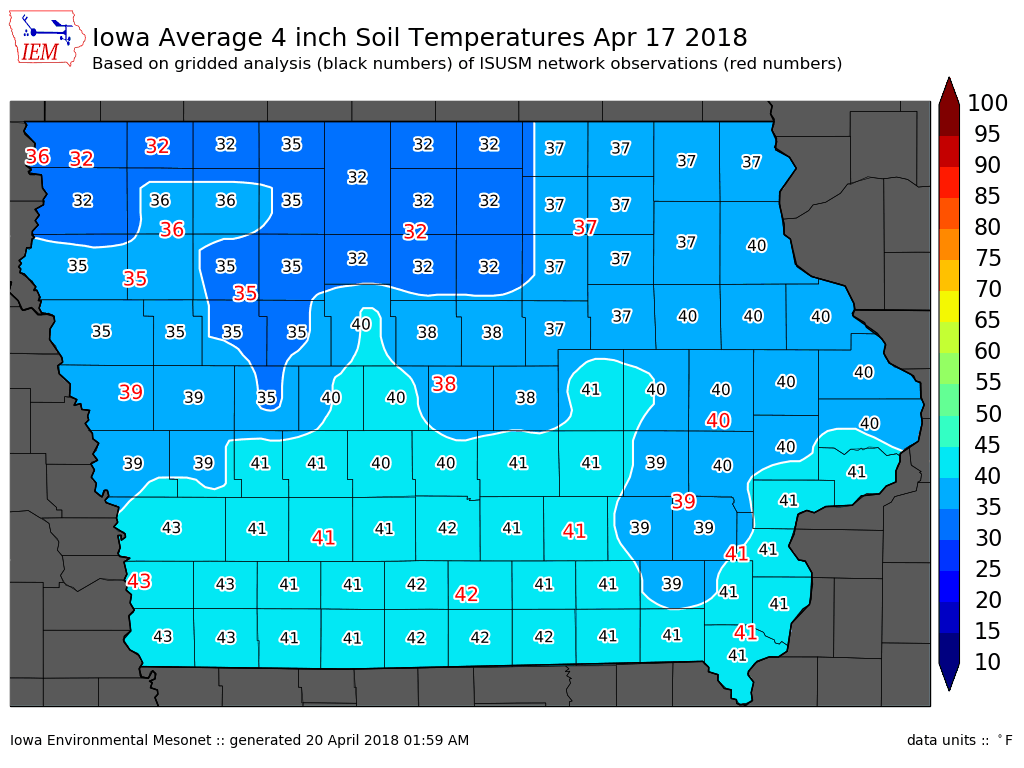

Here's the same week in the previous four years just for fun. The core Corn Belt states have not often started spring planting in widespread drought conditions. The HRW wheat crop in the S. Plains was heavily affected by drought in 2015 and 2018.

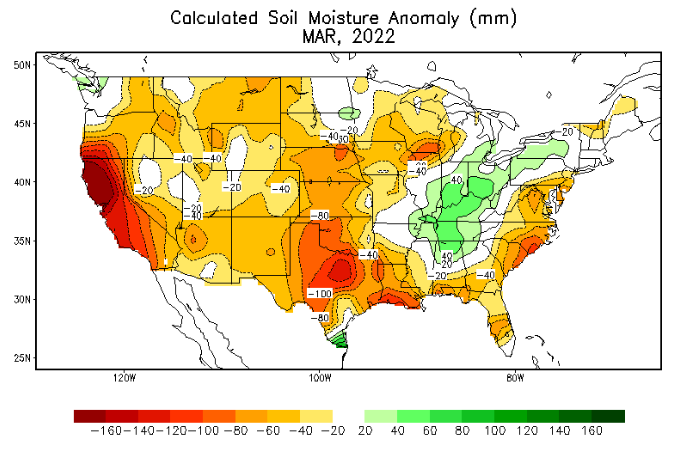

Now versus a month ago. Drought has expanded in the Plains (HRW wheat country, Nebraska, somewhat SD), but it has retreated in North Dakota and parts of the Midwest. Planting into dry soils is not the problem (actually it helps), but the fear is continuation of the dryness.

Just a reminder.... a CLEAR drought monitor is not always better. This is what the 2019 map doesn't show you. Far wetter than normal that March and it stayed that way. Record/near record late corn & soy planting that spring.

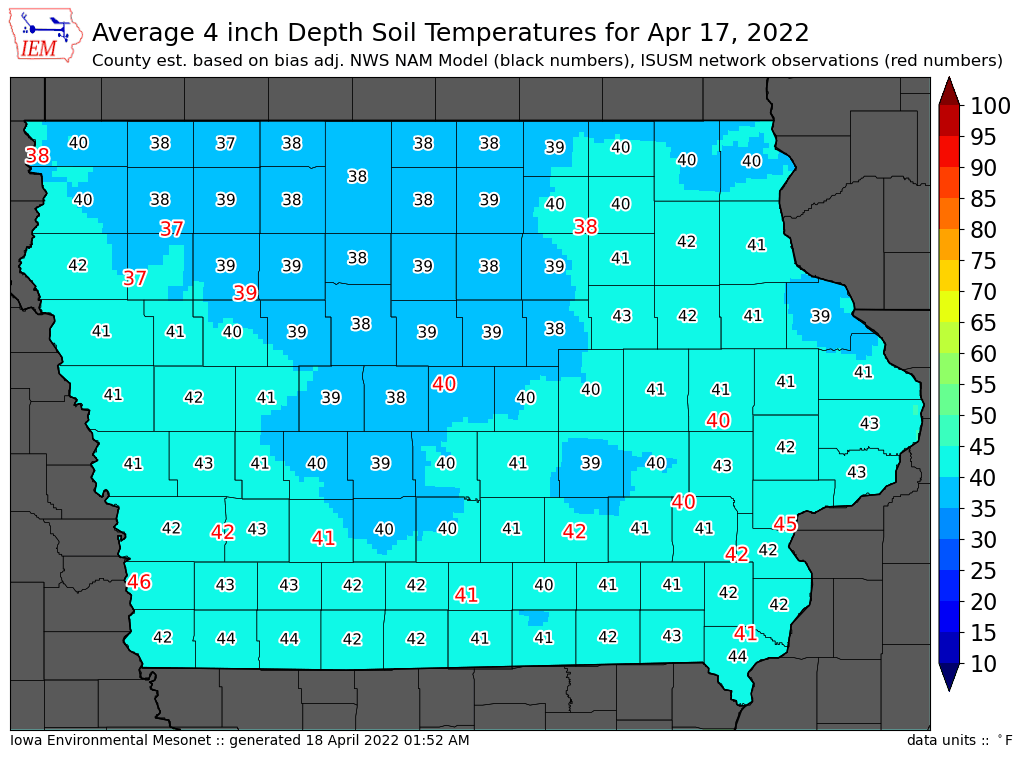

Bit wet in the east now, but dry is the bigger theme.

Bit wet in the east now, but dry is the bigger theme.

• • •

Missing some Tweet in this thread? You can try to

force a refresh