The flash S&P Global/CIPS composite #PMI fell from 60.9 in March to 57.6 in April. Although broadly consistent with GDP growing at a quarterly rate of 0.7-8%, the latest reading signals a marked slowing in the pace of growth 1/

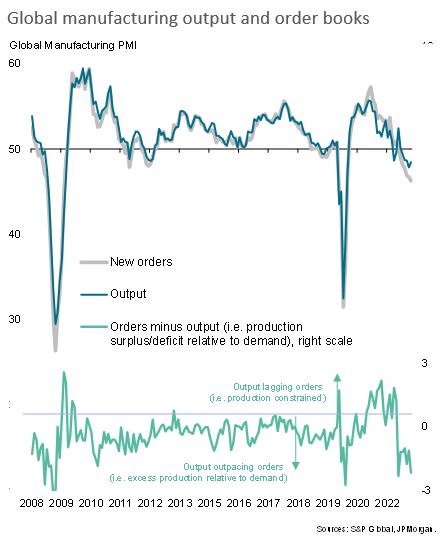

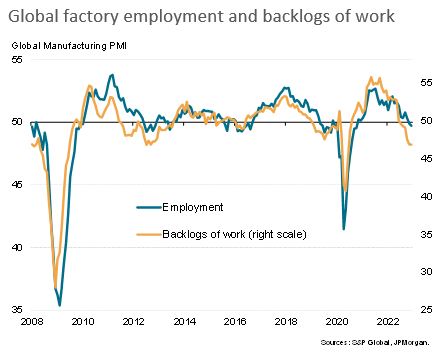

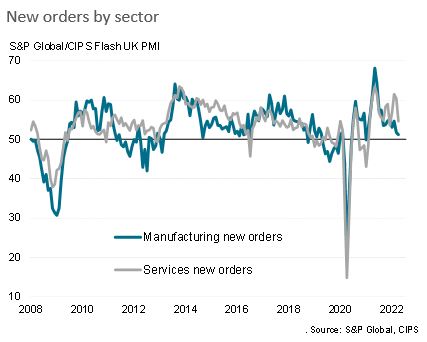

UK service sector business inflows grew at the slowest rate in 2022 to date. In manufacturing, order book growth has lost momentum, driven by an increasing loss of export sales, to result in the weakest rise in new orders since January 2021. 2/

#UK manufacturers and service providers reported demand having been hit by high COVID-19 infection rates and spending power having been squeezed by higher prices, but Brexit was also seen as having hit exports, and the Ukraine war/sanctions was cited as an additional headwind 3/

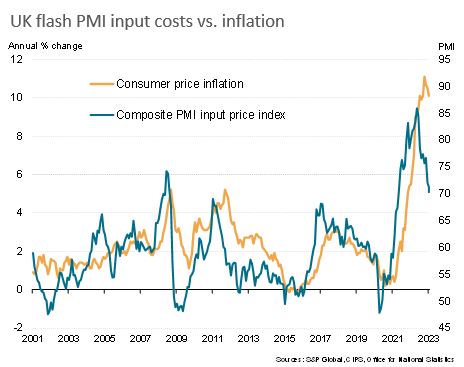

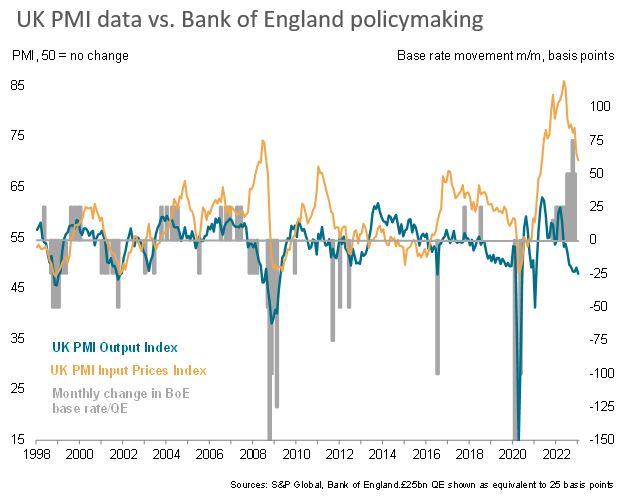

Concerns over the worsening inflation outlook were flamed by another leap in firms' costs in April. Average input costs rose at a rate just shy of last November's record high, pointing to a further re-acceleration of UK inflationary pressures 4/

Having been hit hard in March, future output expectations were scaled back further in April, with prospects now running at their lowest since October 2020 on average. Concerns over the Russia-Ukraine war added to concerns over Brexit, supply chains, prices and economic growth 5/6

In summary, UK April flash #PMI surveys showed an unwelcome picture of slowing demand, slumping business confidence about the year ahead and soaring price pressures 6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh