1/ The #NEAR Protocol stablecoin is out: #USN

1 USN is always backed at 100% by NEAR + stables in the Reserve Fund.

You can mint 1 USN against $1 of NEAR & earn at least 10% APY (Reserve Fund yield).

How does it work and is it superior to #Luna/#UST?

YES.

Why? A thread 👇

1 USN is always backed at 100% by NEAR + stables in the Reserve Fund.

You can mint 1 USN against $1 of NEAR & earn at least 10% APY (Reserve Fund yield).

How does it work and is it superior to #Luna/#UST?

YES.

Why? A thread 👇

2/ What is $USN?

A fully collateralized, algorithmic NEAR-native stablecoin pegged to the US dollar.

It uses on-chain smart contract for NEAR/USN arbitrage like UST and StableSwap pool with other stablecoins (swap USDT for USN).

How does it match against other stables? 👇

A fully collateralized, algorithmic NEAR-native stablecoin pegged to the US dollar.

It uses on-chain smart contract for NEAR/USN arbitrage like UST and StableSwap pool with other stablecoins (swap USDT for USN).

How does it match against other stables? 👇

3/ There are 4 types of stables:

1. Backed by the actual US dollar: #USDT, #USDC = centralized

2. Backed and collateralized by crypto: #DAI = capital inefficient

3. Semi-algorithmic: #FRAX = low adoption

4. Fully algorithmic: #UST = on-chain peg stabilization

USN? 👇

1. Backed by the actual US dollar: #USDT, #USDC = centralized

2. Backed and collateralized by crypto: #DAI = capital inefficient

3. Semi-algorithmic: #FRAX = low adoption

4. Fully algorithmic: #UST = on-chain peg stabilization

USN? 👇

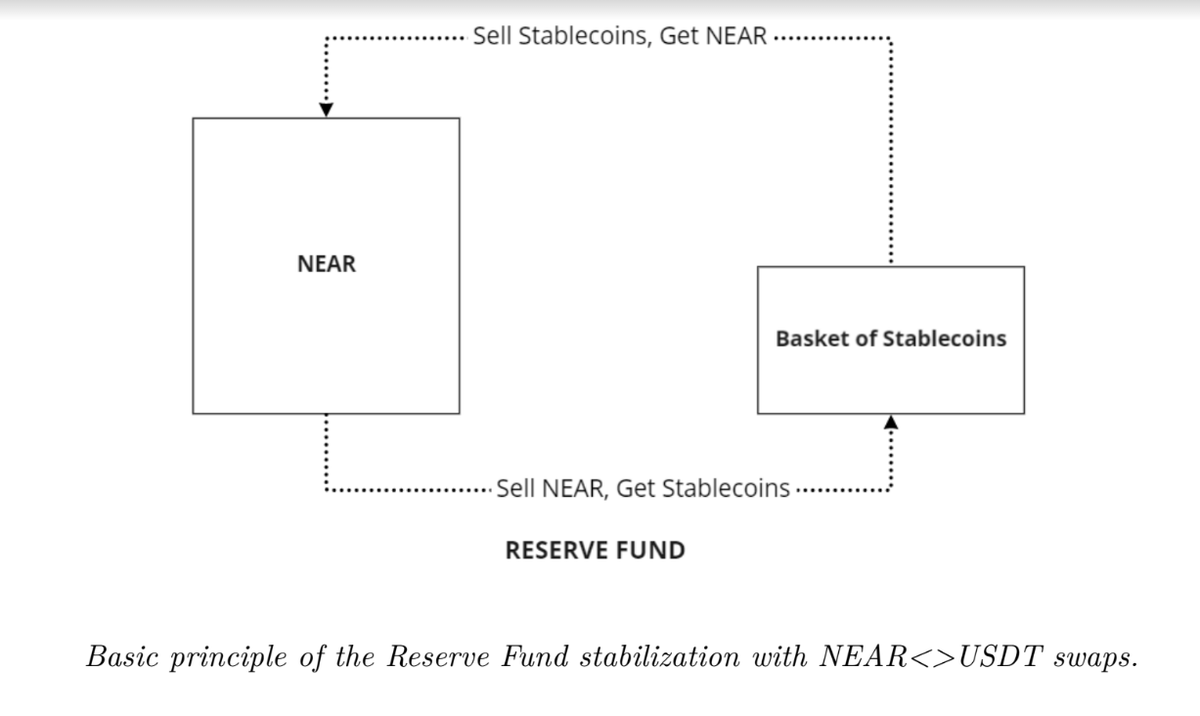

4/ USN uses an on-chain smart contract to issue USN and maintain its peg similar to how UST / Luna works:

1. You exchange NEAR to get USN.

2. You exchange USN to get NEAR.

But there is a catch here which makes USN better than Luna / UST and DAI! 👇

1. You exchange NEAR to get USN.

2. You exchange USN to get NEAR.

But there is a catch here which makes USN better than Luna / UST and DAI! 👇

5/ NEAR is NOT burned to issue USN (compared to Luna), instead, it is placed in the Reserve Fund to 100% back all USN in circulation including with other stables + generate yield!

USN is also capital efficient compared to DAI + decentralized!

USN is fully backed, UST is NOT! 👇

USN is also capital efficient compared to DAI + decentralized!

USN is fully backed, UST is NOT! 👇

6/ While USN / NEAR start as fully collateralized, UST is only now trying to build a reserve in BTC & other coins!

UST is issued on LEVERAGE, while USN is always BACKED!

The NEAR reserve can always buy back the entire issuance of USN!

Death spiral? 👇

UST is issued on LEVERAGE, while USN is always BACKED!

The NEAR reserve can always buy back the entire issuance of USN!

Death spiral? 👇

https://twitter.com/DU09BTC/status/1518552162640576514?s=20&t=yLWR76PI1VJrBZerTXL8kw

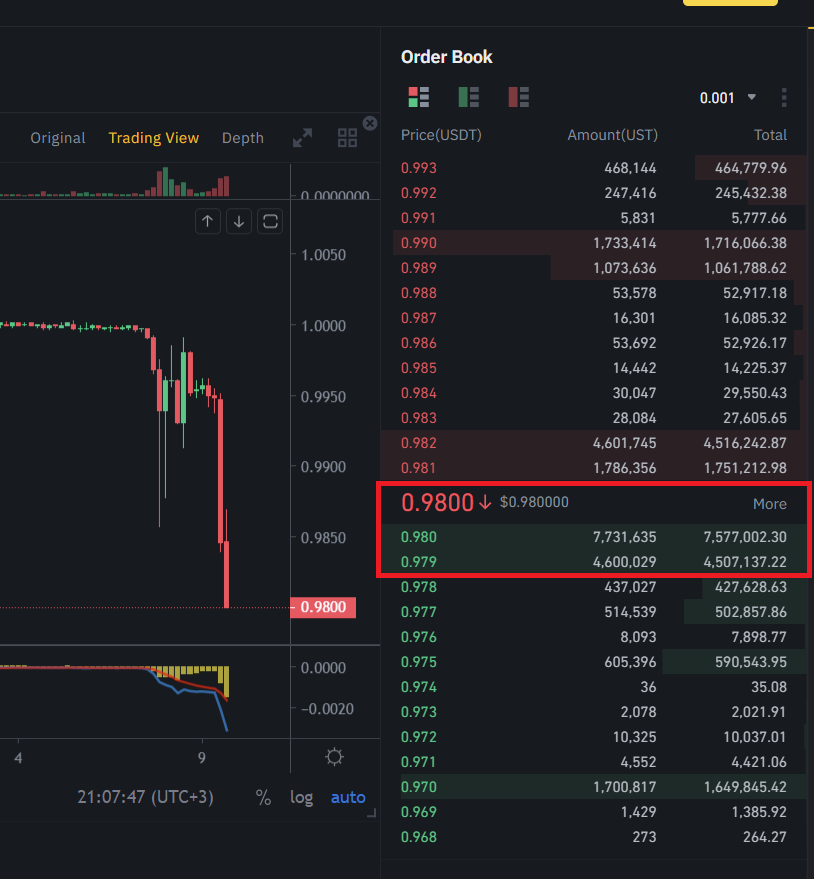

7/ The Reserve Fund (that includes USDT) is a buyer of last resort.

What will it buy? NEAR to ensure USN is BACKED at 100%.

UST does NOT have this feature built into its mechanism & the Terra reserve needs another $16 bil today to catch-up to UST market cap!

Is USN perfect? 👇

What will it buy? NEAR to ensure USN is BACKED at 100%.

UST does NOT have this feature built into its mechanism & the Terra reserve needs another $16 bil today to catch-up to UST market cap!

Is USN perfect? 👇

8/ No.

But at least USN is backed!

Even if NEAR price crashes, the Reserve Fund will have other stablecoins (USDT) to buy NEAR and ensure price does not crash below a certain threshold to put in danger the solvency of USN.

You cannot say that about UST!

USN adoption? 👇

But at least USN is backed!

Even if NEAR price crashes, the Reserve Fund will have other stablecoins (USDT) to buy NEAR and ensure price does not crash below a certain threshold to put in danger the solvency of USN.

You cannot say that about UST!

USN adoption? 👇

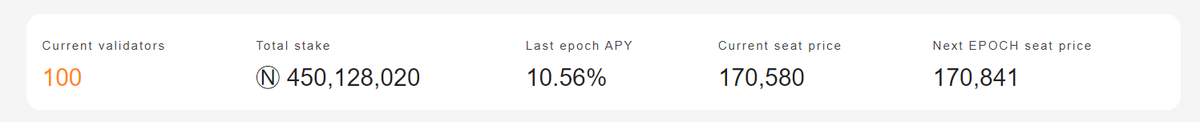

9/ USN will boost adoption by paying at least 10% APY to depositors based on the Reserve Fund yield (paid via NEAR stacking at ~10% APY, real yield could be higher).

This APY will likely sit at 10% as its market cap / depositors grow.

Is this yield better than UST? 👇

This APY will likely sit at 10% as its market cap / depositors grow.

Is this yield better than UST? 👇

10/ Not in the near term.

But UST yield on Anchor will start falling as of May 1 from 20% to 18.5% and so on.

Considering UST is not backed, USN is a superior stablecoins with all the benefits!

Are there risks holding USN? 👇

But UST yield on Anchor will start falling as of May 1 from 20% to 18.5% and so on.

Considering UST is not backed, USN is a superior stablecoins with all the benefits!

Are there risks holding USN? 👇

11/ The biggest risk is smart contracts bugs, hacks and so on.

The peg will likely hold well, similar to UST.

If a bank run happens, USN is much better placed to hold its peg compared to UST that only has 10% backing!

Will NEAR pump? 👇

The peg will likely hold well, similar to UST.

If a bank run happens, USN is much better placed to hold its peg compared to UST that only has 10% backing!

Will NEAR pump? 👇

12/ NEAR is not burned, but rather staked = the impact on NEAR price is still bullish as USN market cap grows.

However, NEAR's price can still crash if a lot of USN exits the ecosystem. Similar to UST / Luna.

But the USN Reserve Fund guarantees a floor price.

What more?👇

However, NEAR's price can still crash if a lot of USN exits the ecosystem. Similar to UST / Luna.

But the USN Reserve Fund guarantees a floor price.

What more?👇

13/ I encourage you to read the white paper:

What to know more about stablecoins? 👇

drive.google.com/file/d/1kYqdv3…

What to know more about stablecoins? 👇

drive.google.com/file/d/1kYqdv3…

14/ Here's my stablecoin guide that can help you navigate this emerging market.

I also made a nice analysis between UST & DAI 👇

I also made a nice analysis between UST & DAI 👇

https://twitter.com/DU09BTC/status/1514996987741065223?s=20&t=qiAJ6Q9ParFu1eFNFPjVrA

15/ Why UST is committed to destroy DAI...

Now Terra has even more competition to worry about. 👇

Now Terra has even more competition to worry about. 👇

https://twitter.com/DU09BTC/status/1510326660335345669

16/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

• • •

Missing some Tweet in this thread? You can try to

force a refresh