If you intend to hold AVAX for the long term and believe in the completion of the existing ecosystem as well as the need for subnets to thrive in the future, you've probably had to decide where to stake your AVAX.

You should read this thread!

#AvaxholicInsights #CSSADT #AVAXDT

You should read this thread!

#AvaxholicInsights #CSSADT #AVAXDT

1/ What will be covered in this thread:

1⃣ Why do we need @BenqiFinance's Liquid Staking?

2⃣ What is BenQI's Liquid Staking?

3⃣ How does it work?

4⃣ BenQI plays an integral role in the Subnet Economy.

5⃣ veQI - Curve Wars on BenQI

6⃣ Potential of BenQI

1⃣ Why do we need @BenqiFinance's Liquid Staking?

2⃣ What is BenQI's Liquid Staking?

3⃣ How does it work?

4⃣ BenQI plays an integral role in the Subnet Economy.

5⃣ veQI - Curve Wars on BenQI

6⃣ Potential of BenQI

2/ As we all know, for a Proof-of-Stake #Blockchain like @avalancheavax, consensus is achieved by validators running hardware and locking up $AVAX collateral to secure the network.

2.1/ Validators earn ~ 9% inflationary rewards in exchange for securing the network. But most staking solutions today have a glaring problem: they’re not built for #DeFi.

3/ Liquid staking is in hot demand as billions in #liquidity flow to projects in the decentralized finance (#DeFi) space serving this need.

#AvaxholicAnalytics #CSSADT #AVAXDT #DEX #yield

#AvaxholicAnalytics #CSSADT #AVAXDT #DEX #yield

4/ Why do we need @BenqiFinance's Liquid Staking?

Problem: Staking $AVAX is a safe way to earn a profit and contribute to the security of the @avalancheavax blockchain; however, $AVAX can't be thrown into different #DeFi protocols to earn a higher % #yield.

Problem: Staking $AVAX is a safe way to earn a profit and contribute to the security of the @avalancheavax blockchain; however, $AVAX can't be thrown into different #DeFi protocols to earn a higher % #yield.

4.1/ Liquid Staking resolves this quandary by allowing you to stake $AVAX and earn staking #yield while also receiving a liquid pegged version ($sAVAX) that can be used in #DeFi protocols to earn even more yield.

4.2/ Liquid Staking allows you to compound your #yields, earning % staking + % yield farming in #DeFi

5/ What is @BenqiFinance's Liquid Staking?

BENQI's Liquid Staking #protocol is a liquid staking protocol for Proof-Of-Stake #blockchains to unlock liquidity for staked assets.

#AvaxholicInsights #CSSADT #AVAXDT

BENQI's Liquid Staking #protocol is a liquid staking protocol for Proof-Of-Stake #blockchains to unlock liquidity for staked assets.

#AvaxholicInsights #CSSADT #AVAXDT

5.1/ It's a protocol enabling users to stake $AVAX to receive @BenqiFinance Liquid Staked AVAX, $sAVAX, an interest bearing version of AVAX.

- TVL of BenQI Liquid Staking increased rapidly since launch.

- TVL of BenQI Liquid Staking increased rapidly since launch.

6/ What is @BenqiFinance's Liquid Staking? - 2

Economic Model

- Users stake $AVAX on BENQI, and receive $sAVAX. $sAVAX appreciates in value against $AVAX at ~7.2% a year. The current sAVAX/AVAX exchange rate is ~ 1.012241.

Economic Model

- Users stake $AVAX on BENQI, and receive $sAVAX. $sAVAX appreciates in value against $AVAX at ~7.2% a year. The current sAVAX/AVAX exchange rate is ~ 1.012241.

6.1/

- Users' $AVAX is then delegated to validators from the entire @avalancheavax validator set that meet the criteria.

- The staking rewards from the delegations are then given to $sAVAX stakers via the appreciation of $sAVAX value.

- Users' $AVAX is then delegated to validators from the entire @avalancheavax validator set that meet the criteria.

- The staking rewards from the delegations are then given to $sAVAX stakers via the appreciation of $sAVAX value.

7/ Should we stake at BLS?

Users prefer liquid staking for its huge benefits, including the possibility of passive income without having to lock your #coin.

Users prefer liquid staking for its huge benefits, including the possibility of passive income without having to lock your #coin.

7.1/ On top of the staking rewards, you can use $sAVAX in many major protocols to further earn yield, such as on @anchorprotocol and @traderjoexyz.

8/ Benefits:

- No lock-up periods

- Zero fees for depositing and withdrawing

- Seamlessly stake your $AVAX and start earning without needing to execute cross-chain transfers to the @avalancheavax P-Chain

- No lock-up periods

- Zero fees for depositing and withdrawing

- Seamlessly stake your $AVAX and start earning without needing to execute cross-chain transfers to the @avalancheavax P-Chain

8.1/

- Gain additional utility on your interest-bearing asset to be freely utilized within #DeFi

- Full control over your asset and associated accounts

- Gain additional utility on your interest-bearing asset to be freely utilized within #DeFi

- Full control over your asset and associated accounts

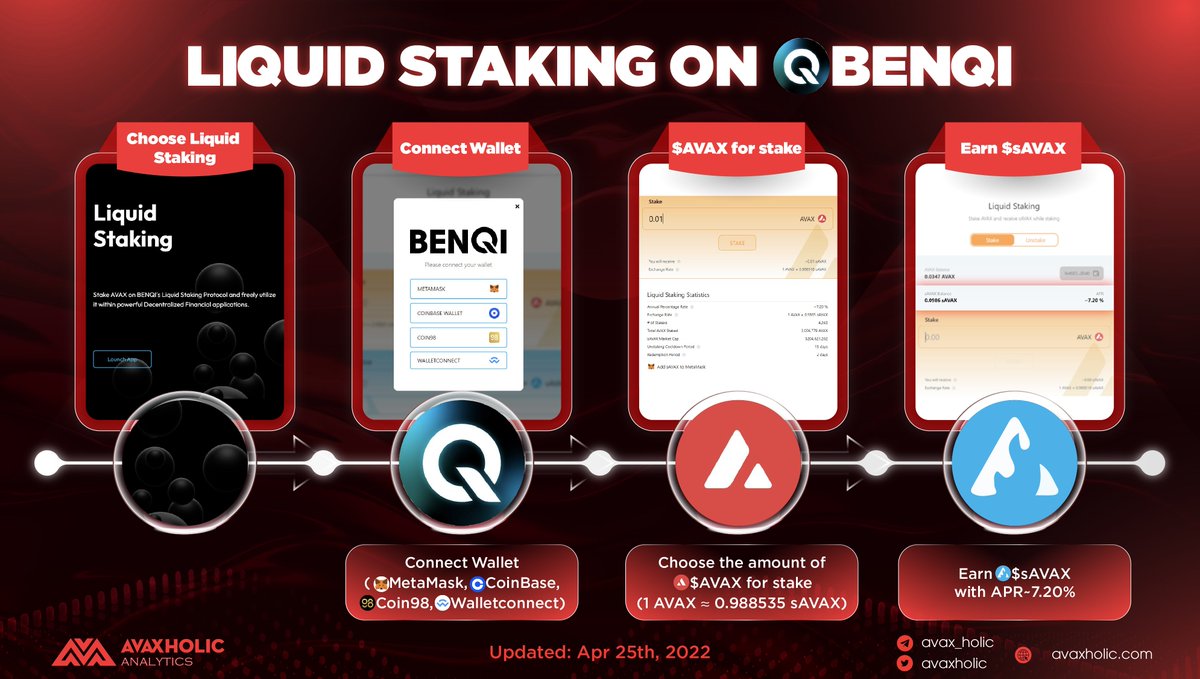

9/ How does it work?

By tokenizing the staked $AVAX into $sAVAX -> freeing up this locked up capital, creating greater capital efficiency within the Avalanche network.

#AvaxholicInsights #CSSADT #AVAXDT

By tokenizing the staked $AVAX into $sAVAX -> freeing up this locked up capital, creating greater capital efficiency within the Avalanche network.

#AvaxholicInsights #CSSADT #AVAXDT

9.1/ This is the process through which a user can gain #liquidity on their staked assets.

10/ DeFi Composability

There are partnerships to really give use cases like Swap, offer, borrow and yield on $sAVAX on the following protocols.

#AvaxholicInsights #CSSADT #AVAXDT

There are partnerships to really give use cases like Swap, offer, borrow and yield on $sAVAX on the following protocols.

#AvaxholicInsights #CSSADT #AVAXDT

11/ @BenqiFinance will play an integral role in the new Subnet Economy.

More subnets -> more validators -> more $AVAX staked -> This is a chance that @BenqiFinance can absorb an extraordinary amount of #TVL.

More subnets -> more validators -> more $AVAX staked -> This is a chance that @BenqiFinance can absorb an extraordinary amount of #TVL.

12/

Imagine:

1000 subnets build on avalanche, each with ~100 validators, each validator must stake 2000+ $AVAX.

-> That would require 1000*100*2000 AVAX = 200,000,000 AVAX

Currently, just only 3M AVAX staked in BenQI, so protential in the future.

https://twitter.com/el33th4xor/status/1515353653980323840

Imagine:

1000 subnets build on avalanche, each with ~100 validators, each validator must stake 2000+ $AVAX.

-> That would require 1000*100*2000 AVAX = 200,000,000 AVAX

Currently, just only 3M AVAX staked in BenQI, so protential in the future.

13/ BenQI DAO - veToken

The @BenqiFinance #DAO will determine key parameters such as Interest rate, validators,...

This will be done through veQI, which represents the QI token locked up for a predetermined period.

The @BenqiFinance #DAO will determine key parameters such as Interest rate, validators,...

This will be done through veQI, which represents the QI token locked up for a predetermined period.

13.1/ By accruing voting power via veQI, users, builders and DAOs will soon be able to direct staked $AVAX to bootstrap and support their favorite subnets (e.g. DFK, @PlayCrabada, @dexalotcom).

14/ Curve Wars on BenQI

veQI could use staked $AVAX to validate these subnets to receive subnet rewards, get boosted QI emissions, and much more. -> So, when @BenqiFinance controls a large amount of $AVAX, there will be a war to accumulate veQI for control over BenQI.

veQI could use staked $AVAX to validate these subnets to receive subnet rewards, get boosted QI emissions, and much more. -> So, when @BenqiFinance controls a large amount of $AVAX, there will be a war to accumulate veQI for control over BenQI.

14/ Potential of BenQI

Looking back, @LidoFinance was founded to provide liquid staking for @ethereum 2.0 and since then has grown continuously to this date and has become the largest staking provider, accounting for 1/3 of the market.

#AvaxholicInsights #CSSADT #AVAXDT

Looking back, @LidoFinance was founded to provide liquid staking for @ethereum 2.0 and since then has grown continuously to this date and has become the largest staking provider, accounting for 1/3 of the market.

#AvaxholicInsights #CSSADT #AVAXDT

14.1/ As we can see, @BenqiFinance is also receiving an increasing number of staked on a daily basis and is quickly becoming a @LidoFinance at @avalancheavax.

Discuss more: t.me/avaxholic_chat

Discuss more: t.me/avaxholic_chat

• • •

Missing some Tweet in this thread? You can try to

force a refresh