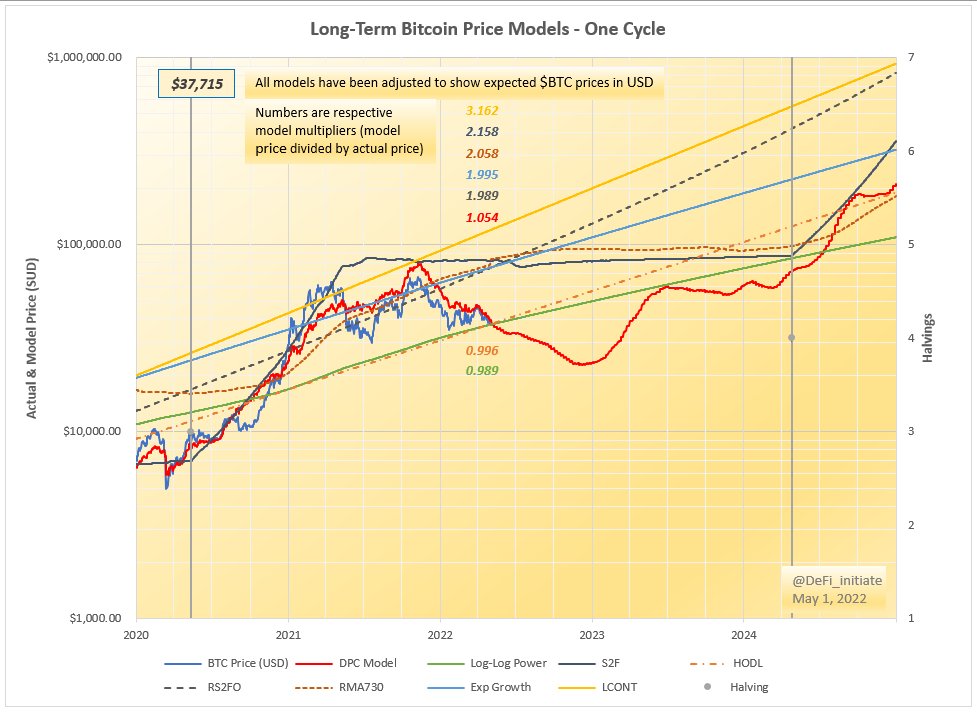

The clash of long-term #bitcoin price models - Weekly update (May 1, 2022). Model projections for yesterday's $BTC closing price:

- Power law: $37K

- HODL: $38K

- $BTC: $38K

- DPC: $40K

- RS2FO: $75K

- Exp growth: $75K

- RMA730: $78K

- S2F: $81K

- LCONT: $120K

- Power law: $37K

- HODL: $38K

- $BTC: $38K

- DPC: $40K

- RS2FO: $75K

- Exp growth: $75K

- RMA730: $78K

- S2F: $81K

- LCONT: $120K

https://twitter.com/DeFi_initiate/status/1518189237715320832

Time span of charts: 16 years & 5 years

Yesterday's $BTC closing price & respective model multiples (projected model price ÷ price of #bitcoin) are shown on the 2nd chart. Best fit is by the HODL model (orange dash dot curve): 0.996 * $BTC was projected for yesterday's close.

Yesterday's $BTC closing price & respective model multiples (projected model price ÷ price of #bitcoin) are shown on the 2nd chart. Best fit is by the HODL model (orange dash dot curve): 0.996 * $BTC was projected for yesterday's close.

Models included:

- Power law: Log-log growth

- HODL: Inverse Hyperbolic Tangent

- DPC: Dynamic Power Cycle

- RS2FO: Raised Stock-to-FOMO

- Exp. growth: Constant annual return

- RMA730: Raised 730-day moving ave.

- S2F: Stock-to-Flow

- LCONT: Life Cycle of New Technology

- Power law: Log-log growth

- HODL: Inverse Hyperbolic Tangent

- DPC: Dynamic Power Cycle

- RS2FO: Raised Stock-to-FOMO

- Exp. growth: Constant annual return

- RMA730: Raised 730-day moving ave.

- S2F: Stock-to-Flow

- LCONT: Life Cycle of New Technology

Model proponents:

- Power law: @hcburger1

- HODL: @therationalroot

- DPC: @DeFi_initiate

- RS2FO: @w_s_bitcoin

- Exp growth: @TechDev_52

- RMA730: @PositiveCrypto

- S2F: @100trillionUSD

- LCONT: @jclcapital

- Power law: @hcburger1

- HODL: @therationalroot

- DPC: @DeFi_initiate

- RS2FO: @w_s_bitcoin

- Exp growth: @TechDev_52

- RMA730: @PositiveCrypto

- S2F: @100trillionUSD

- LCONT: @jclcapital

Dive further into models and predictions: bitcoineconomics.io/charts.html by @BitcoinEcon

• • •

Missing some Tweet in this thread? You can try to

force a refresh