Sheffield United’s 2020/21 accounts covered a season when they finished 20th in the Premier League, leading to relegation after a two-year spell in the top flight. Manager Chris Wilder was replaced by Paul Heckingbottom (interim basis). Some thoughts follow #SUFC #twitterblades

This was the second year under new #SUFC owner Prince Abdullah after the High Court ruled that Kevin McCabe had to sell his 50% share to the Prince. This also triggered an agreement whereby the club had to purchase the stadium, training facility, gym, hotel and offices for £38m.

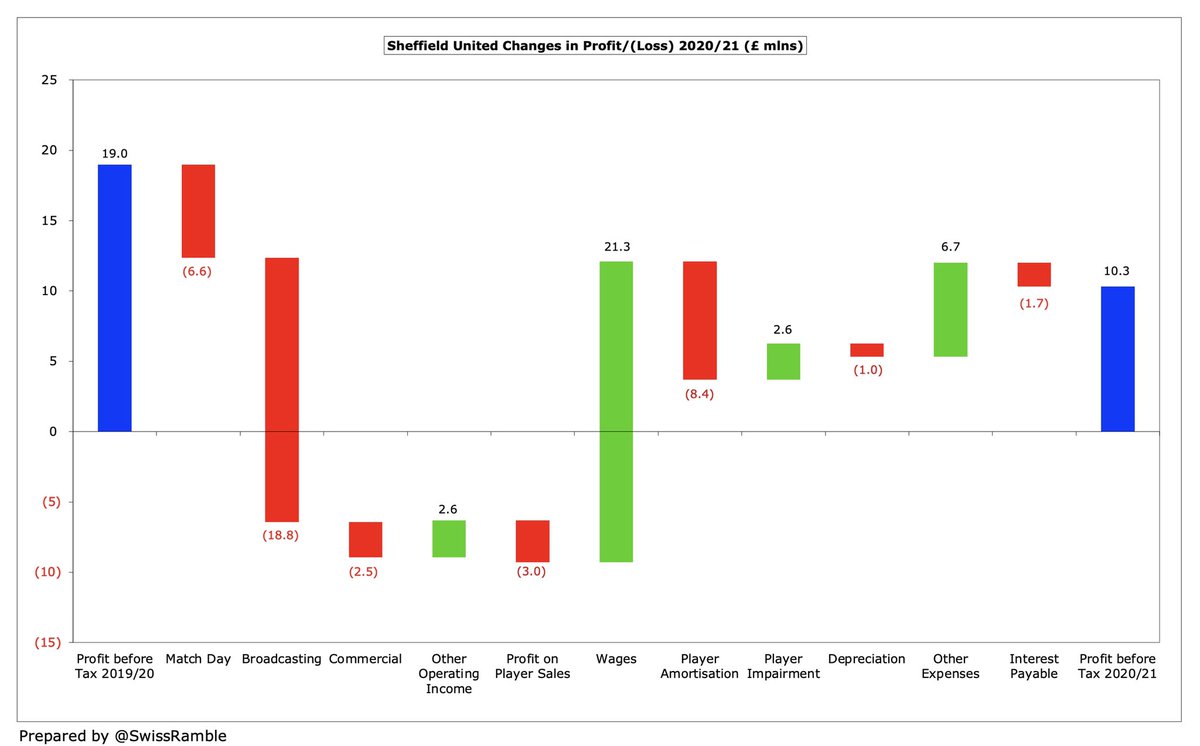

#SUFC pre-tax profit fell from £19m to £10m, as revenue dropped £28m (20%) from club record £143m to £115m and profit on player sales decreased £3m to £1m, partly offset by operating expenses falling £21m (17%). Net interest payable was up £1.7m to £2.5m.

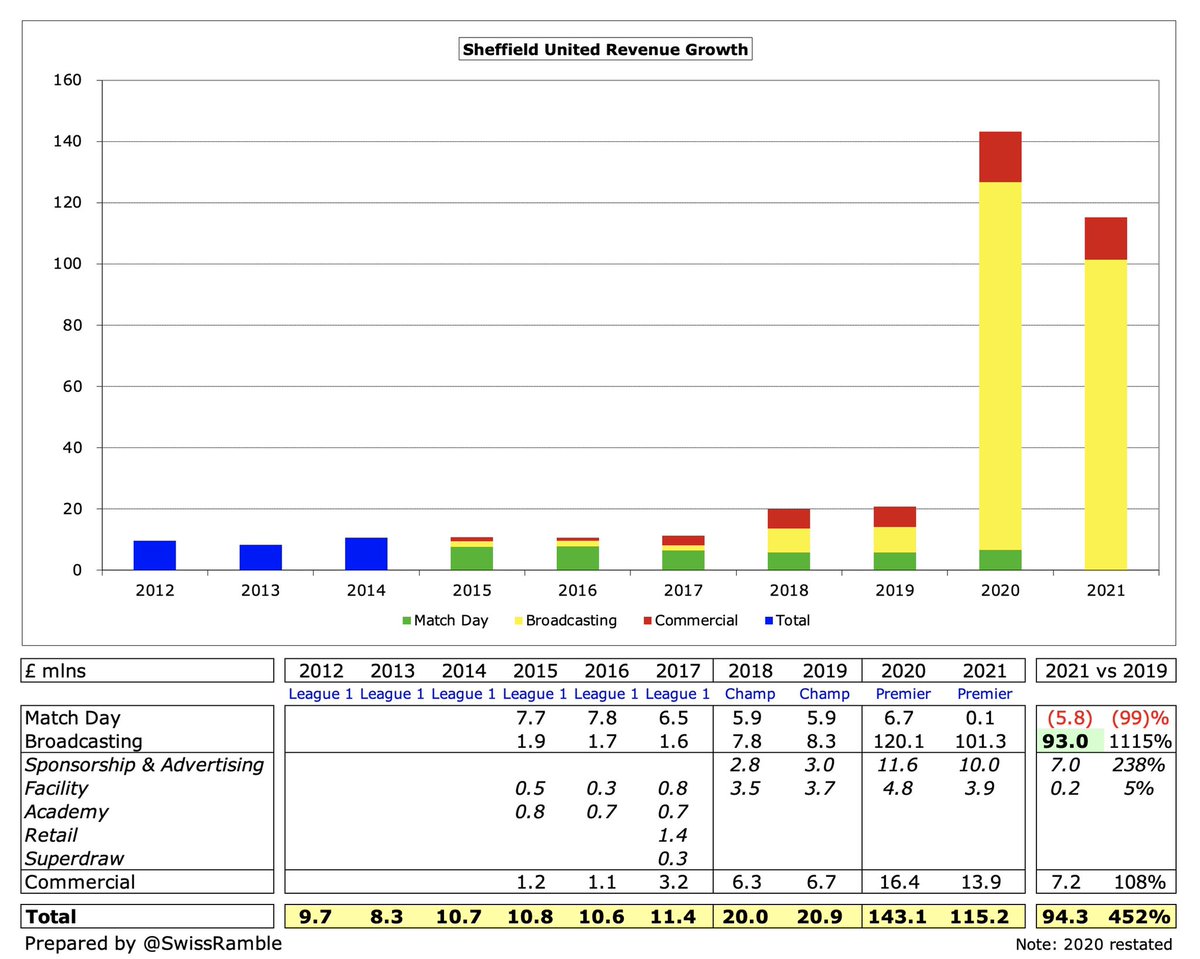

All three #SUFC revenue streams fell with the largest reduction in broadcasting, down £19m (16%) from £120m to £101m. COVID meant that match day dropped £6.6 m (99%) to just £58k, while commercial fell £2m (15%) from £16m to £14m. Other income included £2.5m insurance claim.

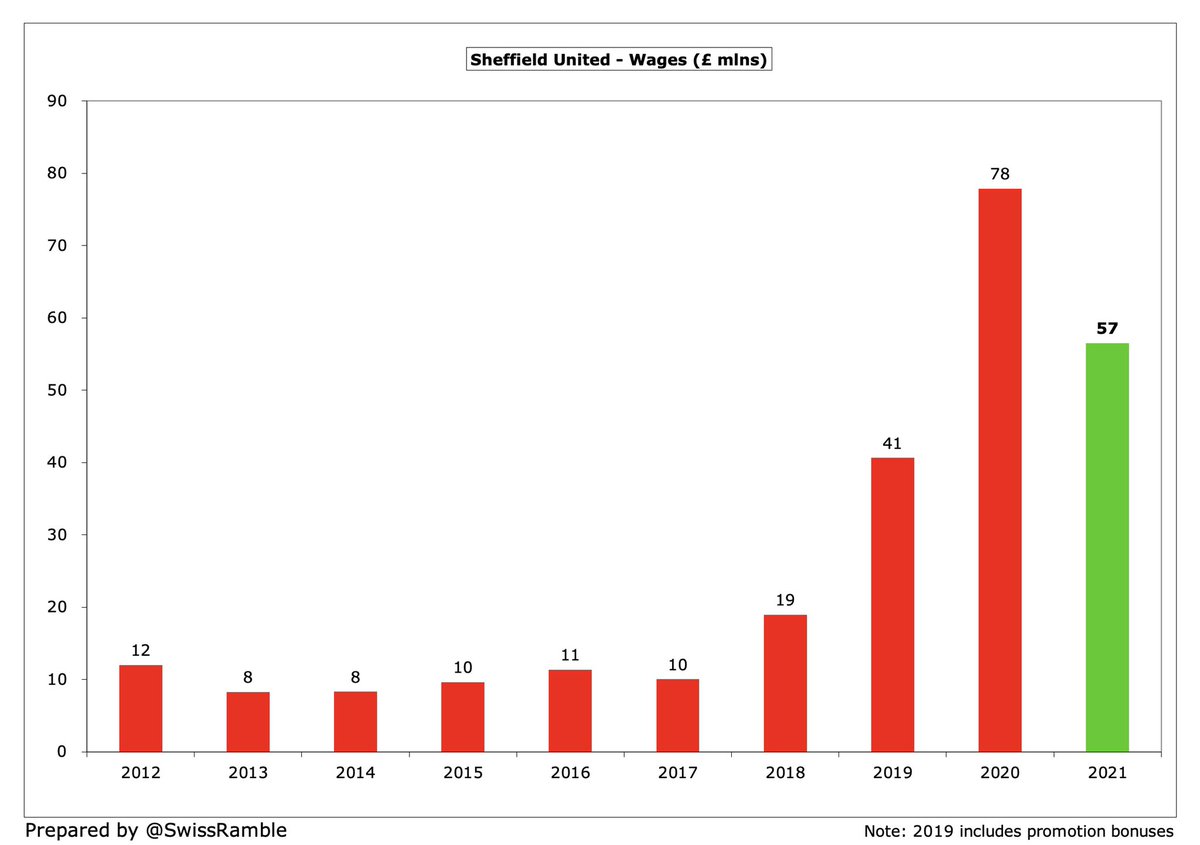

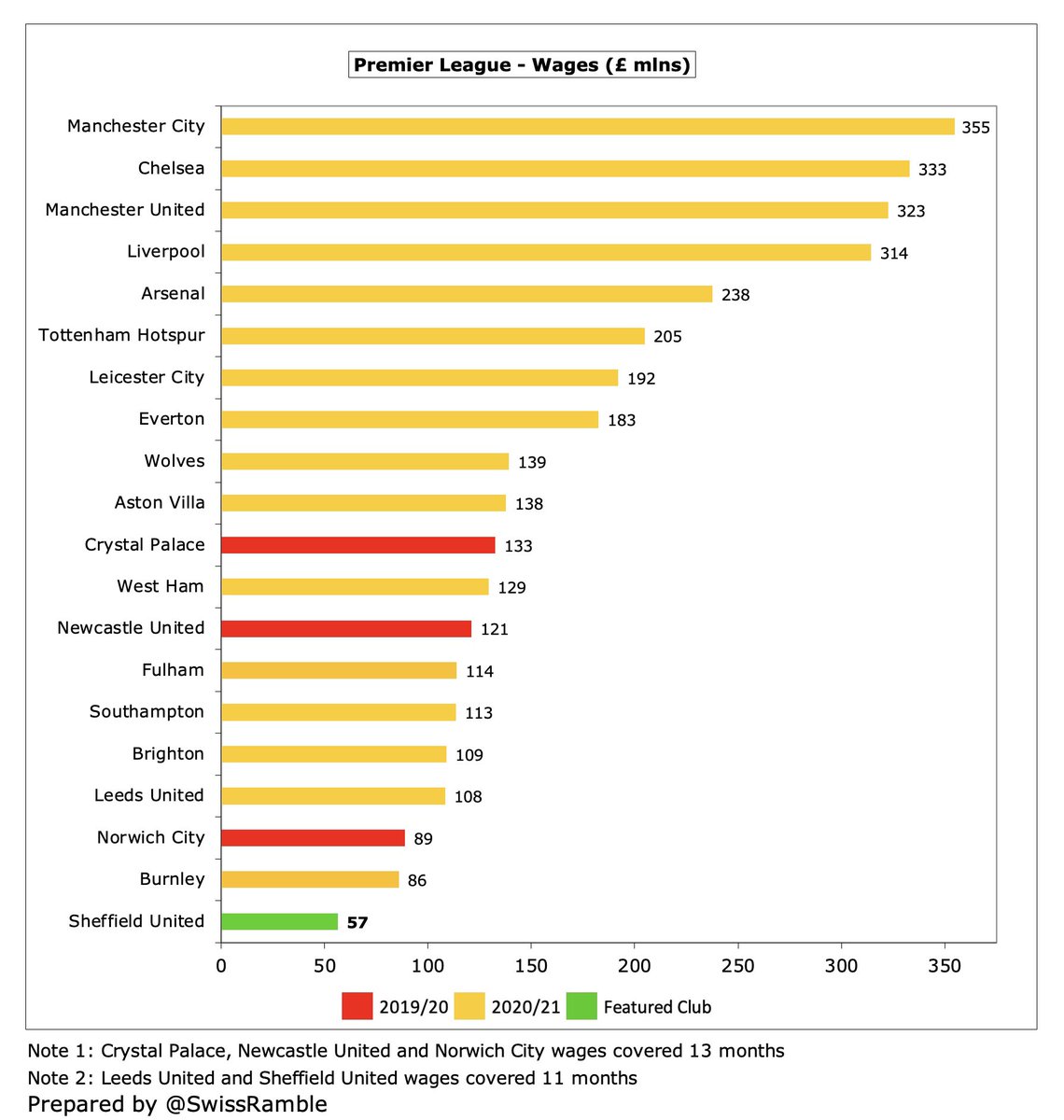

#SUFC wage bill fell £21m (27%) from £78m to £57m (prior year included bonuses for staying up), though player amortisation and impairment increased £6m (29%) to £26m and depreciation rose £1m (54%) to £3m. Other expenses were down £7m (24%) to £21m.

It is worth noting that #SUFC 2020/21 accounts cover 11 months, as they returned to a 30th June year-end. However, prior year covers a period of 13 months, as they extended their financial reporting period to 31st July 2020 to take into consideration the COVID delay.

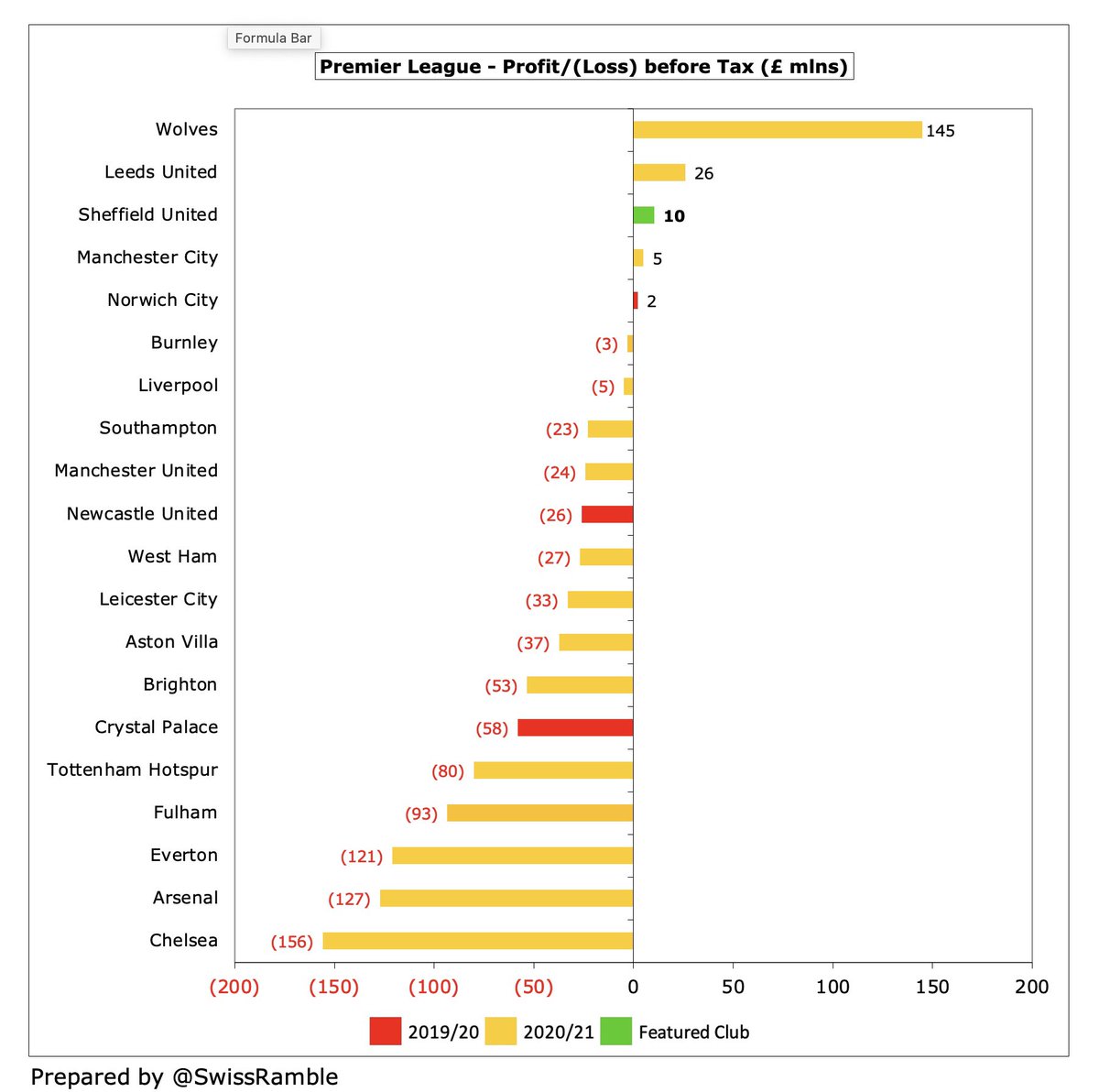

#SUFC are one of only four Premier League clubs to report a pre-tax profit to date, only surpassed by #WWFC £145m (including £127m loan write-off) and #LUFC £26m. In contrast, a full year of COVID meant some very large losses elsewhere, e.g. #CFC £156m, #AFC £127m and #EFC £121m.

#SUFC 2020/21 revenue loss due to COVID was £8.9m ( mainly match day), so their underlying profit would have been even higher at £19m. Added to the £11.2m shortfall in 2019/20 (including £8.7m rebate to broadcasters), that means total revenue lost of £20m in the last two years.

Furthermore #SUFC bottom line only benefited from £1m profit from player sales, down from prior year £4m. Mainly Callum Robinson to WBA with many players released. One of the worst player trading results in the Premier League, miles below #MCFC £69m, #WWFC £61m and #LCFC £44m.

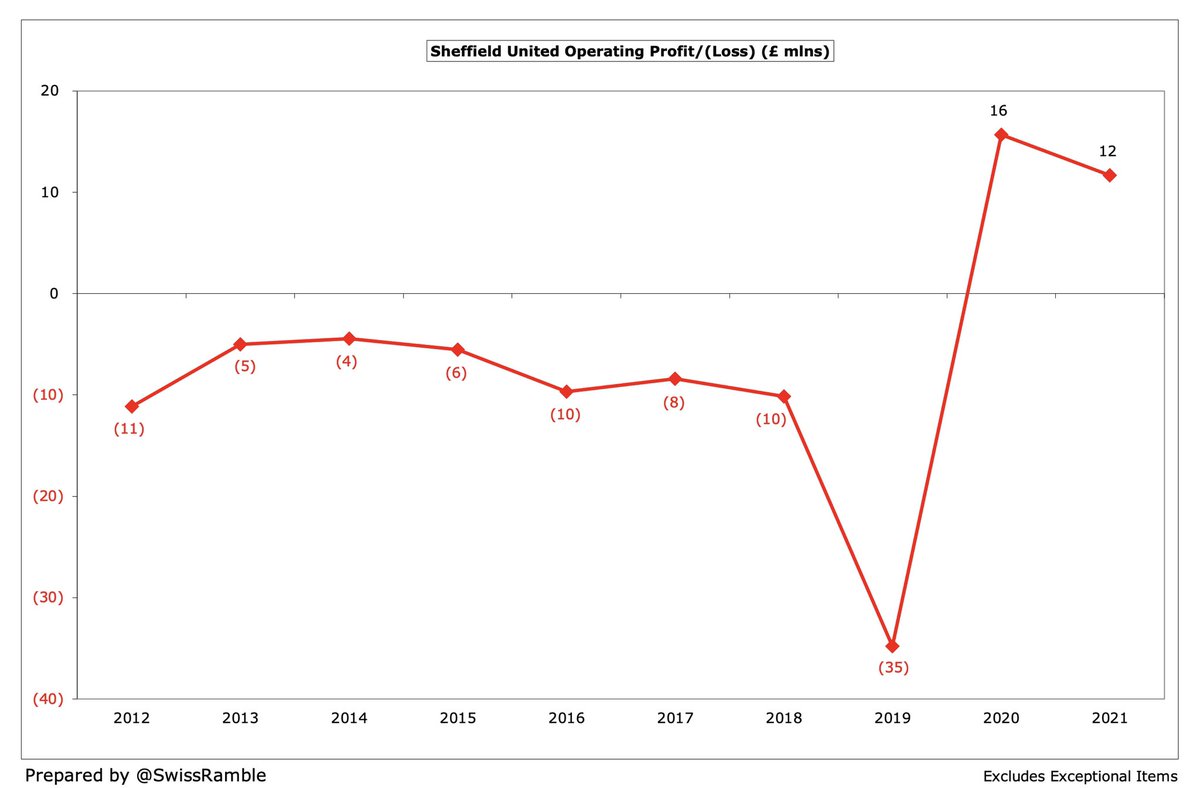

This is the second year in a row that #SUFC were profitable (£29m in total). Only made a profit on one other occasion since 2008, though £31m in 2014 was due to McCabe writing-off £35m loan before partnering with the Prince. The £19m loss in 2019 impacted by promotion bonus.

#SUFC profit from player sales has fallen two years in a row from the £14.2m peak in 2019 to just £1.1m. Last few years have included sell-on fees for Harry Maguire and Kyle Walker. This year’s figures will feature Aaron Ramsdale’s big money move to #AFC

#SUFC operating profit (excluding player sales & interest) fell from £16m to £12m, though still best in the Premier League. Only one other club made an operating profit in 2020/21, namely #LUFC £6m, while some posted huge losses: #CFC £159m, #EFC £118m, #FFC £94m and #AFC £91m.

Despite the fall in 2021, #SUFC £115m revenue is still more than five times as much as the £21m they generated in their last season in the Championship. In fact, they earned over a quarter of a billion pounds (£258m) in their two seasons in the Premier League.

#SUFC £115m revenue was the second lowest in the Premier League, slightly more than Burnley £115m. For some perspective, it was only around a fifth of #MCFC £570m. This season’s rankings are distorted by different amounts of revenue deferred from 2019/20 accounts.

As the 2019/20 season was extended, many clubs deferred revenue into 2020/21 for games played after the accounting close. However, as #SUFC moved year-end to 31st July, they deferred nothing, while clubs with a May year-end benefited significantly, e.g. #WWFC £43m.

#SUFC broadcasting income fell £19m (16%) from £120m to £101m, largely due to a lower merit payment, as their league position dropped from 9th to 20th (each place worth £1.8m). Lowest in the top flight, as others benefited from revenue deferrals from 2019/20.

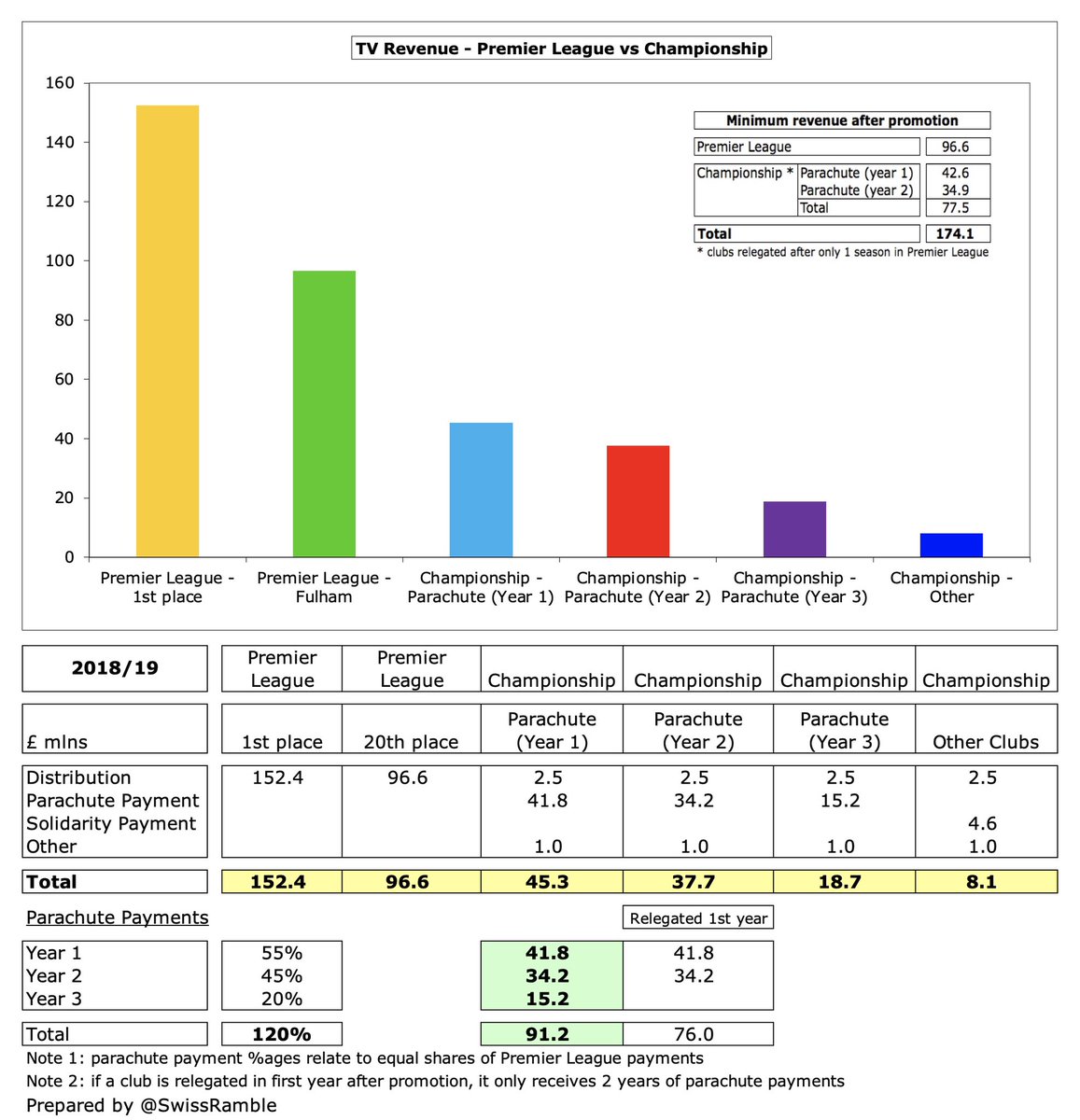

After #SUFC relegation from the Premier League, their TV income will have fallen significantly, albeit cushioned by £42m parachute payment, which gives them much higher revenue than most other Championship clubs. Parachutes fall to £35m in year 2 and £16m in year 3.

#SUFC match day fell £ £6.6 m (99%) to just £58k, as all home games were played behind closed doors (with the exception of one with restricted capacity). Was one of the lowest in the Premier League before the pandemic struck, only 7% of #THFC £95m for some perspective.

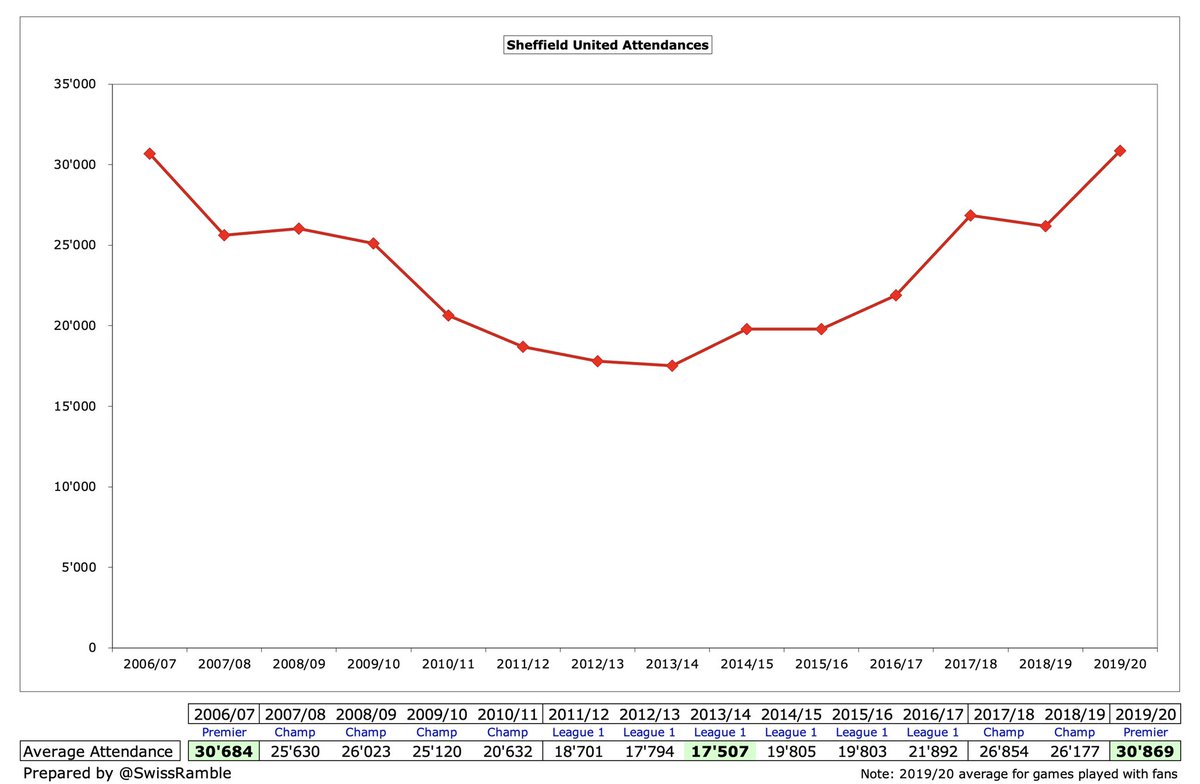

#SUFC average attendance of 30,869 in 2019/20 (for games played with fans) was in the bottom half of the Premier League, though 4,700 (18%) higher than their last season in the Championship and over 13,000 more than their 2013/14 low in League One.

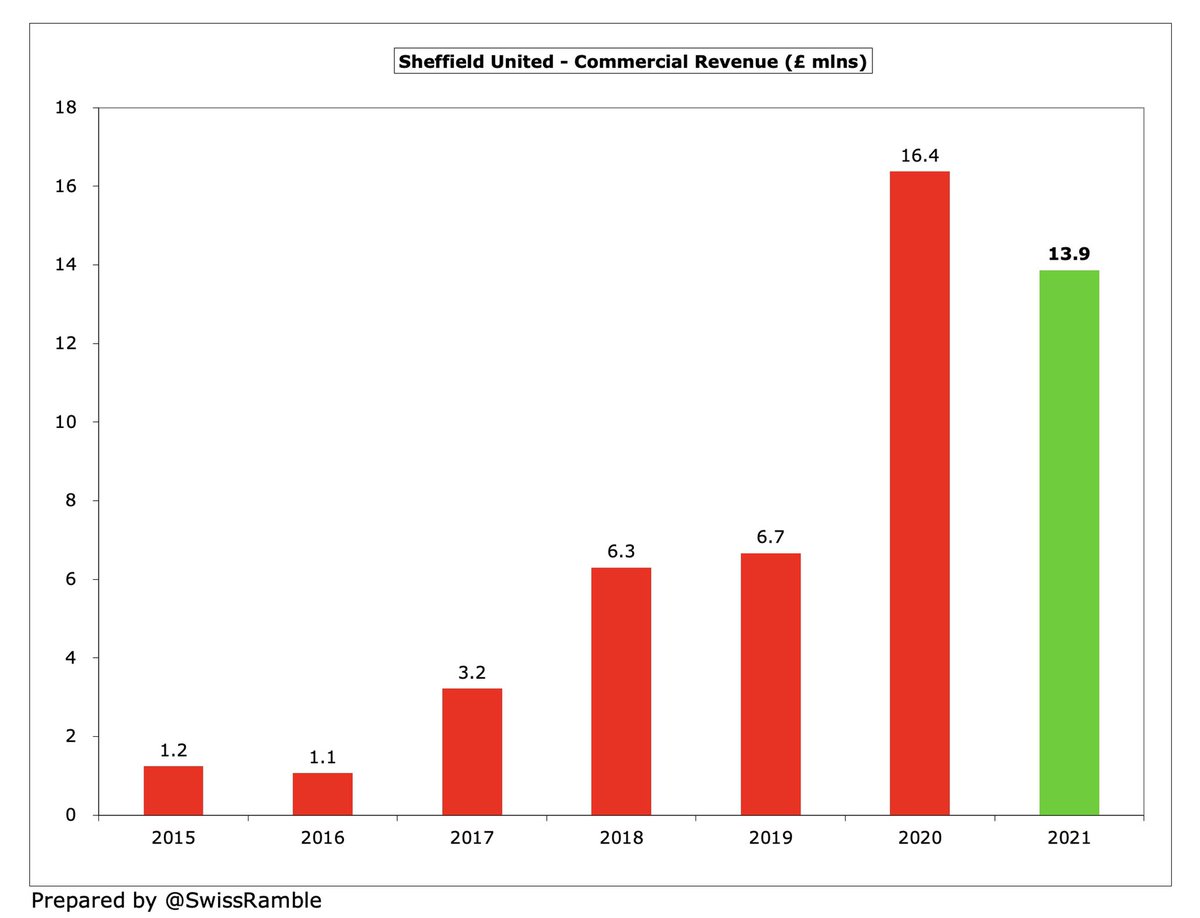

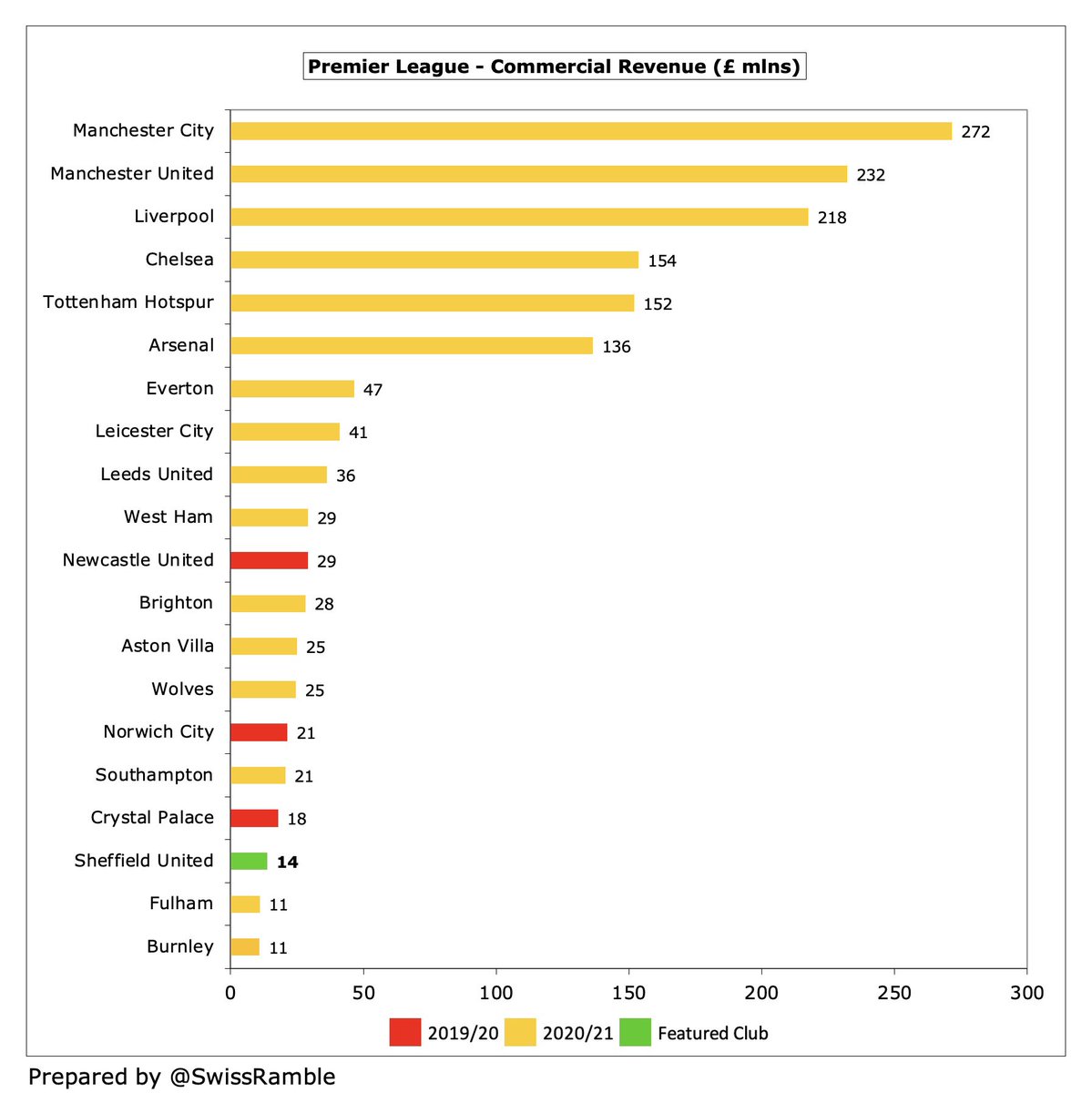

#SUFC commercial income fell £2.5m (15%) from £16.4m to £13.9m, partly due to 11-month accounting period. Includes sponsorship & advertising £10.0m and facility £3.9m. More than double £6.7m in the Championship, but this was still one of the lowest in the top flight.

#SUFC signed a new shirt sponsorship deal in 2019/20 with Union Standard Group, reportedly worth £3.5m a year, though the company went bust, so has been replaced by Randox Health in 2021/22. Long-standing kit supplier deal with Adidas was extended by a year for this season.

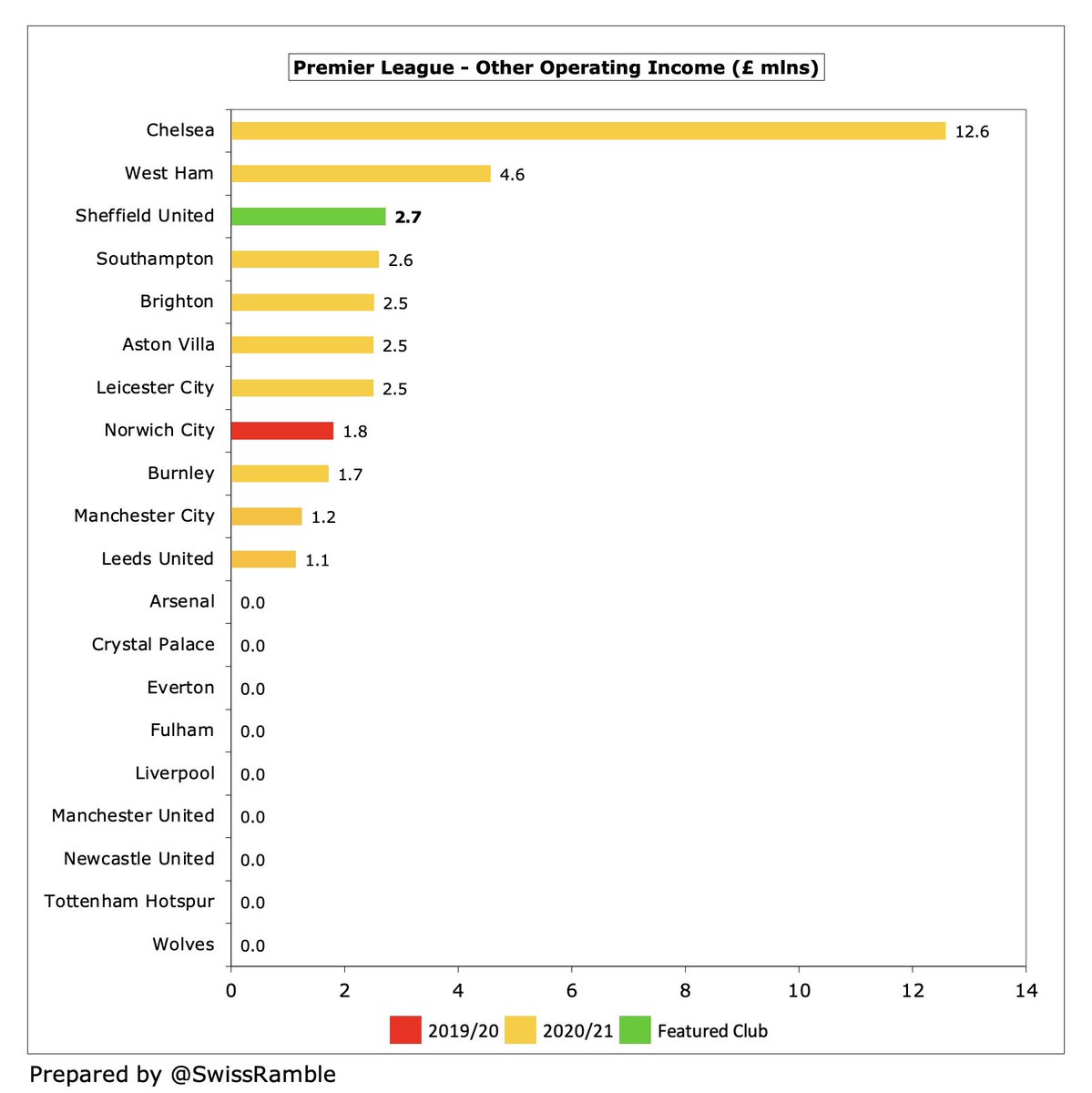

#SUFC also booked £2.7m other operating income, including £2.5m business interruption insurance claim and £149k Coronavirus job retention scheme. Highest amount reported here was #CFC £12.6m, mainly due to unexplained recharges.

#SUFC wage bill fell £21m (27%) from £78m to £57m, mainly because prior year included bonuses for staying up. It’s a bit misleading due to accounting period changing from 13 months to 11 months. On a like-for-like basis, the decrease would be £10m (14%) from £72m to £62m.

Following the steep increase, #SUFC £57m wage bill is by far the smallest in the Premier League, £29m below the next lowest Burnley £86m. While the club could be commended for its tight cost control, the flip side is that low wages made relegation more likely.

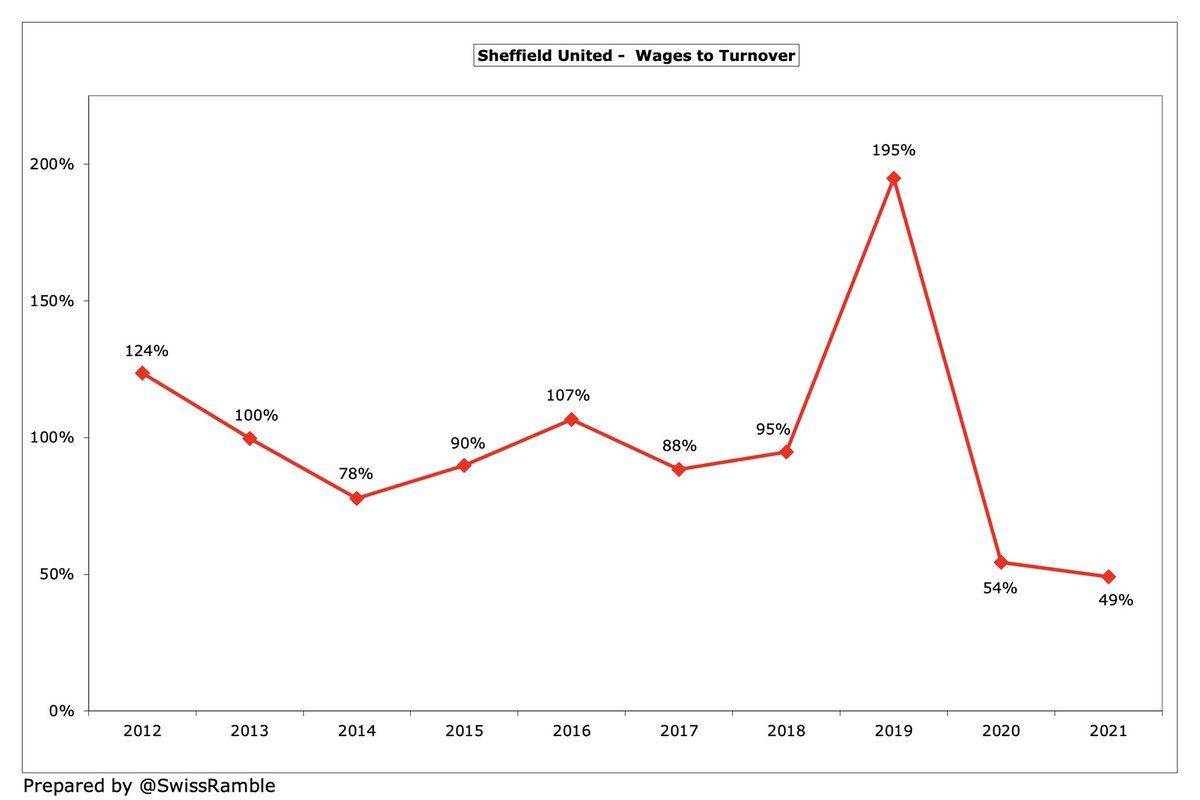

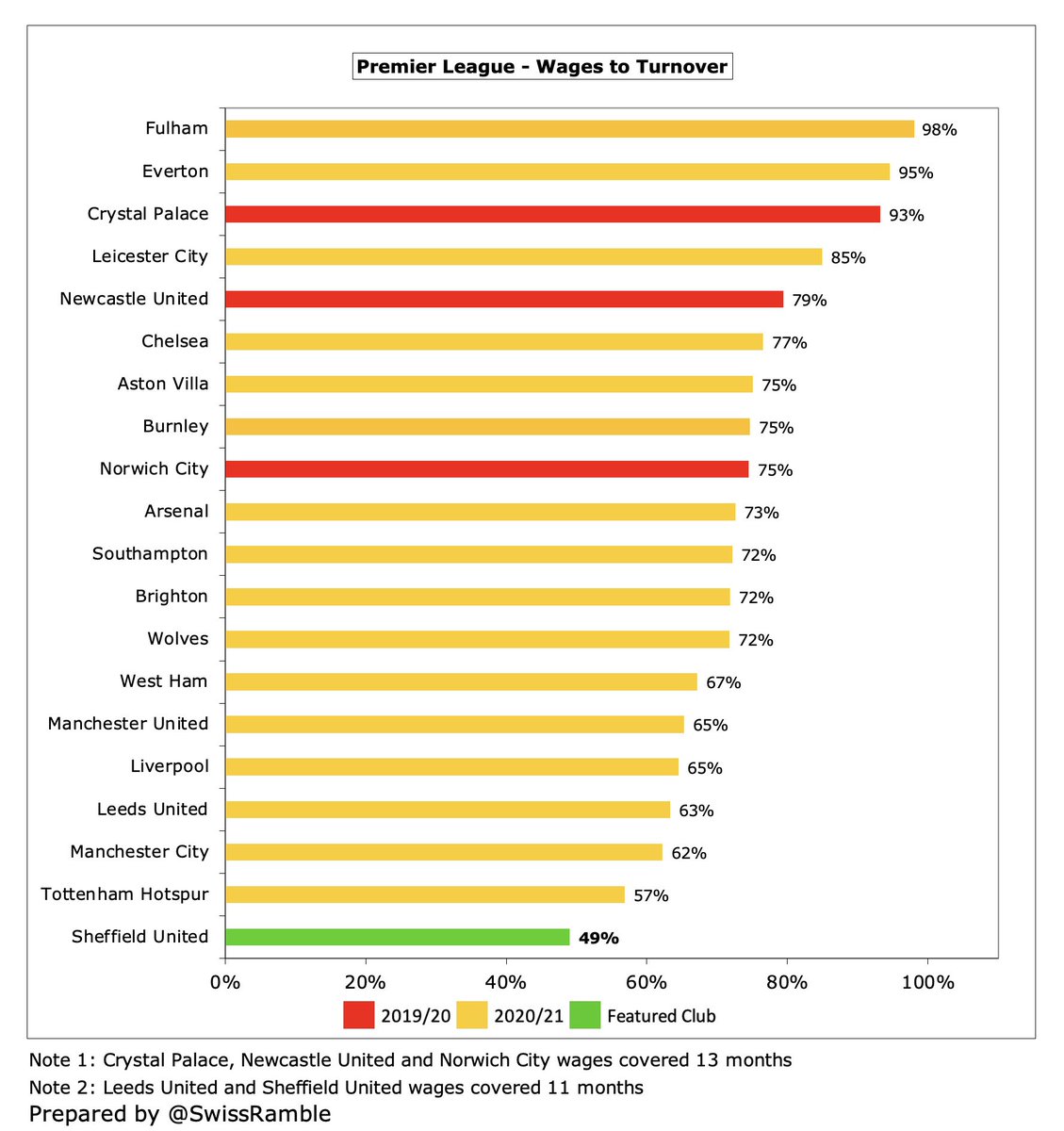

#SUFC wages to turnover ratio fell from 54% to 49%, lowest in the Premier League, having significantly improved from 195% in the Championship (including hefty promotion bonus). Would have been 50% if adjusted for 11 months and COVID impact. Arguably, the club played it too safe.

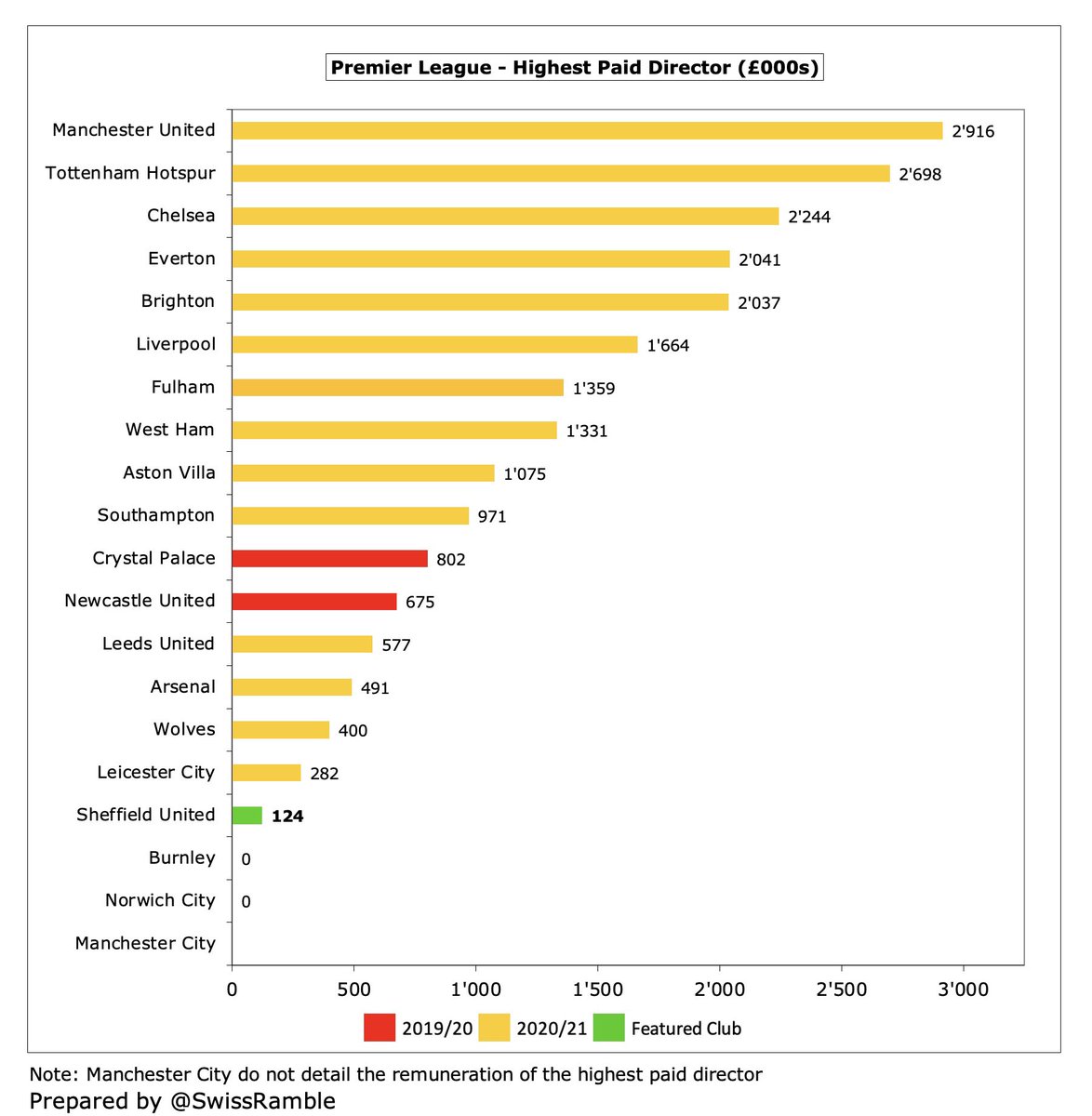

#SUFC highest paid director’s remuneration increased by 11% from £112k to £124k, though this was still very much on the low side in the Premier League, far below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

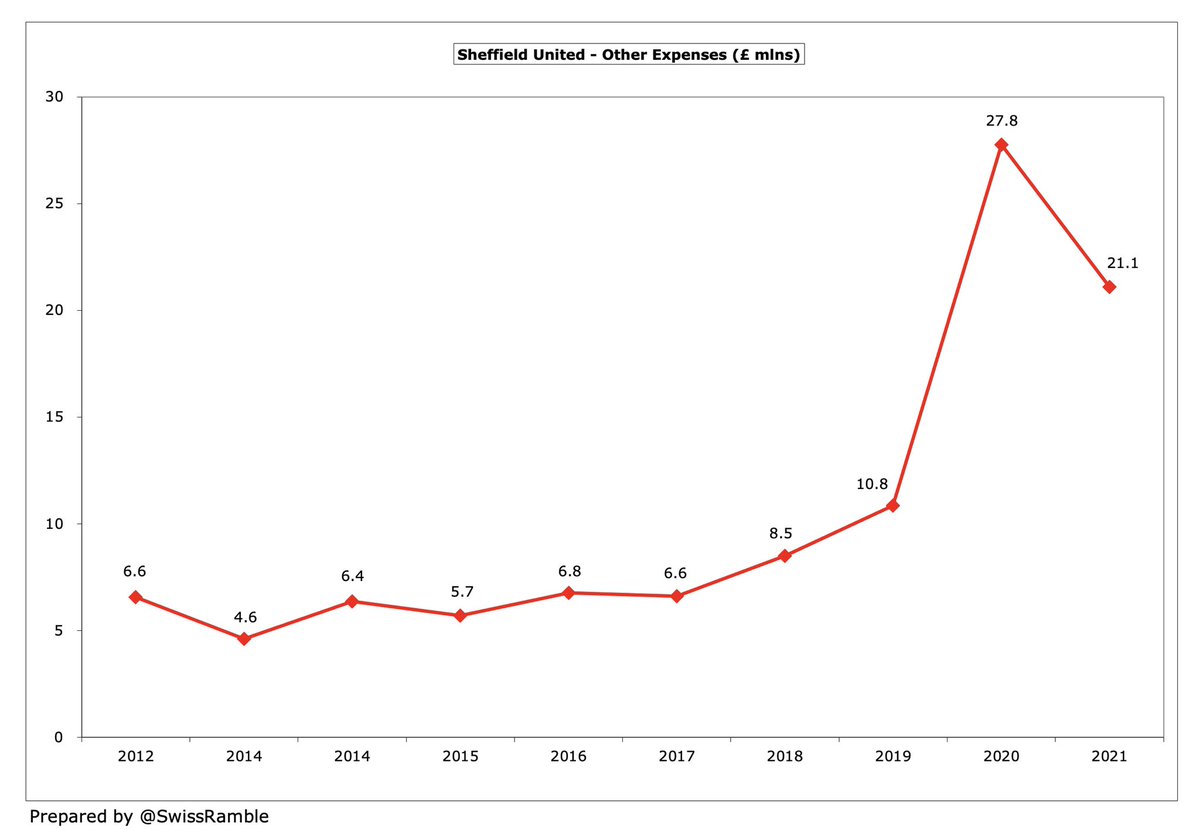

#SUFC other expenses fell £7m (24%) from £28m to £21m, mainly due to the lower cost of staging games, as they were played without fans due to COVID. Still twice as much as £11m in the Championship.

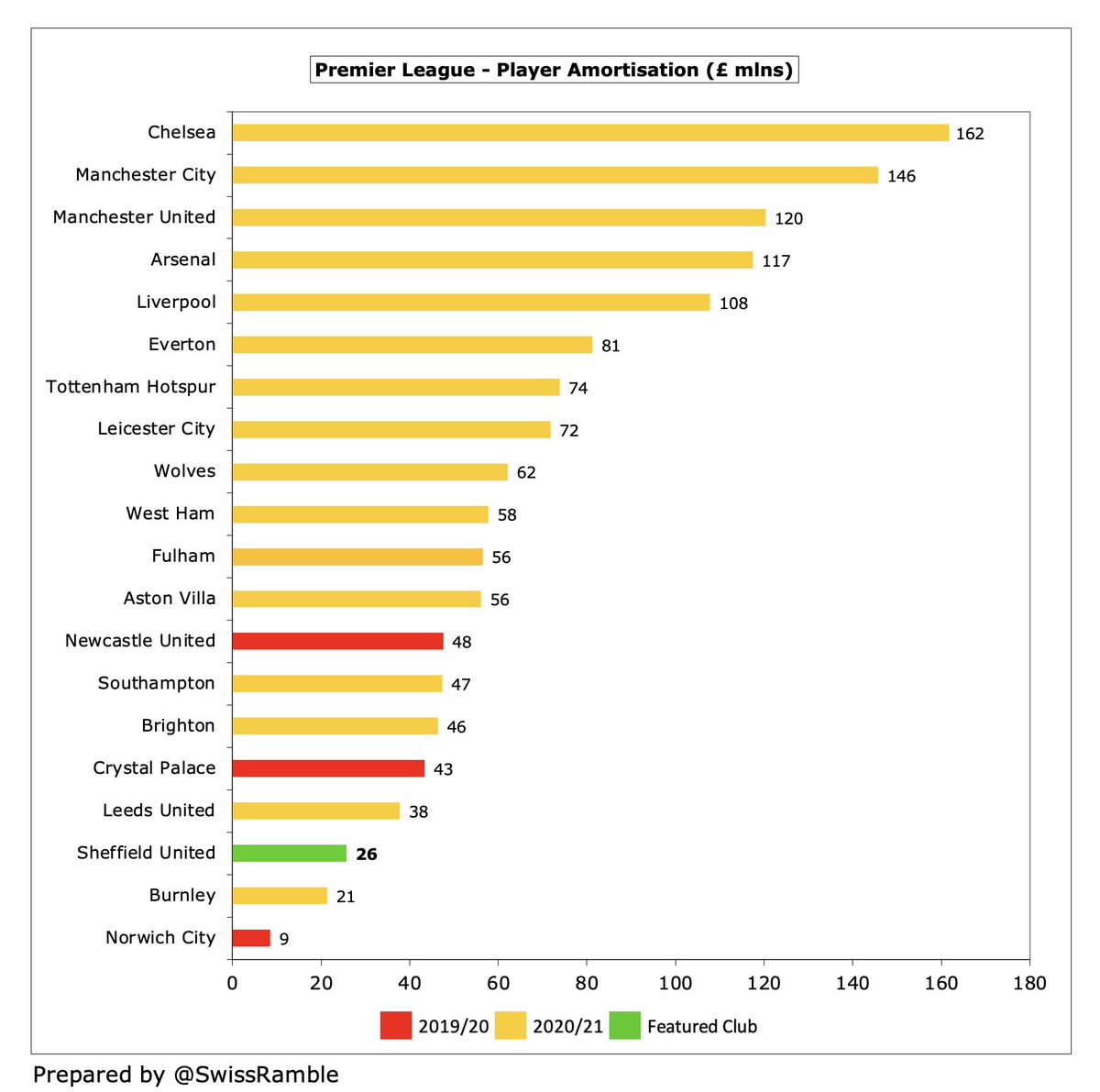

#SUFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £8m to £26m following investment in the squad., though still one of the lowest in the Premier League. Up from just £3m in 2019. No repeat of prior year’s £2.6m player impairment.

#SUFC spent £46m on player purchases, down from club record £66m the previous season, partly distorted by change in accounting date. Included Rhian Brewster from #LFC, Aaron Ramsdale from #AFCB, Oliver Burke from WBA plus Max Lowe and Jayden Bogle from #DCFC.

#SUFC £112m outlay on player purchases in the last two years was more than five times as much as the previous eight years combined. However, they have spent hardly anything on recruitment since relegation to the Championship.

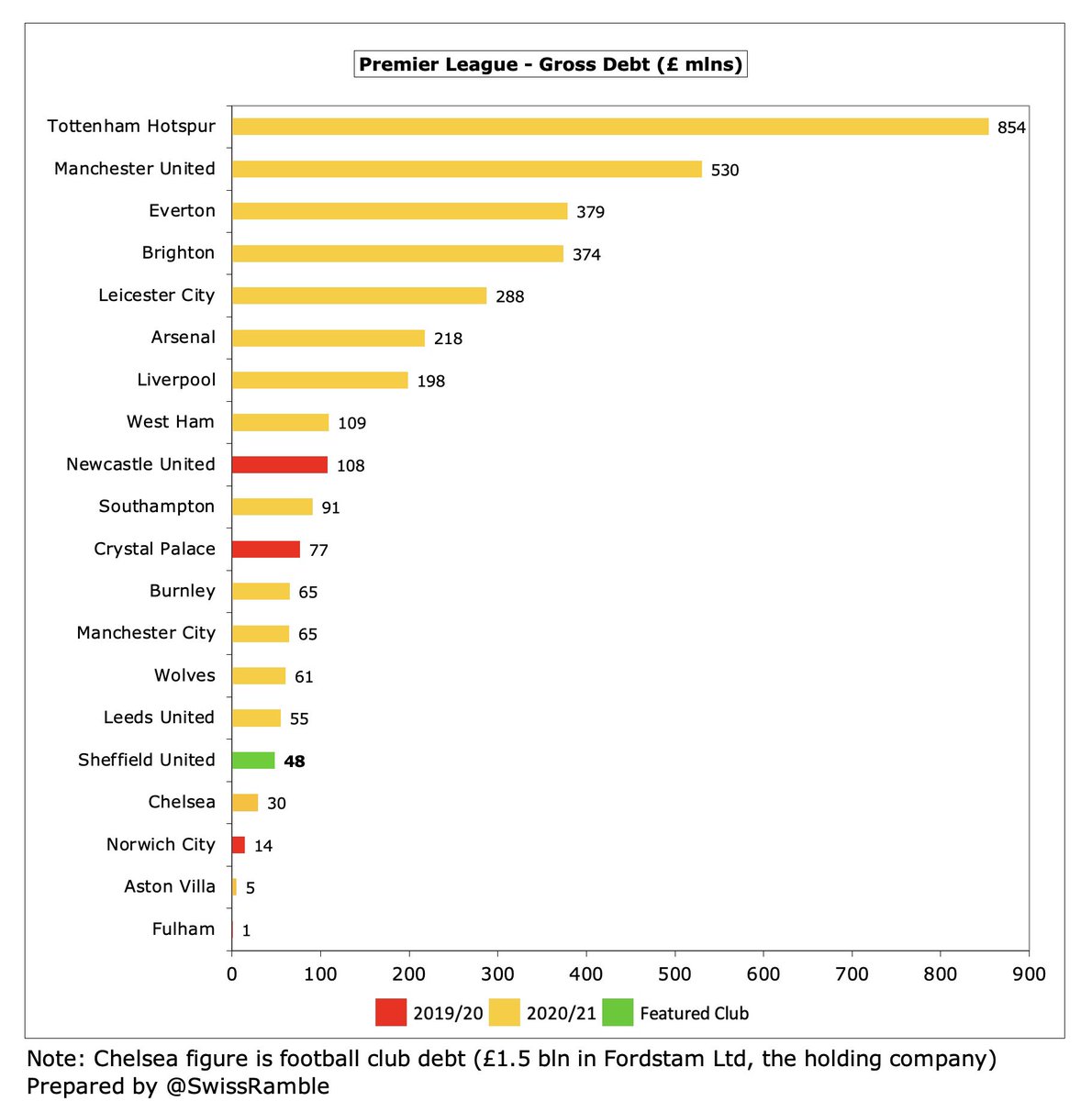

#SUFC gross debt increased from £17m to £48m, as they took out a £30m bank loan from Macquarie, secured on TV money. Also have £18m from shareholders. Debt would have been much higher without owners writing-off £35m debt and converting £27m of debt to equity since 2014.

Despite the increase, #SUFC £48m gross debt was still one of the smallest in the Premier League, much lower than the likes of #THFC £854m (stadium), #MUFC £530m, #EFC £379m and #BHAFC £374m. Since these accounts, have increased debt, secured on Ramsdale transfer payments.

Some fans would argue that the additional debt has effectively been used to fund the Prince’s purchase of the stadium and other assets (as part of the agreement to buy the club from McCabe), so in some ways the takeover was analogous to a leveraged buy-out.

#SUFC interest payment increased from £874k to £2.5m, due to the bank loan taken out by the holding company, Blades Leisure Ltd, though this was significantly lower than the likes of #AFC £34m (debt refinancing break fee), #MUFC £21m and #THFC £18m.

#SUFC transfer debt shot up from £17m to £37m, only slightly offset by £2m transfer fees owed by other clubs. On the low side for the Premier League, e.g. #THFC owe £170m, though they also have £14m contingent liabilities (based on appearances and team performance).

#SUFC £12m operating profit converted to £10m negative cash flow after adding back £29m amortisation/depreciation, offset by £50m working capital movements. Spent £23m on players (purchases £26m, sales £3m), £2m interest and £1m capex. Funded by £29m bank loan.

As a result, #SUFC cash balance decreased by £5m from £7m to £2m, by far the lowest in the Premier League, which helps explain the additional debt taken on after these accounts. Club also issued £15m of shares, but this is likely to be a conversion of debt to equity.

Since 2013 #SUFC’s available cash of £134m is split between operating activities £67m, bank loans £44m and owner financing £23m. Most of this went on player purchases £65m and infrastructure £54m, including buying the stadium, training ground and other assets.

Note that the cash flow statement is from parent company Blades Leisure Ltd, as this is not published in The Sheffield United Football Club Ltd accounts. However, the revenue, wages, P&L and debt numbers are almost the same for these two companies, so it’s a reasonable proxy.

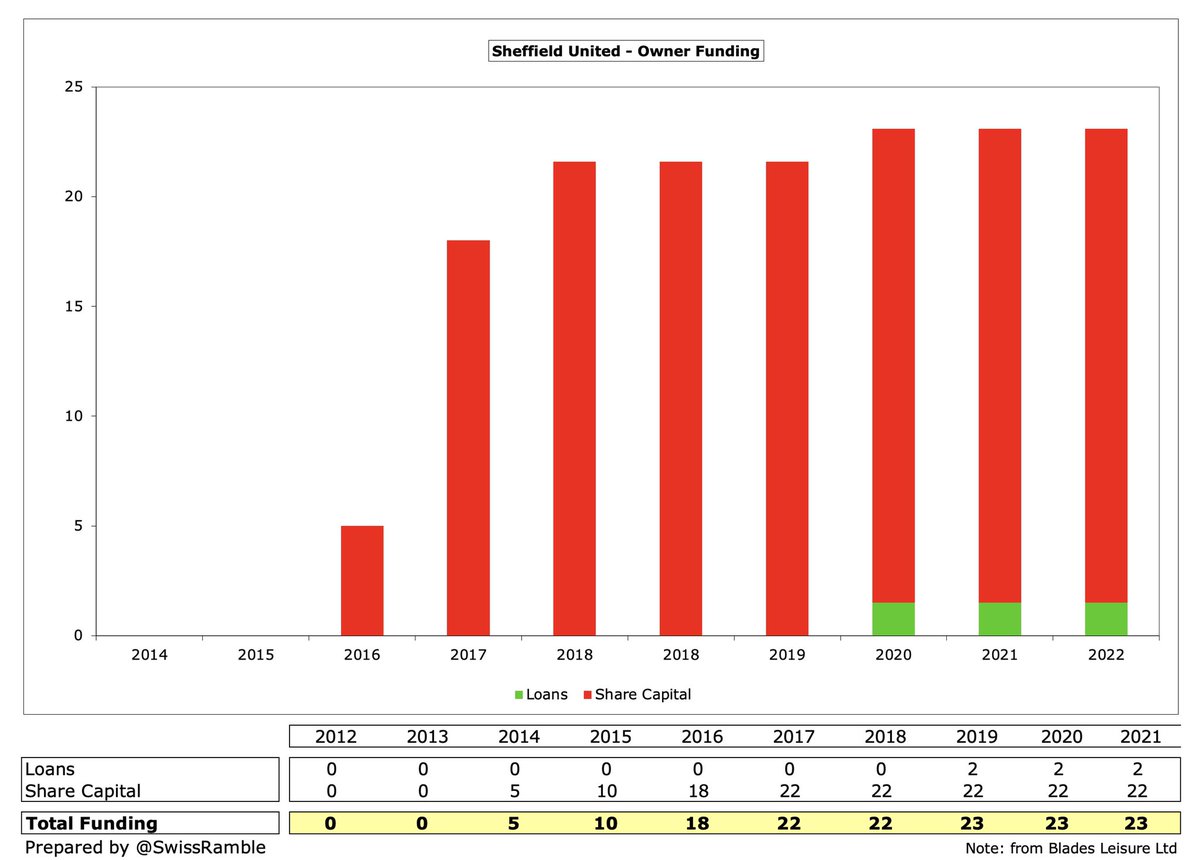

Only £5m owner funding has been provided to #SUFC in the last 5 years, which was one of the lowest in the Premier League. Over that period some other clubs received substantially more from their owners, e.g. #EFC £448m, #AVFC £400m and #FFC £347m.

There are media reports that #SUFC have received a £115m takeover bid from American businessman Henry Mauriss, though the EFL is currently reviewing this to ensure that he passes their Owners' and Directors' Test including source of funding.

It was an impressive achievement for #SUFC to again report a profit in a season that was played almost entirely behind closed doors, but they might have given themselves a better chance of staying up if they had spent a bit more money.

#SUFC have secured a place in the Championship play-offs, so supporters will hope that the club can immediately bounce back to the Premier League. Clearly, the Blades were boosted by the financial advantage of their parachute payment, but they still have to do it on the pitch.

• • •

Missing some Tweet in this thread? You can try to

force a refresh