1/13 Where is the FED Put?

Stock market decline of 30 to 40% in isolation most likely won't cause a FED pivot. Financial (in)-stability the main potential driver for a FED pivot. Watch the US $.

#FederalReserve

#inflation

#NASDAQ

Stock market decline of 30 to 40% in isolation most likely won't cause a FED pivot. Financial (in)-stability the main potential driver for a FED pivot. Watch the US $.

#FederalReserve

#inflation

#NASDAQ

2/13 "Don't fight the FED" is investment advise with a lot of muscle memory. Over the last three decades stock market investors have gotten used to the FED coming to the rescue when markets are down 20+ %.

3/13 Greenspan 1997/Long Term Capital Management, Greenspan again 2001/Internet Bubble, Bernanke 2008/Great Financial Crisis and Powell in 2019/Repo Crisis are prime examples. While the S&P is not quite down 20% from its peak, the NASDAQ and Russell 2000 are already there.

4/13 The focus on stock market declines as the main driving force for the FED stepping in is misleading. The FED has 3 implicit mandates. Price stability, full employment and financial stability. The FED faces an optimization problem between these 3 conflicting targets.

5/13 Over the last 30 years price stability has not been an issue as the deflationary 3 amigos of demographics, technology and high debt levels have kept it mostly in check. So the FED focus was more on financial stability and full employment.

6/13 The FED is messaging very clearly that its main focus is now on price stability. They can't print oil, wheat or lithium. Work from home, lockdowns in China, Ukraine war are all complicating factors out of their control. Their only dial is to bring down demand.

6/13 Higher rates, lower stock prices (negative wealth effect), QT, stronger US$, higher credit spreads and higher asset volatility are all helping to tighten financial conditions and bring down demand. That's the plan!

7/13 I see no reason to doubt the FED about their messaging/intentions. Will it work is a different question. Stocks down 30 to 40% won't panic them this time as long as ...

8/13 Financial stability is not in danger. It is the factor to most likely make the FED pivot especially as the labor market is still strong and moves generally like a big ocean liner (takes time to change direction).

9/13 There are some murmurs already. Y Yellen said "there is some worry about the treasury market functioning". The strong US $ causes some stress in currency pegs as as the HKMA just sold US$ against HK $ . We also had a stable coin (Terra) blow up in the crypto world.

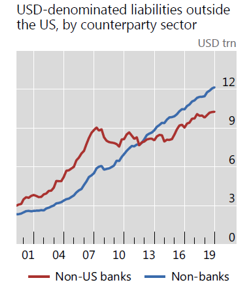

10/13 The strong US $ is important here for a number of reasons. There are large amounts of US $ debt around the world (Euro $ market) which need to be serviced. The size of the Euro $ market is difficult to estimate but 2019 data from the BIS points to US $ 20 trillion plus.

11/13 While a strong US $ helps with price stability (lower import prices), it can cause problems for countries with large denominated US $ debt as they scramble for US $ and drive the US $ even higher.

12/13 Then there are countries with large holdings of US securities such as Japan or China. At what US $/Yen rate does Japan intervene in the currency markets by selling US treasuries (into a treasury market which is already lacking depth) or tap into FED swap lines like in 2020.

13/13 Either way the FED would probably be forced into flooding the world with dollars and end the tightening of financial conditions.

There are other ways for financial market instability to develop but for now I would focus on the $ as a transmission link for a fed pivot.

There are other ways for financial market instability to develop but for now I would focus on the $ as a transmission link for a fed pivot.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh