Former Banker and Hedge Fund Partner; Dipl. Vwl; Gym Rat; Not Investment Advice

How to get URL link on X (Twitter) App

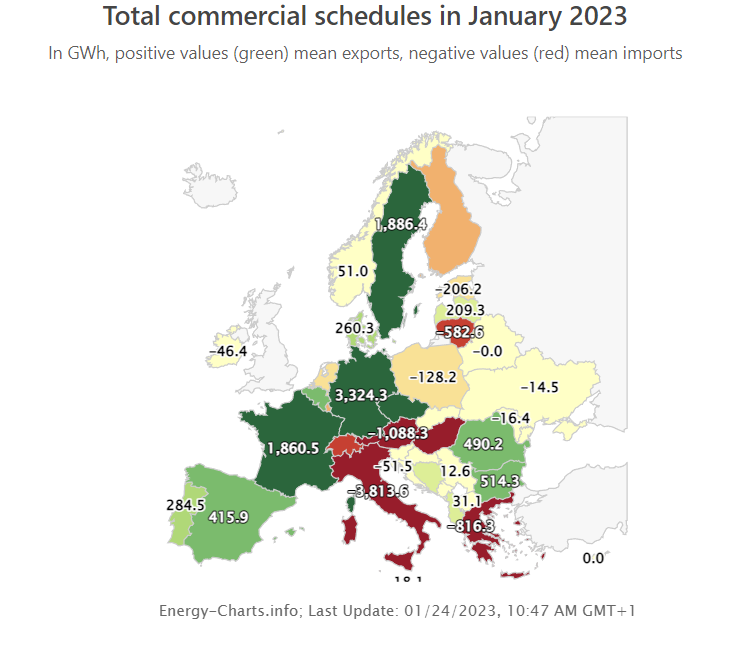

2/2 Actual situation up to January 24th 2023 for the month of January (peak of winter in 🇩🇪):

2/2 Actual situation up to January 24th 2023 for the month of January (peak of winter in 🇩🇪):

2/8 The first counter argument is that this is somewhat more a return to the past with TTF generally trading way above Henry Hub.

2/8 The first counter argument is that this is somewhat more a return to the past with TTF generally trading way above Henry Hub.

2/13 Let me say upfront that I am not against nuclear energy but it has to make sense. For example Germany made a mistake in shutting down nuclear energy quickly for political reasons. A better approach would have been to sweat the nuclear assets as long as reasonably possible.

2/13 Let me say upfront that I am not against nuclear energy but it has to make sense. For example Germany made a mistake in shutting down nuclear energy quickly for political reasons. A better approach would have been to sweat the nuclear assets as long as reasonably possible.

2/16 I seek out information which does not confirm my thesis that oil consumption is peaking for good.

2/16 I seek out information which does not confirm my thesis that oil consumption is peaking for good.

2/6 Reuters reported a few days ago that Ukraine (a major transit route of Russian gas into Europe) is stopping some gas deliveries into Europe.

2/6 Reuters reported a few days ago that Ukraine (a major transit route of Russian gas into Europe) is stopping some gas deliveries into Europe.

2/6 Poland (40%) and Bulgaria (77%) have traditionally been dependent on Russian Gas (numbers are from 2020 and are estimated somewhat higher for 2021).

2/6 Poland (40%) and Bulgaria (77%) have traditionally been dependent on Russian Gas (numbers are from 2020 and are estimated somewhat higher for 2021).

2/9 On April 20th I wrote a thread about the arguments for and against the demise of the US $ as the global reserve currency. No matter where you come down on this, there is an additional dynamic for currencies pegged to the US $. Political and oil related.

2/9 On April 20th I wrote a thread about the arguments for and against the demise of the US $ as the global reserve currency. No matter where you come down on this, there is an additional dynamic for currencies pegged to the US $. Political and oil related.