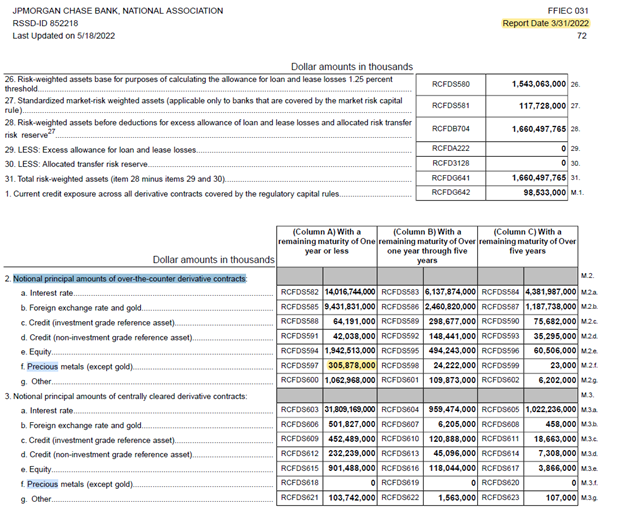

Massive jump in Notional principal amount of over-the-counter derivative contracts for Precious metals (Silver, Platinum, Palladium only) for JP Morgan.... $278.8 Billion increase over 1 quarter. This is breath taking.

Appreciate @cruthergien for pointing this out

Appreciate @cruthergien for pointing this out

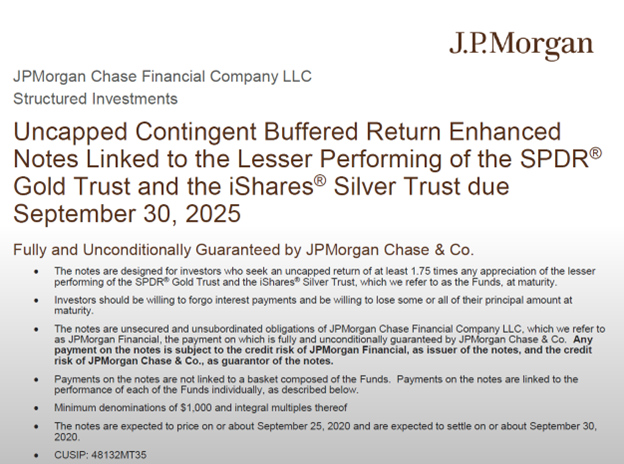

I doubt institutions are tripping over themselves to invest $278 Billion in derivative products like these.

If they are, I think individual investors need to wake up and rethink about relying on institutions to look out for their interests

If they are, I think individual investors need to wake up and rethink about relying on institutions to look out for their interests

I have reached out to various departments within the OCC 2 months ago and still have not received a word on further clarity of these derivative positions. With this latest increase from JP Morgan, would appreciate any help in explaining the 10x increase in 3 months.

Investors and institutions need to get real and protect themselves from counterparty risk! Derivatives will not accomplish this.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh