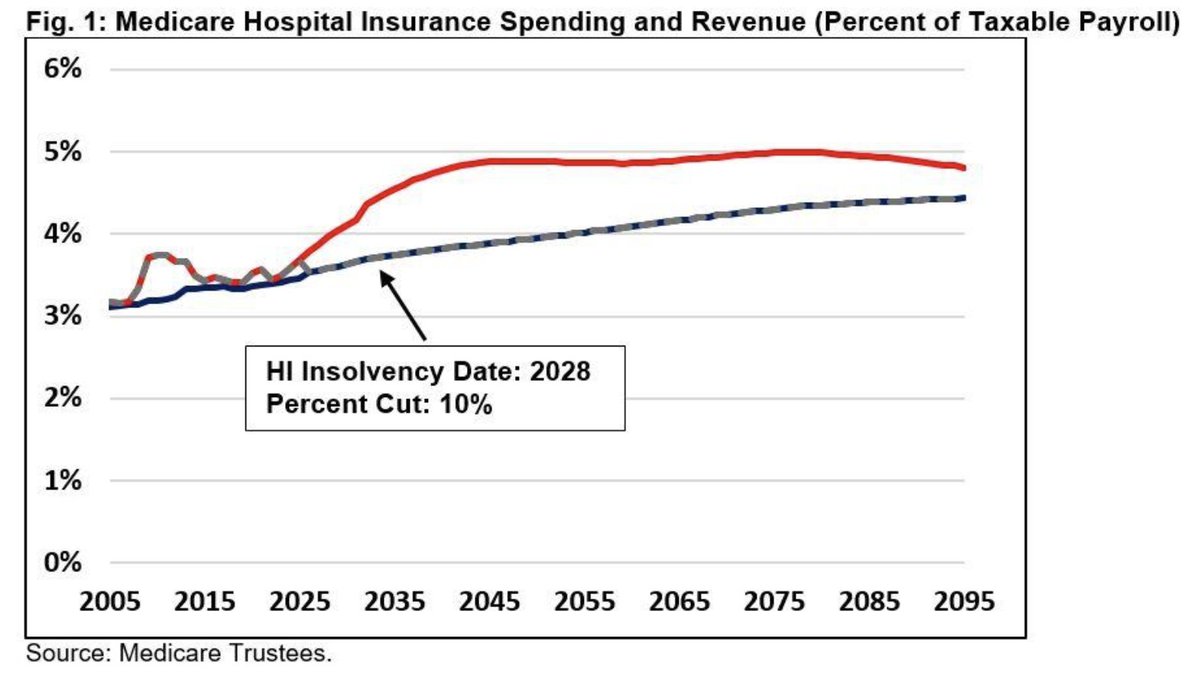

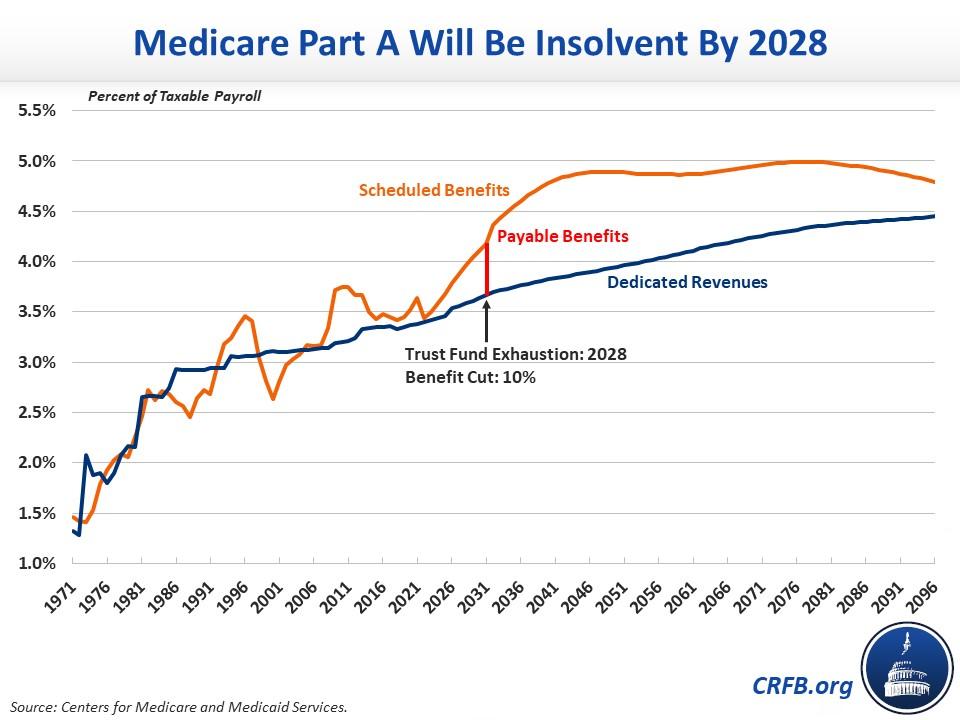

🚨The #SocialSecurity and #Medicare Trustees released their annual reports on the state of the trust funds today, finding that #Medicare HI will be insolvent by 2028 and theoretically combined #SocialSecurity by 2035.

The following is a statement from @MayaMacGuineas:

The following is a statement from @MayaMacGuineas:

"#SocialSecurity is only 13 years from insolvency and #Medicare is only 6 years. Policymakers need to get their heads out of the sand and stop pretending these vital programs’ funding issues will fix themselves." crfb.org/press-releases….

"Today’s youngest retirees will be 68 years old when #Medicare runs out of reserves and 75 years old when #SocialSecurity becomes insolvent. Workers under the age of 55 will retire into an insolvent system."

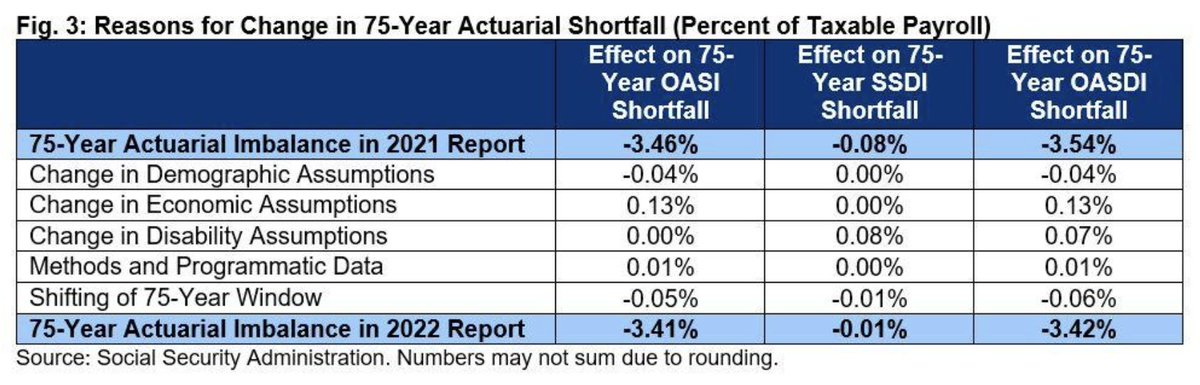

"At the time of #SocialSecurity insolvency, all beneficiaries will face a 20% cut in their benefits if we do nothing."

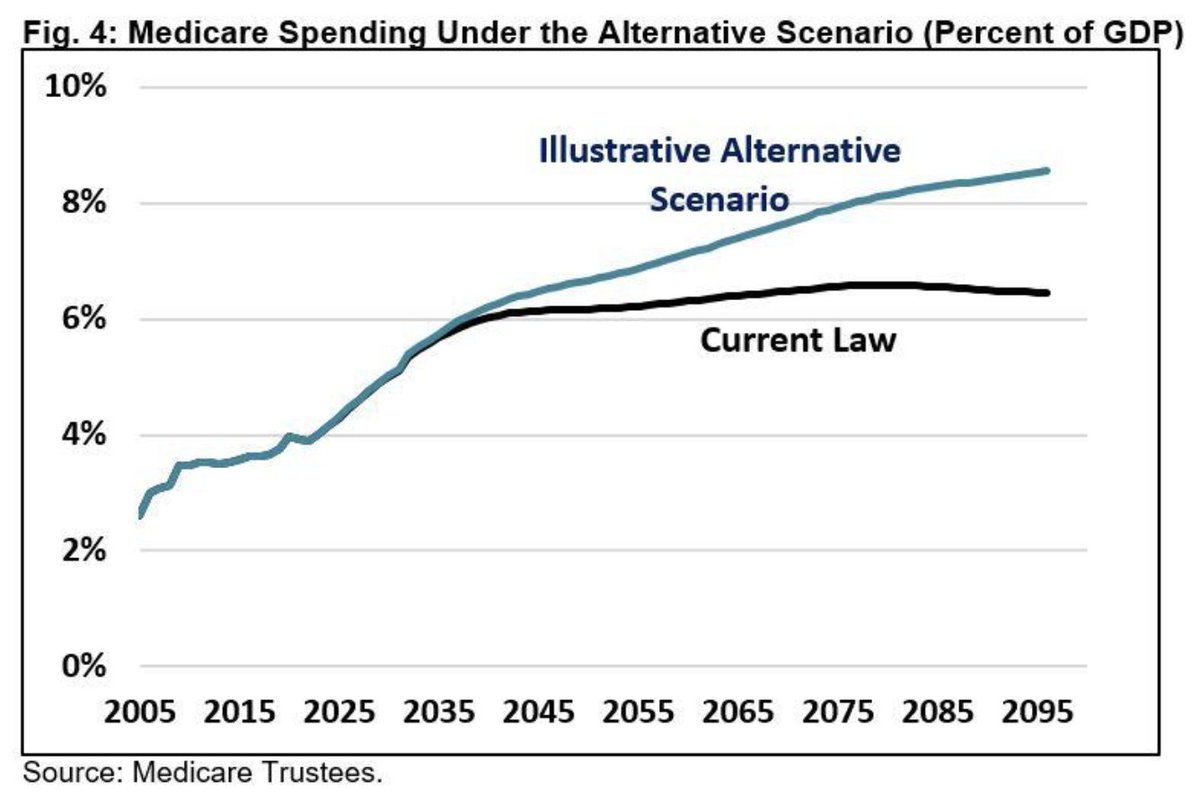

"#SocialSecurity’s 3.4% of payroll shortfall is a slight improvement from last year but would still require the equivalent of a 20% benefit reduction or a 26% tax increase to close. If we wait until 2035,..."

"...benefits would need to be cut by a quarter or taxes raised by a third, and we wouldn’t be able to give workers and retirees time to adjust to this new reality." crfb.org/press-releases….

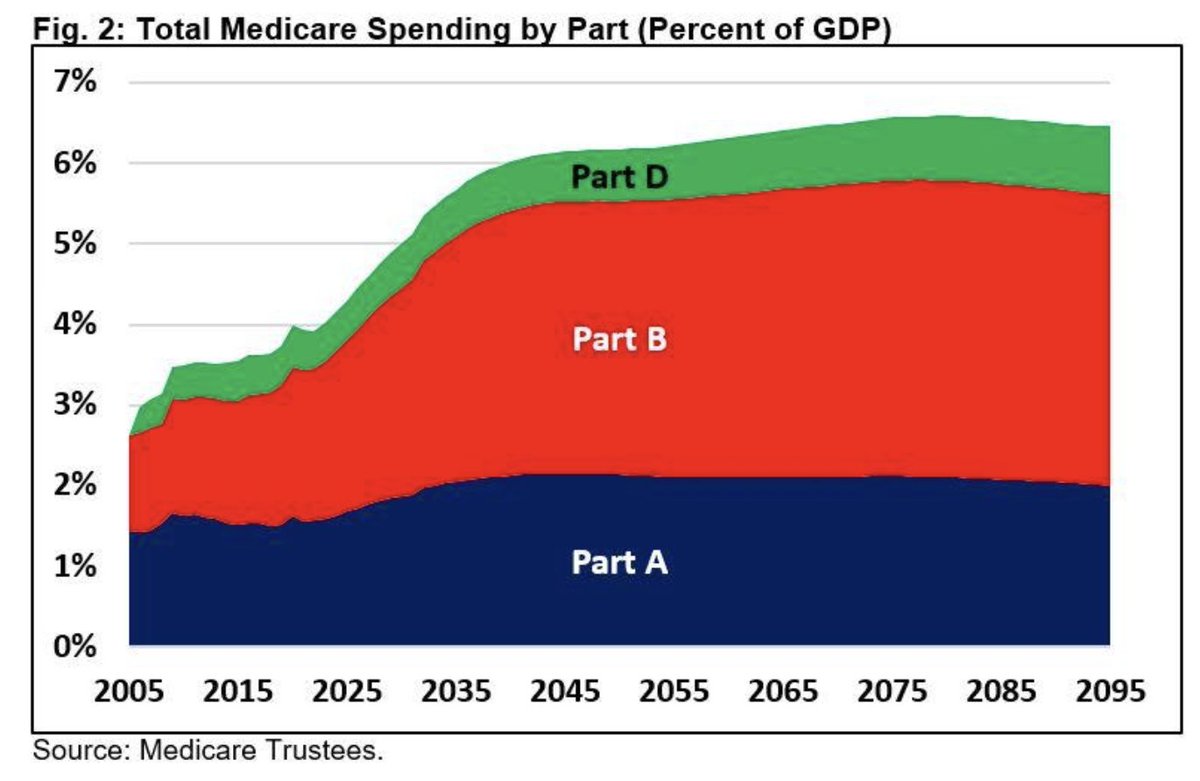

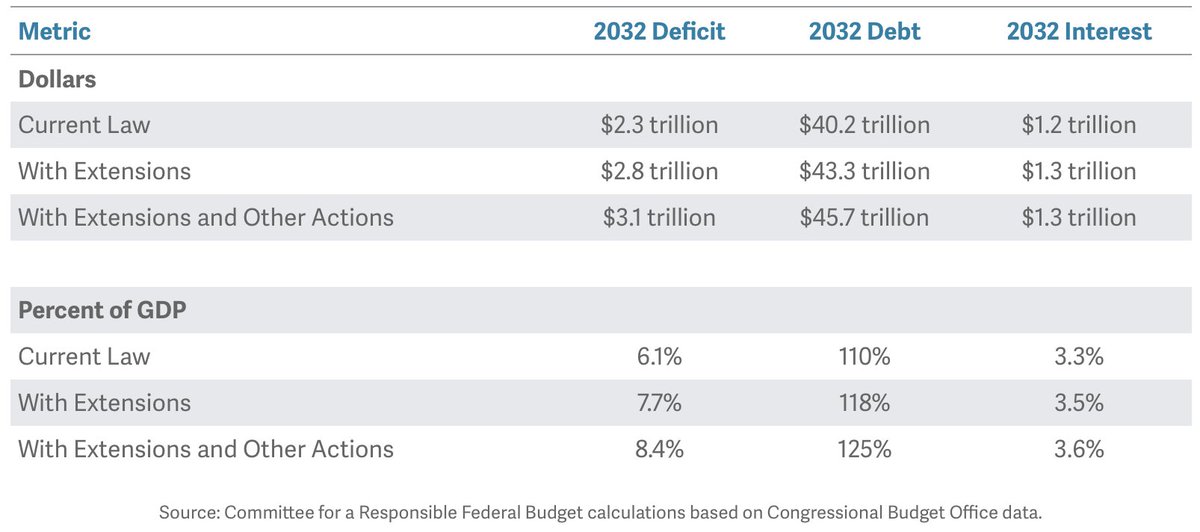

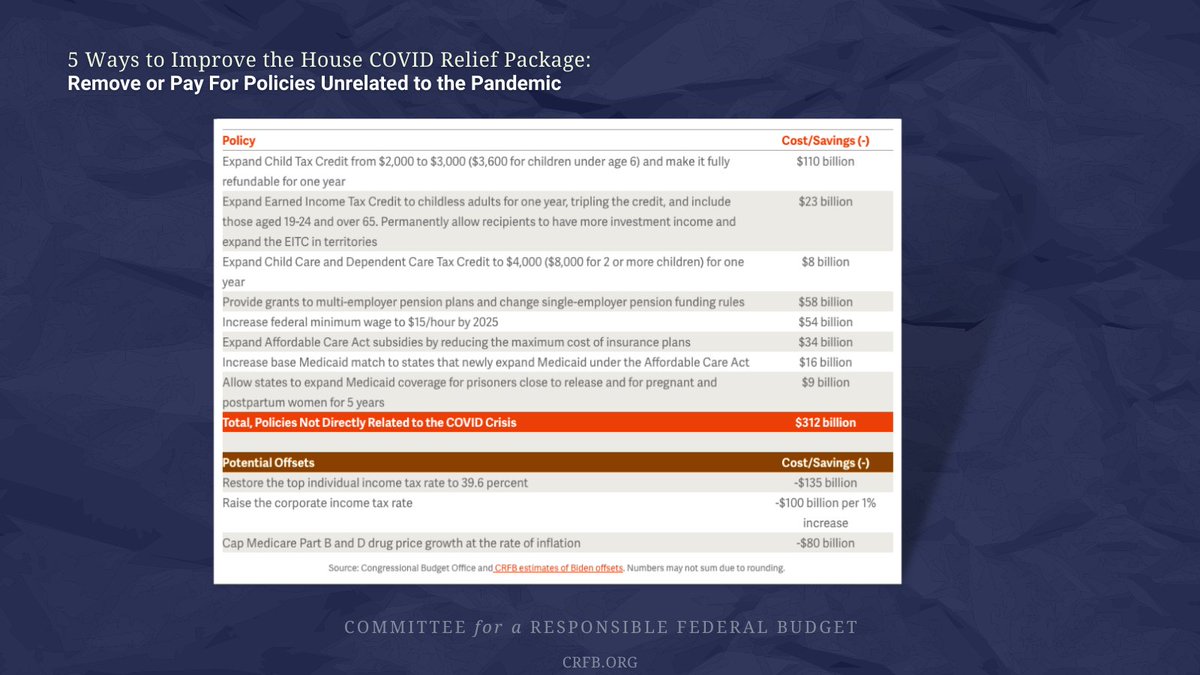

"Combined with last week’s projections from @USCBO, we have a bleak fiscal future ahead of us. It doesn’t have to be this way – we can start enacting thoughtful reforms that increase revenue, reduce spending, lower #healthcare costs,..."

"...stamp out today’s rampant #inflation, help grow the economy, and secure our trust funds. But first policymakers need to open their eyes to the challenges we face."

"The looming insolvency of #SocialSecurity and #Medicare are problems we’ve known about for decades. It’s long past time to enact trust fund solutions that put these programs and our #nationaldebt on a more sustainable path." crfb.org/press-releases….

CRFB will publish our full analyses of both Trustees' reports later today and tomorrow – in the meantime, you can register for our upcoming event featuring an expert panel discussing the Trustees' findings in-depth.

🔗events.r20.constantcontact.com/register/event….

🔗events.r20.constantcontact.com/register/event….

• • •

Missing some Tweet in this thread? You can try to

force a refresh