UEFA have announced new Financial Sustainability regulations from June 2022. President Aleksander Ceferin explained, “The evolution of the football industry, alongside the inevitable financial effects of the pandemic, has shown the need for wholesale reform and new regulations.”

UEFA director Andrea Traverso noted, “Competitive imbalance cannot be addressed simply by financial regulations. It must be addressed in combination with other measures. This is why we changed the name. The name fair play was interpreted as creating a level playing field.”

Ceferin added, “UEFA’s first financial regulations, introduced in 2010, served their primary purpose.” Now, instead of so-called Financial Fair Play, the focus is on the financial sustainability of clubs with 3 key pillars being monitored: solvency, stability and cost control.

Solvency requirements have been addressed by strengthening the rules around overdue payables for football clubs, tax authorities and employees to better protect creditors, including mandatory assessments and quarterly payment dates (15 days to settle overdue amounts).

Stability is covered by the former FFP rules, whereby a club’s loss over the 3-year monitoring period is restricted to the “acceptable deviation”. However, the limit has been doubled from €30m to €60m, if the excess over €5m is covered by an equity contribution from the owner.

If a club is deemed to be in good financial health, then it could be permitted up to an additional €10m allowance per reporting period, i.e. €30m over the 3-year monitoring period. This would mean that a club’s FFP allowable losses could potentially triple from €30m to €90m.

However, it is worth noting that certain expenses that could previously be excluded from the FFP calculation can no longer be deducted. This covers money spent on youth football, infrastructure, community and women’s football.

The FFP calculation encourages equity investment from owners rather than loans, though the new rules do not directly address debt. For example, clubs like #CFC, #THFC & #FCBarcelona, whose 2021 debt was well over a billion, would not be penalised – so long as no overdue payables.

The biggest change in the new rules is the introduction of squad cost control with the ratio of player wages, transfers & agent fees being limited to 70% of revenue & profit on player sales. This is similar to a European Super League guidelines, though its ratio was lower at 55%.

UEFA said its objectives are to: (a) have a direct measure between squad costs and income to encourage more performance-related costs; (b) limit the inflationary impact of wages and transfer fees of players. Covers clubs with wages above €30m who qualify for a UEFA competition.

UEFA accepted that many clubs would struggle to meet the 70% limit straightaway, so there will be a gradual implementation over 3 seasons to allow clubs the necessary time to adapt. As a result, the limit will be 90% in 2023/24, 80% in 2024/25 and 70% only from 2025/26 onwards.

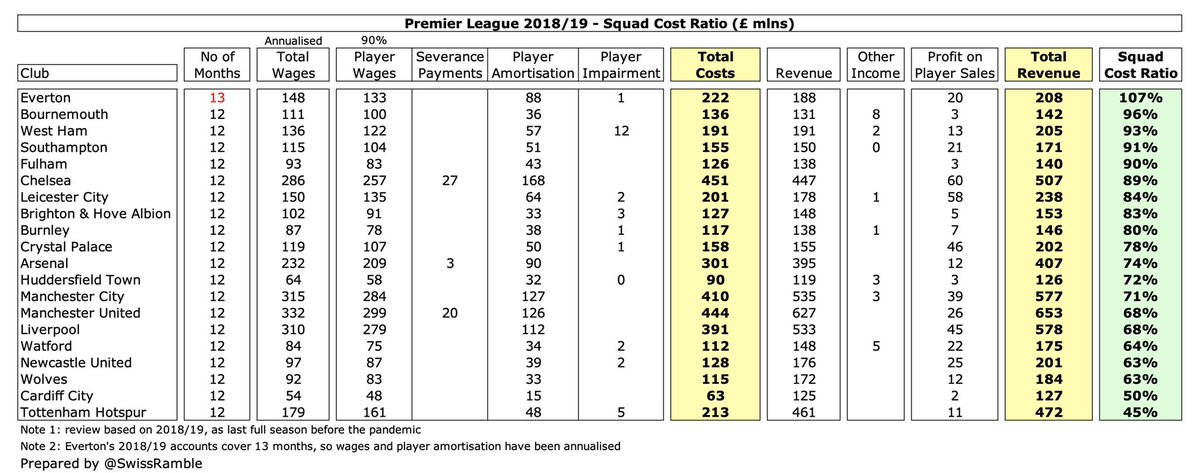

It is worth noting that the cost ratio does not include all wages, only those for players (male professionals) and the head coach, but it does also include bonuses, image rights and termination payments. Based on a review of a few clubs, around 90% of total wages go on players.

If we look at the “Big Six” clubs in the Premier League for 2020/21, this would mean that #MCFC wages for the cost control ratio are £319m, as opposed to the £355m reported in the accounts. The next highest would be #CFC £300m, followed by #MUFC £290m and #LFC £283m.

Transfer fees are assessed in the cost control ratio via player amortisation (and impairment). Note: agent fees and signing-on fees are capitalised, so they are included in the amortisation figures.

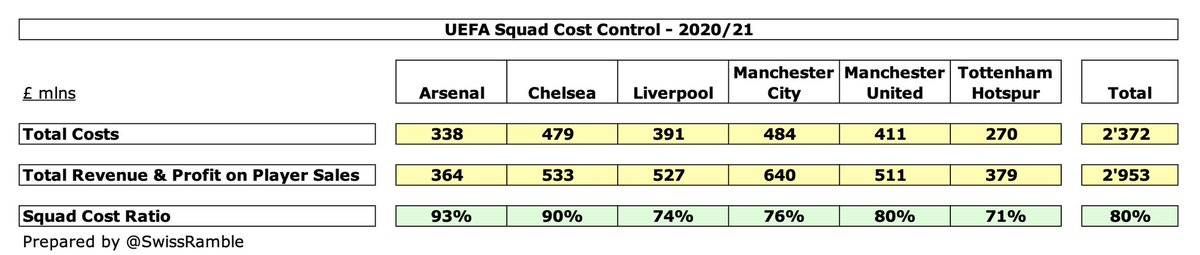

Adding player amortisation (and impairment) plus termination payments gives us total costs for the control ratio. Here, #MCFC £484m and #CFC £479m are almost identical. In contrast, #THFC only have £270m, just over half of those two clubs.

One issue will be the disparity between tax rates and social security payments in different countries in Europe, which will penalise, for example, French clubs, as their gross wages are inflated compared to others.

Traverso added, “There might be various ways to circumvent, to disguise payments of salary, but it would breach national law as well as UEFA regulations. Our capacity to investigate is limited, we are not the police, but it is becoming more and more difficult to get around.”

The most important element of the cost control ratio denominator is obviously the revenue reported in the club’s accounts. The highest in 2020/21 was #MCFC £570m, followed by #MUFC £494m, #LFC £487m, #CFC £435m, #THFC £360m and #AFC £328m.

However, the calculation also includes profit on player sales, which will be assessed over 36 months, pro-rated to 12 months. Note: in the introductory period, this will be “the better of 12, 24 or 36 months”, so #CFC and #MCFC would be boosted by £85m and £69m respectively.

Clearly, there is scope for clubs to improve ratios with profitable player trading, so it will be important for UEFA to monitor transfers to ensure there are no issues with accounting profits being artificially inflated to meet the target (as has sometimes happened in the past).

The revenue definition for the cost control ratio also included other operating income, so adding together revenue, operating income and profit on player sales gives the total “revenue”. On this basis, #MCFC had £640m, over £100m more than #CFC£533m, #LFC £527m and #MUFC £511m.

Comparing costs and revenue per UEFA’s definition, the squad cost control ratios for the “Big Six” in 2020/21 reveal that two clubs would fall foul of the initial 90% limit, namely #AFC and #CFC, while #THFC 71% are already very nearly in line with the eventual 70% target.

So the English clubs do not seem too bad in terms of the cost control ratio, but what about other countries? Looking at leading continental clubs, the highest costs by far were at #FCBarcelona €704m, including hefty €161m player impairment. In contrast, #Milan had only €220m.

The highest “revenue” for the cost control ratio, i.e. including profit on player sales, was #RealMadrid with €759m, followed by #FCBarcelona €648m, #FCBayern €639m and #PSG €610m. #Milan also reported the lowest revenue with only €259m.

The cost control ratios for the overseas clubs tended to be higher than the English clubs in 2020/21 with three of them over 100%, namely #FCBarcelona 109%, #Inter 104% and #PSG 102%. The lowest (best) ratio was #FCBayern 63%, though they were only just ahead of #RealMadrid 65%.

Putting all that together, only two of the leading clubs were already below UEFA’s 70% cost control ratio, #FCBayern 63% and #RealMadrid 65% , based on 2020/21 figures. The contrast between the two Spanish Giants was stark, as #FCBarcelona were worst with 109%.

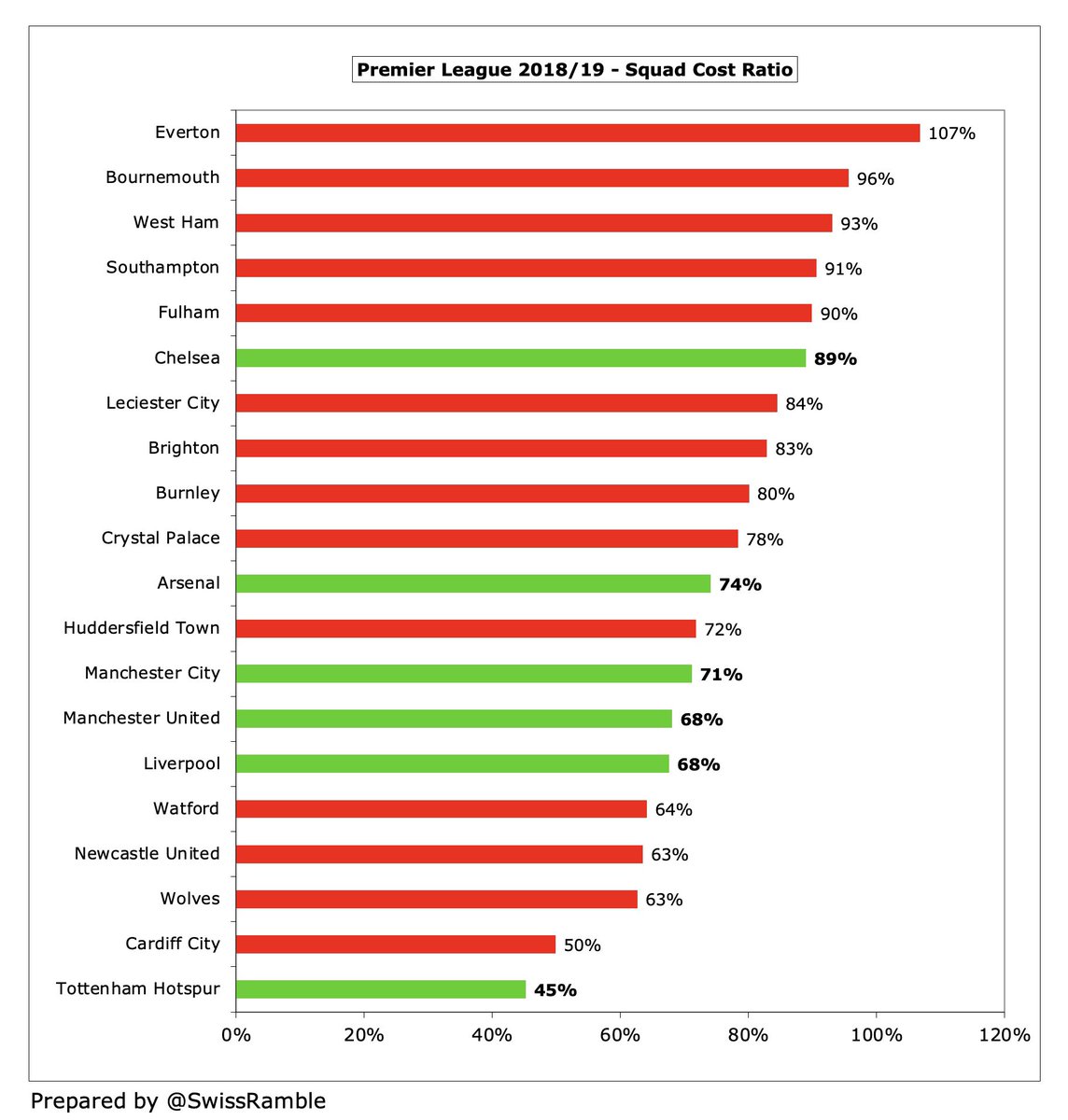

Of course, last season was badly impacted by COVID-19, which almost wiped out match day revenue, as games were almost entirely played behind closed doors, so maybe a better perspective would be from the 2018/19 season, i.e. the last one not affected by the pandemic.

Interestingly, this shows that most clubs were already either below the 70% cost control limit or within striking distance. There is a need for focus by Italian clubs and (perhaps surprisingly) also English clubs – with the exception of #THFC with an astonishingly low 41% ratio.

The fair value rule has been extended, so it now covers all transactions, not just those with a related party. Of course, it’s easier said than done to assess fair value, as previous cases with #MCFC & #PSG (among others) have amply demonstrated. Of particular interest to #NUFC…

Traverso suggested that “Italian clubs will be the ones who have to work hardest” to meet cost control targets, which is supported by reviewing the country averages country for the leading clubs, especially in a normal, pre-pandemic year, when their 76% was easily the highest.

In contrast, the average ratios for German clubs (#FCBayern and #BVB) were comfortably the lowest (53% in 2018/19), so they reportedly pushed for a lower UEFA limit. Premier League clubs should enjoy an advantage, thanks to the huge TV deal, but they need more cost control.

In reality, the cost control ratio will benefit the wealthiest clubs, who either benefit from big TV money or large commercial deals. Looking at the 2018/19 Premier League, the elite clubs tend to have lower cost control ratios, though #CFC were an outlier in the Abramovich era.

Perhaps a better way of highlighting how the new ratio will widen the gap to the elite clubs is the amount they could spend and still be within the 70% cost control target. The difference between the Big Six and the 7th-placed club is enormous, ranging from £120m to nearly £300m.

Sanctions for failing to meet the cost control ratio depend on the severity of the breach and the number of breaches committed over a period of four years, e.g. up to 10% over the limit would mean a fine of 10-25% for a first breach (normally deducted from UEFA prize money).

Additional sanctions are possible for significant breaches, including prohibition on registering new players in UEFA competitions, demotion between UEFA competitions (e.g. Champions League to Europa League) and even exclusion from UEFA tournaments.

Alternatives considered and rejected by UEFA include a fixed salary cap, partly due to opposition from some clubs, but also because of concerns around European employment law. Similarly, a luxury tax, whereby any overspend would be distributed among other clubs, was also vetoed.

As a technical aside, UEFA will review a 12-month period to 31st December, which means that it will be more difficult for external analysts to understand which clubs are in danger of failing to meet the targets, as only published accounts (usually to 30th June) are available.

In conclusion, while it will be challenging for clubs to meet UEFA’s new cost control target, it should be eminently achievable for the majority, especially when not impacted by COVID, eased by the gradual implementation. As always, it is likely to benefit the richest the most.

• • •

Missing some Tweet in this thread? You can try to

force a refresh