1/13 Have you ever heard a world where #DeFi rewards are automatically harvested & reinvested? Welcome in the #YieldOptimizer World. Here is a 🧵why they are one of the first door to open for newcomers in #DeFi 👇

Concrete example on @optimismPBC with @beethoven_x & @beefyfinance

Concrete example on @optimismPBC with @beethoven_x & @beefyfinance

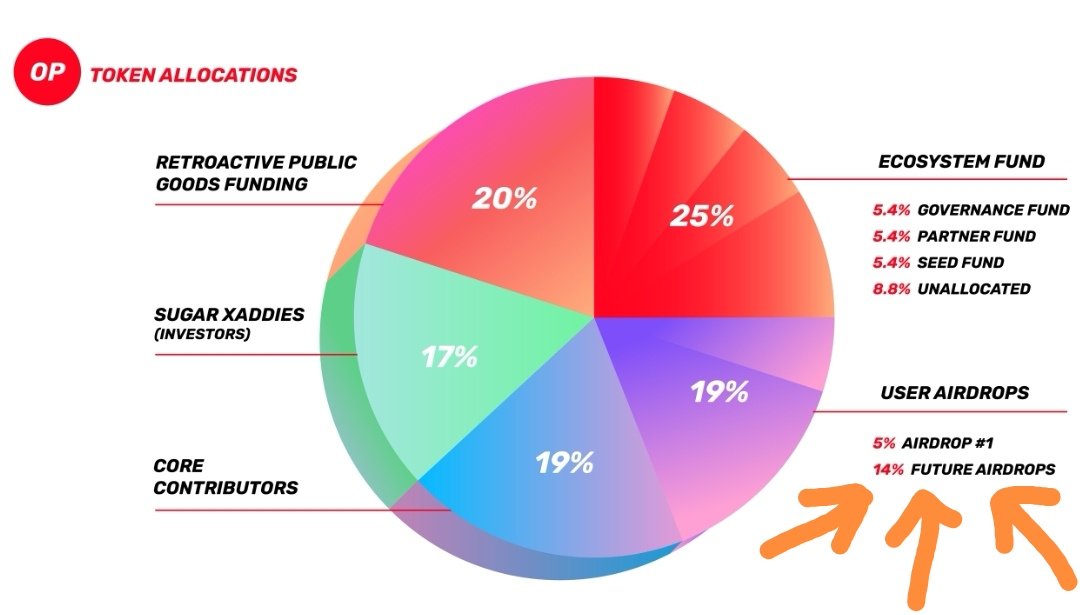

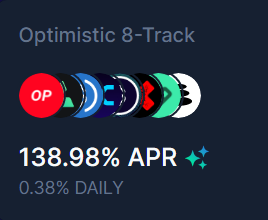

2/13 When you deposit into a Liquidity Pool, you receive token(s) reward based on the #APR of this pool. APR stands for: Annual Percentage Rate. On @beethoven_x , this pool is made up of 8 #tokens, with an APR of 139%

$OP $LYRA $USDC $SNX $BEETS $sUSD $PERP $BAL

$OP $LYRA $USDC $SNX $BEETS $sUSD $PERP $BAL

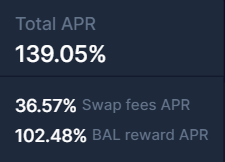

3/13 As you may know @beethoven_x is a friendly fork of @BalancerLabs coming from #Fantom who deployed their platform on #Optimism. Reward of this pool are split:

- 37% of swap fees => your LP token will increase in quantity

- 102% liquidity mining => Reward received in $BAL

- 37% of swap fees => your LP token will increase in quantity

- 102% liquidity mining => Reward received in $BAL

4/13 So let's say you want to take your $BAL and re-invest it in the LP, you have to:

1-Harvest reward

2-Deposit $BAL into the pool (@beethoven_x will take care to split your deposit into an equal amount of the 8 tokens)

3-Stake your LP token

=> 3 operations each time = 3xfees

1-Harvest reward

2-Deposit $BAL into the pool (@beethoven_x will take care to split your deposit into an equal amount of the 8 tokens)

3-Stake your LP token

=> 3 operations each time = 3xfees

5/13 Mind that other DEXes can either offer multiple token rewards, or don't not have this "ZAP" function that distributes automatically your deposit into the different tokens of the LP. So 3 operations can turn into 10 transactions 💵💵💵

6/13 If you'd like to reinvest every week ♻️, that makes 10*52 = 520 transactions 😱. So either you don't have time, or the transactions fees will exceed your rewards. Fortunately, specific protocol exists to help you and do the work for you:

7/13 @beefyfinance is one of them. It's called a Yield Optimizer. It will harvest and autocompound the reward for you, transforming APR into APY = Annual Percentage Yield. If you want to know the difference between APR and APY, please check this site: aprtoapy.com

8/13 Once you deposited into @BeethovenX Pool "Optimistic 8-Track", do not #stake your LP token and go to app.beefy.com, look for the same #vault, and deposit your LP token on Beefy.

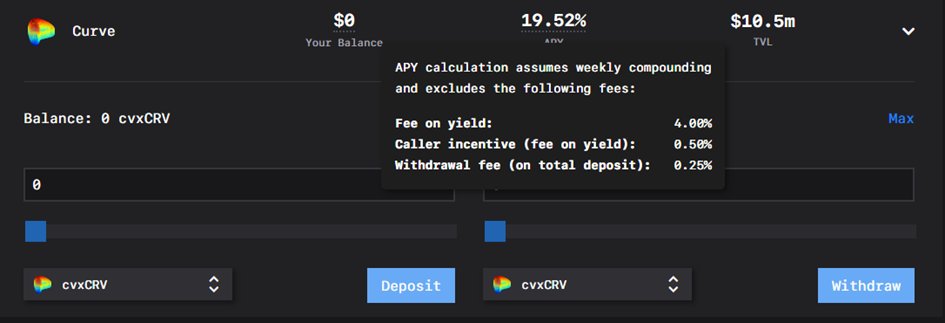

9/13 So how much APY does 137% APR makes? See the picture! OMG 🥳🥳, so you can double your yield. And instead of multiple transaction fees in case of manuel harvesting, #Beefy takes 4.5% of performance fee and 0.1% on withdrawal, but does everything for you.

10/13 But what i like the most on Beefy V2 is

FIRST the APY history, as we all know about yield volatily in Defi.

FIRST the APY history, as we all know about yield volatily in Defi.

12/13 IMO it's a wonderfull entry door for newcomers who starts investing. As #DeFi on #Optimism grows, other protocols will join, and be sure i'll cover them to provide deep insights.

As of today, #beefy proposed only LP Token from @beethoven_x but that will change for sure.

As of today, #beefy proposed only LP Token from @beethoven_x but that will change for sure.

13/13 If you liked this thread please feel free to share, i'm sure we have all a friend who have already asked you this kind of question.

https://twitter.com/Subli_Defi/status/1542164259853025280?s=20&t=BEXHCk4bXgLfj_fp2OlNHg

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh