/1 @VelodromeFi TVL is up 120% in the last week!

But is there any reason for this spike? 🤔

A 🧵 about Velodrome #AMM, the next-gen AMM which prioritizes volume rather than liquidity! 👇

#Ethereum #Optimism

But is there any reason for this spike? 🤔

A 🧵 about Velodrome #AMM, the next-gen AMM which prioritizes volume rather than liquidity! 👇

#Ethereum #Optimism

/2 A Solidly Fork

If you are a #Fantom degen, you've probably heard about @solidlyexchange, a new type of AMM developed by Andre Cronje.

Solidly was the first AMM that incentivized trading fees rather than passive liquidity.

But how did it work?

If you are a #Fantom degen, you've probably heard about @solidlyexchange, a new type of AMM developed by Andre Cronje.

Solidly was the first AMM that incentivized trading fees rather than passive liquidity.

But how did it work?

/3 Solidly implemented a veToken model in order to allow token holders to vote on pools emissions.

However, Solidly token stakers' rewards depended on the volume of the pools they voted for.

Their trading fees share came only from the pool they cast their vote for.

However, Solidly token stakers' rewards depended on the volume of the pools they voted for.

Their trading fees share came only from the pool they cast their vote for.

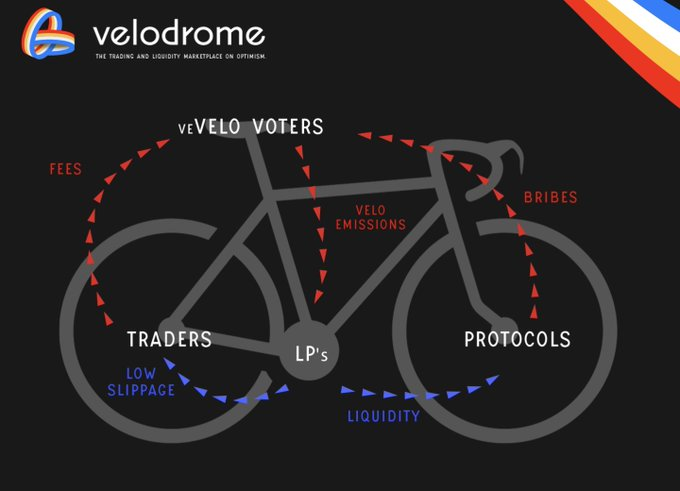

/4 you vote for pools with high volume->high rewards for you and LPs->more liquidity in these pools->less slippage

A pretty interesting model IMO🤩

But Solidly had some bugs and the team didn't solve them, so the project was abandoned.

Let's speak about Velodrome now👇

A pretty interesting model IMO🤩

But Solidly had some bugs and the team didn't solve them, so the project was abandoned.

Let's speak about Velodrome now👇

/5 Velodrome is a Solidly fork on steroids💪

They solved the bugs that were reported and launched Velodrome on #Optimism.

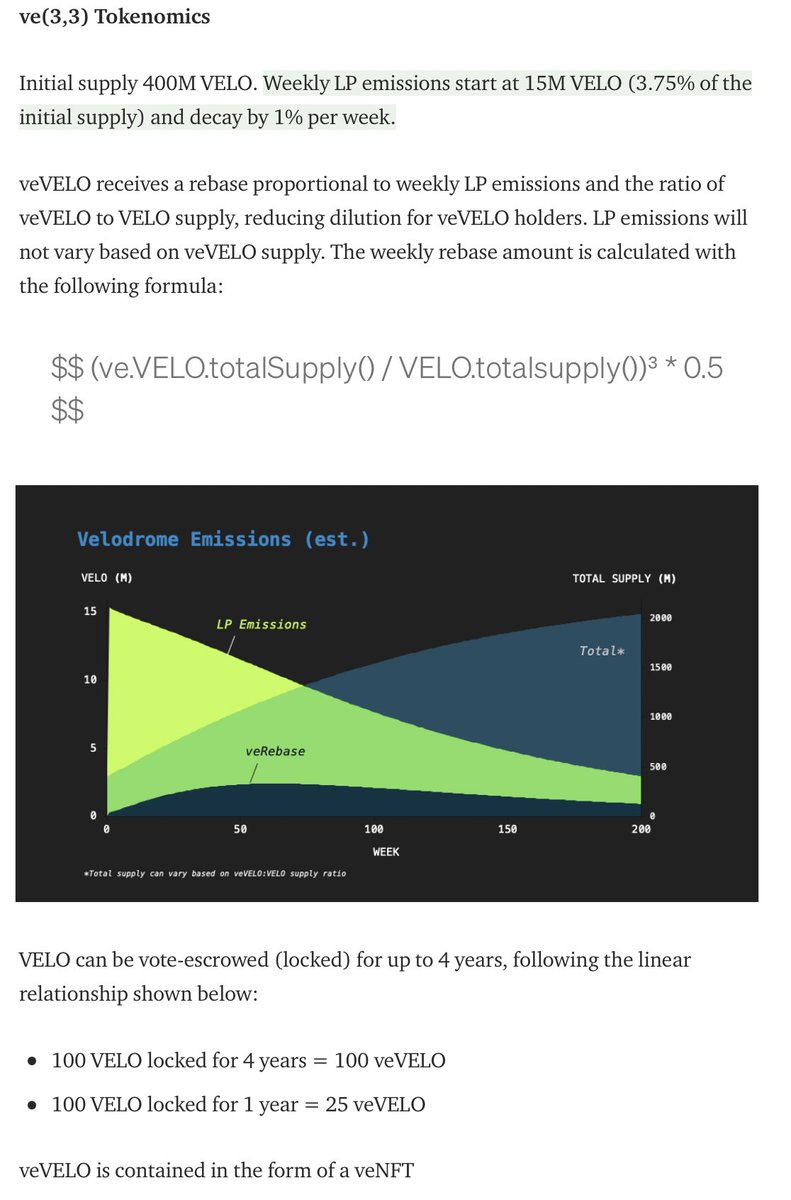

More than that, they created a better emission model, so it will take 200 weeks from the launch till all $VELO tokens will be in circulation.

They solved the bugs that were reported and launched Velodrome on #Optimism.

More than that, they created a better emission model, so it will take 200 weeks from the launch till all $VELO tokens will be in circulation.

/6 Thanks to the Solidly model that prioritize only the pools with big volume rather than all pools, the trading fees can be very low on Velodrome(0.02% atm).

Similar to @CurveFinance, there are protocols that bribe $VELO lockers to vote for their pools.

Similar to @CurveFinance, there are protocols that bribe $VELO lockers to vote for their pools.

/7 So $VELO lockers have to choose between voting for pools with high volume(to get fees) or voting for pools with a small volume for bribes.

This model insures that LPs are incentivized to deposit liquidity in pools with high volume in order to reduce the slippage for traders.

This model insures that LPs are incentivized to deposit liquidity in pools with high volume in order to reduce the slippage for traders.

/8 $VELO

$VELO holders lock their tokens for up to 4 years in order to get voting power and rewards.

$VELO lockers revenue is coming from:

-trading fees(they get all trading fees from the pools they voted for)

-external bribes(for voting for specific pools)

$VELO holders lock their tokens for up to 4 years in order to get voting power and rewards.

$VELO lockers revenue is coming from:

-trading fees(they get all trading fees from the pools they voted for)

-external bribes(for voting for specific pools)

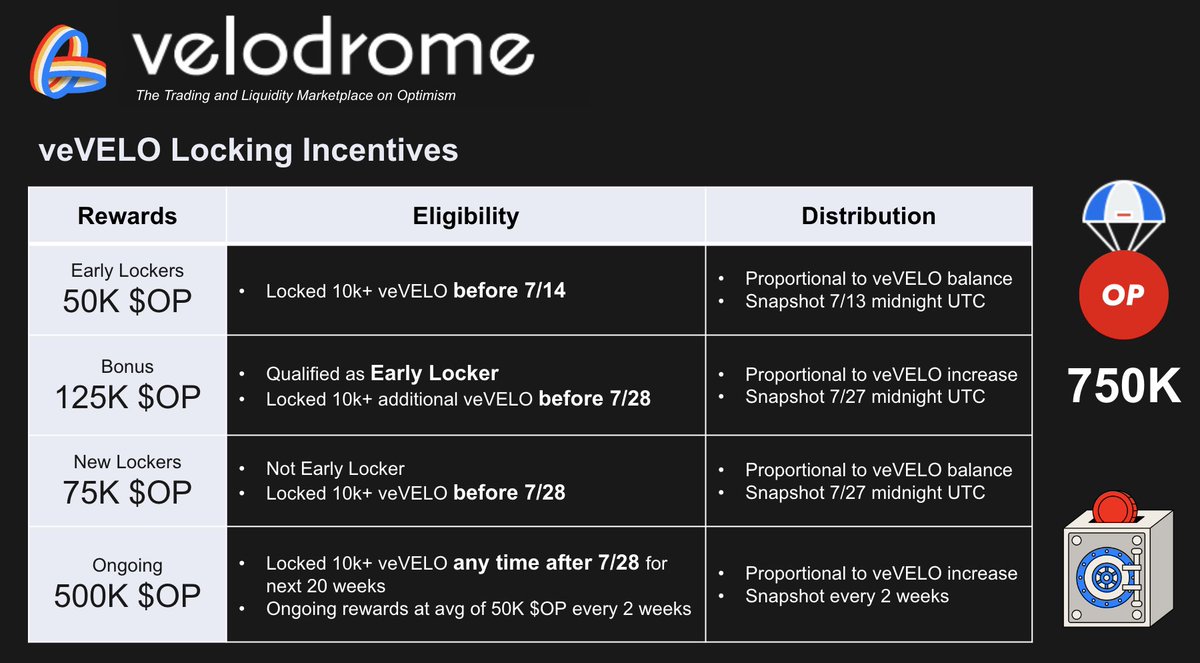

/9 Optimism Airdrops

As you might have already heard, Optimism is airdropping a part of the $OP supply to those who use Optimism DApps.

So those who lock $VELO before 28.07.2022 will get an $OP AIRDROP🎁🤩

As you might have already heard, Optimism is airdropping a part of the $OP supply to those who use Optimism DApps.

So those who lock $VELO before 28.07.2022 will get an $OP AIRDROP🎁🤩

/10 Roadmap🗺️

The next Velodrome update is called Velodrome Relay. Here are the update key features:

-allow holders to delegate their voting power

-LP emission auto-compounder

-Fees/bribes auto-compounder for VELO stakers

-liquidity for veNFTs(sell veVELO positions as an NFT)

The next Velodrome update is called Velodrome Relay. Here are the update key features:

-allow holders to delegate their voting power

-LP emission auto-compounder

-Fees/bribes auto-compounder for VELO stakers

-liquidity for veNFTs(sell veVELO positions as an NFT)

/11 Yield farming season is live

There are some great yield farming opportunities for LPs that deposit liquidity on Velodrome.

Here are my favorite pools:

USDC/sUSD - 15.5% APR

WETH/USDC-33% APR

USDC/MAI - 18% APR

alETH/WETH- 25% APR

sUSD-Synthetix USD

There are some great yield farming opportunities for LPs that deposit liquidity on Velodrome.

Here are my favorite pools:

USDC/sUSD - 15.5% APR

WETH/USDC-33% APR

USDC/MAI - 18% APR

alETH/WETH- 25% APR

sUSD-Synthetix USD

/12 That's all!

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

P.S. Let me know in the comments which protocols I should cover😉

If you found this thread helpful, please leave a like and retweet the 1st tweet. 🤝

P.S. Let me know in the comments which protocols I should cover😉

@FUCORY

@0xInuarashi

@crypto_klay

@rektdiomedes

@0x_____________

@JackNiewold

@calchulus

@thekriskay

@sassal0x

@kelvinfichter

@norswap

@MSilb7

@billy191

@kamikaz_ETH

@DefiShaka

@0xfoobar

@caiovicentino

@patipon_amphet

@0xInuarashi

@crypto_klay

@rektdiomedes

@0x_____________

@JackNiewold

@calchulus

@thekriskay

@sassal0x

@kelvinfichter

@norswap

@MSilb7

@billy191

@kamikaz_ETH

@DefiShaka

@0xfoobar

@caiovicentino

@patipon_amphet

• • •

Missing some Tweet in this thread? You can try to

force a refresh