[1/26] I was listening to @RyanSAdams and @TrustlessState on a past @BanklessHQ (I’m a huge fan) podcast episode on #TheMerge & #Ethereum

Sentiments are bullish on $ETH. But does on-chain reflects so? Lets use @nansen_ai smart money and other tools to evaluate 🧵👇👇👇

Sentiments are bullish on $ETH. But does on-chain reflects so? Lets use @nansen_ai smart money and other tools to evaluate 🧵👇👇👇

[2/26] Before that, here are what I’ll cover:

- On chain analysis with Nansen

- Fundamental analysis

- Tokenomics

- Developer activity

- Narrative of #Ethereum

- Summary

- On chain analysis with Nansen

- Fundamental analysis

- Tokenomics

- Developer activity

- Narrative of #Ethereum

- Summary

[3/26] Lets kick things off using @nansen_ai, $WETH is the undisputed fave token of smart money by far at 60% of their holdings with a clear accumulation uptrend spike from mid Apr onwards

[4/26] Digging further, the majority of smart money held $WETH for the longer term, with 76% of tokens held for 1-2 years or more. They are #Hodlers and optimistic on Ethereum.

Unique addresses have increased from 150K+ to almost 490K within a 1 year time span.

Unique addresses have increased from 150K+ to almost 490K within a 1 year time span.

[5/26] At present, 13.2M $ETH (~$21.6B) is deposited for staking, highest among PoS chains. And almost 100% increase Y.o.Y with @LidoFinance, @krakenfx, @staked_us and @stakefish the largest depositers among a total of 77.7K unique depositors

Clear sign of investor confidence.

Clear sign of investor confidence.

[6/26] ETH2 beacon chain is also the most decentralised PoS chain in terms of total numbers of validators at 412K. Competing alt L1 chains like #Solana and #Avalanche have 1,918 and 1,213 respectively.

Bodes well for #ETH security and ability to be censorship resistant

Bodes well for #ETH security and ability to be censorship resistant

[7/26] $ETH has seen an outflow from exchanges from a balance of 24.6M in end Feb to 22.2M at present. This is seen generally as bullish with lesser coins available to sell.

And over the last month, $ETH has been up almost 50%

And over the last month, $ETH has been up almost 50%

[8/26] Ethereum smashes the L1 competition in terms of TVL, holding a 65.32% market share with $58B TVL, far surpassing #BSC, its nearest competitor at $6.77B

@MakerDAO, @LidoFinance, @Uniswap, @CurveFinance and @AaveAave, collectively holds 56% of TVL on #Ethereum

@MakerDAO, @LidoFinance, @Uniswap, @CurveFinance and @AaveAave, collectively holds 56% of TVL on #Ethereum

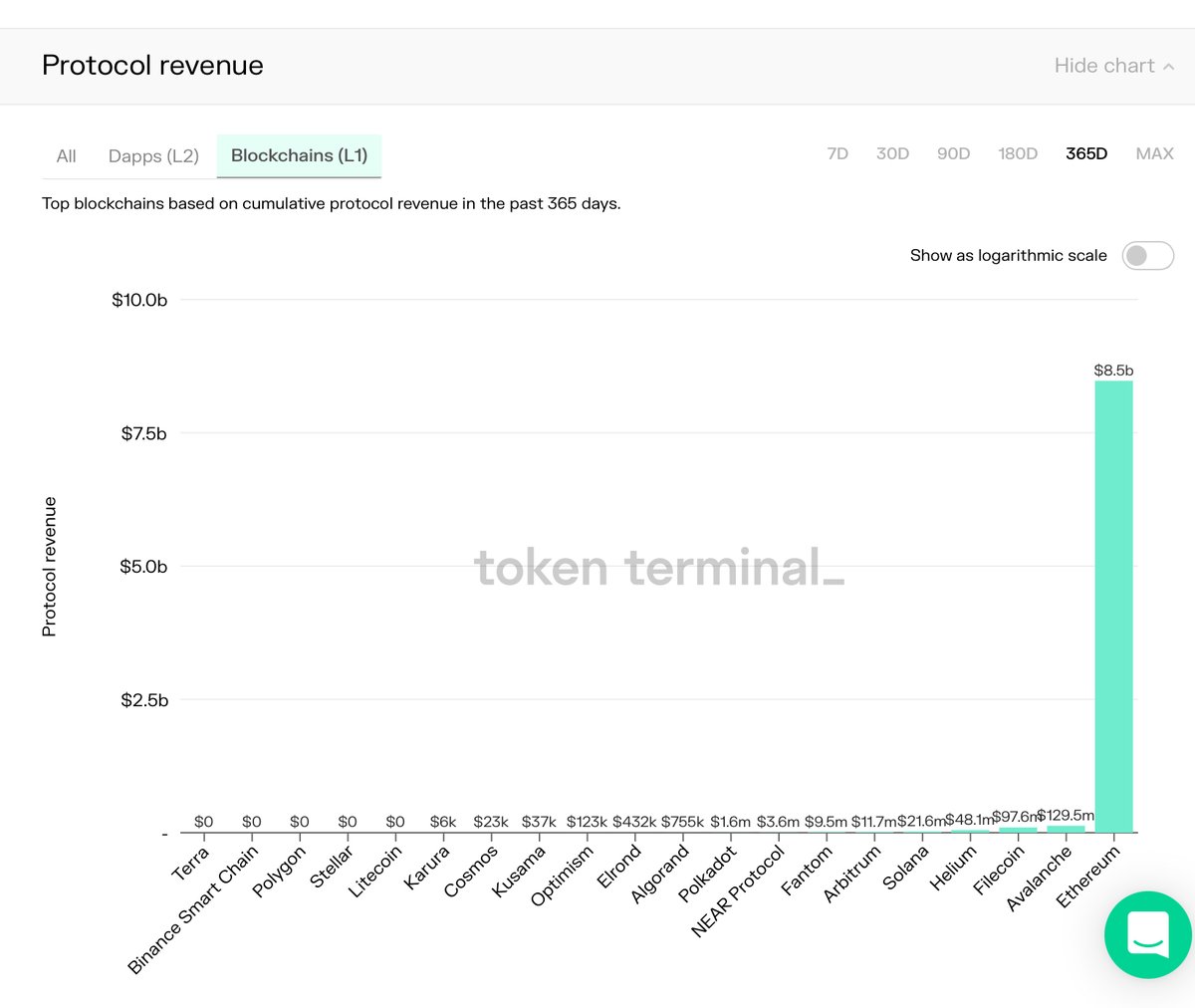

[9/26] With so many #dApps usage on #Ethereum, it is no wonder that it is by far the most dominant L1 blockchain with the highest total revenue ($10B) and protocol revenue ($8.5B) over 365 days.

[10/26] Here’s how Ethereum stacked up against its nearest competitors:

Revenue - 1028.5 % more than #BinanceSmartChain

Protocol Revenue - 6463.7 % more than #Avalanche

Revenue - 1028.5 % more than #BinanceSmartChain

Protocol Revenue - 6463.7 % more than #Avalanche

[11/26] Tokenomic-wise, supply growth of Ethereum is currently at 4.3%

$ETH is set to be deflationary after #TheMerge and supply growth will reduce to 0.2% as we will see more ETH destroyed via fee burn than ETH is created via issuance.

$ETH is set to be deflationary after #TheMerge and supply growth will reduce to 0.2% as we will see more ETH destroyed via fee burn than ETH is created via issuance.

[12/26] As $ETH will become deflationary with the transition from Proof of Work to Proof of Stake, it will become a truly ultra sound money with an ongoing decreasing supply

[13/26] With reduced issuance (-90% from 15K ETH/day to ~1.5K ETH/day) post merge, not only does Ethereum faces drastically less selling pressure (from miners) as before, it is also set to be the first profitable blockchain when its protocol revenue outrun its issuance cost

[14/25] Lets move to evaluate the potential profit margin of ETH blockchain after the merge.

As we do not know the actual total revenue and protocol revenue in future, we will take the past 30 days revenue as a reference to attempt to derive a rudimentary value of profit margin

As we do not know the actual total revenue and protocol revenue in future, we will take the past 30 days revenue as a reference to attempt to derive a rudimentary value of profit margin

[15/26] Last 30 days

- Total revenue (30 day) = $107.5M

- Total protocol revenue (30 day) = $77.54M

- Issuance cost (30 day) = 1.5K ETH x 30 x $1,640 = $73.8M

Profit margin = ($77.54 - $73.8M)/$107.5M = 3.48%

A positive return on profit margin at last!

- Total revenue (30 day) = $107.5M

- Total protocol revenue (30 day) = $77.54M

- Issuance cost (30 day) = 1.5K ETH x 30 x $1,640 = $73.8M

Profit margin = ($77.54 - $73.8M)/$107.5M = 3.48%

A positive return on profit margin at last!

[16/26] We are now in the midst of the bear market which has a reduction in transactions which in turn adversely affects #Ethereum protocol revenue and profit margin.

When the market picks up, we should see these metrics go up too

When the market picks up, we should see these metrics go up too

[17/26] Quite a feat considering it does so without compromising on security! In fact, it will likely be the most secure PoS chain with the highest $ amount staked and the highest number of validators.

[18/26] Post-merge, Ethereum will also consume ~99.95% less energy than before and transit to a green and environmentally friendly blockchain

This helps overcome a big stigma critics attach to crypto given the worsening global warming issue and brightens up the $ETH narrative

This helps overcome a big stigma critics attach to crypto given the worsening global warming issue and brightens up the $ETH narrative

[19/26] To add to the overall positivity of #Ethereum, the total amount of put and call contracts on ETH surpassed BTC for the first time on July 28!

[20/26] Importantly, Ethereum has continued to show strong development activities and contributors count relative to #Bitcoin, #Solana and #Avalanche @santimentfeed

[21/26] Beyond that, Ethereum has an extremely vibrant L2 scaling ecosystem (TVL of $4.87B and increasing) with the likes of @0xPolygon, @optimismFND, @arbitrum and @StarkWareLtd offering users lower cost and faster transactions.

Here’s a L2 lowdown:

l2beat.com

Here’s a L2 lowdown:

l2beat.com

[22/26] To summarize, on-chain evidence has shown #Ethereum investors and the smart money to be bullishly optimistic of its future.

They put the money where their mouth is in terms of the high amount being staked and rising no. of validators’ participation over the long term.

They put the money where their mouth is in terms of the high amount being staked and rising no. of validators’ participation over the long term.

[23/26] Fundamentally, it’s also hugely impactful that Ethereum is set to be the 1st profitable blockchain after #TheMerge.

Blockchains are not exempt from being sustainable and profitability is important! It disproves naysayers from saying that blockchain have no fundamentals!

Blockchains are not exempt from being sustainable and profitability is important! It disproves naysayers from saying that blockchain have no fundamentals!

[24/26] Advances in #zkEVM tech will supercharge scalability and cost efficiency with @0xPolygon, @Scroll_ZKP and @zksync leading the way. Expect to see user adoption and developer activities increase in the long term

All in all, the future for $ETH ecosystem shines brightly!

All in all, the future for $ETH ecosystem shines brightly!

[25/26] Lastly I like to give a shout-out to @BanklessHQ episode for the interview with @VitalikButerin who BTW opines that #TheMerge is not priced in yet.

@RyanSAdams and @TrustlessState are just awesome for giving away so much value in their podcast

@RyanSAdams and @TrustlessState are just awesome for giving away so much value in their podcast

https://mobile.twitter.com/TrustlessState/status/1552414199220936708

[26/26] If you found value from this 🧵, please give the original post a “like” and “retweet”. Appreciate it! 👇👇👇

https://mobile.twitter.com/blocksaurus1152/status/1555402723201552385

• • •

Missing some Tweet in this thread? You can try to

force a refresh