🔴🔴It's time for a summup of Cycle 4 voting round and tell you the #DeFi proocols that just won $OP grant, and how you can benefit from them. Former cycle rounds summary can be found just below

Let's see the winners of Cycle 4 🎉🎉

https://twitter.com/Subli_Defi/status/1550605511552294915?s=20&t=n5b5aWlaFKWeShj9bbeXaQ

Let's see the winners of Cycle 4 🎉🎉

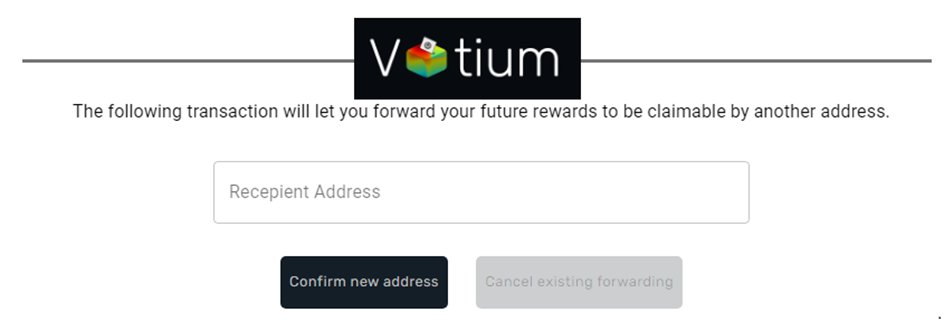

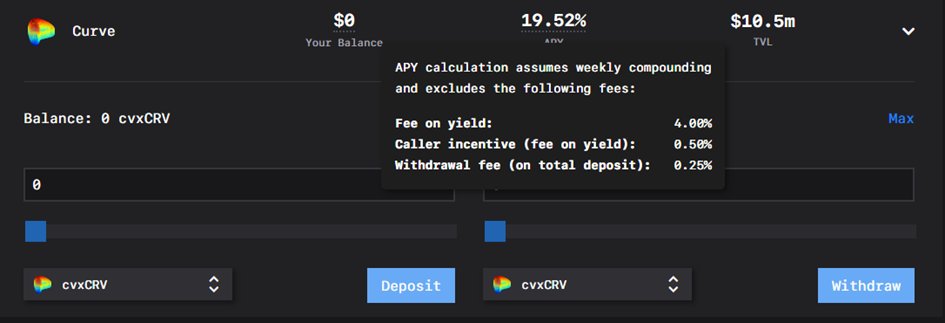

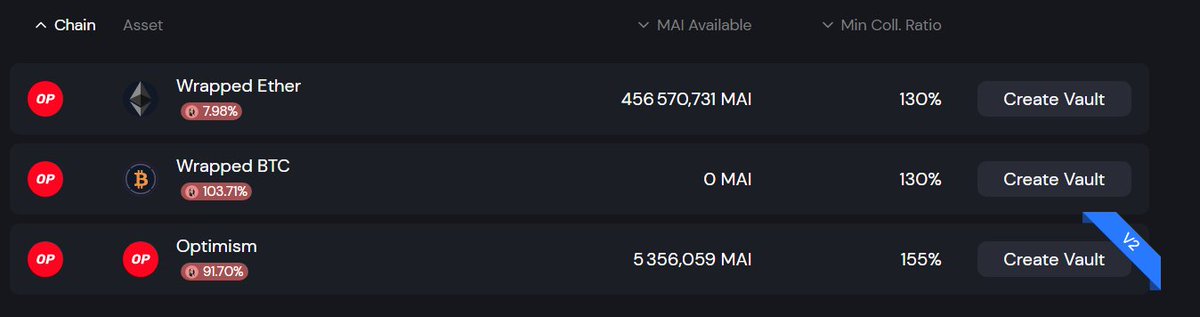

1/ @QiDaoProtocol : Got 750k $OP. 80% will be given to users:

- 20% to reward borrowers

- 60% to incentivize $MAI liquidity on Optimism through

I remind you that $OP rewards are backed 1:1 in $MAI incentives! DYOR!! or make your own calculation MYOC!! But see what you can get:

- 20% to reward borrowers

- 60% to incentivize $MAI liquidity on Optimism through

I remind you that $OP rewards are backed 1:1 in $MAI incentives! DYOR!! or make your own calculation MYOC!! But see what you can get:

2/ @beefyfinance : Finally, after 2 against voting round, the protocol manages to update the proposal to get that grant. It's gonna be 650k $OP which 35% will go to incentivize $BIFI liquidity and 50% to boost farm of native protocols of #Optimism

https://twitter.com/Subli_Defi/status/1542164259853025280?s=20&t=wImdPPjFBFo_9INFftjYjQ

3/ @Rocket_Pool has been granted 600k $OP spread as follows:

- 70% $OP - A main @beethoven_x $rETH/ $WETH pool

- 30% $OP - @VelodromeFi $rETH/ $WETH pair

$rETH being the proof of deposit of your staer $ETH, very similar as the $stETH from @LidoFinance

- 70% $OP - A main @beethoven_x $rETH/ $WETH pool

- 30% $OP - @VelodromeFi $rETH/ $WETH pair

$rETH being the proof of deposit of your staer $ETH, very similar as the $stETH from @LidoFinance

4/ @boardroom_info : A new dashboard and APP to find, select and delegate your $OP. Granted 100k $OP shared between $OP holders that delegate or re-delegate through the APP. boardroom.io

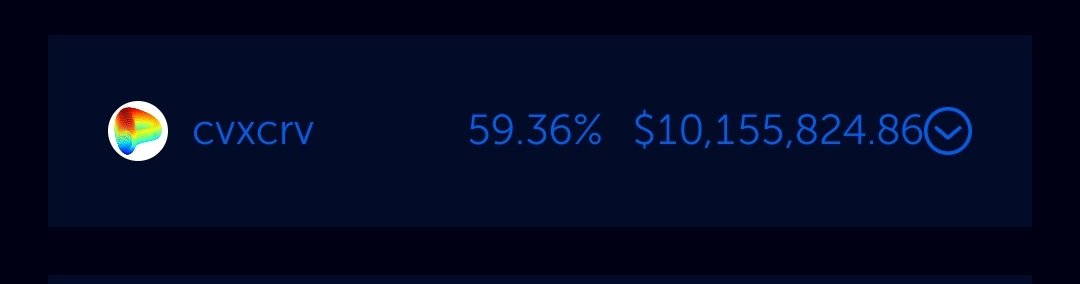

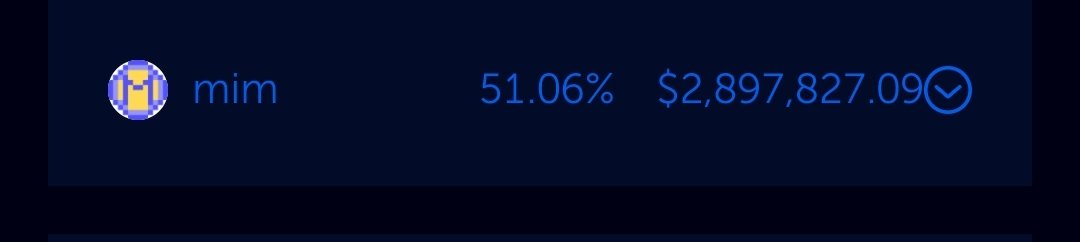

5/ A JV between @xtokenterminal & @GammaStrategies: protocols built on top of @Uniswap V3 has been granted 900k $OP. The total will be used to incentivize #DeFi solutions across xToken Terminal, Gamma Strategies, and UniswapV3Staker on $WETH/ $OP Liquidity Pool.

6/ Finally, in case you missed one of the biggest news on #Optimism this week, @AaveAave got as Phase 0 grant programm a total of 5.3m of $OP 🔥🔥

https://twitter.com/AaveAave/status/1555230478394966018?s=20&t=wImdPPjFBFo_9INFftjYjQ

This is the end of Round 4 voting. Please feel free to share the 1st tweet, that gives you also the link of my previous threads covering all the cycles since the beggining of the Grant Programm. #L222 is on fire!

https://twitter.com/Subli_Defi/status/1555559749177024517?s=20&t=n5b5aWlaFKWeShj9bbeXaQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh