1/13 📅Here is the monthly catch-up of Global #DeFi market analysis. Last one is here below with some conclusions about Smart Money leaving Defi. Was it still the case on July? Quick thread but you'll get the general trend where ecosystems are exploding.

https://twitter.com/Subli_Defi/status/1537552252763783168?s=20&t=ibkHxszY0zsox0x78EFKdQ

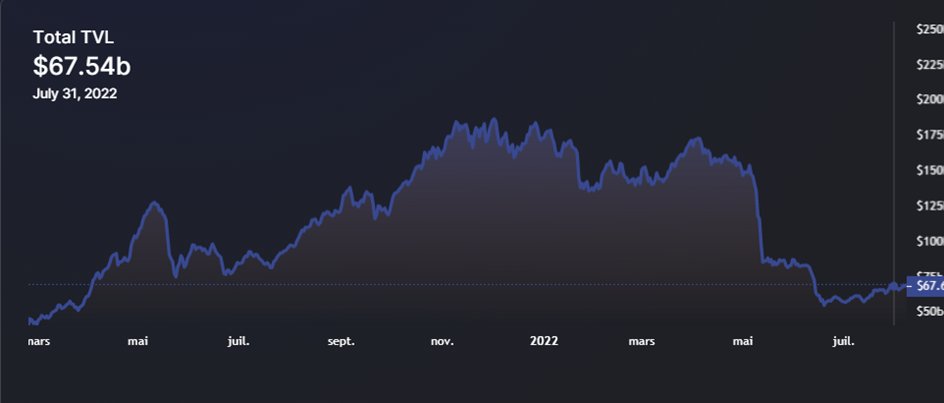

2/13 TVL on @Defilama is at 68b$ at 31/July, increasing by +21% since end of June.

3/13 On the other hand, #crypto total market cap just crossed the 1b$ threshold and sitting now at 1,075b compared to 848b end of June, so +27% increase.

4/13 However would be great to have the DEFI ecosystem Market Cap to be more relevant. There are several indexes but there is no consensus on which protocol need to categorized at DEFI. Can @DefiLlama do that?

5/13 Now according to @TheBlock__ stablecoin MC is at 145.3b, stable since end of June. theblock.co/data/decentral…

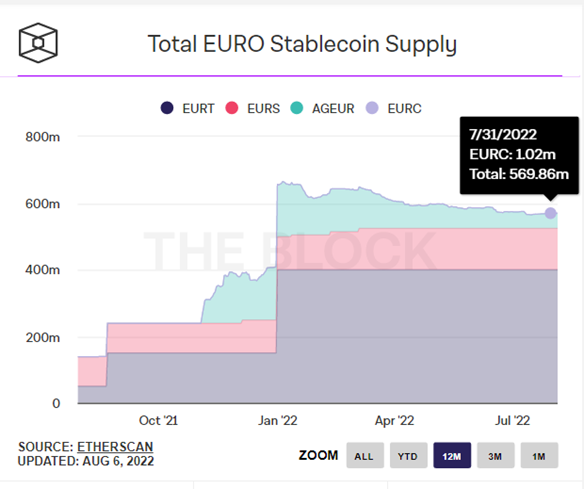

6/13 One thing to focus on is the $EURO stablecoin, with the beginning of $EURC, which is presume is the $EUROC from @circle, that reaches it’s 1st m$ of MC.

7/13 Despite the constant market cap of Stablecoin, one thing you may have noticed is the amount of new stablecoins popping everywhere: @AaveAave , @redactedcartel , etc… I’m sure I’m missing other ones, so please feel free to add to the list.

8/13 To draft a conclusion: Crypto MC increases by +27% while TVL in Defi by +21% only. I assume then that Smart Money did not enter the game yet and that a slice of money left Defi.

9/13 In addition over the past month, we could see tremendous growth of few ecosystems that exceed the average DEFI TVL increase, such as #Optimism, #Algorand and #Metis leading the ranking (blockchain with TVL > 50m$). Let's dig into those 3 #blockchains

10/13 First, @optimismFND Grant is still on-going. Here is a recap of the 4 voting cycles and the protocols who succeeded in obtaining $OP grants. Thanks to this incentivization, protocol exceeds the 1b TVL beg. of August.

https://twitter.com/Subli_Defi/status/1555559749177024517?s=20&t=4TClMIDolYBRPhGWvGiz3Q

11/13 @MetisDAO has also announced a 100m$ incentive program - this is just 2x the blockchain TVL!! A great recap has been made by @SmallCapScience:

https://twitter.com/SmallCapScience/status/1554981683866152960?s=20&t=4TClMIDolYBRPhGWvGiz3Q

12/ @Algorand saw his TVL doubled thanks to the arrival of the primitives blocks of DEFI such as Dexes, lending, liquid staking protocols

If you like this monthly catch-up please feel free to retweet. If you would like me to add other metrics, do not hesitate to advise.

https://twitter.com/Subli_Defi/status/1556566133519548416?s=20&t=ibkHxszY0zsox0x78EFKdQ

In addition i really like the weekly catch-up of @Dynamo_Patrick , so don't hesitate to follow.

https://twitter.com/Dynamo_Patrick/status/1553890151167819777?s=20&t=ibkHxszY0zsox0x78EFKdQ

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh