As we near the end of the transfer window, some fans ask why their club has not splashed more cash on bringing in new players, despite generating significant revenue. This thread will look at where the money goes by analysing the last 5 years for the Big Six Premier League clubs.

This analysis will look at the source and use of funds for the 5 years up to 2021 (most recently published accounts). We will remove pure accounting entries, such as player amortisation and profit on player sales, but incorporate all cash movements to give a “real world” view.

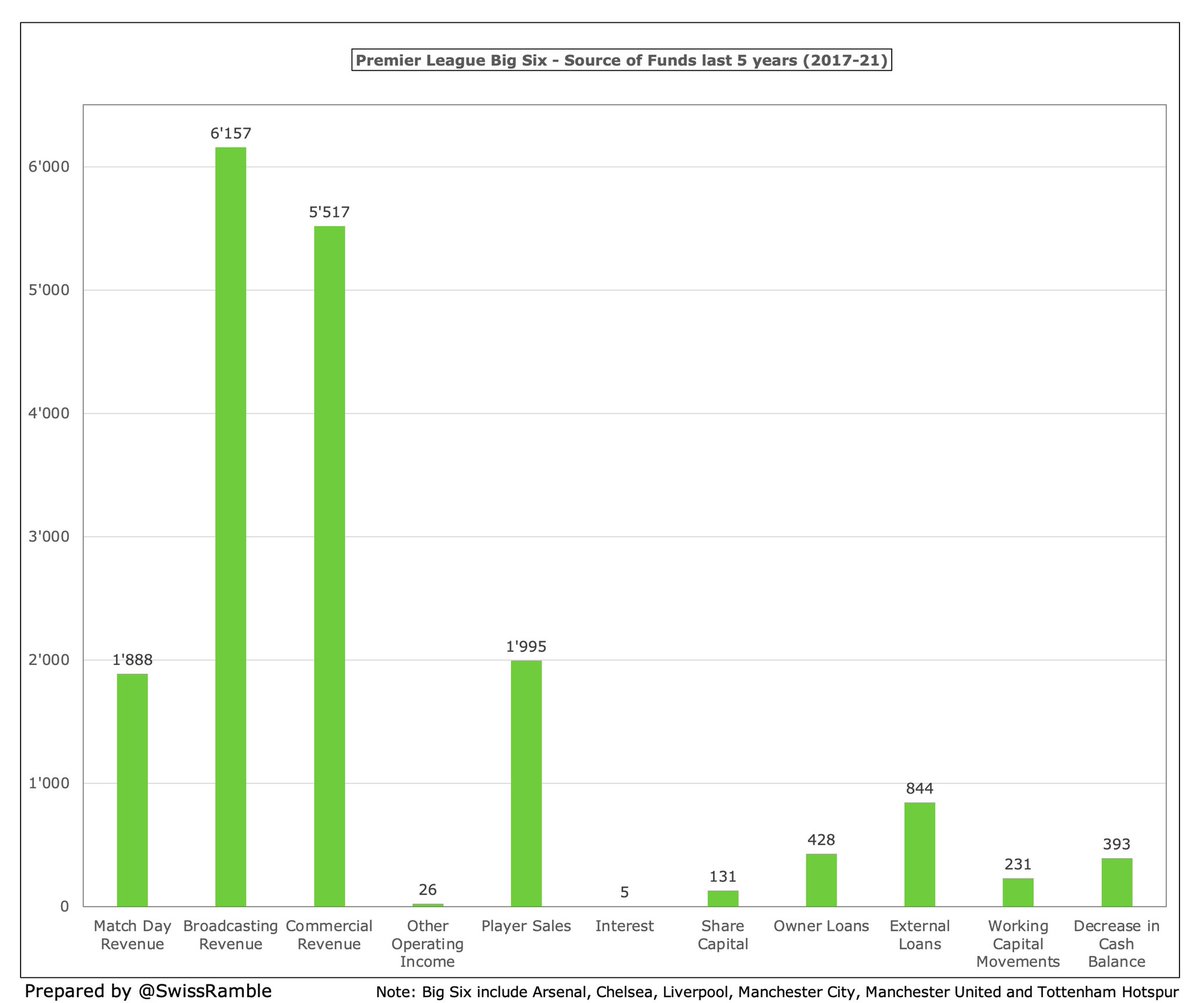

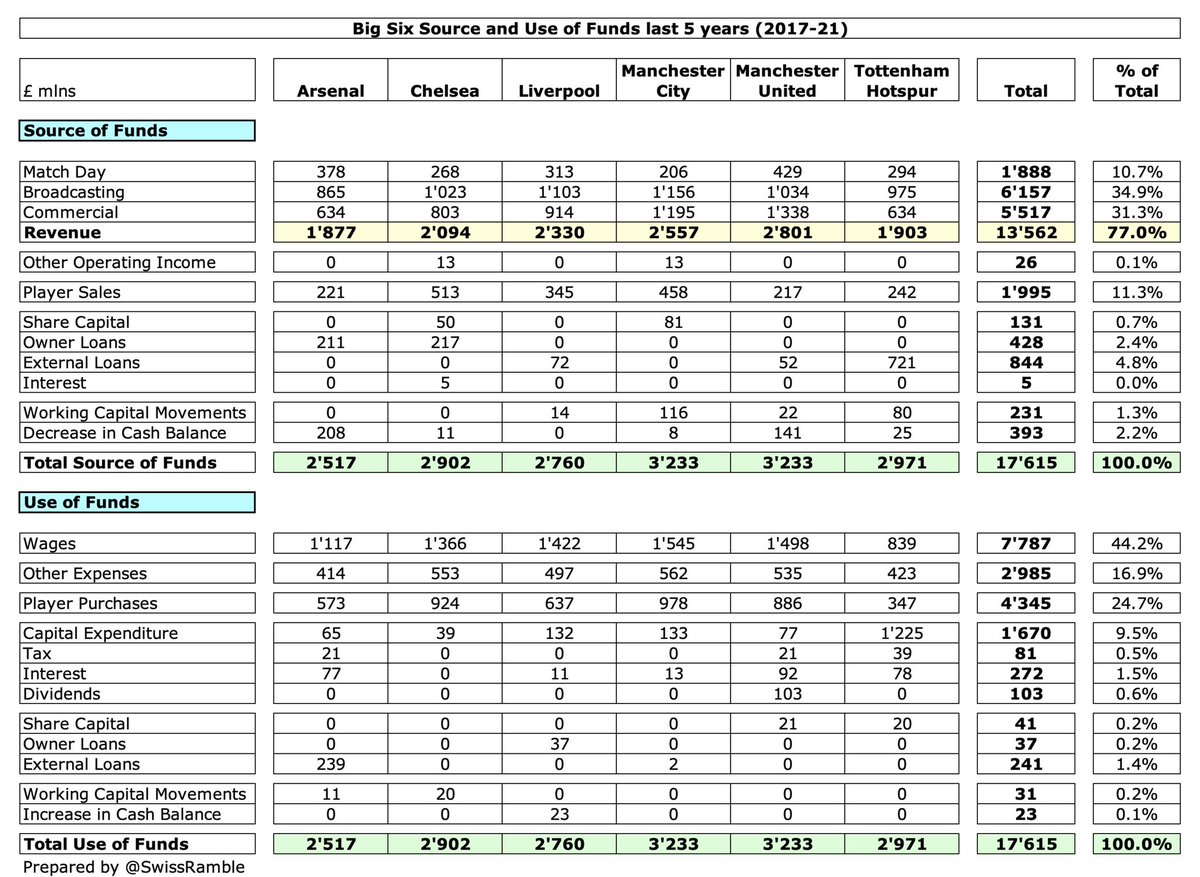

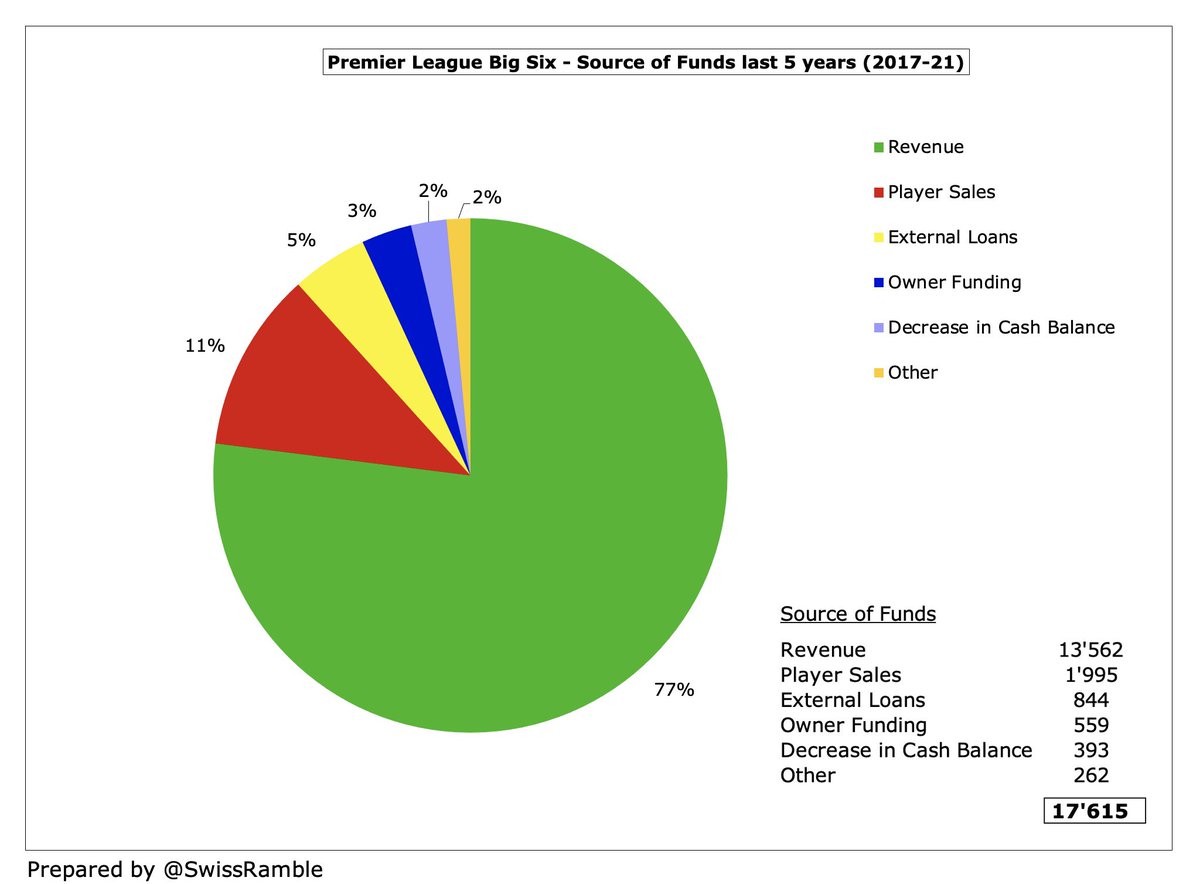

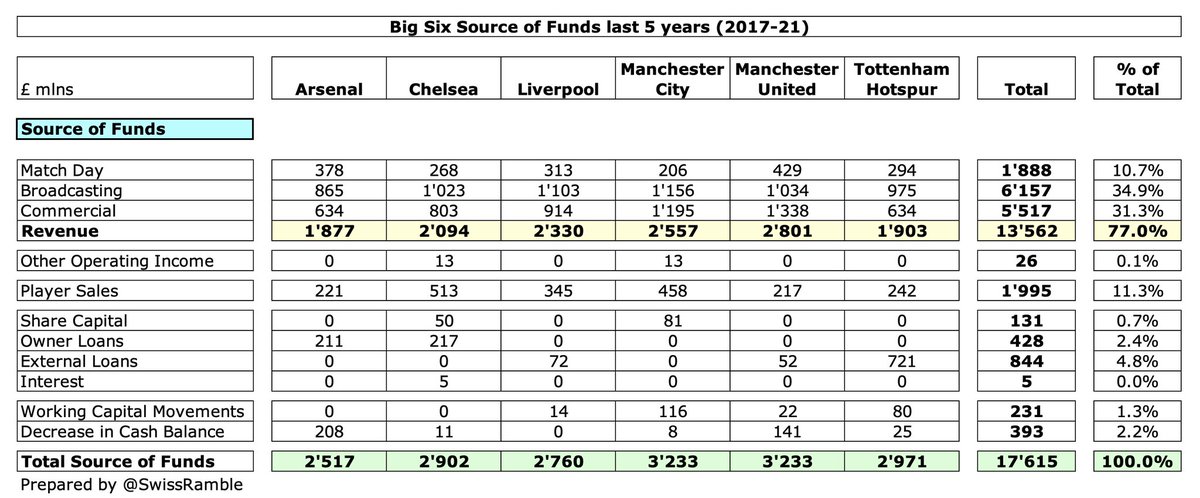

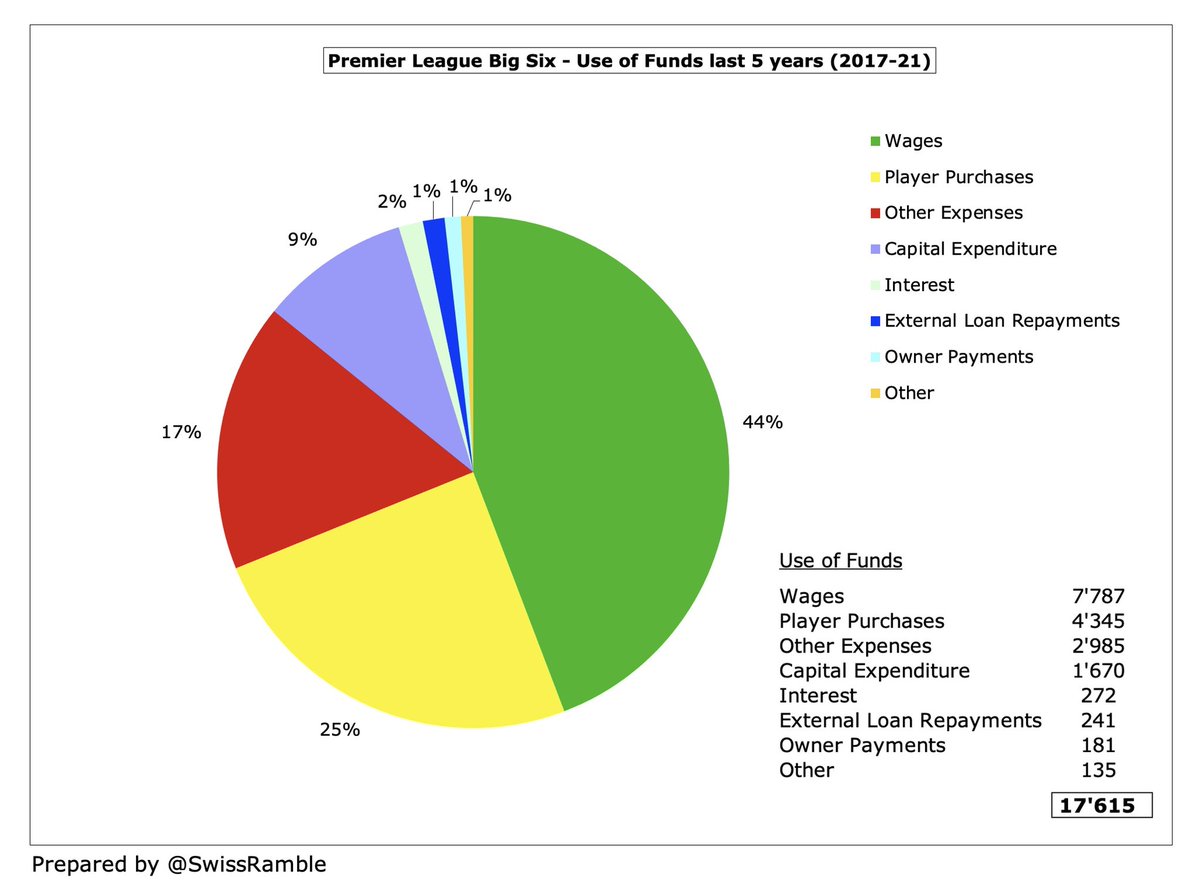

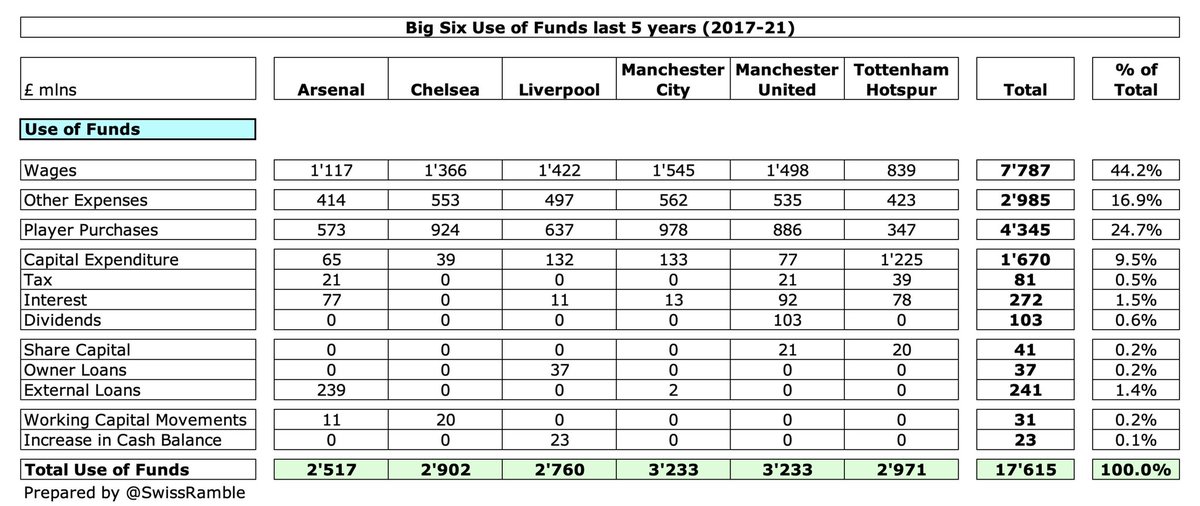

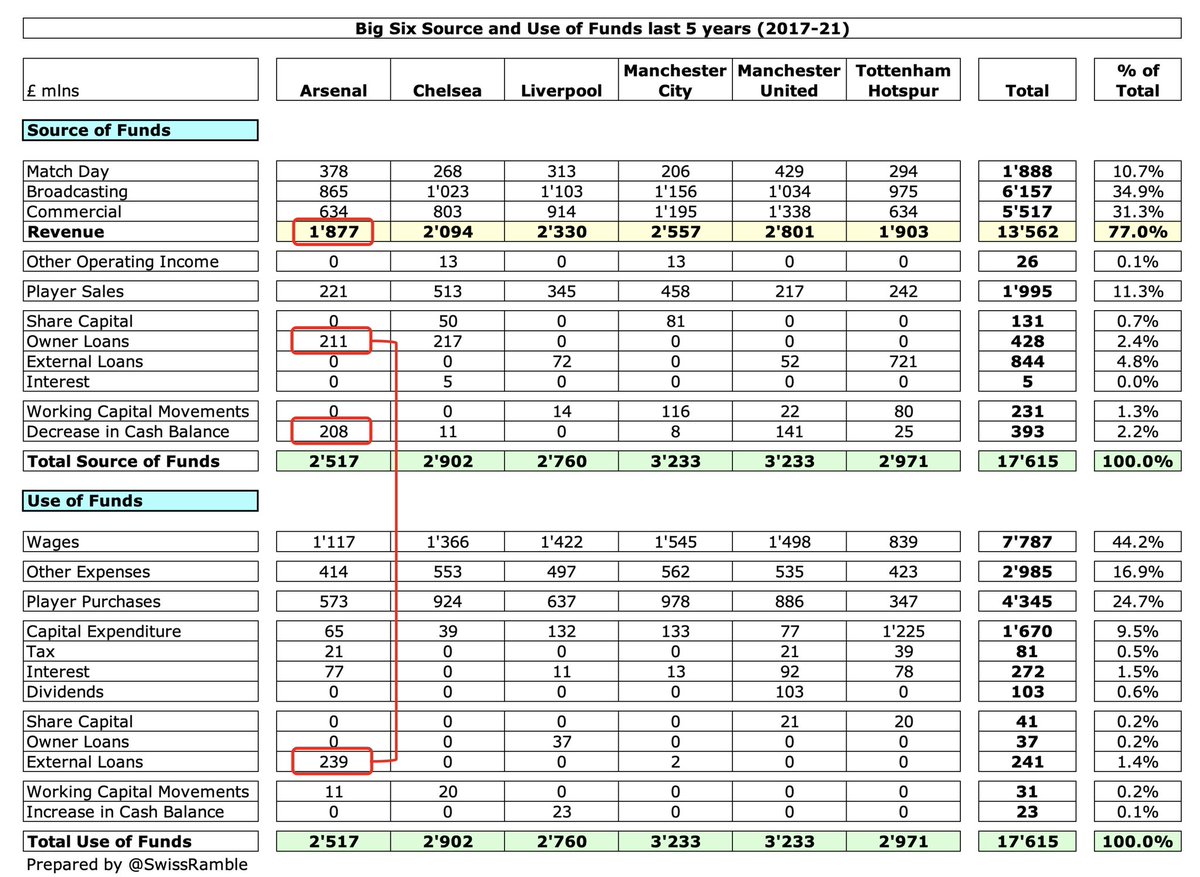

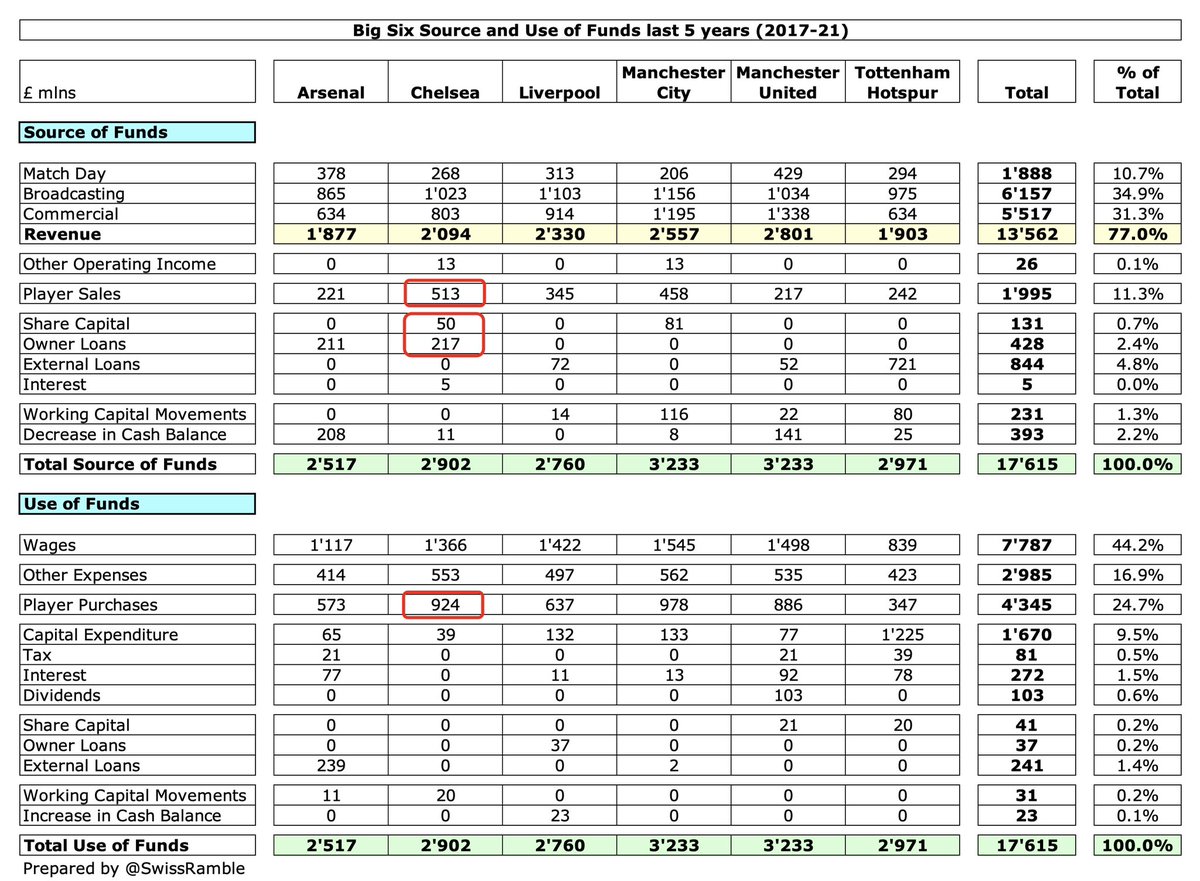

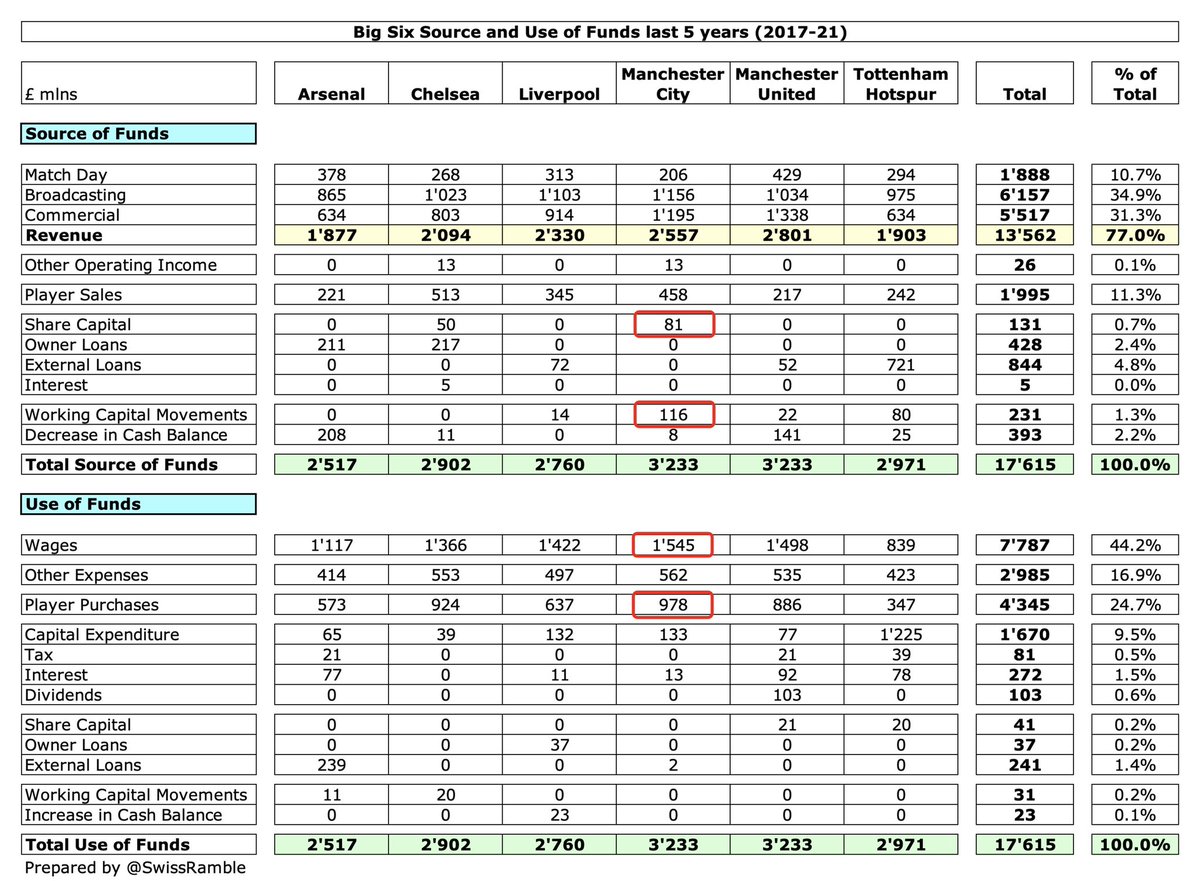

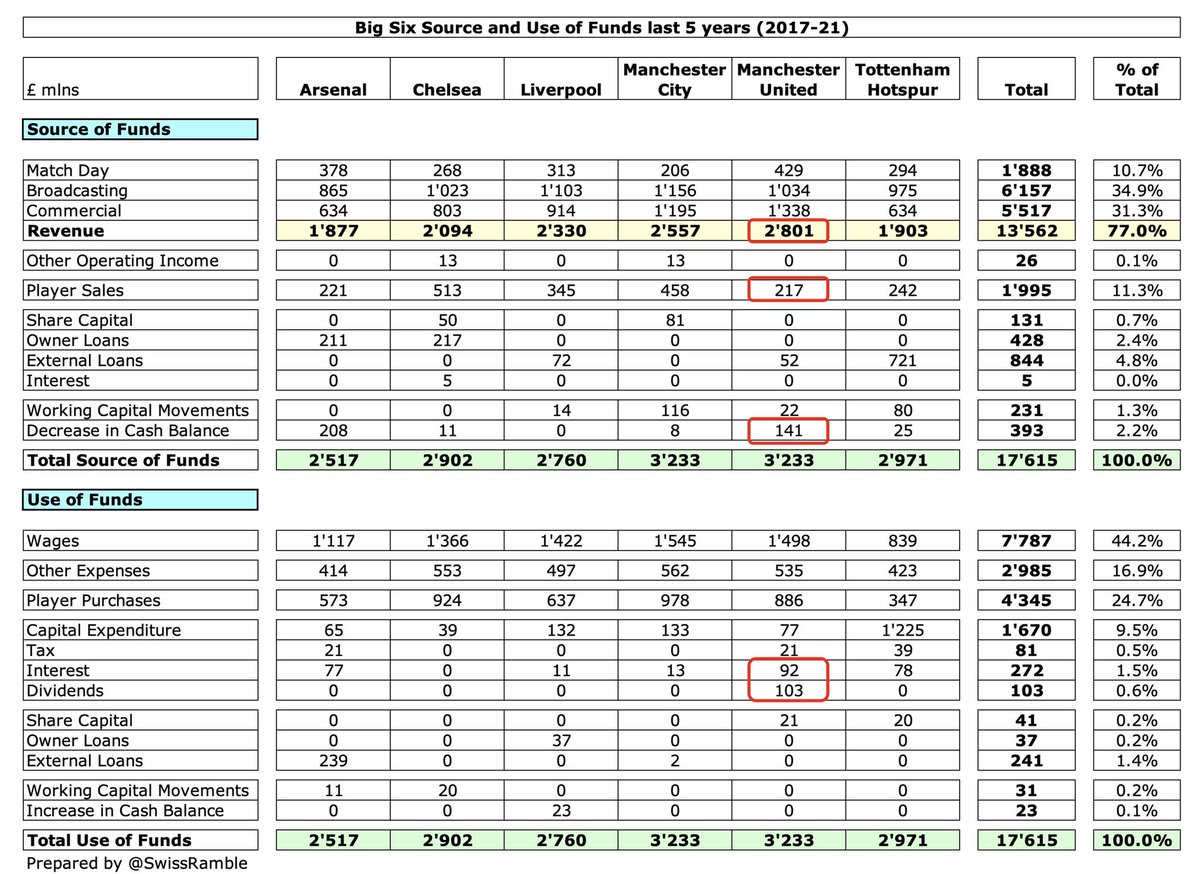

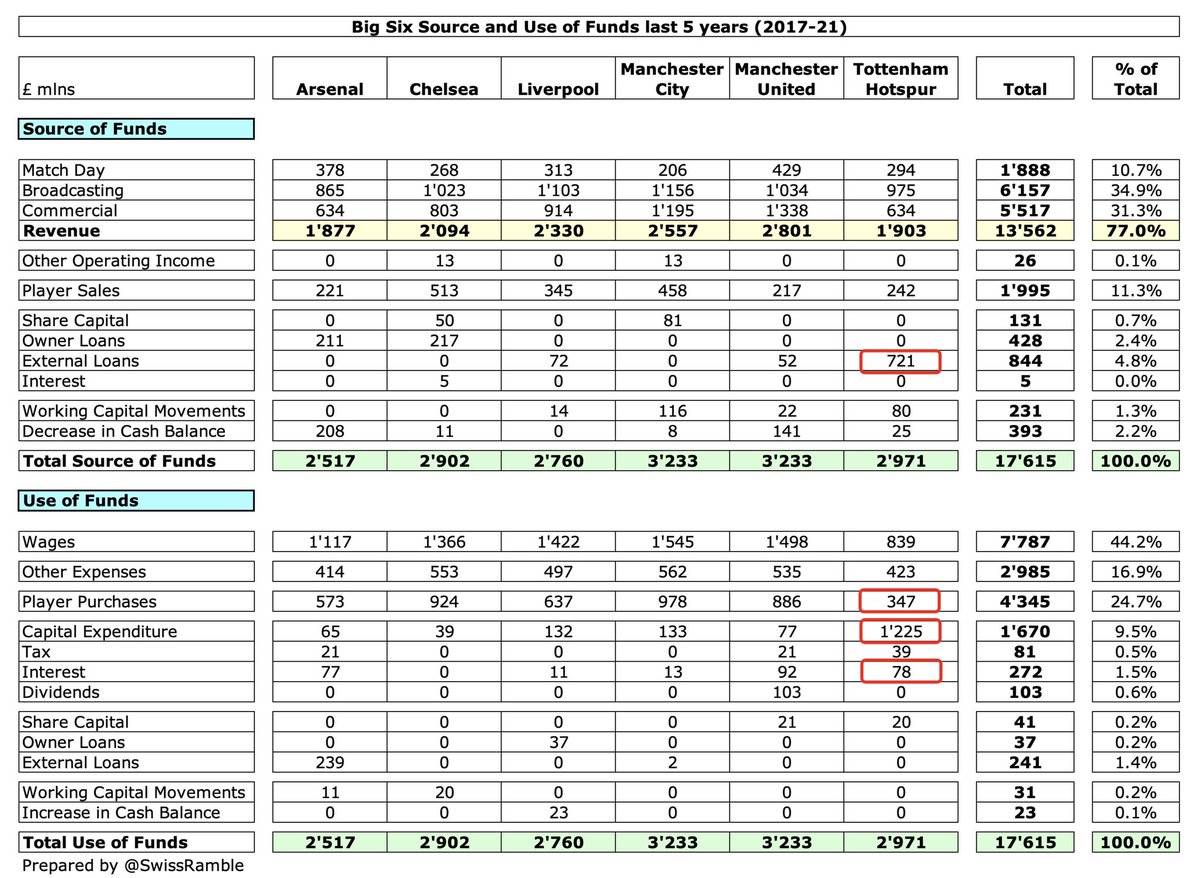

The Big Six Premier League clubs had £17.6 bln available funds, ranging from £3.2 bln for #MCFC & #MUFC to £2.5 bln for #AFC. Main driver is obviously £13.6 bln revenue with 57% (£7.8bln) going on wages. Net transfer spend is £2.3 bln: purchases £4.3 bln less £2.0 bln sales.

Over 88% of Big Six funds come from revenue £13.6 bln (77%) and player sales £2.0 bln (11%). They only required £1.4 bln funding with £844m from banks and £559m from owners, though they also had to take £393m from previous cash reserves.

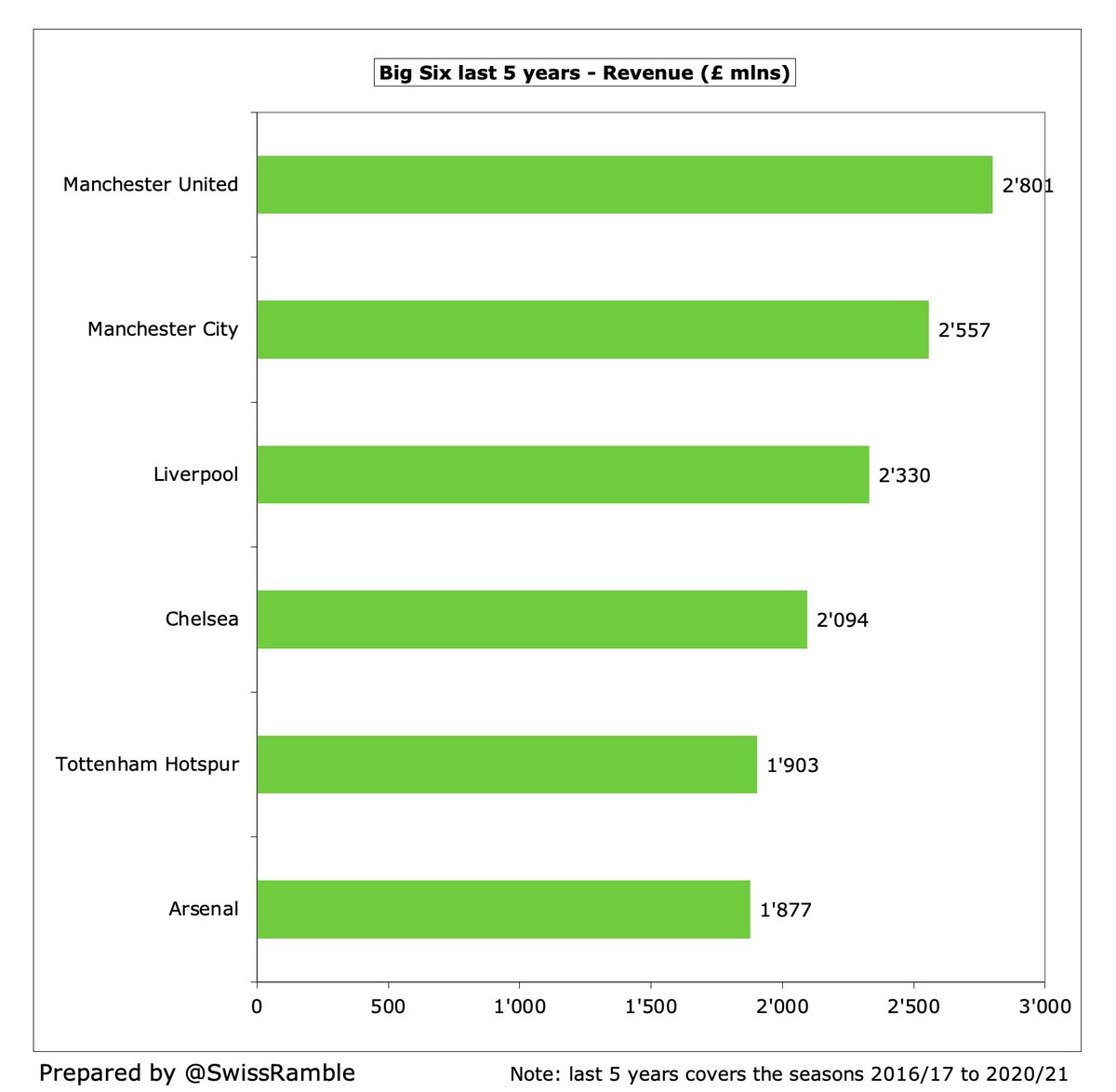

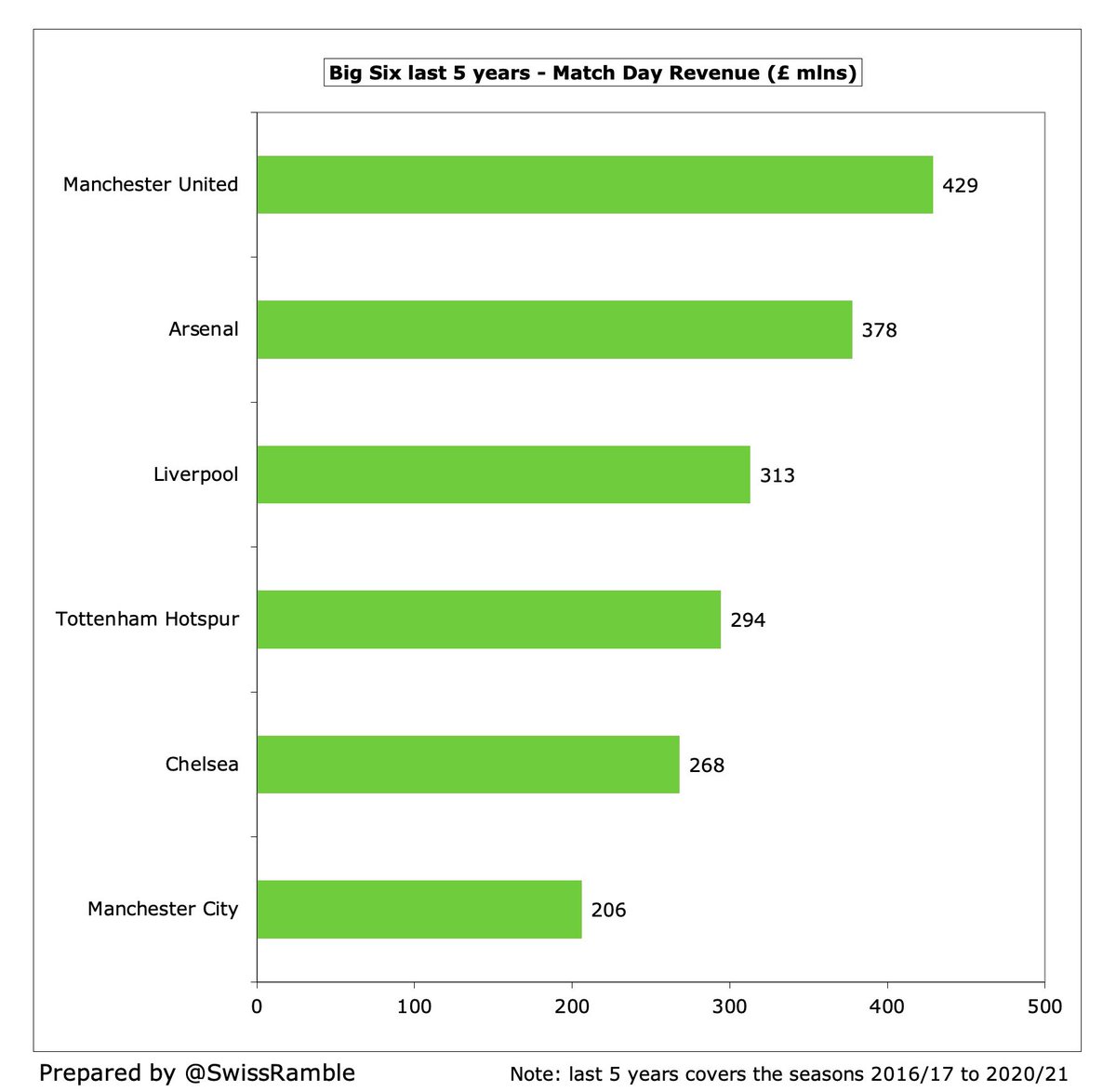

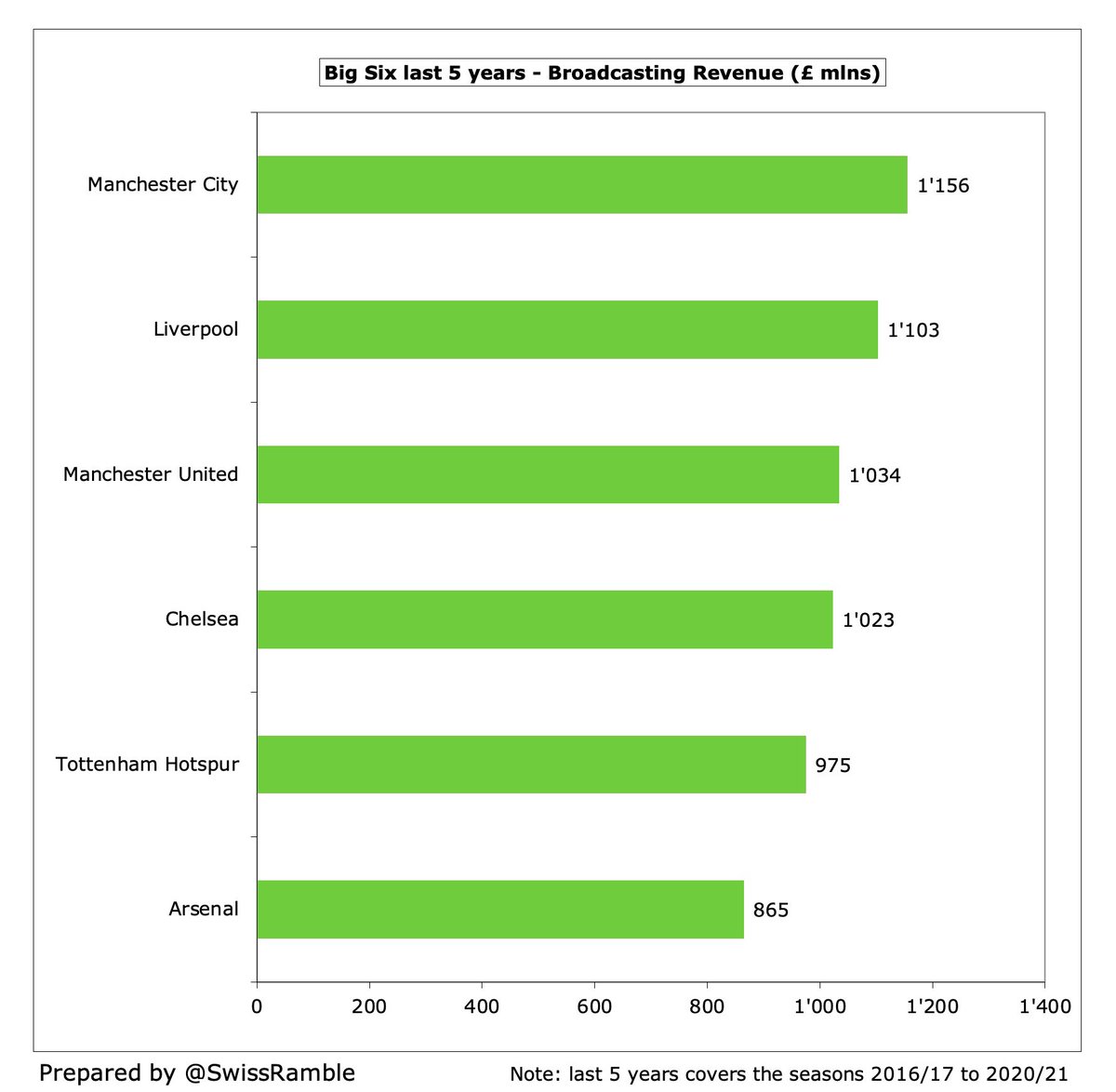

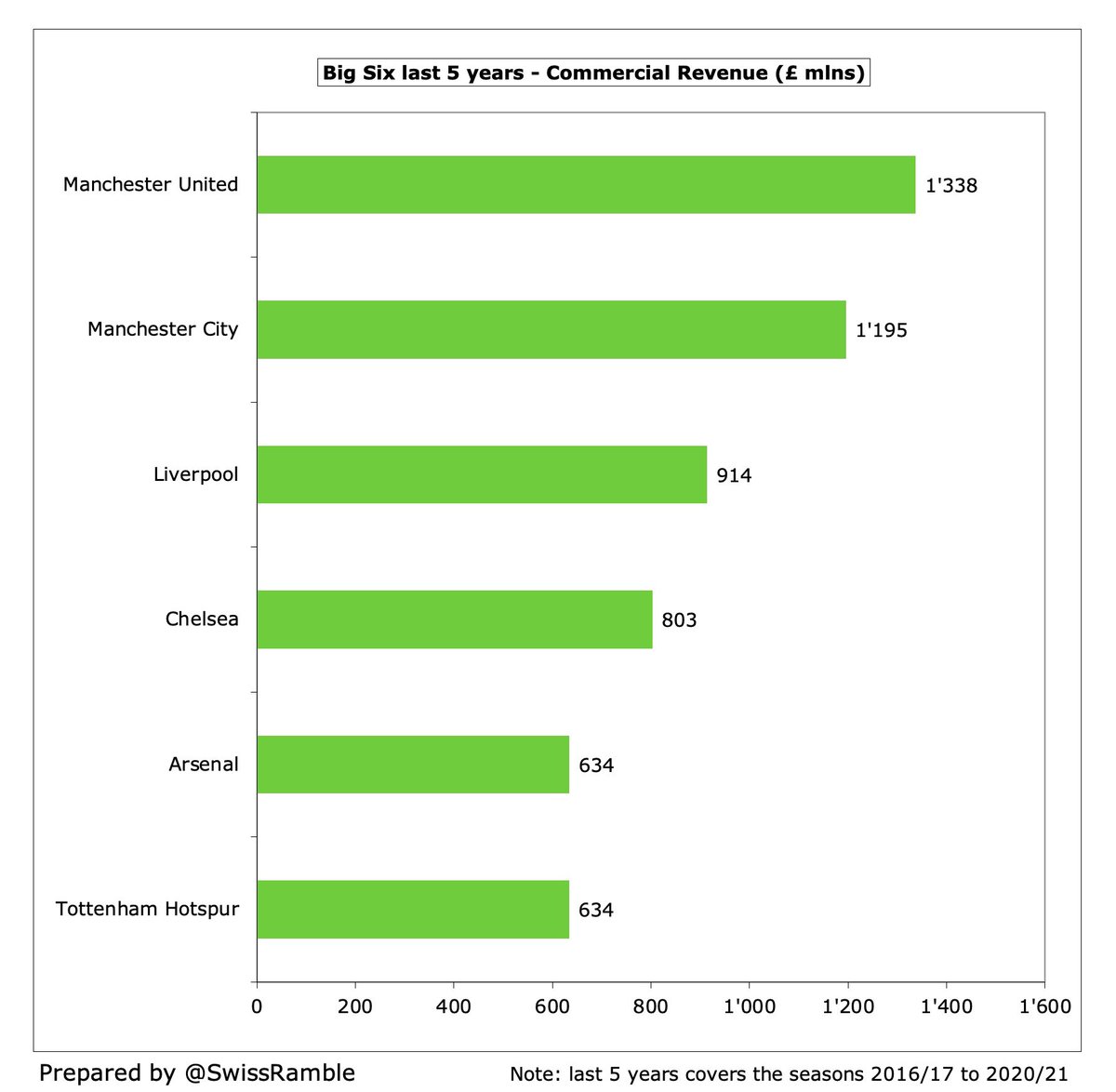

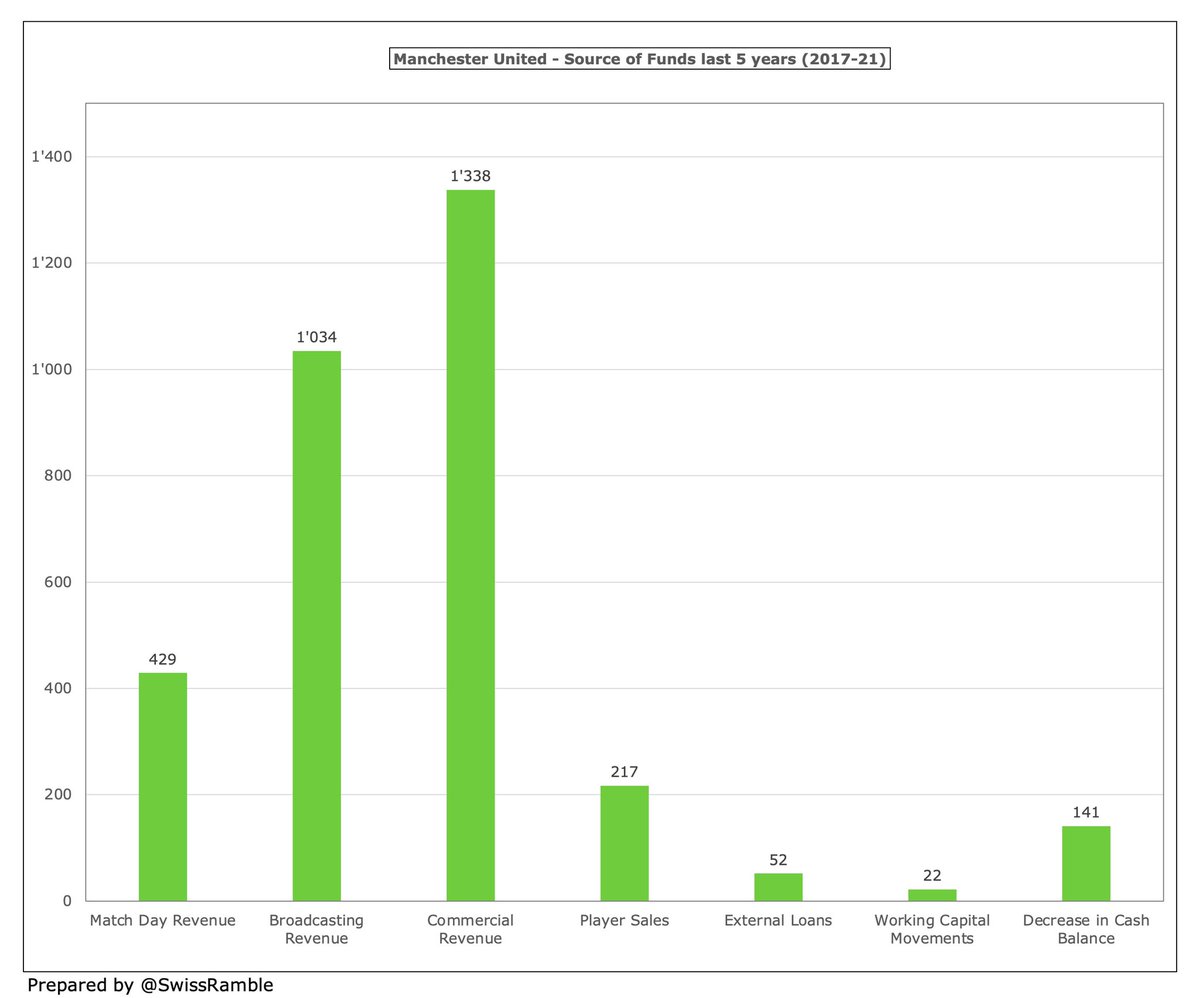

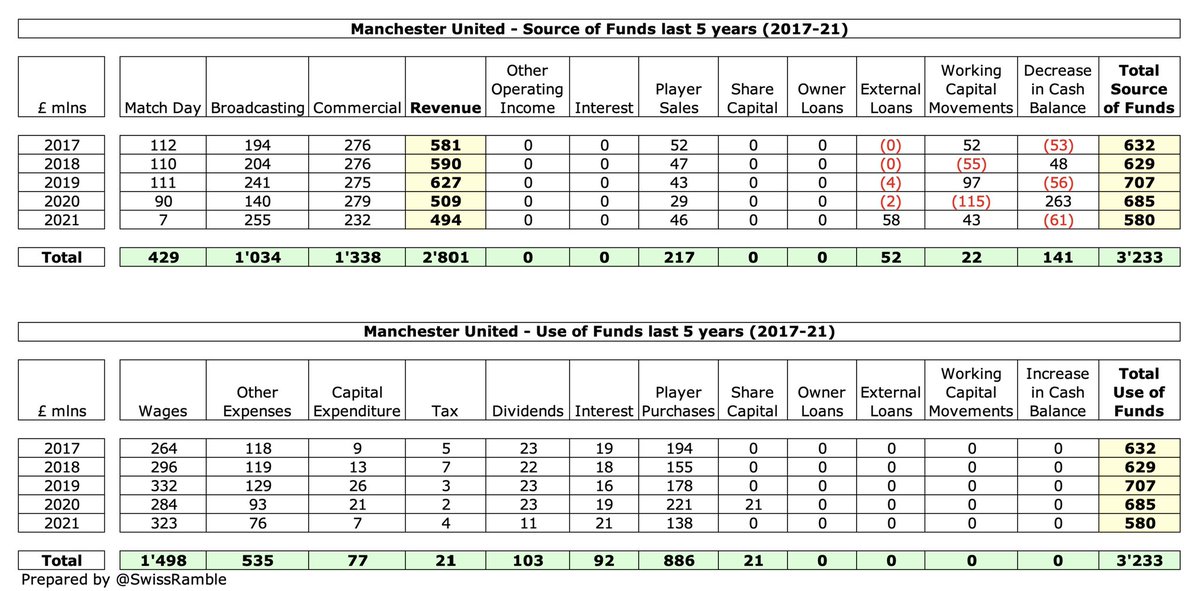

#MUFC generated most revenue in the last 5 years with £2.8 bln, ahead of #MCFC £2.6 bln, and around £900m more than #THFC and #AFC. United led the way in both match day and commercial income, but were behind #MCFC and #LFC in broadcasting revenue.

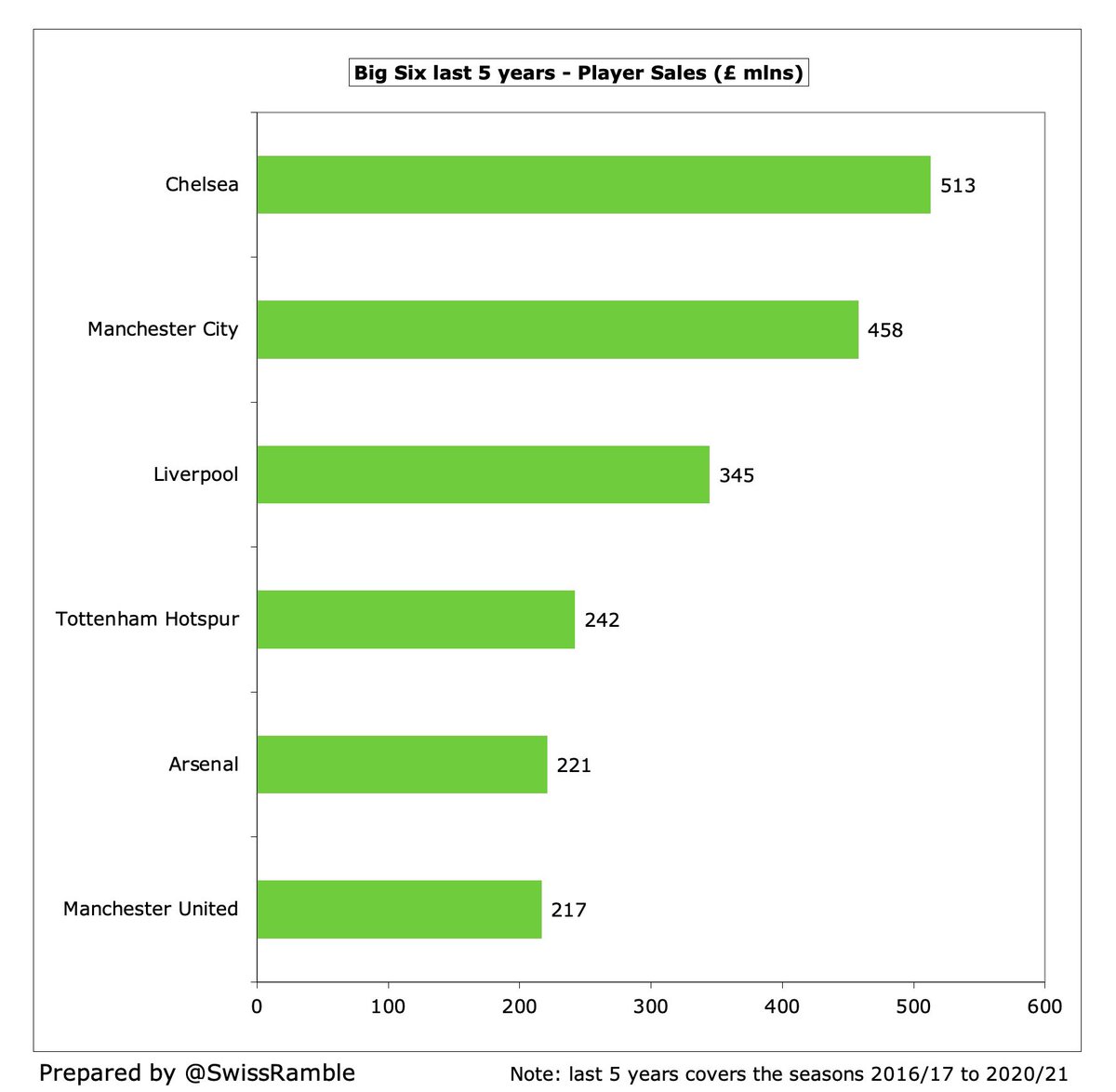

Two clubs made a lot of money from player sales: #CFC £513m and #MCFC £458m. In contrast, much lower amounts at #MUFC £217m, #AFC £221m and #THFC £242m. Note: this represents cash received, not the accounting profit from player trading.

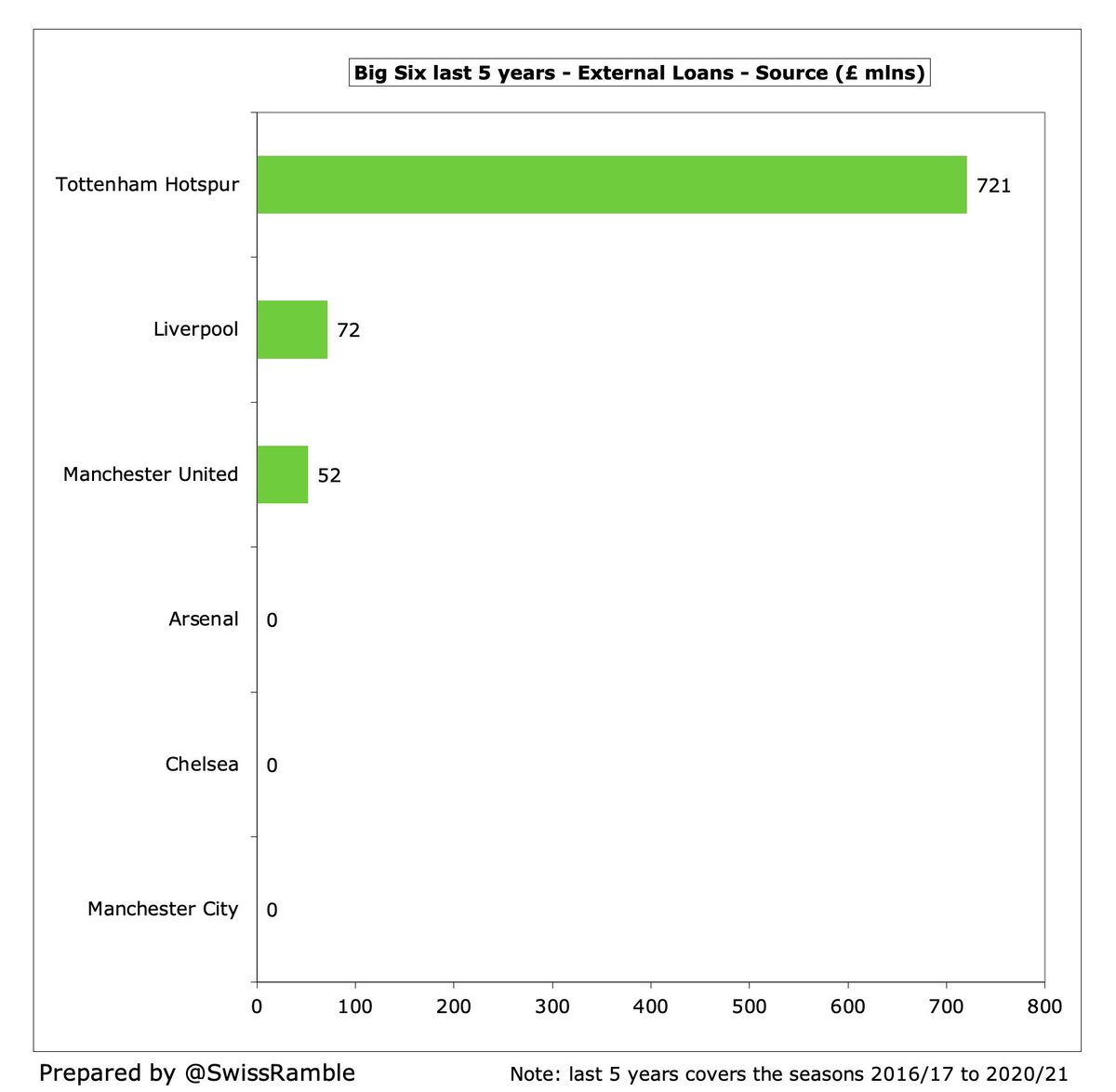

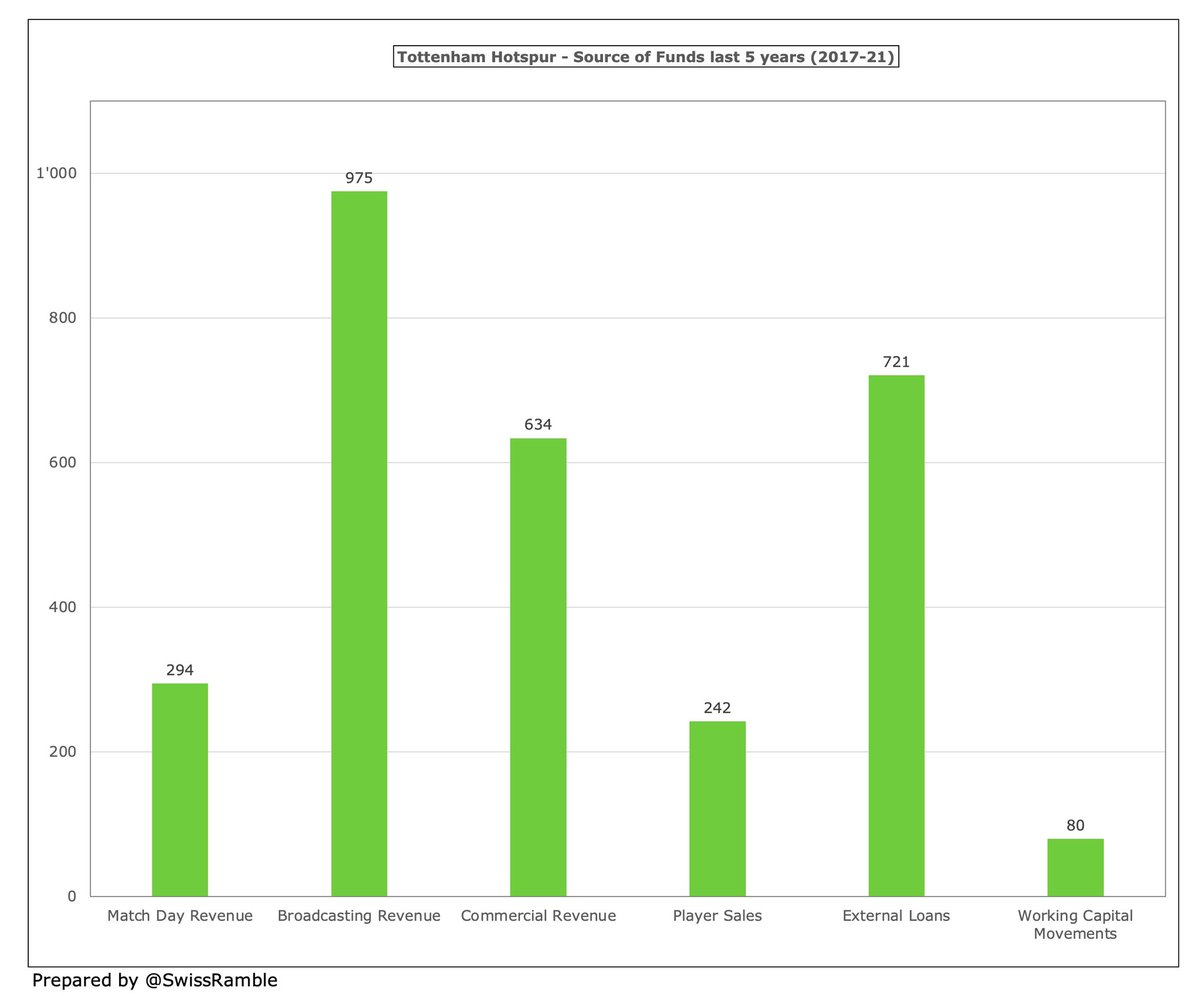

Only three of the Big Six tapped the external loan market, with the highest by far being #THFC £721m to help finance the development of their new stadium. #LFC £72m and #MUFC £52m took out smallish loans, mainly to help cover operational shortfalls caused by COVID.

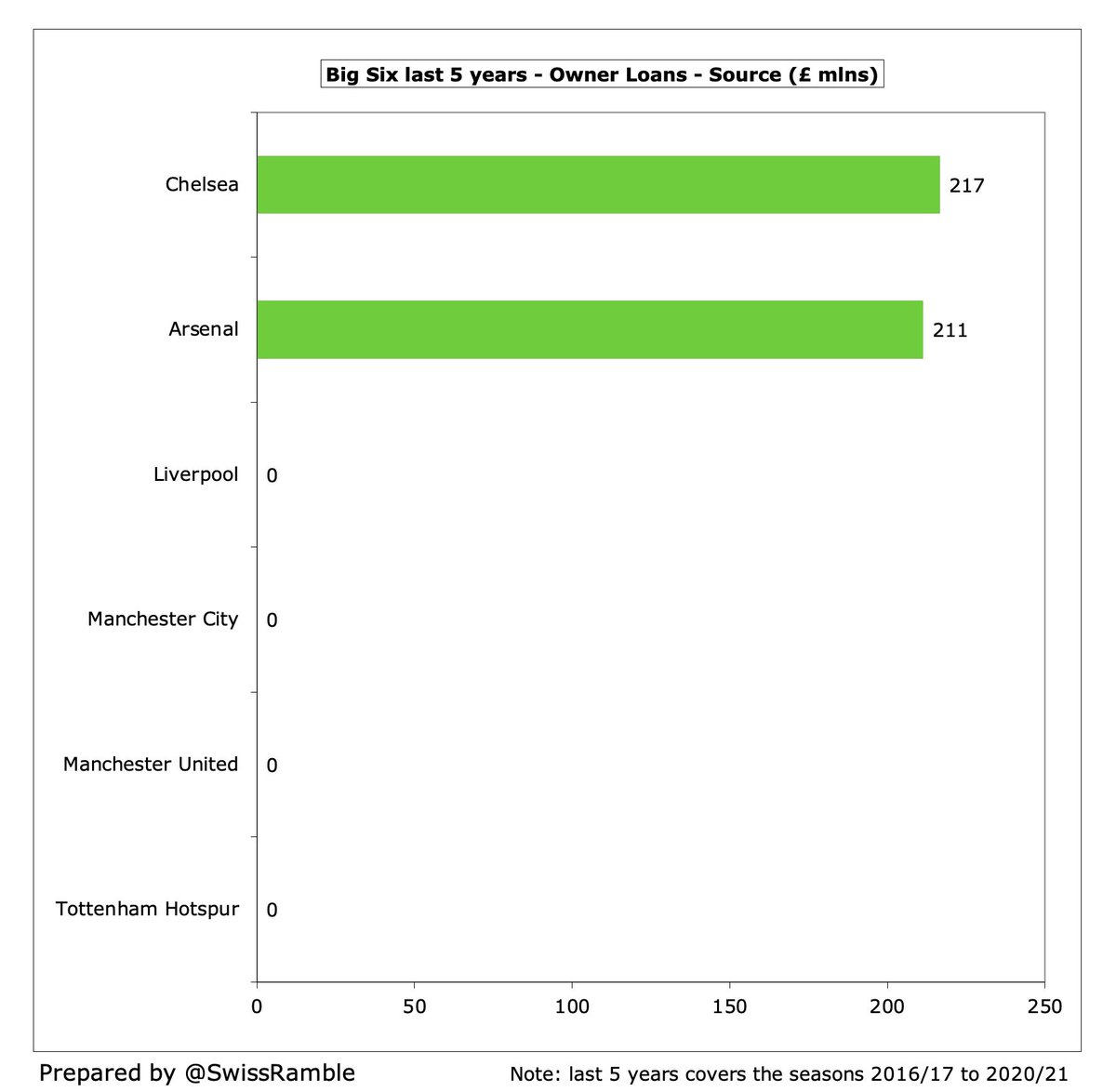

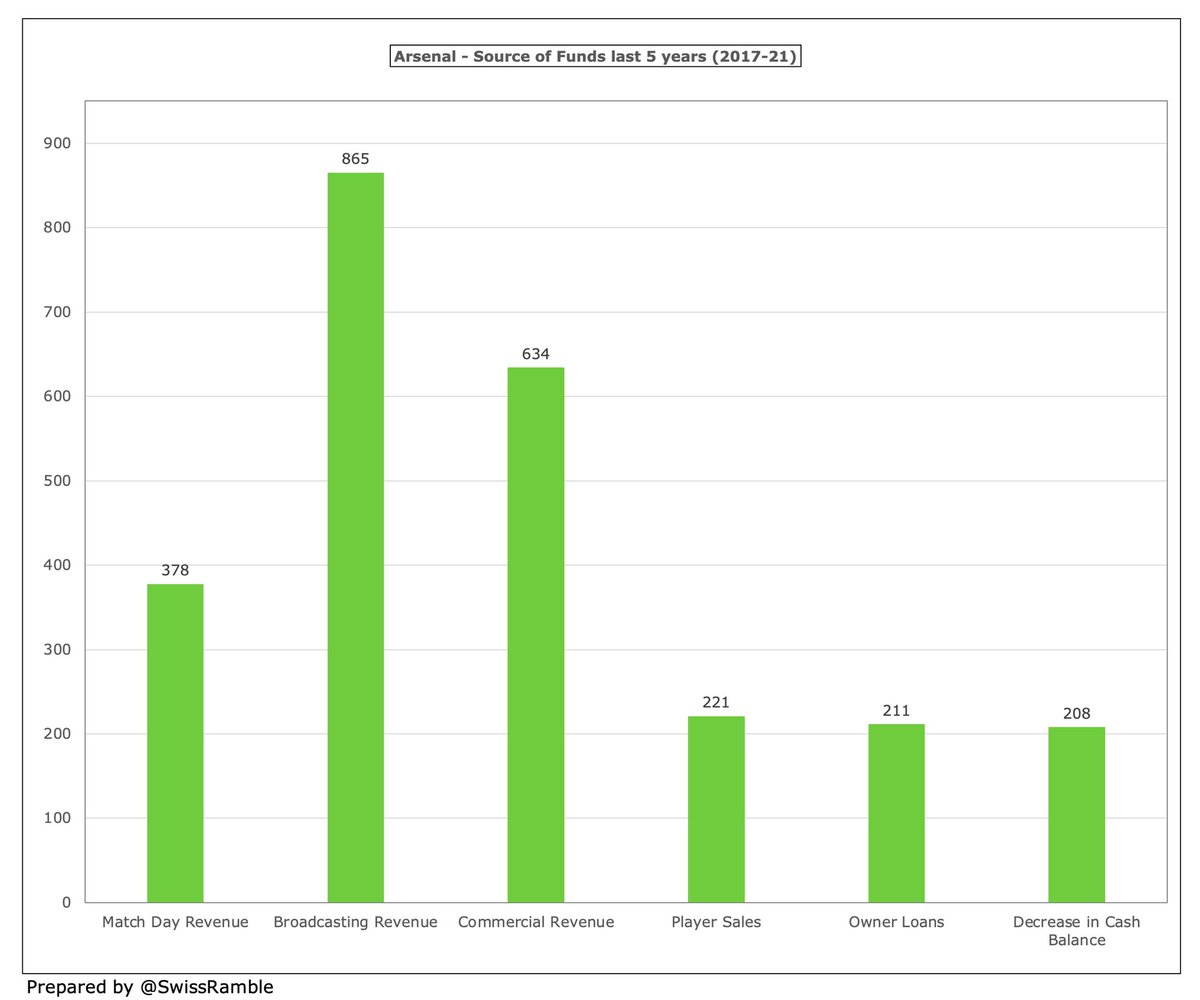

Only two of the Big Six received loans from their owners. #CFC got £217m from Roman Abramovich, while #AFC received £211m from Stan Kroenke to replace some external debt, as the club redeemed bonds used to fund the construction of the Emirates Stadium.

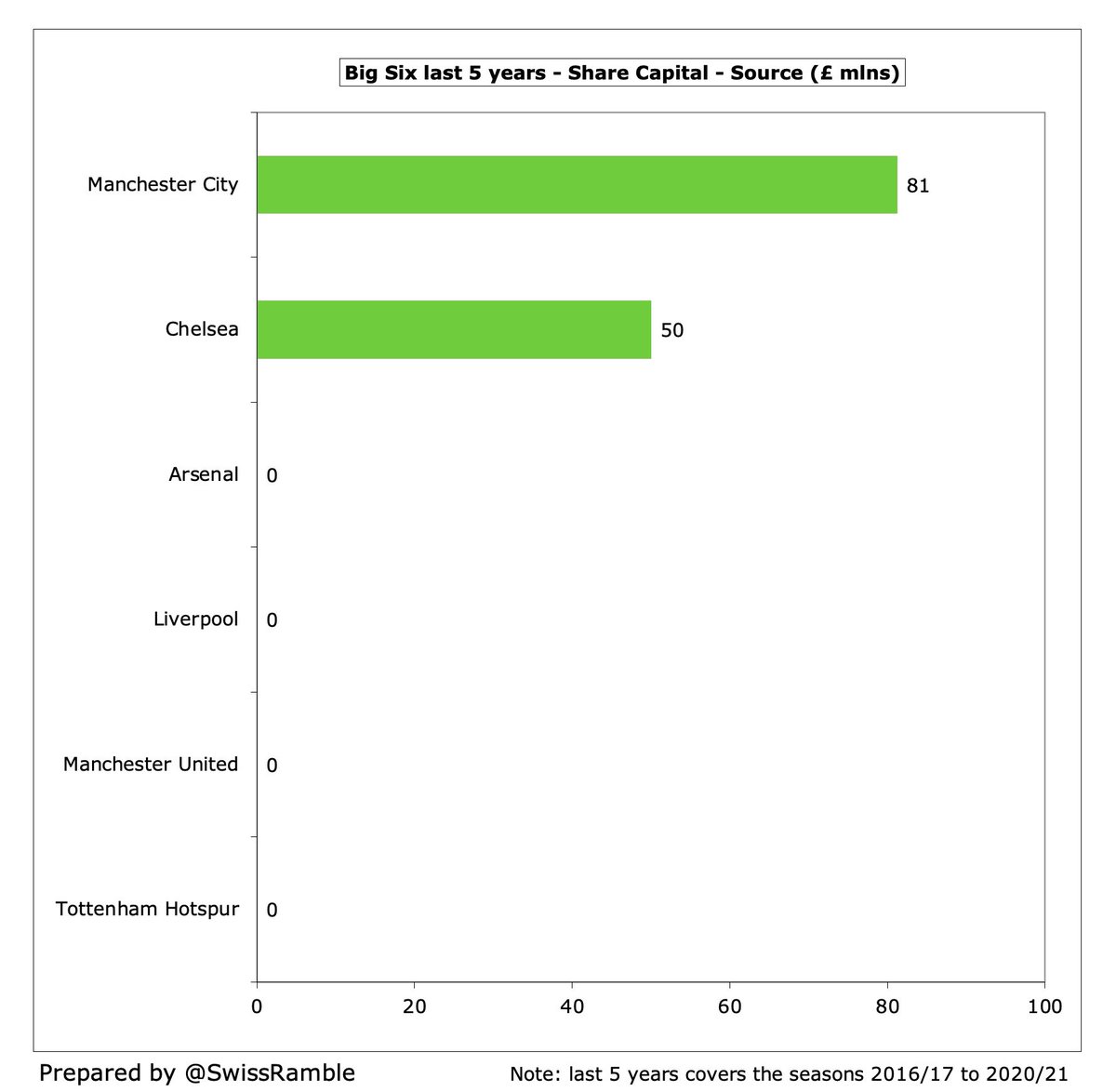

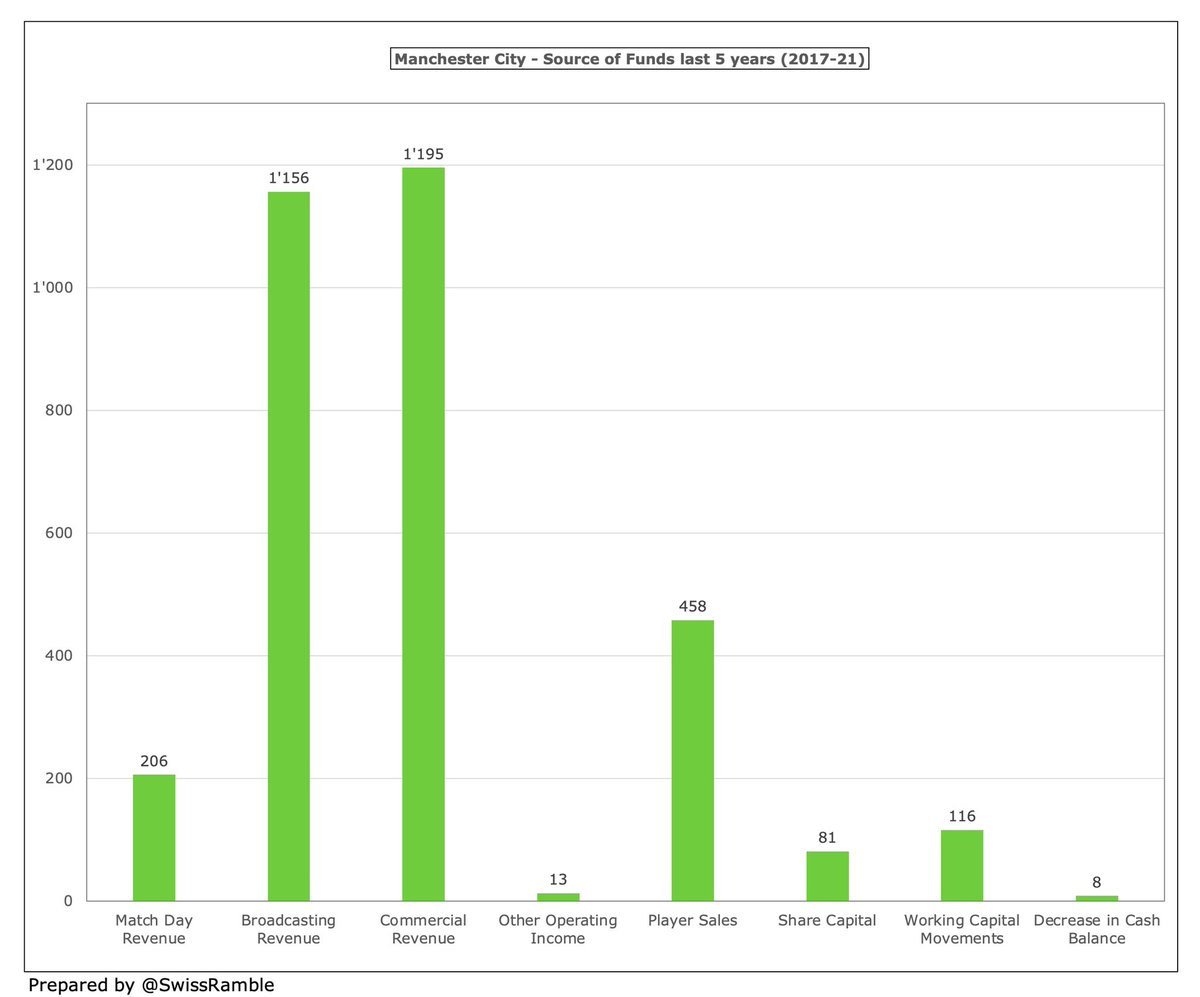

Again, two of the Big Six received owner funding in the form of share capital injections: #MCFC £81m and #CFC £50m. This is the best form of owner financing for the club, as it does not need to be repaid.

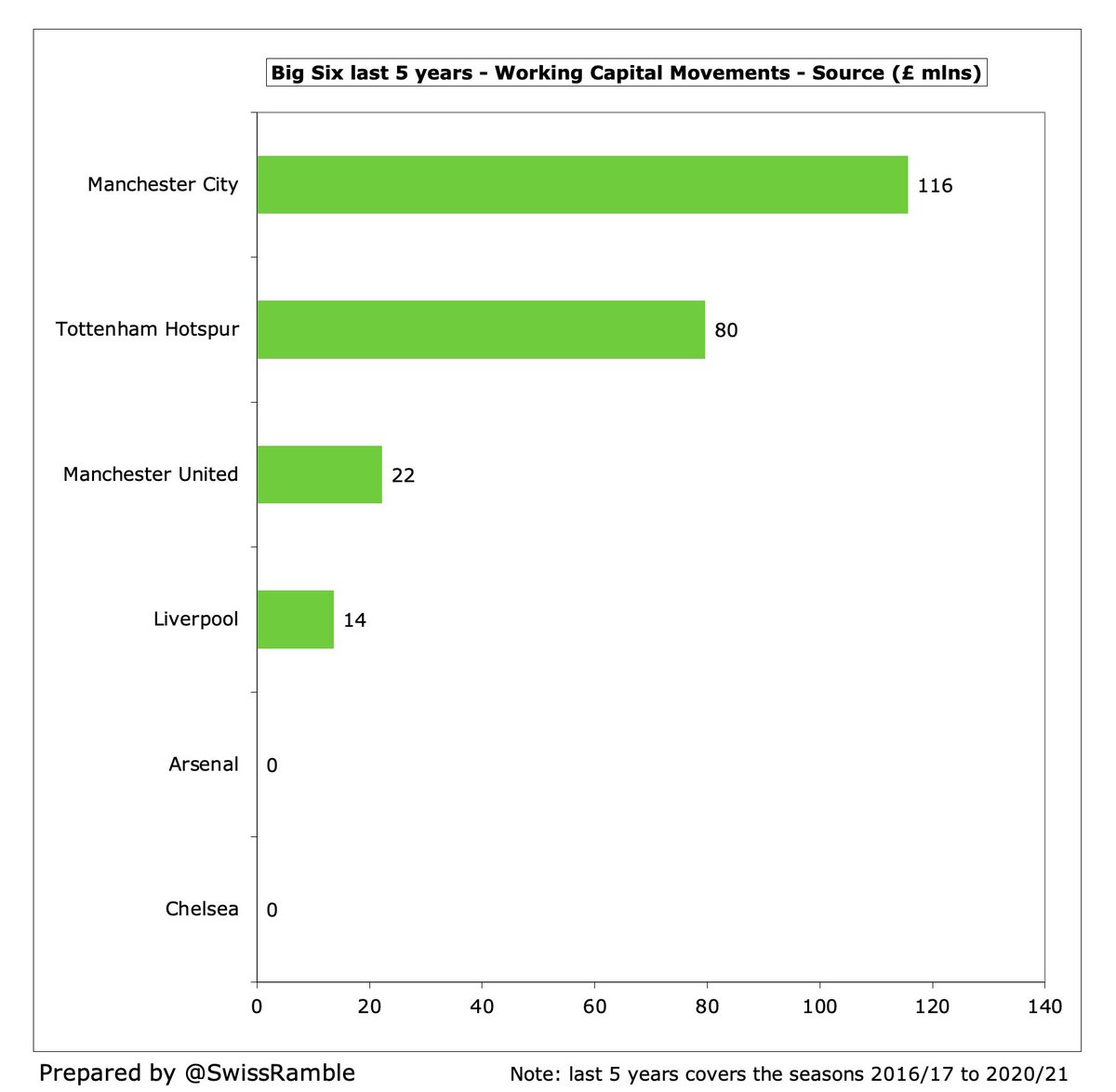

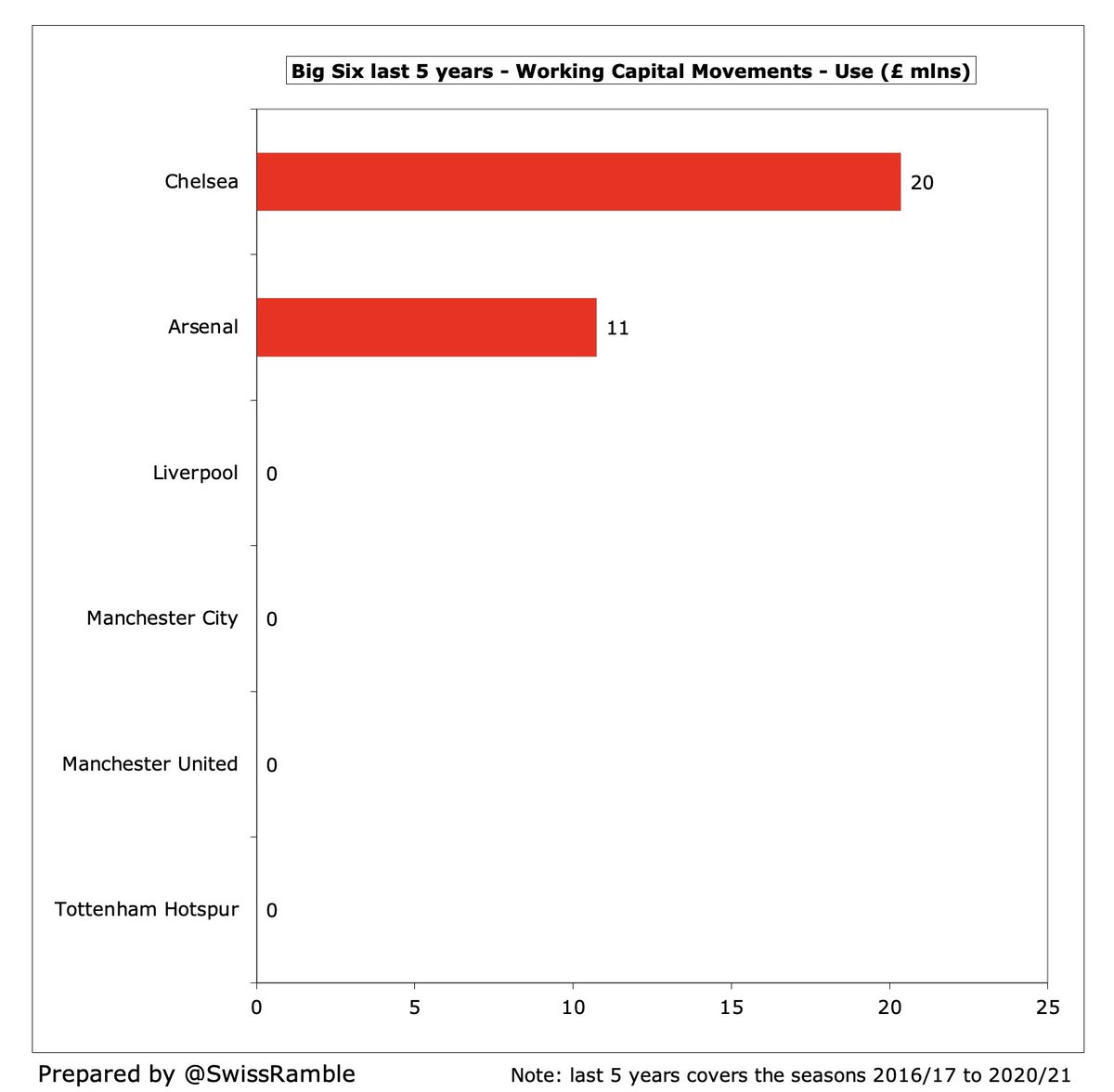

Working capital measures short-term liquidity, defined as current assets less current liabilities. Changes in working capital can cause operating cash flow to differ from net profit, as clubs book revenue and expenses when they occur instead of when cash actually changes hands.

Clubs have positive cash flow if liabilities increase, as this means a club is paying suppliers more slowly, or if debtors decrease, as it collected more money from customers than recorded as revenue. #MCFC £116m and #THFC £80m had the highest beneficial working capital movements

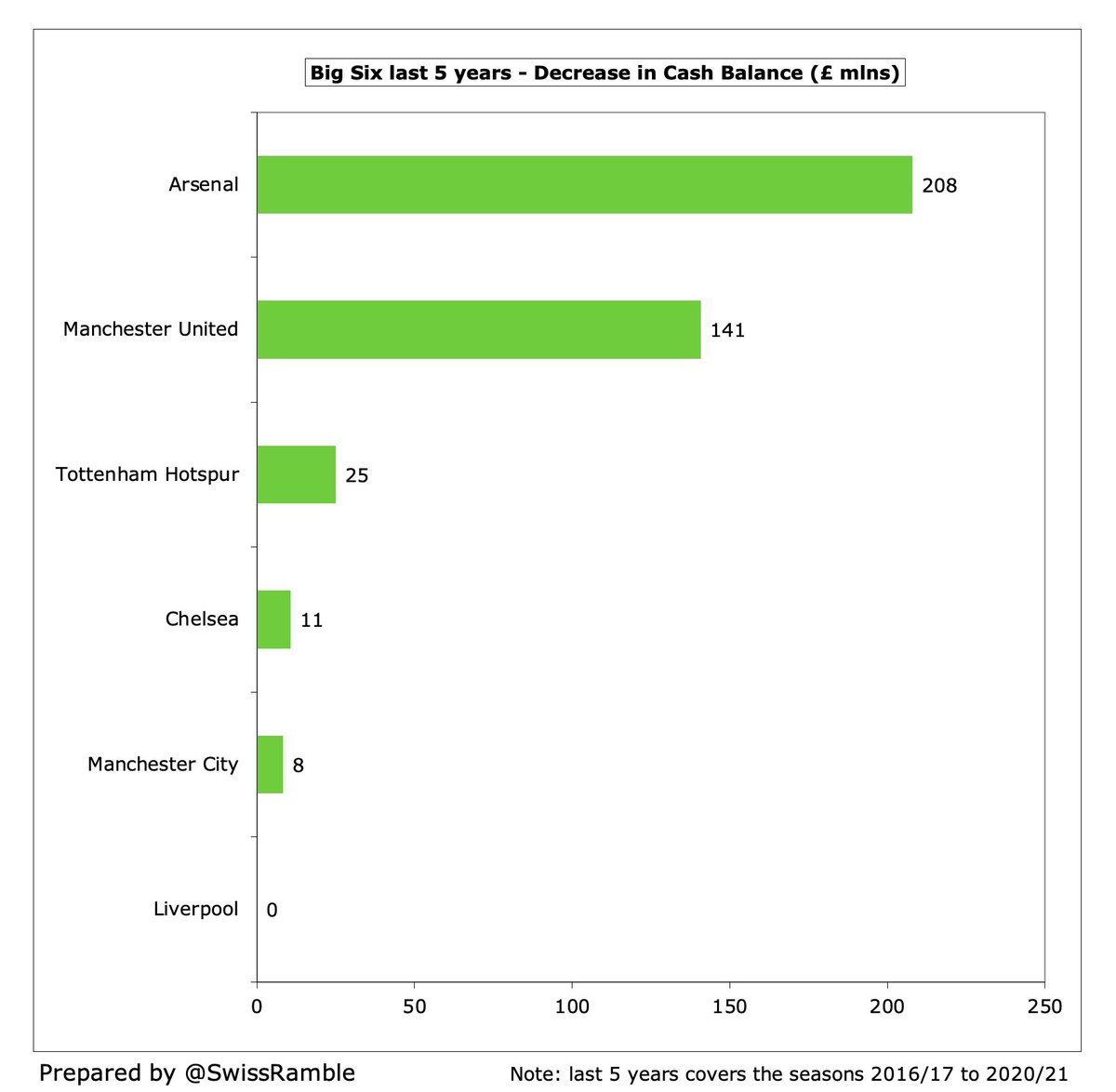

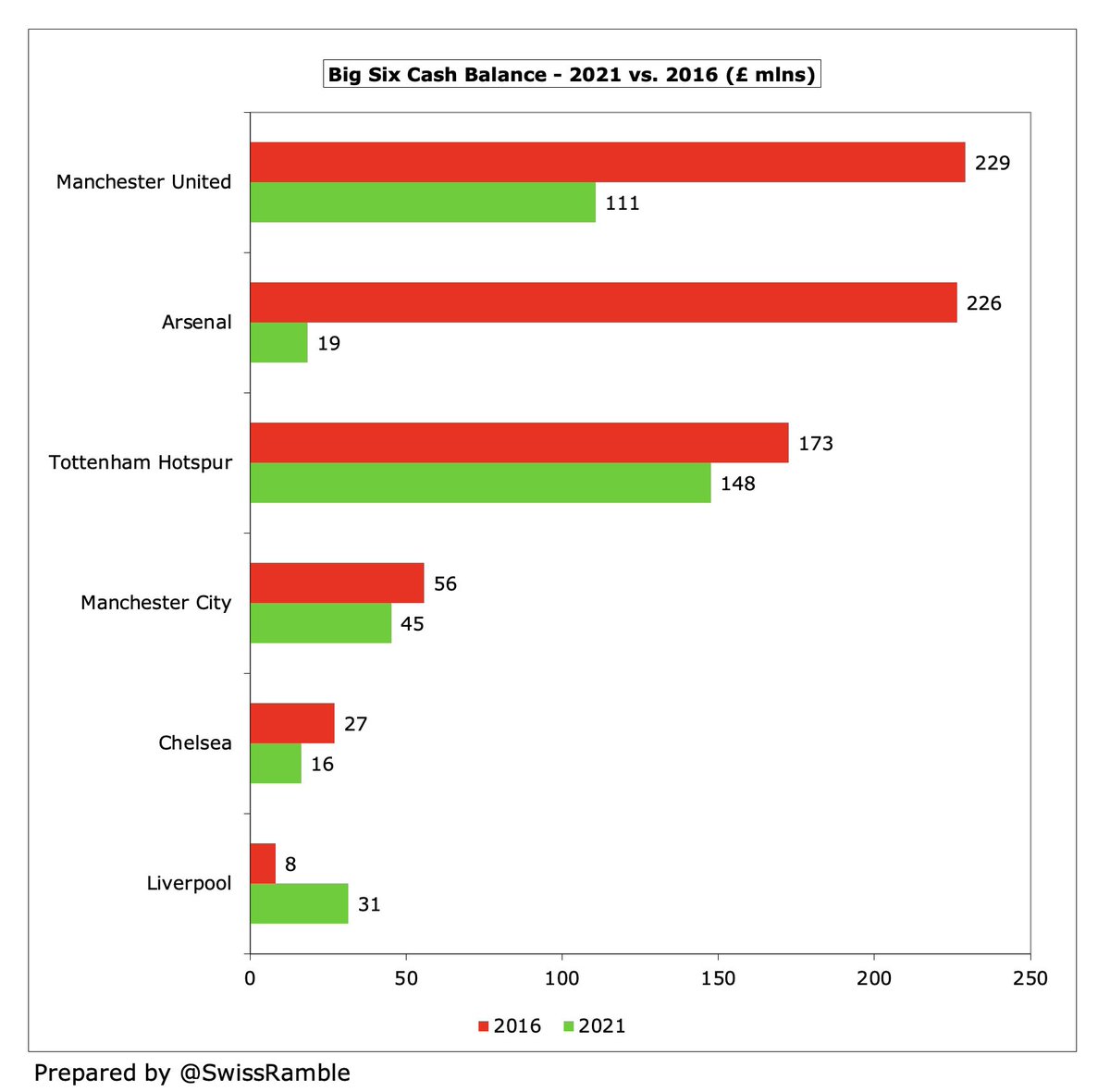

Given the challenges posed by the pandemic, most of the Big Six had to eat into their cash reserves to help fund activities, especially #AFC £208m (balance down from £226m to £19m) and #MUFC £141m.

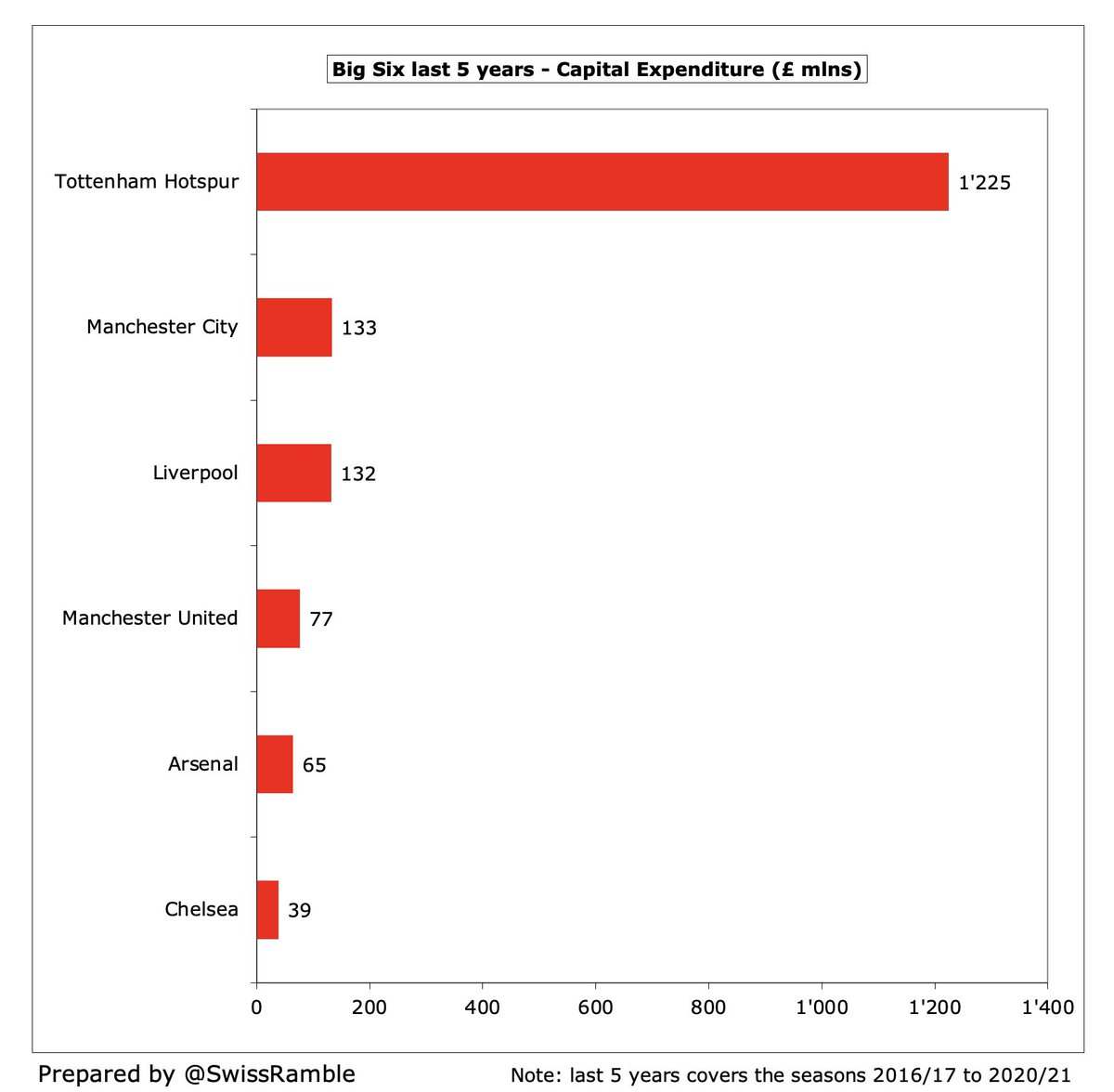

Around 60% of the Big Six clubs’ money went on operating expenses, wages £7.8 bln (44%) plus other costs £3.0 bln (17%), with a further £4.3 bln (25%) on player purchases and £1.7 bln (9%) on capital expenditure. Very little on interest and loan repayments.

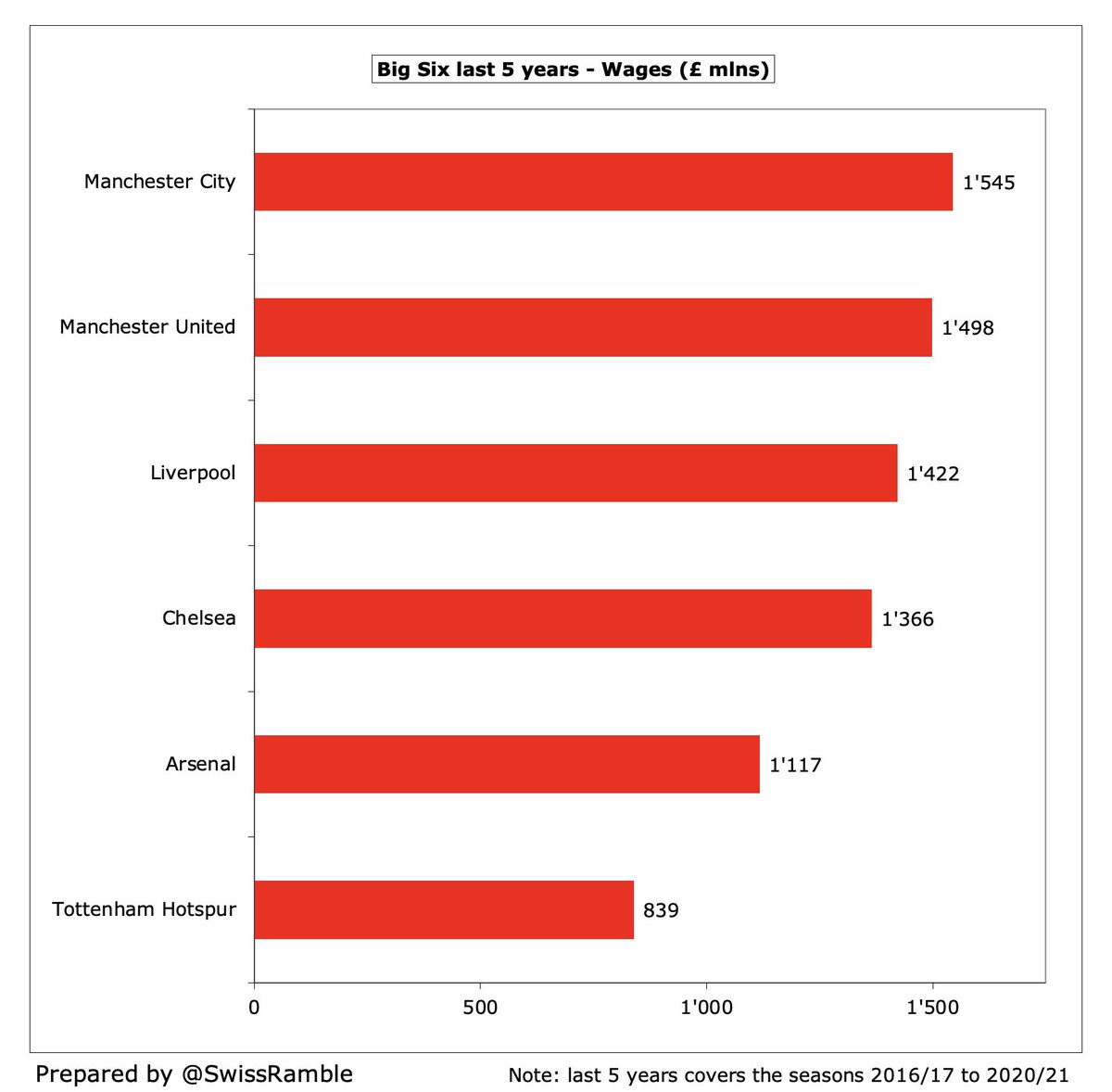

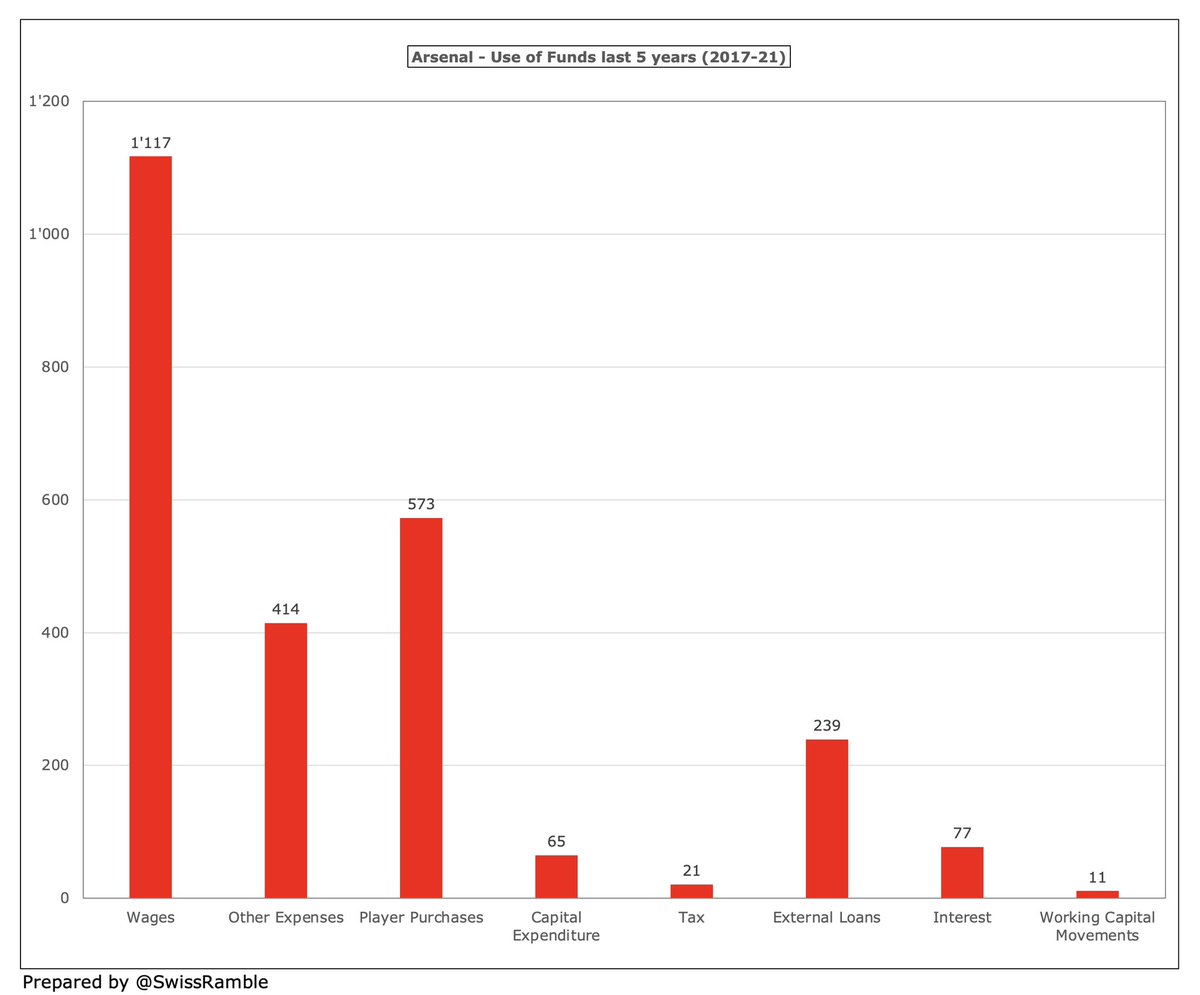

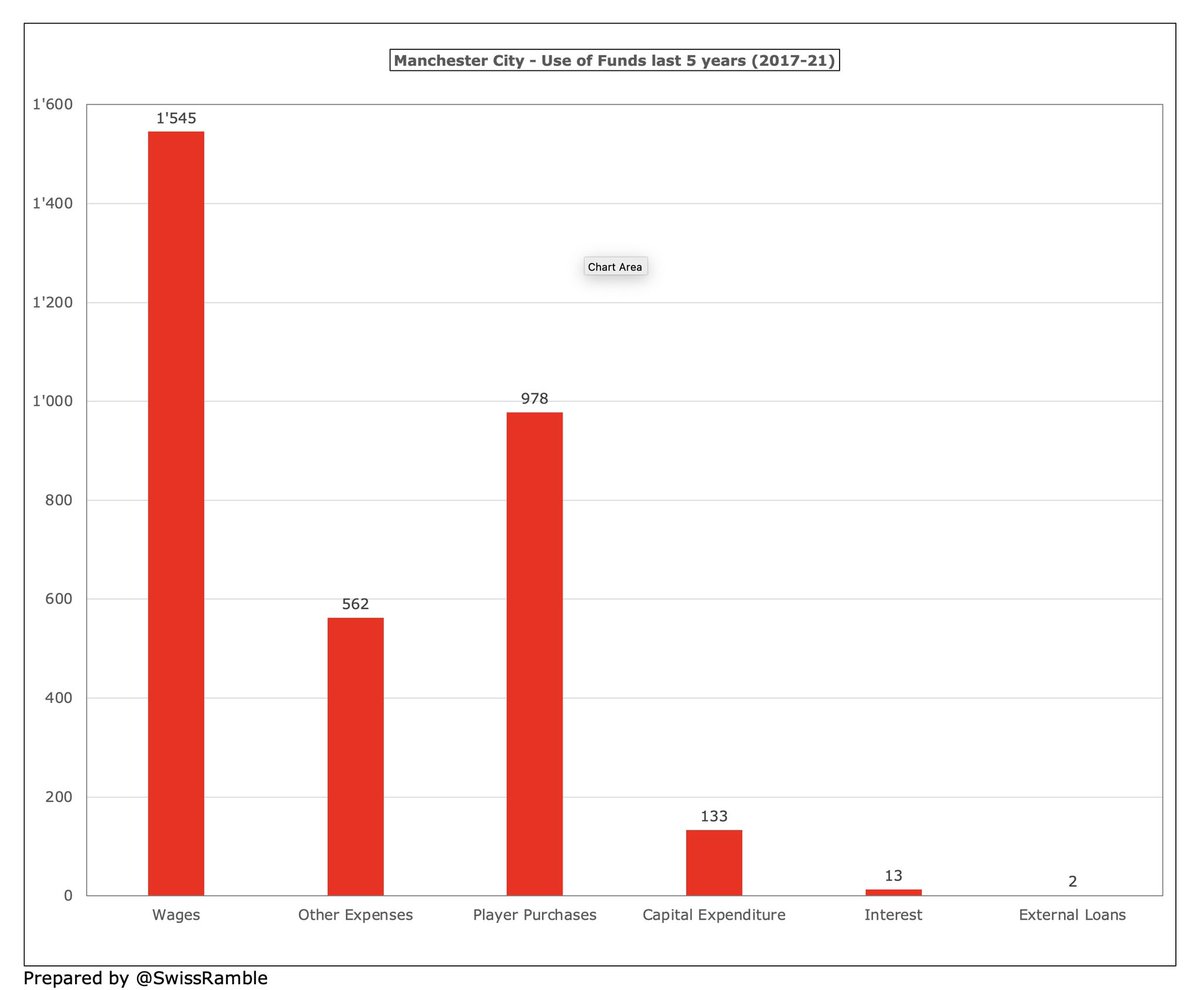

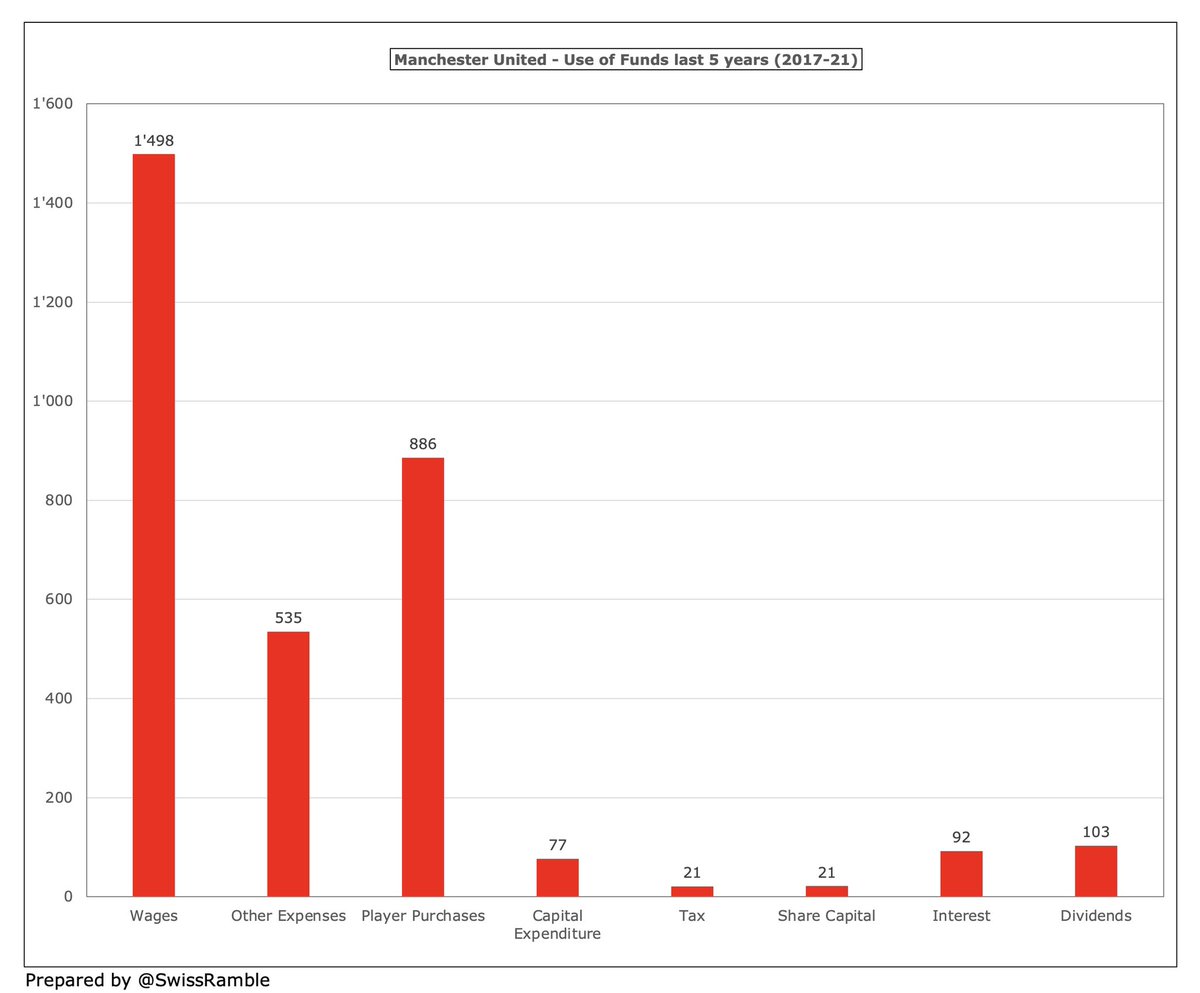

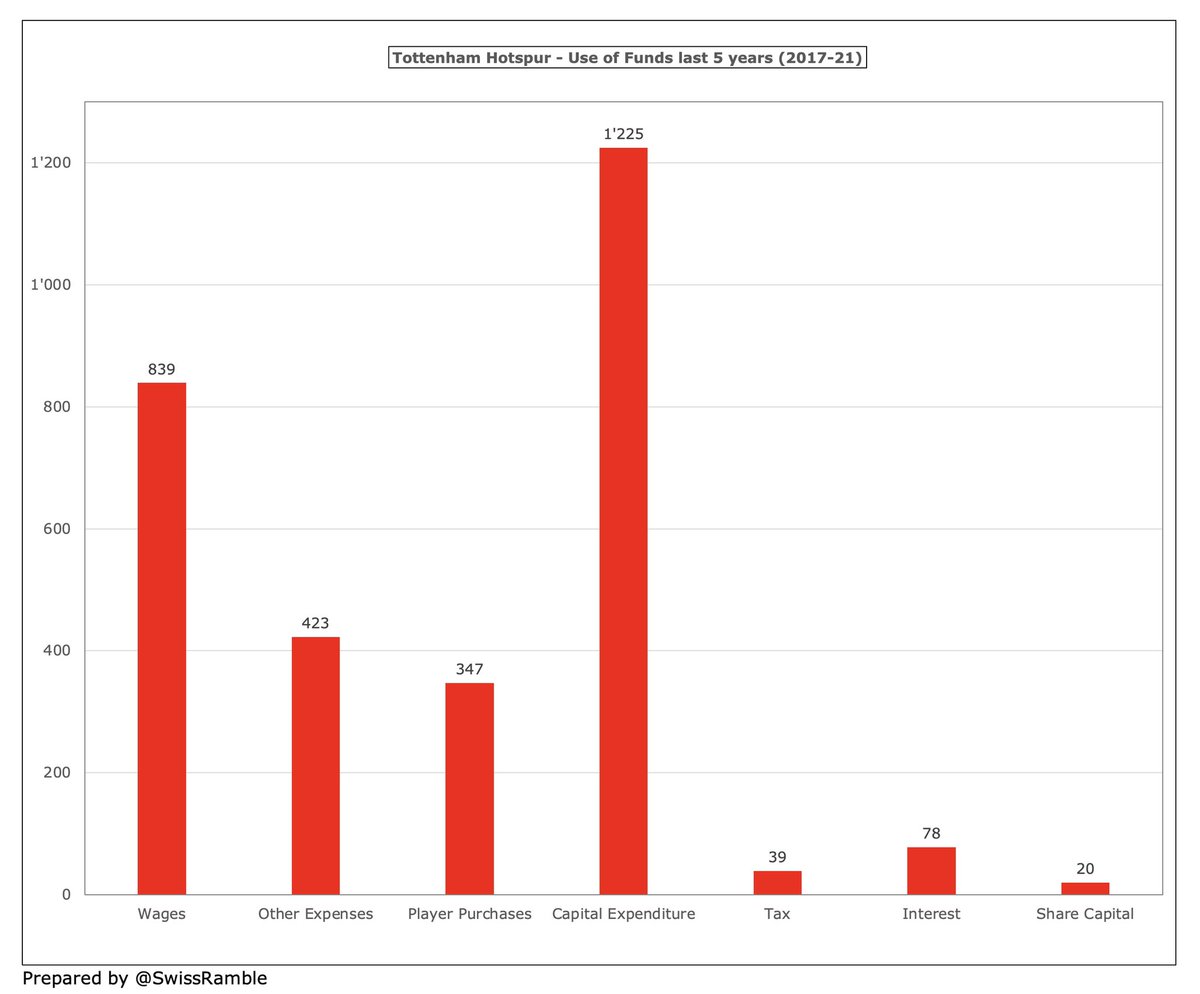

Four of the Big Six spent between £1.4 bln and £1.5 bln on wages in the last 5 years. #MCFC led the way with £1,545m, just ahead of #MUFC £1,498m, followed by #LFC £1,422m and #CFC £1,366m. There is then a big gap to #AFC £1,117m and particularly #THFC £839m.

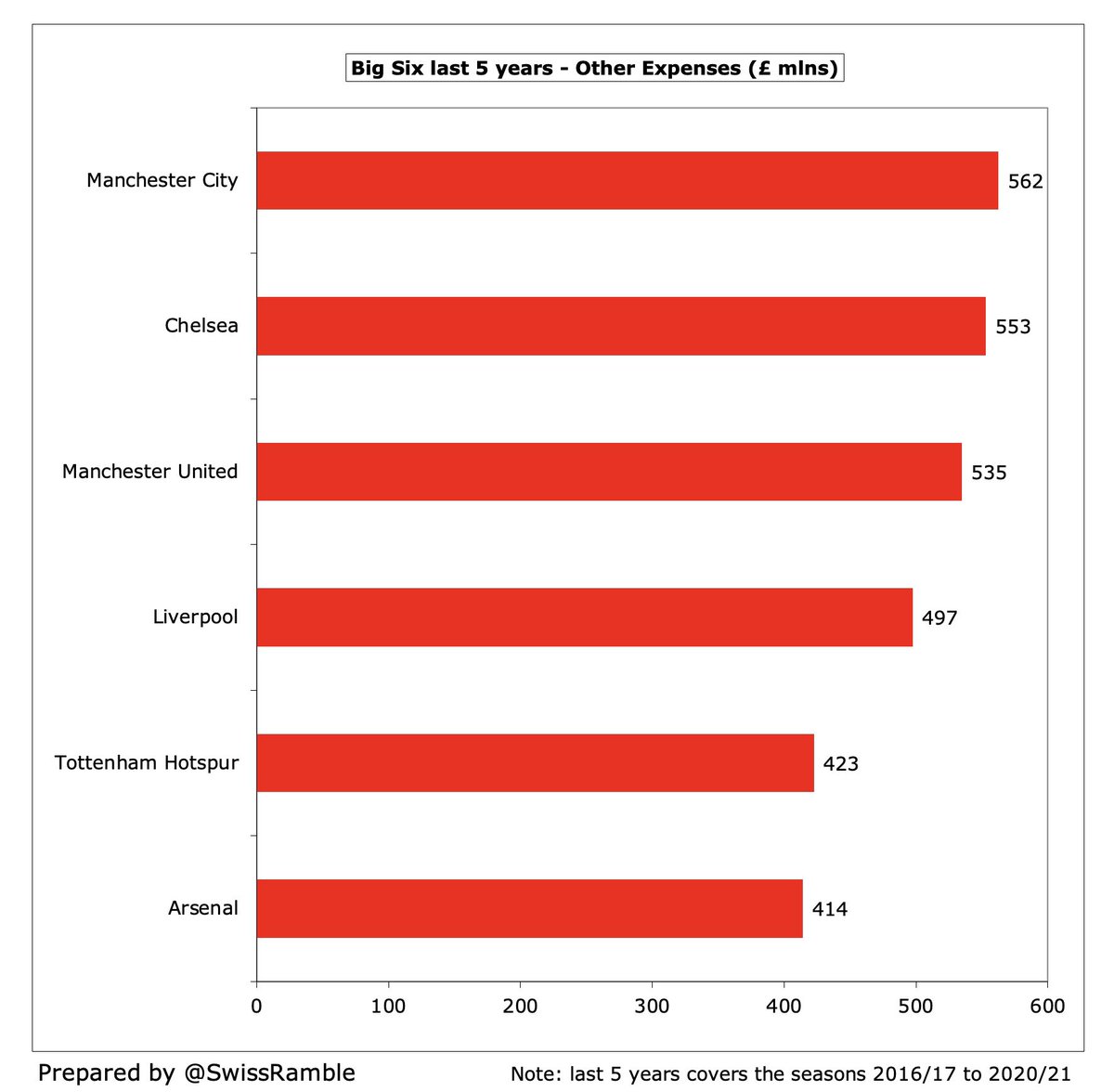

On top of wages, clubs have to pay other operational expenses, which ranged from £562m for #MCFC to £414m for #AFC in the last 5 years. These cover things like cost of staging games, travel, rent, marketing, administration, consultancy, legal fees, etc.

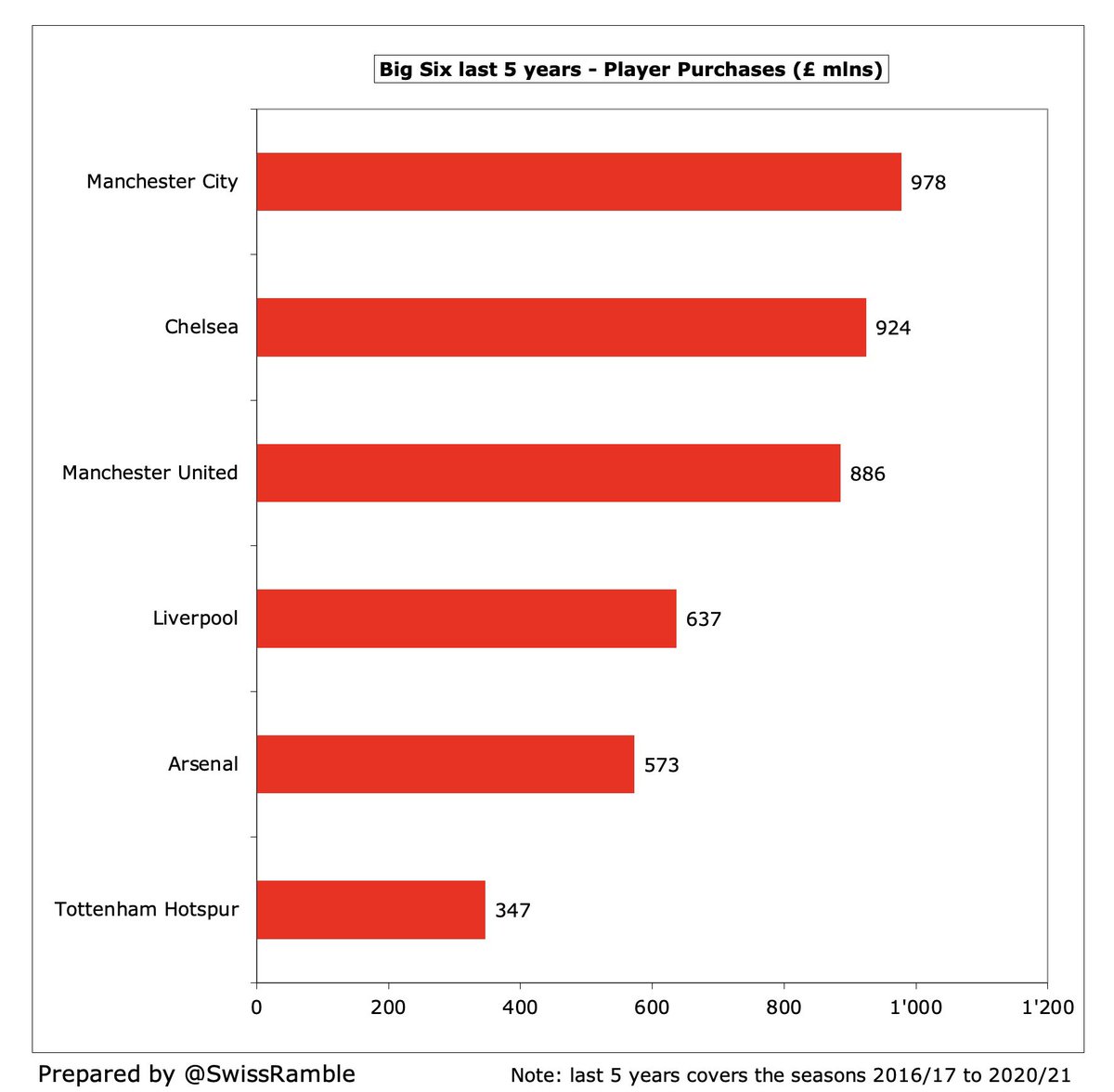

Three of the Big Six account for two-thirds of player purchases in last 5 years, namely #MCFC £978m, #CFC £924m and #MUFC £886m. There is then a fairly steep drop to #LFC £637m, #AFC £573m and #THFC £347m. Reminder: these are cash payments, so impacted by transfer instalments.

#THFC are responsible for over 70% of the Big Six capital expenditure in the last 5 years with £1.2 bln (very largely on their new stadium). The others’ outlay is considerably smaller, though both #MCFC and #LFC spent around £130m on infrastructure improvements.

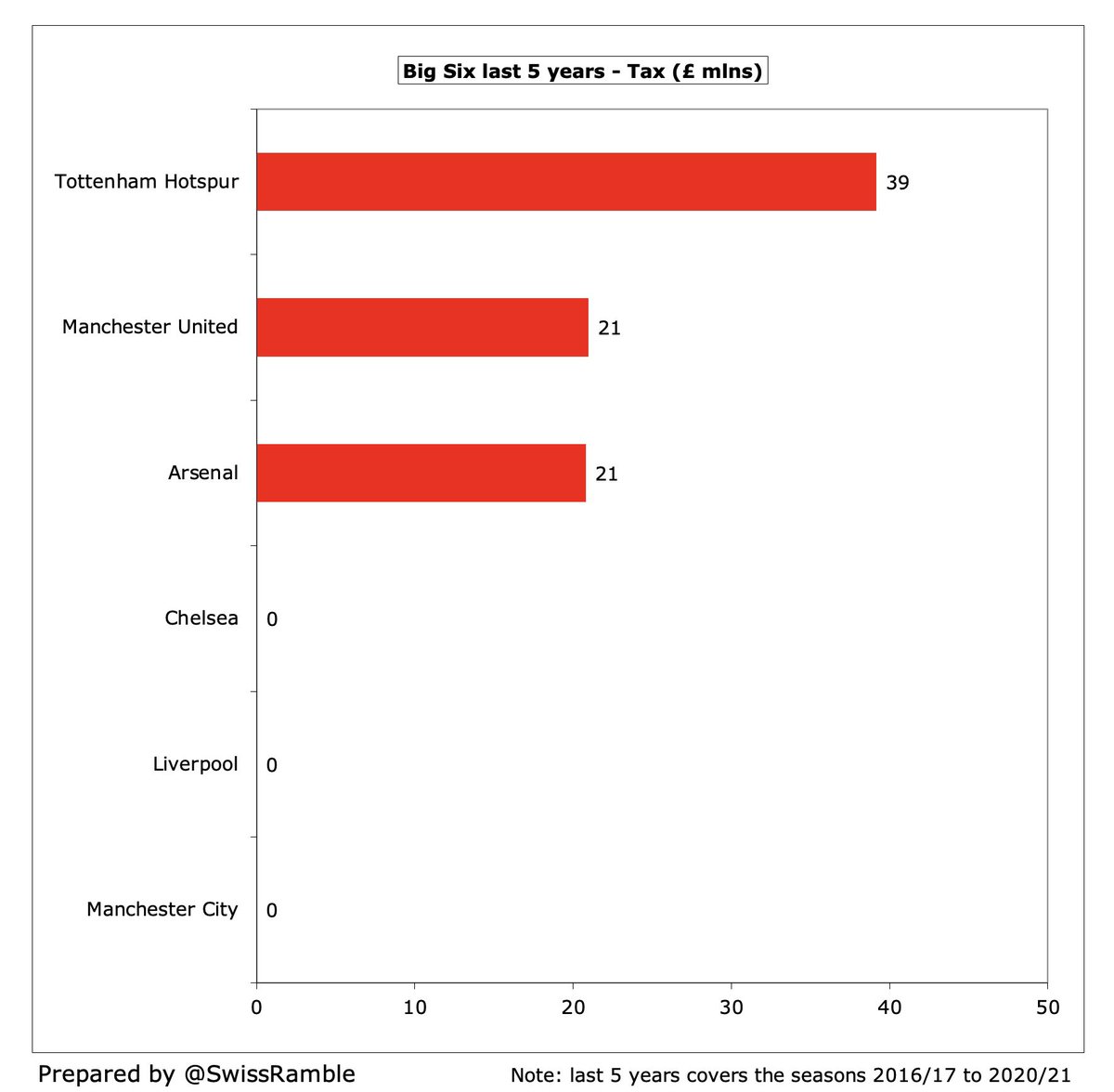

Only three of the Big Six paid corporation tax, the highest being #THFC £39m, followed by #MUFC and #AFC, both £21m. The use of prior year losses and other allowances helps lower tax payments. Football does pay a lot of tax via PAYE on salaries and VAT on (domestic) transfers.

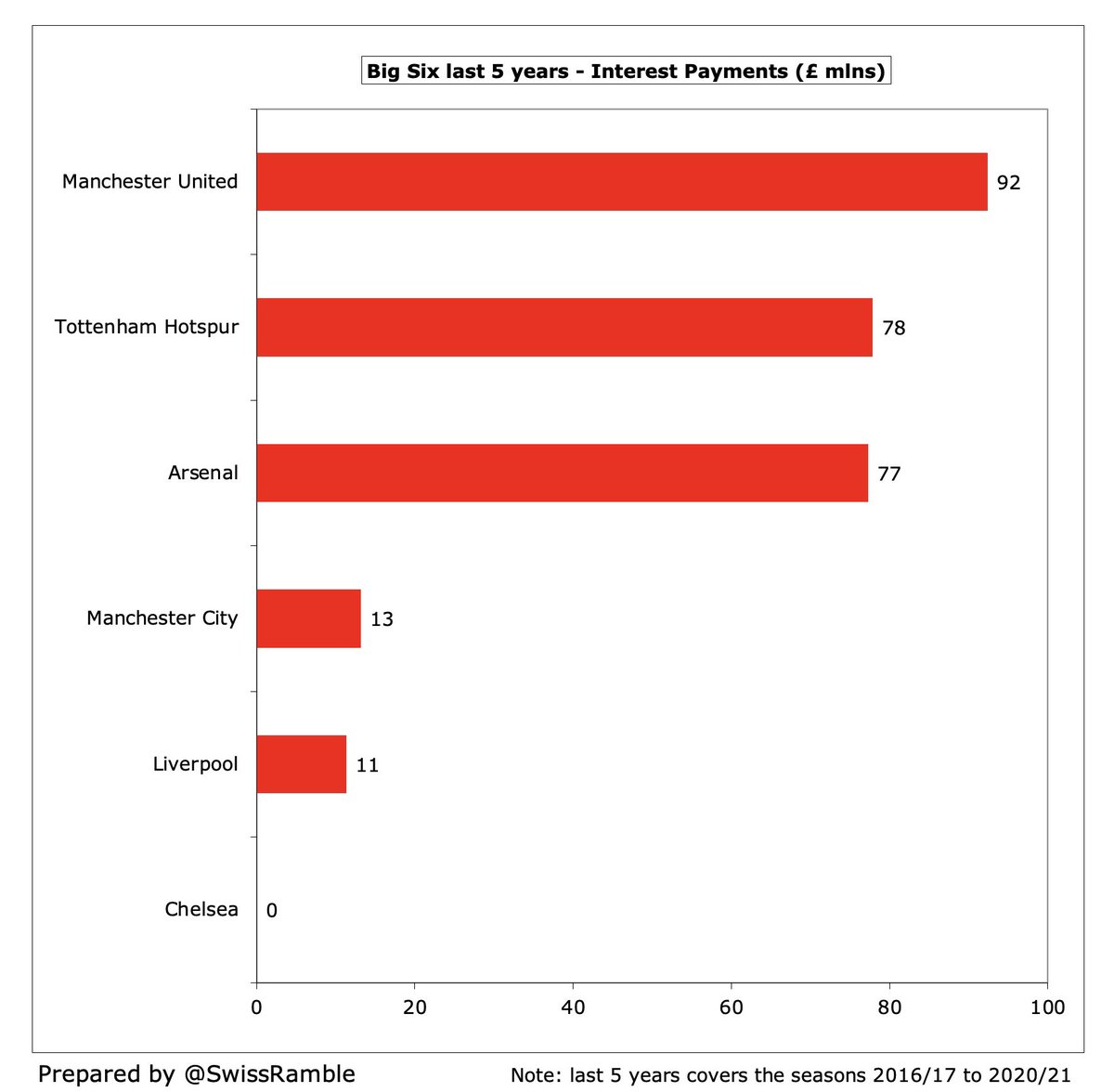

Three of the Big Six are burdened by largish annual interest payments with #MUFC paying-out £92m in the last 5 years for the loans placed on the club by the Glazers’ LBO, followed by #THFC £78m and #AFC £77m for debt used to finance new stadium development.

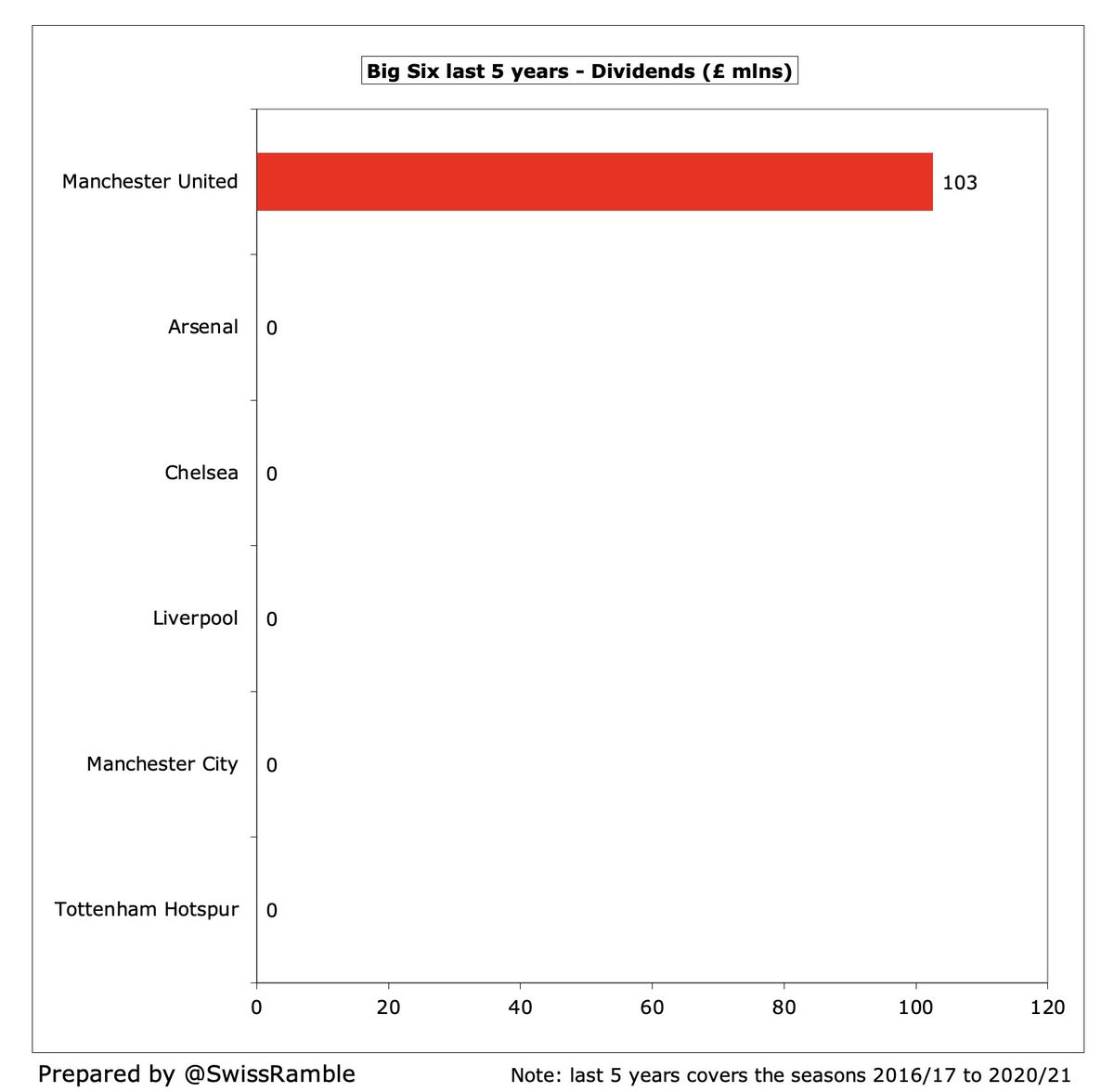

#MUFC are currently the only club in the Premier League to pay dividends to their owners (mainly the Glazers), adding up to £103m in the 5 years up to 2021.

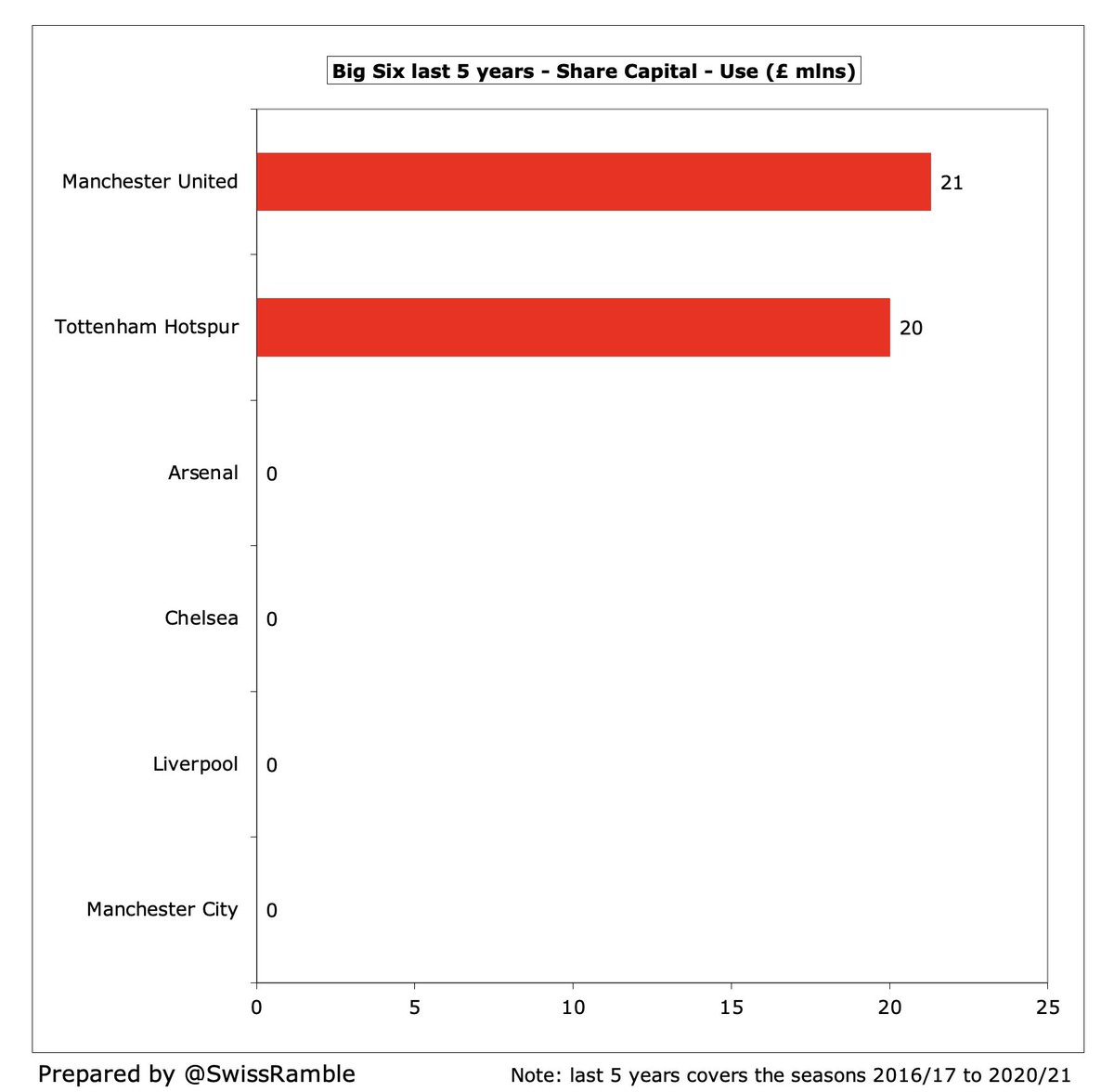

Two clubs spent money on capital purchases in the last 5 years. #MUFC used £21m for a share buyback in 2019/20. #THFC £20m is a bit misleading, as this represents the final buyback of the £40m preference shares issued in 2014 (the net impact was zero).

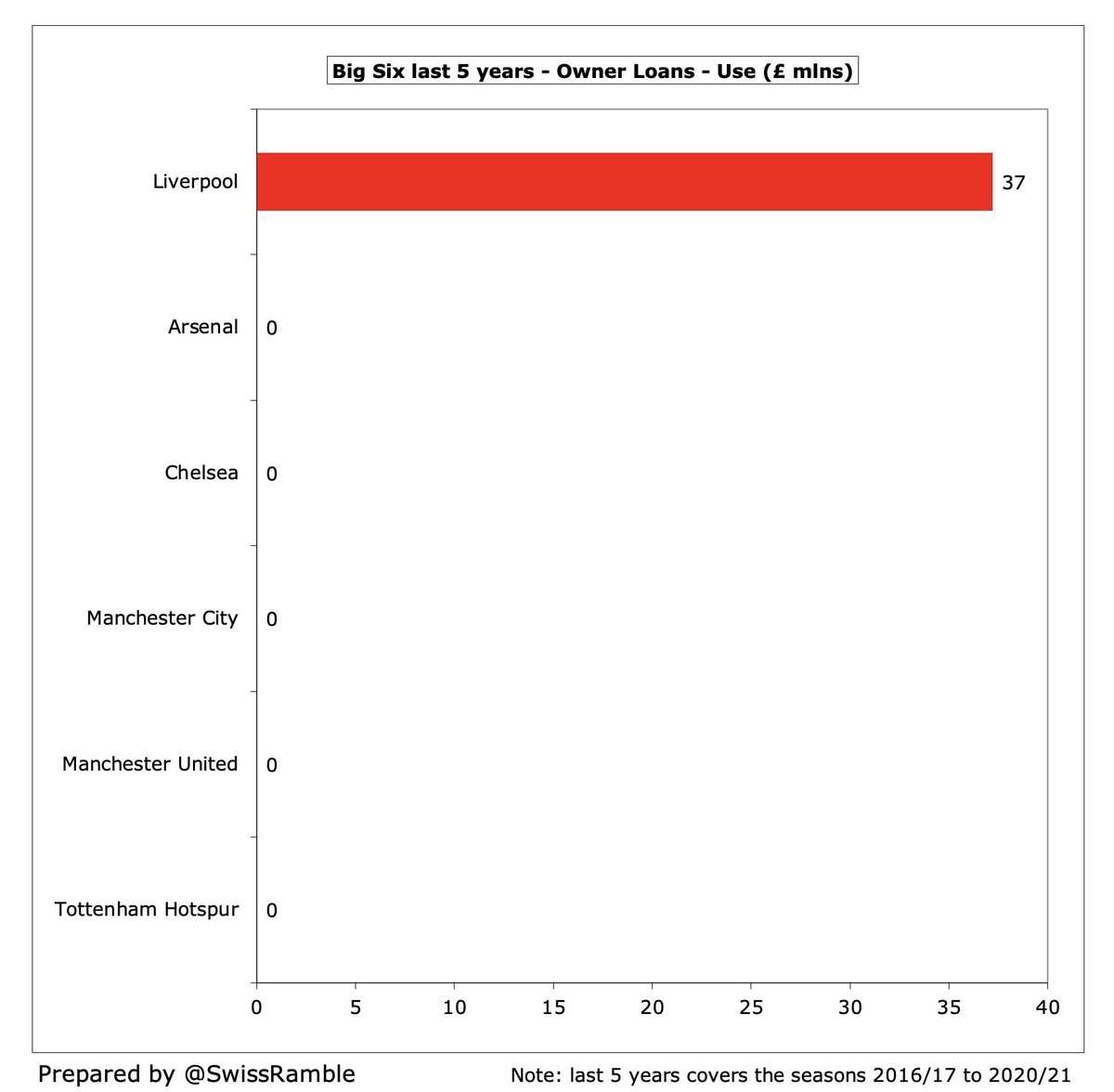

Only #LFC spent money on repaying owner debt with £37m in the last 5 years. This reduced the owner loans from the £109m provided in 2015 & 2016 to £71m as at end-June 2021.

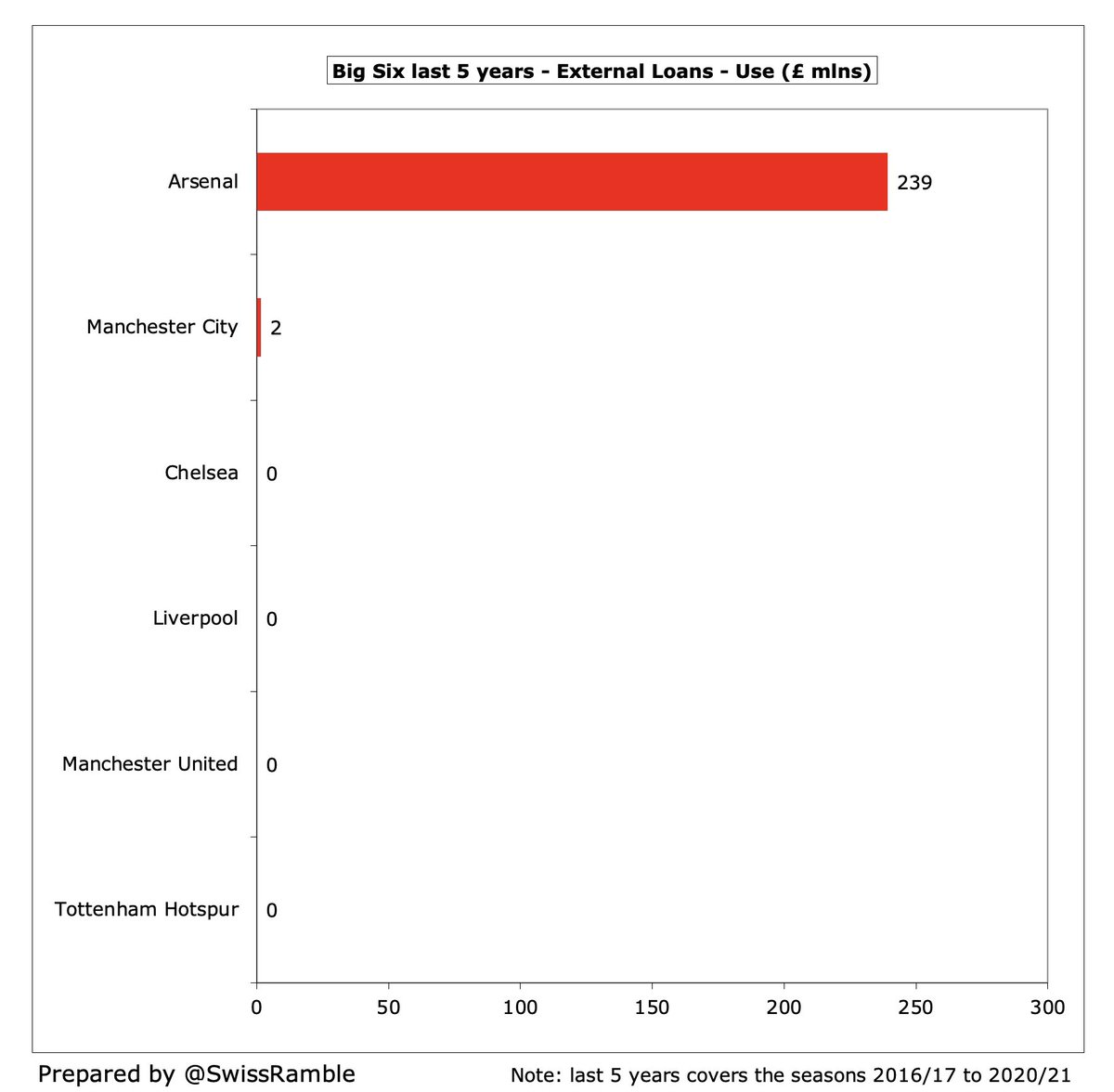

#AFC spent £239m on the redemption of bonds used to help finance the Emirates stadium. The early repayment cost them a £32m break fee, but will reduce annual interest payments going forward, as this has been replaced with an owner’s loan from Stan Kroenke.

#CFC and #AFC were hit by negative working capital movements in the last 5 years with £20m and £11m respectively. Chelsea was mainly due to an increase in debtors, while Arsenal included a decrease in creditors.

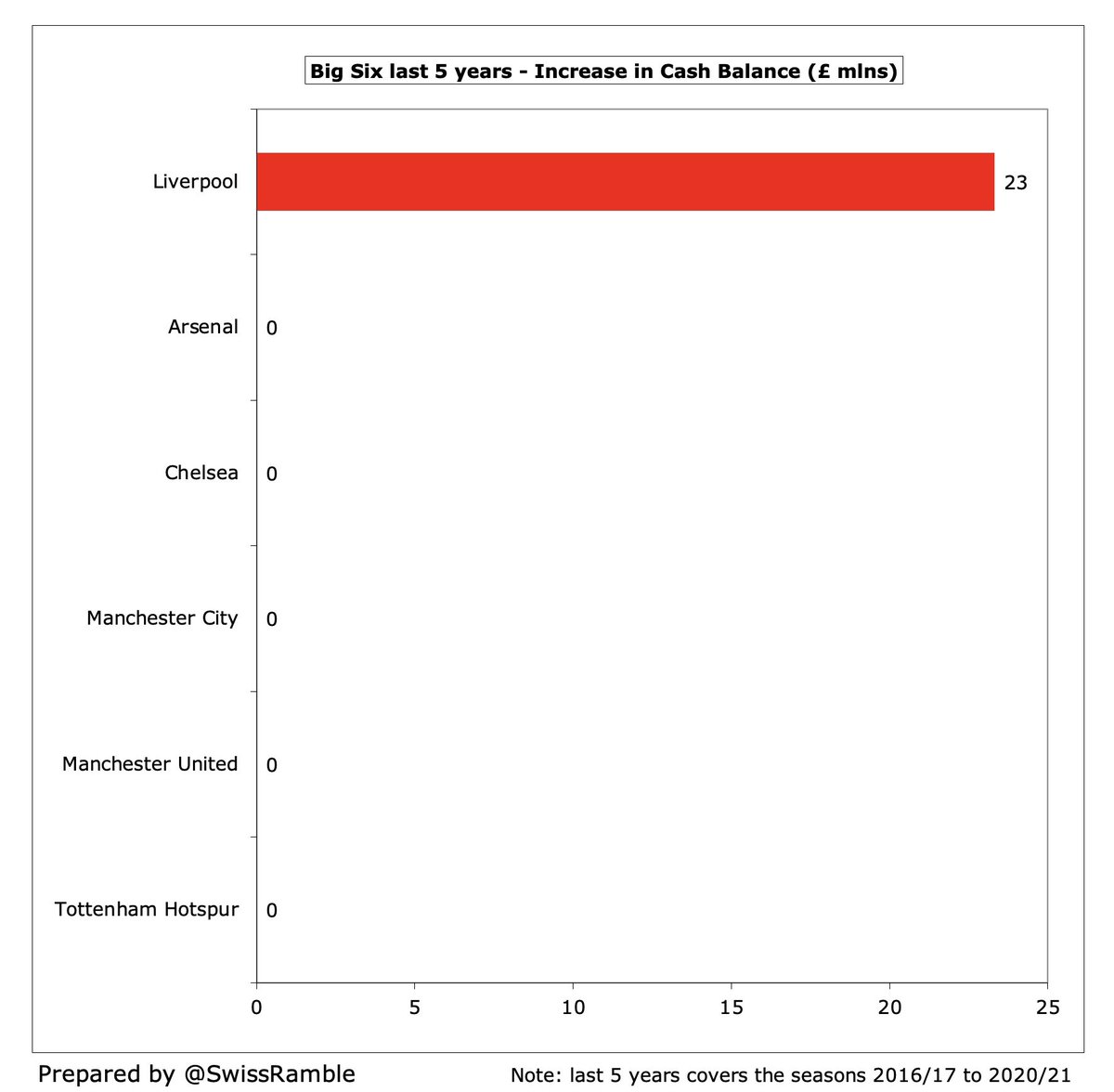

Only #LFC managed to increase their cash in the bank in the last 5 years by £23m from £8m to £31m, though this is still relatively low for a leading Premier League club.

Let’s now look at each of the Big Six clubs separately to identify where they have sourced their funds and how they have used their money.

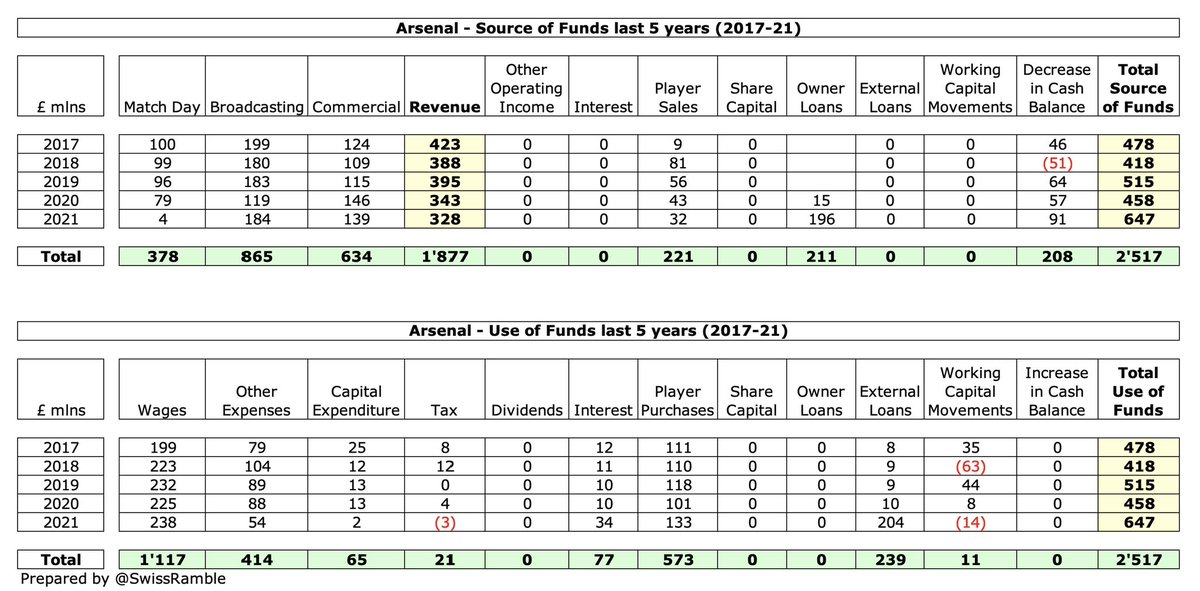

In the last 5 years #AFC had the lowest revenue and just about lowest player sales of the Big Six. As a result their wages and player purchases lagged behind. They still had to use £239m of the cash reserve they had built up in better times. External loan replaced by owner loan.

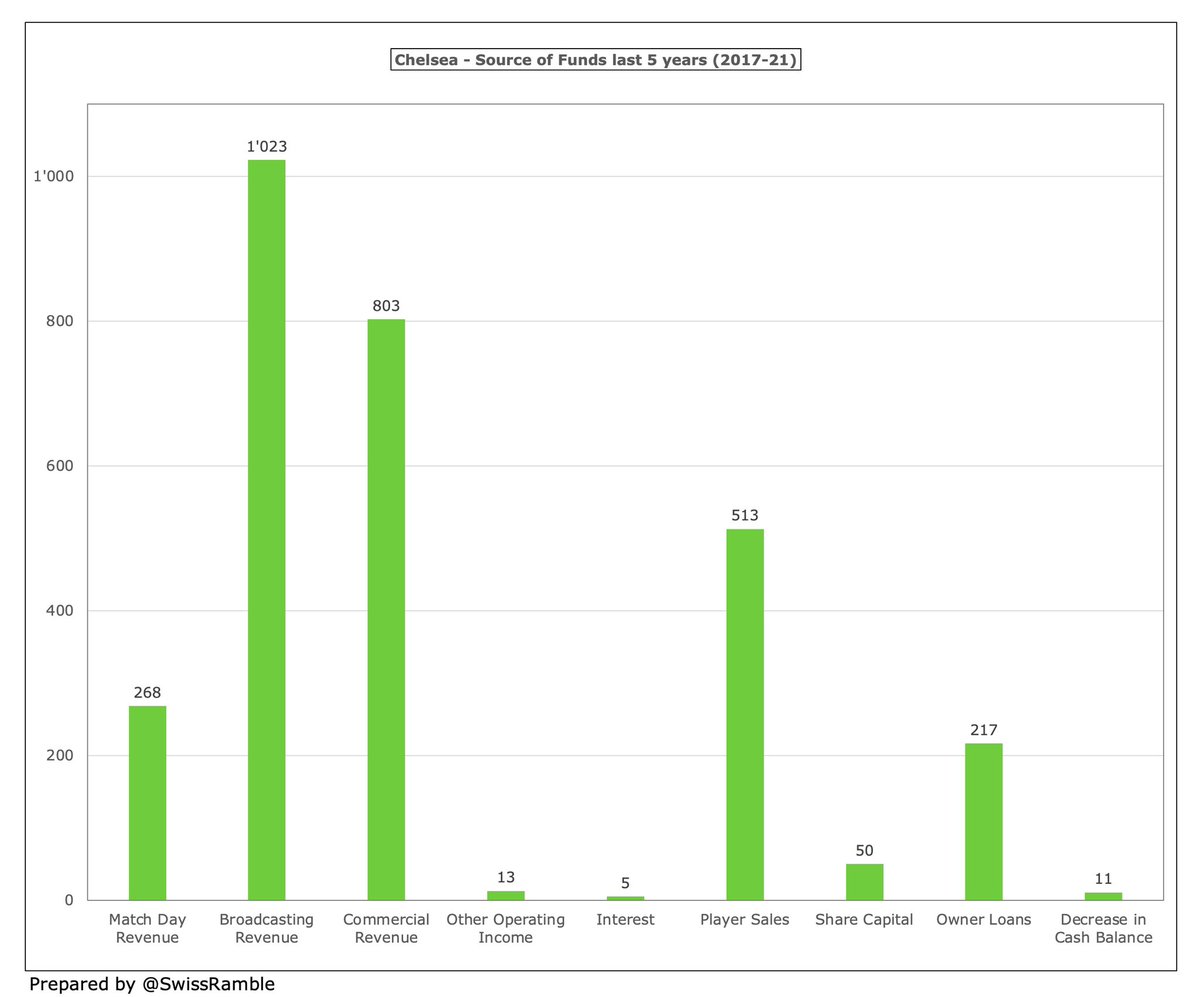

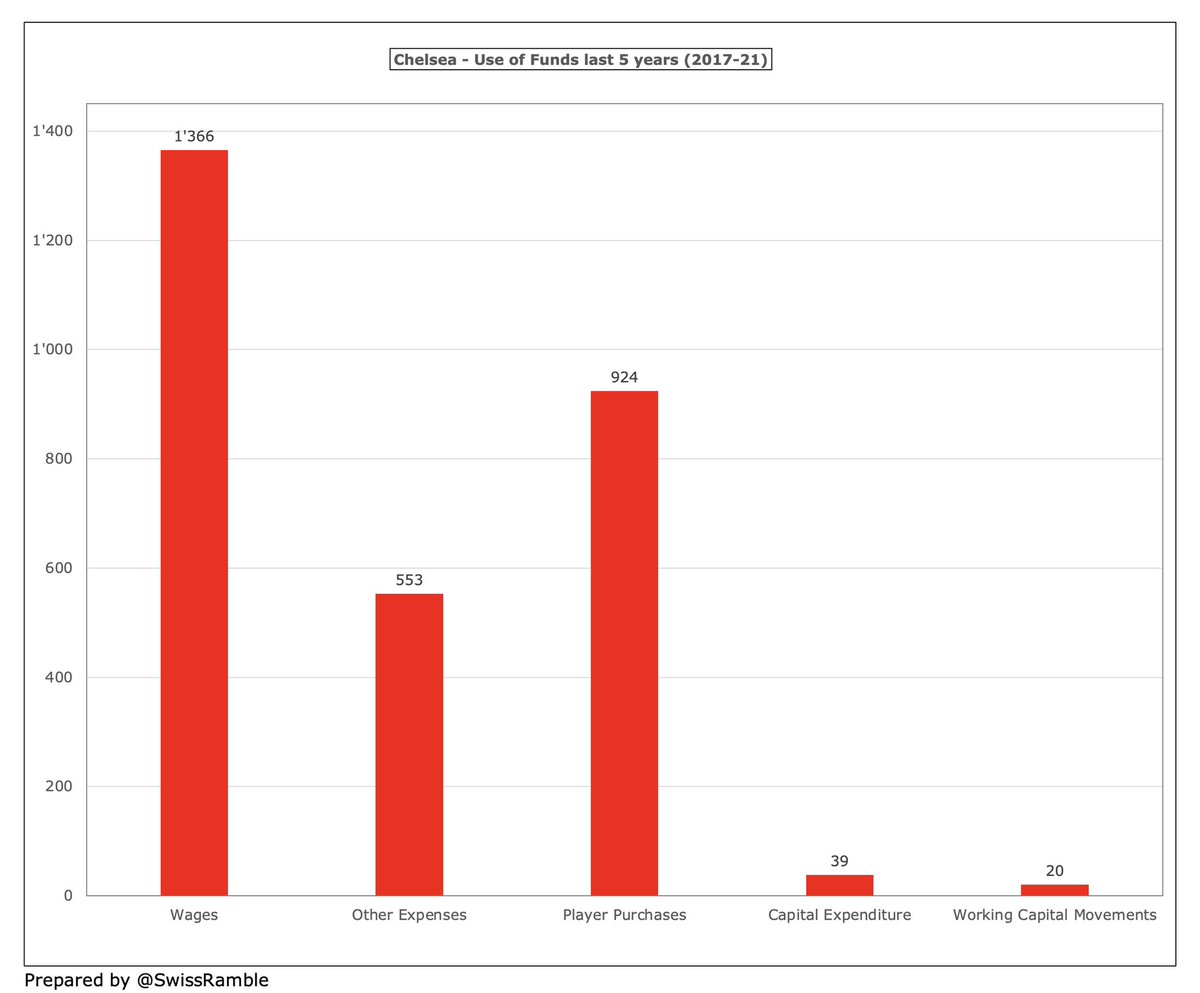

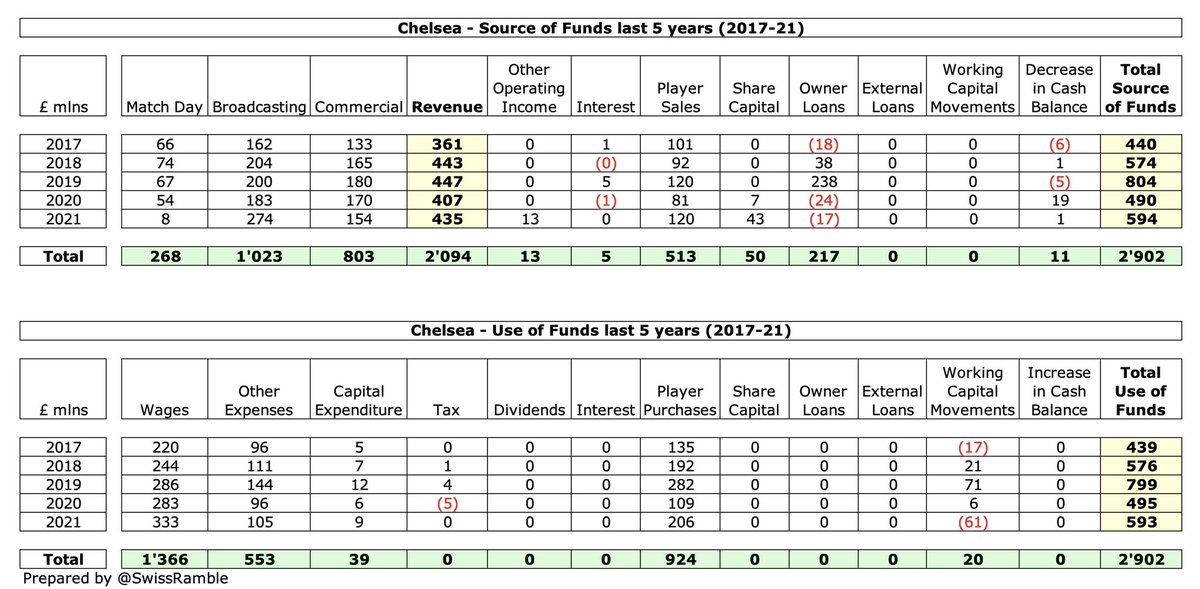

#CFC benefited the most from owner funding with £267m in the last 5 years (loans £217m and share capital £50m), but generated the most from player sales with £513m. They had the second highest player purchases with £924m.

Zero owner funding for #LFC in the last 5 years. In fact, Liverpool were the only one of the Big Six to make a repayment of owner loans (£37m) and also the only club to increase the balance in its bank account. Took out a £72m bank loan. High capital expenditure at £132m.

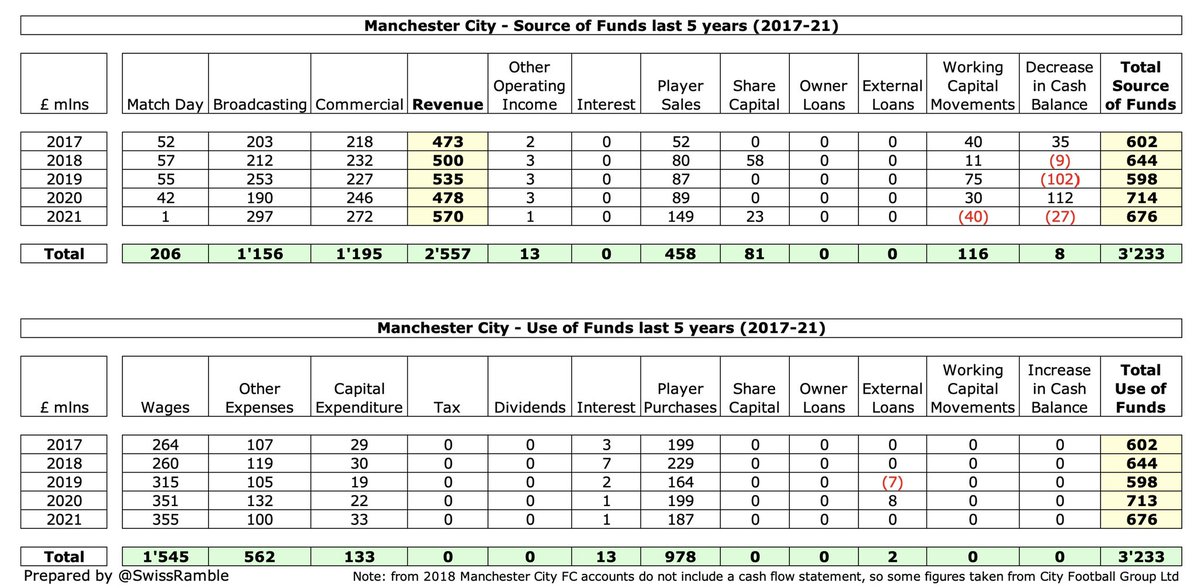

#MCFC spent the most on wages (£1.5 bln) and player purchases (£1.0 bln) in the last 5 years. Owner injected £81m capital. Benefited from £116m working capital movements. Interestingly, both City and United had exactly the same amount of cash available with £3,233m.

#MUFC had the highest revenue, but lowest player sales of the Big Six in the last 5 years. They had the highest interest payments of £92m and were the only club to pay dividends (£103m). Had to dip into reserves by reducing the cash balance by £141m.

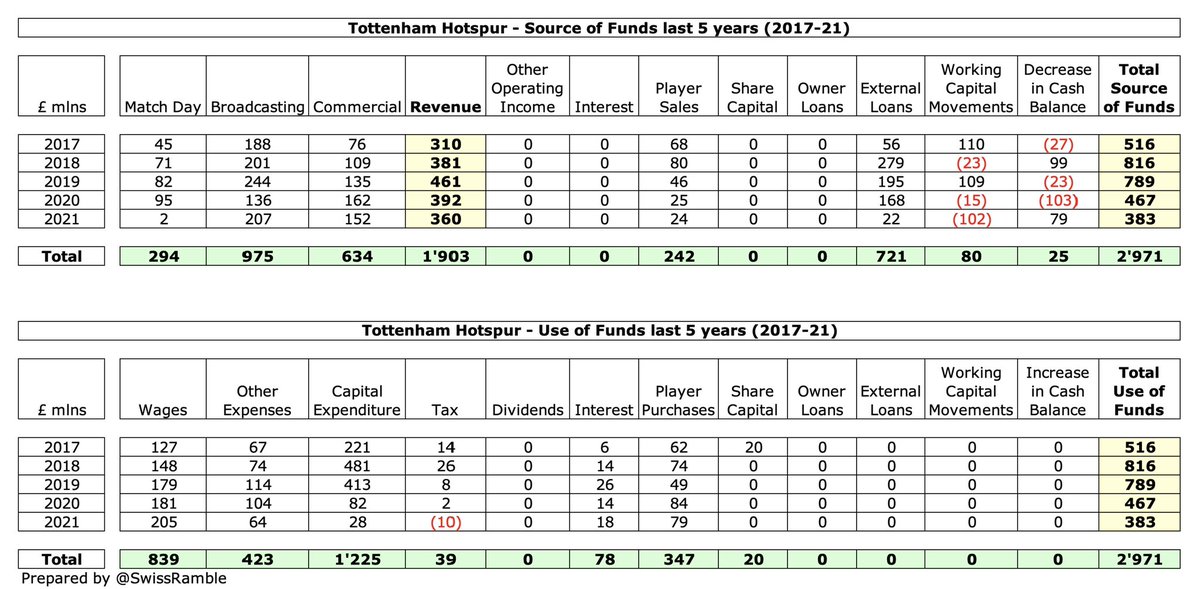

#THFC cash flow dominated by their new stadium: highest capital expenditure of £1.2 bln, which required the highest bank loan of £721m and growing interest payments (£78m). This probably also impacted the low £347m player purchases, but not helped by low revenue and player sales.

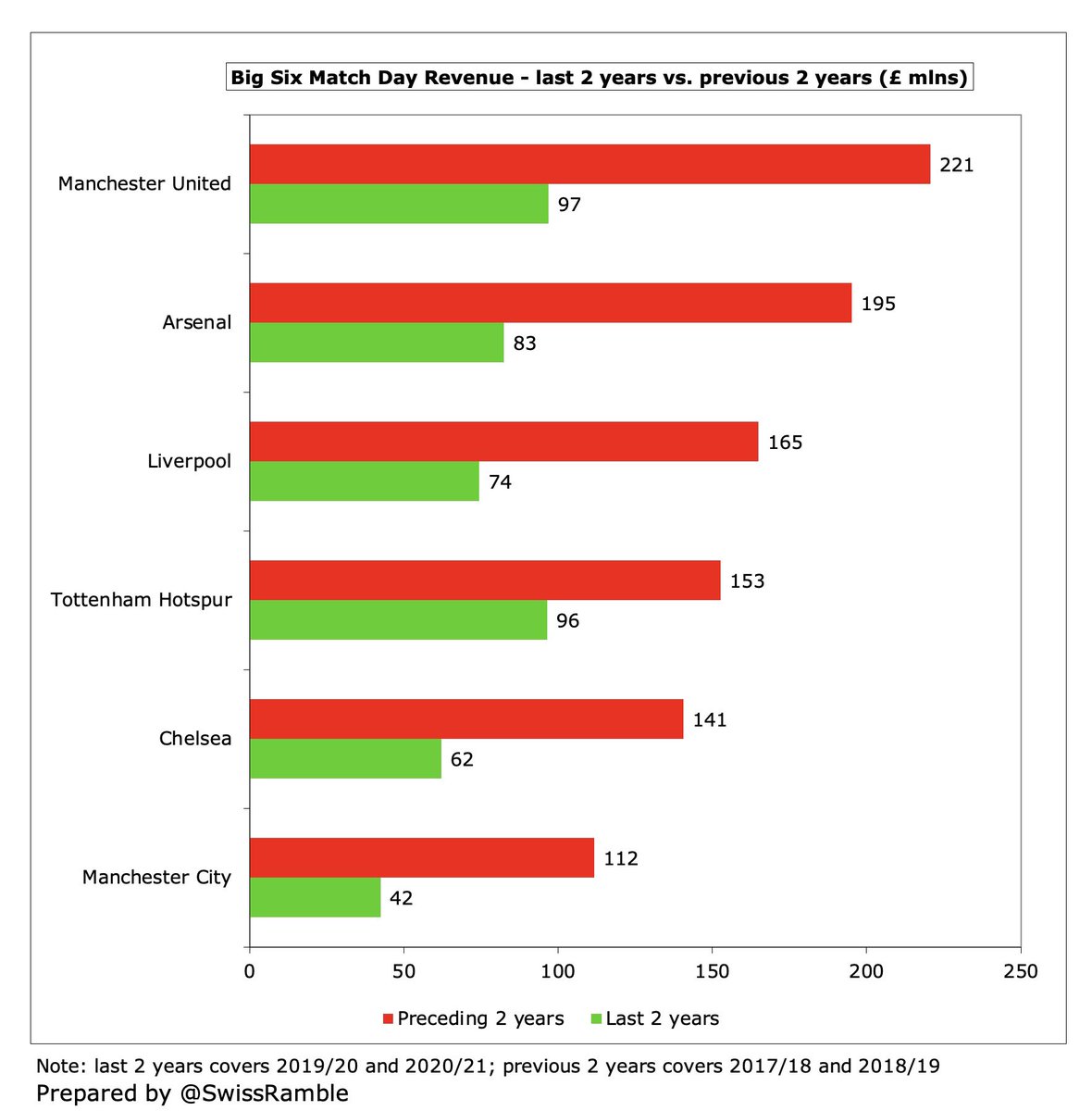

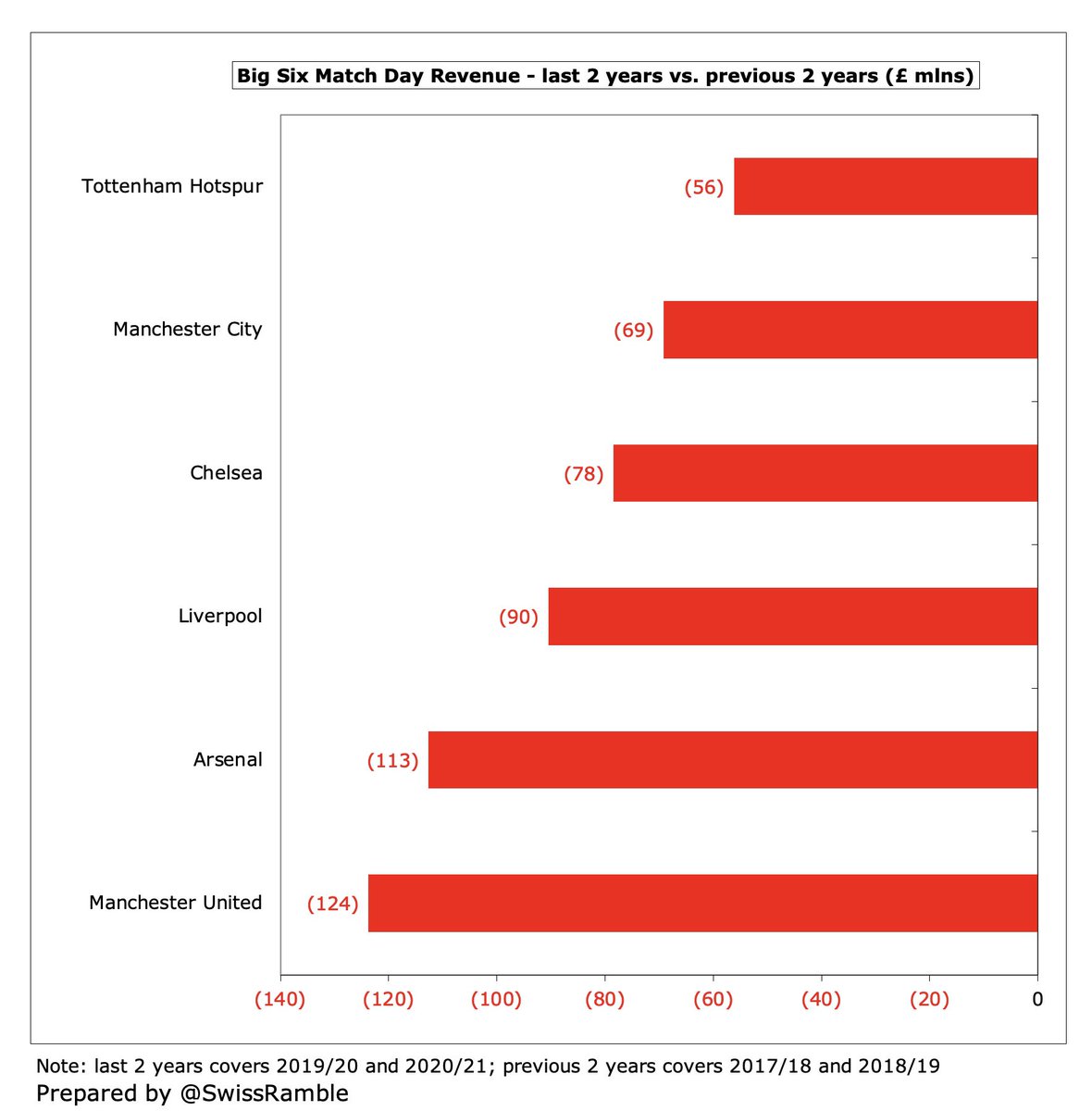

Of course, these figures have been adversely impacted by the COVID pandemic, which significantly reduced revenue in 2020/21 and (to an extent) in 2019/20. For example, with many games played behind closed doors, the Big Six suffered over half a billion lost match day income.

This has been a slightly different way of looking at football finances, but it should at least allay supporters’ concerns that owners might be siphoning off cash. Whether the fans believe that the owners are doing enough for their team is, of course, another story.

• • •

Missing some Tweet in this thread? You can try to

force a refresh