Good news from #Brussels

The leaked @EU_Commission non-paper on Emergency Electricity Mkt Interventions addresses the root sources of the 10-fold electricity price increase:

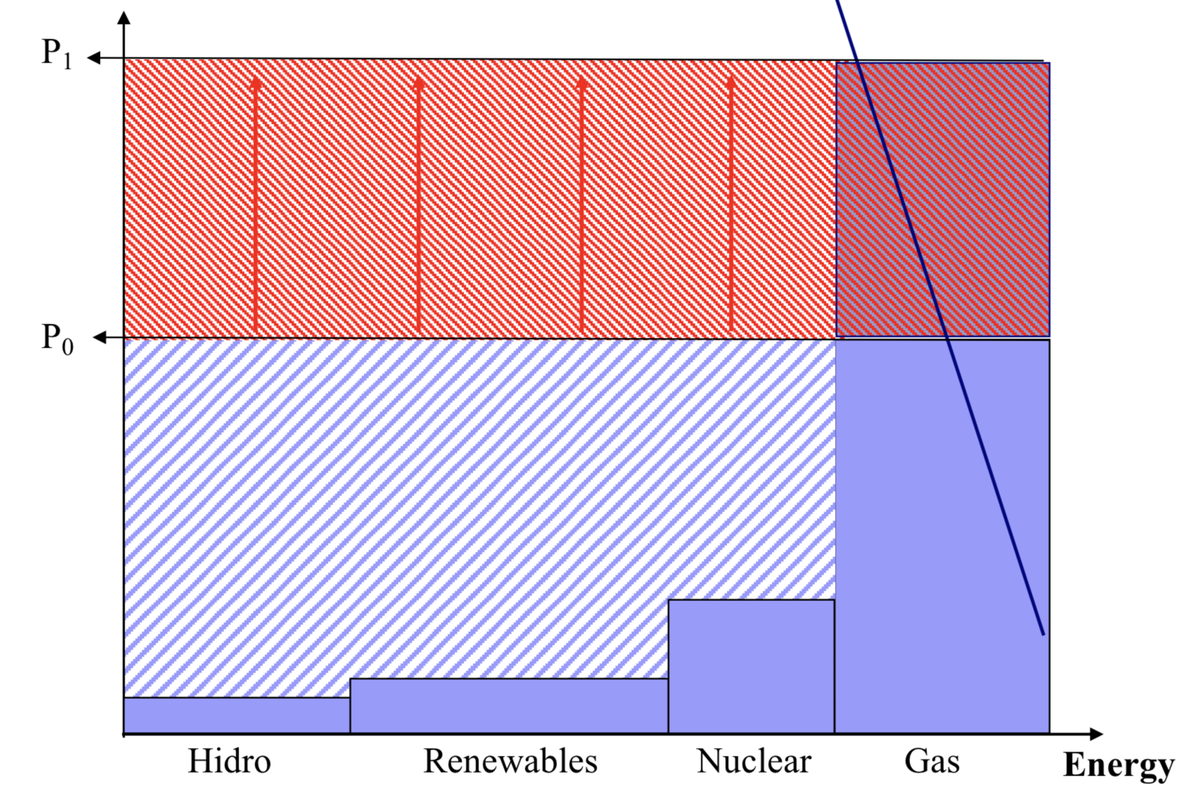

➡️Excessive profits of inframarginal technologies (nuclear, hydro, renewables)

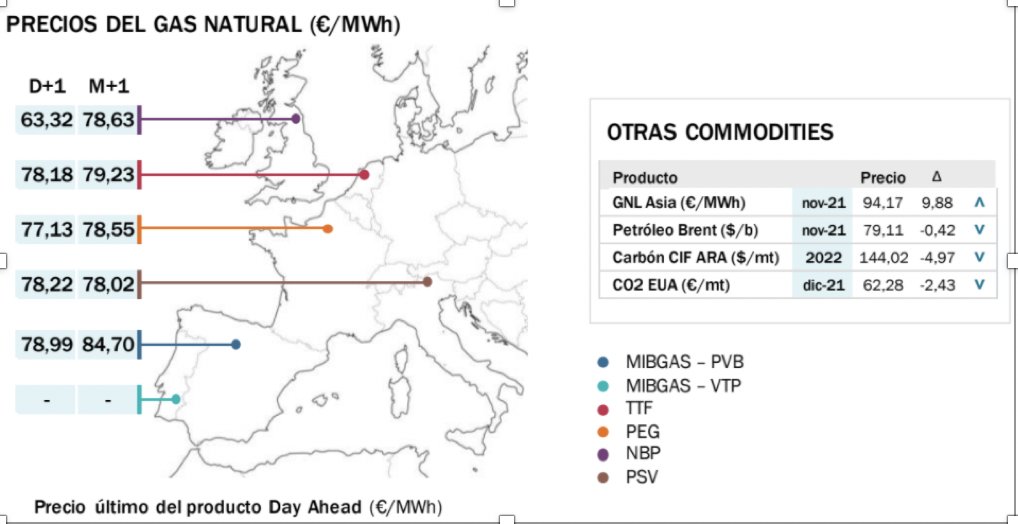

➡️Gas scarcity

🧵 Thread

The leaked @EU_Commission non-paper on Emergency Electricity Mkt Interventions addresses the root sources of the 10-fold electricity price increase:

➡️Excessive profits of inframarginal technologies (nuclear, hydro, renewables)

➡️Gas scarcity

🧵 Thread

The proposals imply a big step #forward in our understanding of how #electricity markets should be designed

And watch out 🔊 because emergency measures pave the way to #structural reform!

Some key reasons & thoughts...

And watch out 🔊 because emergency measures pave the way to #structural reform!

Some key reasons & thoughts...

1/ Acknowledging that not all technologies should be paid at the cost of gas-fired generation is equivalent to acknowledging that:

📢 a single *technology-neutral* *energy-only* market design is not adequate – under emergencies & beyond

📢 a single *technology-neutral* *energy-only* market design is not adequate – under emergencies & beyond

2/ Acknowledging that price increases do not drive enough demand reduction is equivalent to acknowledging that:

📢 markets alone do not deal with *security of supply externalities* correctly, which justifies a greater involvement of *regulators*

📢 markets alone do not deal with *security of supply externalities* correctly, which justifies a greater involvement of *regulators*

3/ Addressing inframarginal rents directly by limiting their prices is preferable (and more transparent) than doing it indirectly by affecting the marginal price, as the latter creates other distortions + complexities

4/ Addressing inframarginal rents directly is also preferable to #windfall taxes:

➡️firms could bypass some of the rent extraction through their accounting practices;

➡️it is difficult to avoid the risk that the tax is partially passed-through to electricity prices

➡️firms could bypass some of the rent extraction through their accounting practices;

➡️it is difficult to avoid the risk that the tax is partially passed-through to electricity prices

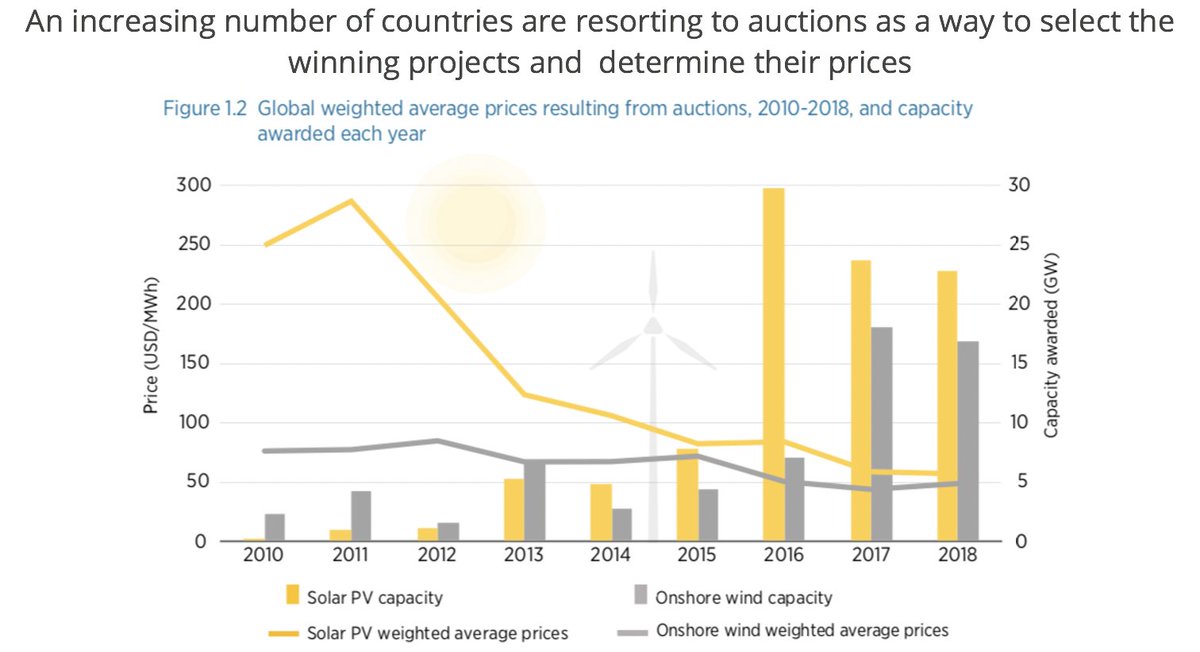

5/ Prices for inframarginal energy should be set through #auctions for entering the market

But since this isn't feasible for existing assets, regulating those prices becomes unavoidable - and should not be taboo

#Regulation is better than #Competition if the latter is impossible

But since this isn't feasible for existing assets, regulating those prices becomes unavoidable - and should not be taboo

#Regulation is better than #Competition if the latter is impossible

6/ Setting the price limits for inframarginal energy correctly can unfreeze vast resources

To understand the scope, just compare the average costs of these technologies (in the range 40-60€/MWh) with current wholesale electricity prices above 300€/MWh

iea.org/reports/projec…

To understand the scope, just compare the average costs of these technologies (in the range 40-60€/MWh) with current wholesale electricity prices above 300€/MWh

iea.org/reports/projec…

7/ These rents can be passed on to final consumers to reduce their electricity bills:

- Broadly, or in a #targeted manner

- Through lower electricity prices or lump-sum #cheques

- Through demand reductions

- Broadly, or in a #targeted manner

- Through lower electricity prices or lump-sum #cheques

- Through demand reductions

8/ Consumer bills should reflect the #average cost, not the marginal cost, of electricity generation, which is compatible with facing consumers with marginal signals

This is key for #equity, but also #efficiency, esp. for long-run decisions (industry location, electrification..)

This is key for #equity, but also #efficiency, esp. for long-run decisions (industry location, electrification..)

9/ Reducing gas and electricity demand has a triple dividend:

1- Easing security of supply concerns

2- Reducing our imports of Russian gas, which help Putin finance the #war

3- Removing price pressure from gas and electricity markets, and thus from #inflation

1- Easing security of supply concerns

2- Reducing our imports of Russian gas, which help Putin finance the #war

3- Removing price pressure from gas and electricity markets, and thus from #inflation

10/ #Auctioning the demand reductions has the merit of selecting those consumers for whom reducing demand is less costly – the design of these auctions will be key to achieving an efficient allocation at a low cost

11/ Yet, some key issues have not been specified:

➡️At which price(s) will inframarginal technologies be paid?

➡️How to induce the right use of hydropower generation?

Some further thoughts on this....

➡️At which price(s) will inframarginal technologies be paid?

➡️How to induce the right use of hydropower generation?

Some further thoughts on this....

12/ On price setting:

- a uniform price across all inframarginal technologies would lead to the same mistake that has brought this crisis: **the fallacy of technology-neutral prices**

Treating #unequal things #equally, is it being #neutral? 🤷

- a uniform price across all inframarginal technologies would lead to the same mistake that has brought this crisis: **the fallacy of technology-neutral prices**

Treating #unequal things #equally, is it being #neutral? 🤷

13/ On price setting (cont):

Once acknowledged that the prices for inframarginal technologies should be regulated, let’s set prices = average costs + reasonable rate of return

➡️ Higher prices would keep on inflating generators’ rents at the expense of the consumers + the economy

Once acknowledged that the prices for inframarginal technologies should be regulated, let’s set prices = average costs + reasonable rate of return

➡️ Higher prices would keep on inflating generators’ rents at the expense of the consumers + the economy

14/ On #hydropower dispatch:

Setting a fixed price for hydro-generation is challenging as (if dispatched by firms) they would lack signals for an efficient use of the limited hydro resources

But there are ways to do it...

Setting a fixed price for hydro-generation is challenging as (if dispatched by firms) they would lack signals for an efficient use of the limited hydro resources

But there are ways to do it...

15/ It is possible to reconcile proper incentives for hydro dispatch + proper payments:

📢Contracts at a regulated strike price settled by differences with the average market price - not their captured prices

➡️Full price exposure preserved while adjusting for the right payments

📢Contracts at a regulated strike price settled by differences with the average market price - not their captured prices

➡️Full price exposure preserved while adjusting for the right payments

16/ There are still many pending discussions & details, but it is reassuring to see that measures start moving in the right direction (or so it seems...) 🤞

End 🧵/

End 🧵/

• • •

Missing some Tweet in this thread? You can try to

force a refresh