🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Global Macro Review

September 5, 2022

Hello Labor Day 🇺🇸!

Other than the $USD, very little that was in the green long side last week. This morning, commodities are bouncing but equities ↘️

Let’s review the week and the real-time 🧮!

🧵

Global Macro Review

September 5, 2022

Hello Labor Day 🇺🇸!

Other than the $USD, very little that was in the green long side last week. This morning, commodities are bouncing but equities ↘️

Let’s review the week and the real-time 🧮!

🧵

Asia 🪓🩸 last week with $HSI -3.55%, $NIKK -3.45%, and $KOSPI -2.9%.

Today ↔️

$NIKK 27620 -0.1%

$SSEC 3200 +0.4%

$TWII 14661 -0.1%

$HSI 2404 -0.25%

$IDX 7232 +0.75%

$ASX 6852 +0.35%

$BSE 59209 +0.7%

Chart: $NIKK flipped to neutral Trend (T) -0.4% over the past 3 months

Today ↔️

$NIKK 27620 -0.1%

$SSEC 3200 +0.4%

$TWII 14661 -0.1%

$HSI 2404 -0.25%

$IDX 7232 +0.75%

$ASX 6852 +0.35%

$BSE 59209 +0.7%

Chart: $NIKK flipped to neutral Trend (T) -0.4% over the past 3 months

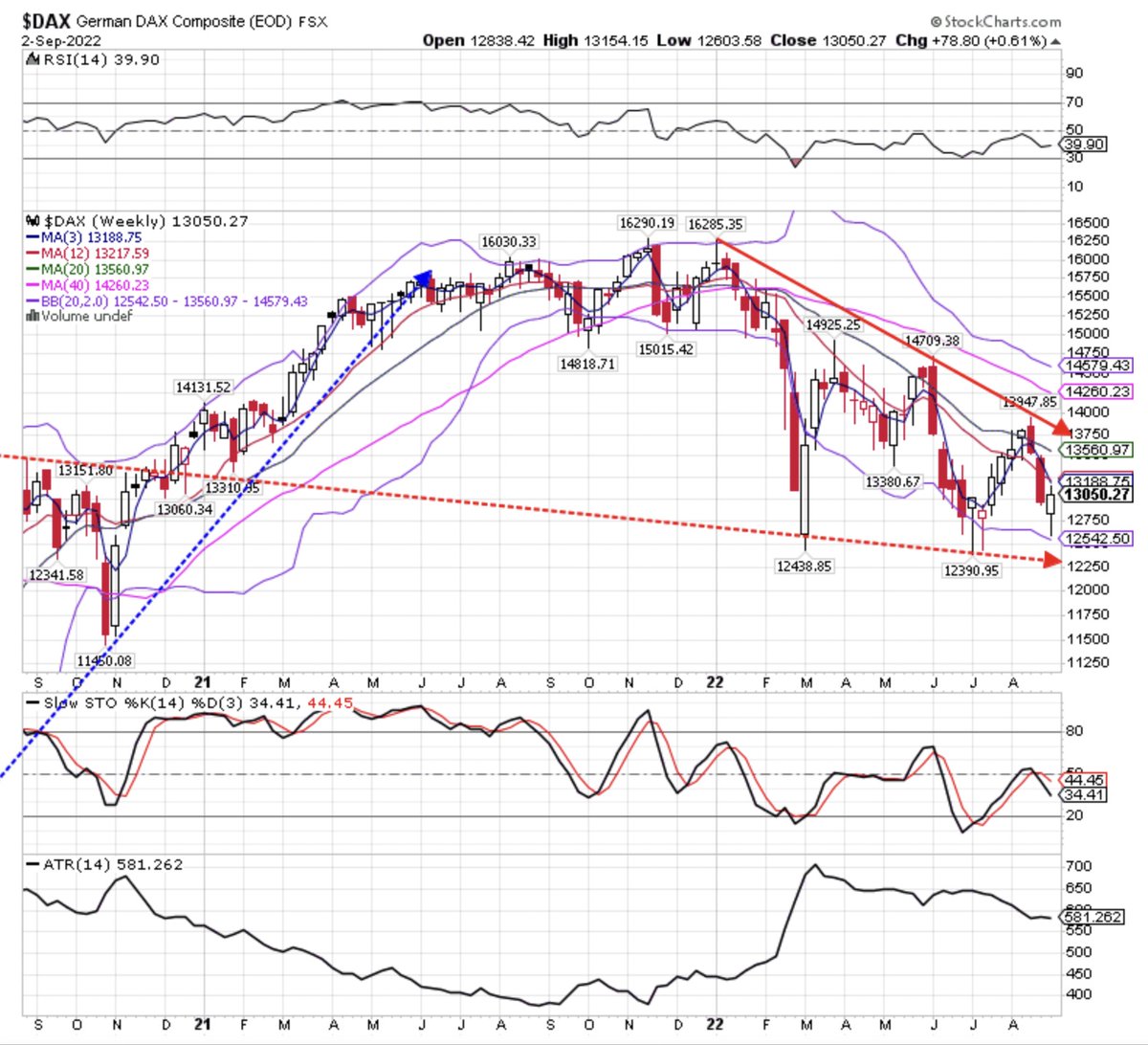

Unambiguously 🪓🩸 ↘️ this morning, Europe was ↔️ last week with $DAX + 0.44% and $CAC -1.7%

$DAX 12640 -3.15%

$FTSE 7200 -1.1%

$CAC 6031 -2.2%

$AEX 666 -1.9%

$IDEX 7778 -1.95%

$MIB 21327 -2.7%

$SMI 10704 -1.7%

$MOEX 2457 -0.6%

$VSTOXX 28.96 🔺

Chart: $DAX bye higher low 💣

$DAX 12640 -3.15%

$FTSE 7200 -1.1%

$CAC 6031 -2.2%

$AEX 666 -1.9%

$IDEX 7778 -1.95%

$MIB 21327 -2.7%

$SMI 10704 -1.7%

$MOEX 2457 -0.6%

$VSTOXX 28.96 🔺

Chart: $DAX bye higher low 💣

🇺🇸 equities 🪓🩸↘️ last week with $SPX -3.3% and $COMPQ -4.2%

Futures ↔️

$ES 3926 +0.05%

$NQ 12078 -0.15%

$RTY 1804 -0.3%

$VIX 26.74 🔺

Chart: $IWM -4.7% small caps and now -19.05% YTD

Futures ↔️

$ES 3926 +0.05%

$NQ 12078 -0.15%

$RTY 1804 -0.3%

$VIX 26.74 🔺

Chart: $IWM -4.7% small caps and now -19.05% YTD

Metals 🐒🔨'd last week with $GOLD -1.5% and $COPPER -7.85% 🩸

Today 🏀

$GOLD 1724 +0.1%

$SILVER 18.04 +0.9%

$COPPER 3.437 +0.7%

$PLAT 824 +0.7%

$PALL 2032 +0.3%

$ALI 2304 +0.2%

$ZINC 3177 +1.65%

Chart: Dr. $COPPER is 🤒 -23.7% (T) and -23.55% YTD

Today 🏀

$GOLD 1724 +0.1%

$SILVER 18.04 +0.9%

$COPPER 3.437 +0.7%

$PLAT 824 +0.7%

$PALL 2032 +0.3%

$ALI 2304 +0.2%

$ZINC 3177 +1.65%

Chart: Dr. $COPPER is 🤒 -23.7% (T) and -23.55% YTD

Hydrocarbons 🪓🩸↘️ last week with $WTIC -6.65%, $GASO -8.2%, and $NATGAS -5.3%

Today 🏀↗️

$WTIC 89.16 +2.65%

$BRENT 95.66 +2.85%

$GASO 2.49 +1.25%

$NATGAS 8.892 +1.15%

$OVX 53.90

Chart: $GASO ⛽️ is -42% over the past 3 months, compliments of Uncle Joe and #SPR release

Today 🏀↗️

$WTIC 89.16 +2.65%

$BRENT 95.66 +2.85%

$GASO 2.49 +1.25%

$NATGAS 8.892 +1.15%

$OVX 53.90

Chart: $GASO ⛽️ is -42% over the past 3 months, compliments of Uncle Joe and #SPR release

While 🐻 Trend (T), grains hung in there last week

$WHEAT 811 +0.7% (w), -22.0% (T)

$CORN 666 +0.25% (w), -8.45% (T)

$SUGAR 18.2 -1.6% (w), -5.7% (T)

$SOYB -2.8% (w), -16.35% (T)

Chart: $COFFEE ☕️ -3.9% (w), -1.3% (T)

$WHEAT 811 +0.7% (w), -22.0% (T)

$CORN 666 +0.25% (w), -8.45% (T)

$SUGAR 18.2 -1.6% (w), -5.7% (T)

$SOYB -2.8% (w), -16.35% (T)

Chart: $COFFEE ☕️ -3.9% (w), -1.3% (T)

With 👊🥣 removal underway, the $USD 💪↗️ +0.7% and trading ↗️ this morning

$EUR 0.991 -0.4%

$GBP 1.1487 -0.18%

$AUD 0.678 -0.44%

$USD 110.00 +0.45%

$USDJPY 140.49 +0.2%

$USDCHF 0.9833 +0.3%

$USDCAD 1.316 +0.25%

$USDCNH 6.953 +0.5% 🇨🇳

Chart: 🇬🇧 💷 -1.95% (w) -14.9% YTD 💣💥

$EUR 0.991 -0.4%

$GBP 1.1487 -0.18%

$AUD 0.678 -0.44%

$USD 110.00 +0.45%

$USDJPY 140.49 +0.2%

$USDCHF 0.9833 +0.3%

$USDCAD 1.316 +0.25%

$USDCNH 6.953 +0.5% 🇨🇳

Chart: 🇬🇧 💷 -1.95% (w) -14.9% YTD 💣💥

#Bitcoin traded -1.4% and #cryptocurrencies are trading ↘️ this morning

$BTC 19779 -1.1%

$ETH 1565 -0.85%

Chart: #Bitcoin is clinging to 20,000 but has downside to 18,400 - today!

$BTC 19779 -1.1%

$ETH 1565 -0.85%

Chart: #Bitcoin is clinging to 20,000 but has downside to 18,400 - today!

UST yields ↗️ across the curve

10/2s to -20.1 BPS 🐻 #steepening

MOVE 120.72 🔻🛗

Chart: $TLT -3.0% (w), -5.0% (T), -25.6% YTD

10/2s to -20.1 BPS 🐻 #steepening

MOVE 120.72 🔻🛗

Chart: $TLT -3.0% (w), -5.0% (T), -25.6% YTD

While economic signals may not be 100% clear, market signals are unambiguous - #Quad4 #deflation is in full swing 🪓🩸💣💥

Stay long the weapons of choice - the $USD 💵 and $WTIC 🛢️as a hedge.

Cash 💸 is a position

⚠️🚩 and have a super profitable 💰 week!

Stay long the weapons of choice - the $USD 💵 and $WTIC 🛢️as a hedge.

Cash 💸 is a position

⚠️🚩 and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh