1/13 Do you want to add a #YieldFarming layer on top of the most well known #DeFi projects such as @CurveFinance , @ConvexFinance and @fraxfinance ? Composability, leverage farming, yield optimizing you said? Let's go through @0xC_Lever, an @aladdindao project 👇🧵

2/13 @0xC_Lever allows user to take a self repaying loan without the risk of being liquidated. Deposit $CVX as Collateral, Borrow $clevCVX as debt, swap it for more $CVX. Rince & Repeat for a 2x leverage effect.

You can also repay your debt at anytime.

You can also repay your debt at anytime.

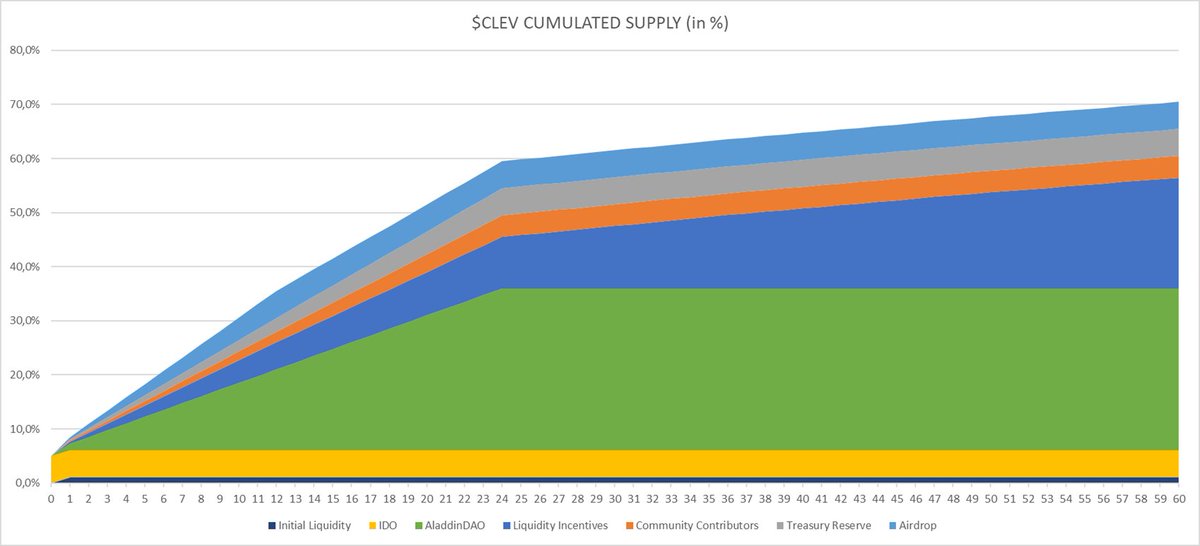

3/13 @0xC_Lever is currently on Beta mode, and in September-22, together with their Token Launch $CLEV, you will be able to leverage your $CVX and benefit from the full power of the protocol.

4/13 Token launch? Yes!! $CLEV will be available for a period of 7 days where you will be able to buy against 1x $CVX up to 100k $CVX. But what's $CLEV utility? Lock it for 4 years and enjoy:

- Governance Vote

- Protocol Revenue Sharing, min 75% go to lockers pocket!

- Governance Vote

- Protocol Revenue Sharing, min 75% go to lockers pocket!

5/13 @0xC_Lever will supply liquidity onto a $clevCVX / $CVX pool on @CurveFinance. And what will the project be doing with the acquired 100k $CVX? Most likely vote to incentivize the above Pool, so LPers will benefit from @0xC_Lever voting power also!

7/13 But that doesn't stop here, i'm still amazed about smart people in #Crypto !! @0xC_Lever partnered with @fraxfinance in order to leverage Stablecoin Farming, more info here:

https://twitter.com/0xC_Lever/status/1567899078658523142?s=20&t=ZVqf51gfsDXzGTzuDR3cLg

8/13 But what's the point: Ok, first do you remember @0xconcentrator , the yield optimizer on top of @ConvexFinance and @fraxfinance ? For the last summary, please check here:

https://twitter.com/Subli_Defi/status/1564283949836341248?s=20&t=x9LNZetj7ivUciRO4UXXXw

9/13 So quickly: Deposit liquidity into a @fraxfinance Stable vault, and leverage it by borrowing $clevUSD, it's the same system as $clevCVX. And it's still a self repaying loan, as the yield generated by @0xconcentrator will automatically pay the debt.

Leverage your Stable LP🫡

Leverage your Stable LP🫡

10/13 But more interesting, @fraxfinance will in return incentivize the new LP on @CurveCap clevUSD/ $FRAX with 300k $CVX for the first 3 months.

11/13 so if i summarize:

- @0xC_Lever will increase $CVX buy pressure

+ Frax Stable Pool leverage will increase $FRAX buy pressure and volume.

If you want to learn more about @0xC_Lever check this video on Youtube:

- @0xC_Lever will increase $CVX buy pressure

+ Frax Stable Pool leverage will increase $FRAX buy pressure and volume.

If you want to learn more about @0xC_Lever check this video on Youtube:

12/13 @0xconcentrator :

$aCRV will increase $CRV buy pressure

$aFXS will increase $FXS buy pressure

😍😍

If you want to learn more about @0xconcentrator check this video on Youtube:

$aCRV will increase $CRV buy pressure

$aFXS will increase $FXS buy pressure

😍😍

If you want to learn more about @0xconcentrator check this video on Youtube:

13/13 So leveraging all the bluechips of #DeFi through one @aladdindao mother project! I'm sure there will be a lot of things coming up and count on me to share it with you. Please retweet the 1st post if you liked it:

https://twitter.com/Subli_Defi/status/1568164325646376960?s=20&t=uNIF_dwFkY7OYAKHEPr0eg

• • •

Missing some Tweet in this thread? You can try to

force a refresh