Thoughts on the #BankofEngland intervention… 🧵

The Bank will carry out *temporary* purchases of long-dated UK government bonds from 28 Sep to 14 Oct to stabilise the market.

The purchases ‘will be carried out on whatever scale is necessary’, but are *strictly time-limited*…

The Bank will carry out *temporary* purchases of long-dated UK government bonds from 28 Sep to 14 Oct to stabilise the market.

The purchases ‘will be carried out on whatever scale is necessary’, but are *strictly time-limited*…

At the same time, the #MPC is pausing the start of active #QT (i.e. selling bonds bought under #QE) until 31 Oct.

This might be reviewed depending on economic and market conditions, but the annual target of £80bn of sales is unchanged, so this is a delay rather than a U-turn...

This might be reviewed depending on economic and market conditions, but the annual target of £80bn of sales is unchanged, so this is a delay rather than a U-turn...

In my view, this is a sensible and proportionate response.

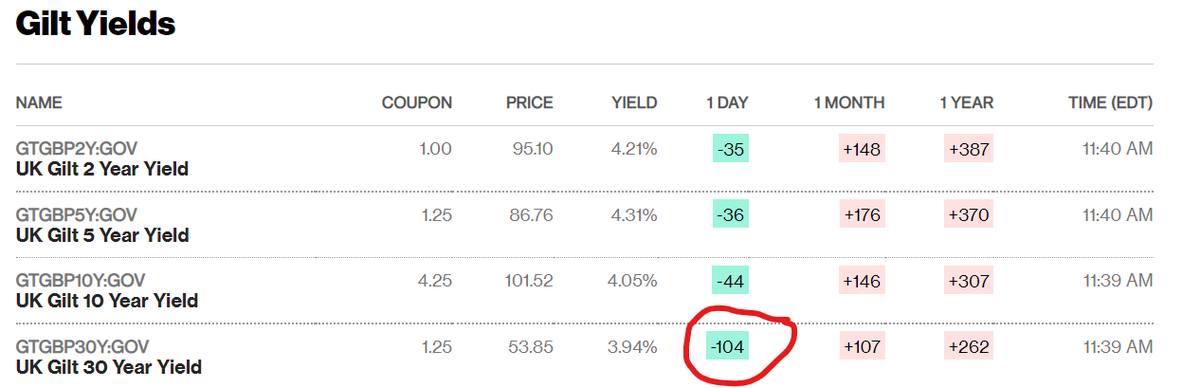

Of course, it would be better if this hadn’t been necessary, but the aim was to lower gilt yields and the intervention has worked: 30-year yields have fallen by one full percentage point (!) today...

Of course, it would be better if this hadn’t been necessary, but the aim was to lower gilt yields and the intervention has worked: 30-year yields have fallen by one full percentage point (!) today...

Even after this intervention, financial conditions are still much tighter than before the mini-Budget. This is technically more ‘QE’, but only on a very limited basis, so should not be inflationary.

It should also help to put a floor under the #pound and UK equities...

It should also help to put a floor under the #pound and UK equities...

It makes far more sense for the Bank to intervene in the bond market than the currency market.

The fall in the #pound is still mainly about dollar strength. Sustained turmoil in the bond market is potentially much more dangerous for financial stability and the real economy...

The fall in the #pound is still mainly about dollar strength. Sustained turmoil in the bond market is potentially much more dangerous for financial stability and the real economy...

This sort of intervention is highly unusual, but other major central banks have stepped in to stabilise bond markets before, and the ECB will probably have to do so again soon. But none of this will stop the usual suspects from gleefully writing this up as negatively as they can!

In the meantime, the Bank’s intervention gives the government more breathing space to flesh out its supply-side agenda and the medium-term fiscal plan, which should also help to restore market confidence.

Ps. today's intervention was mainly about financial stability, not monetary policy.

The #MPC should still set official interest rates at whatever level they think is necessary to bring #inflation back under control. But a more stable #pound might take some of the pressure off.

The #MPC should still set official interest rates at whatever level they think is necessary to bring #inflation back under control. But a more stable #pound might take some of the pressure off.

• • •

Missing some Tweet in this thread? You can try to

force a refresh