A long thread on the initial direct & indirect impacts of the chaos in the markets over the past week on UK house building & construction ...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

It's clearly early days into the government-made chaos in the financial markets but there are some impacts for the UK construction industry that we can identify (albeit quantifying them is a much greater issue)...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

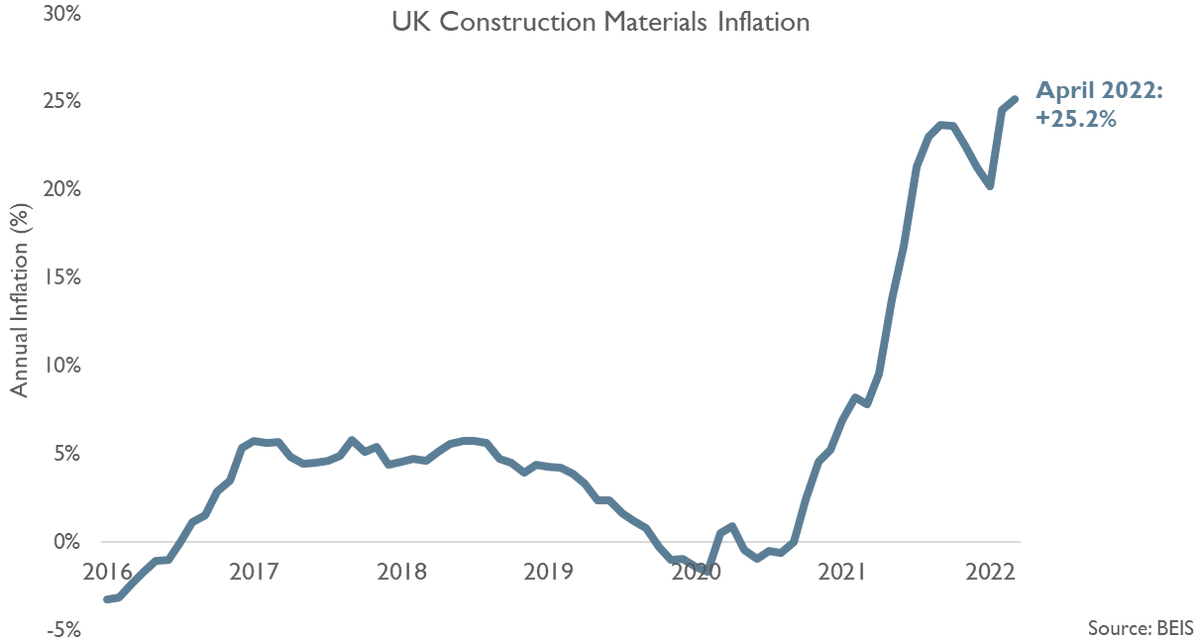

Firstly, Sterling depreciations mean further rises in construction materials prices, which in July 2022 were already 24% higher than a year ago. Sterling has depreciated 12% since the end of July &...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... this will increase the price of imports. Directly, the price of imported construction products (such as steel, aluminium and electrical wiring) will increase even more sharply. In addition, however,...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... the price of domestically made construction products will also rise further as they use input materials & components that are imported plus fuel/energy often priced in dollars. This means that...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... all construction sectors will be badly affected over the next 12-18 months as construction cost rises more sharply. Costs were rising in the past 12 months but that was whilst demand was rising sharply as well. However,...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... the markets chaos has led to sharp rises in expected interest rates, badly affecting homeowner (mortgage & remortgage) costs when real household income is falling. A week ago markets expected interest rates rising to 3% but...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

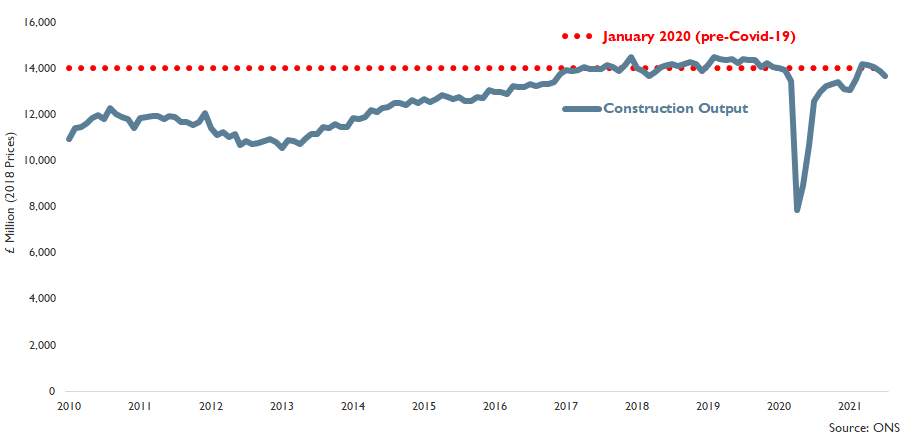

... now they expect rates rise to around 6%. The mortgage rates rise means demand in the housing market (prices, transactions), & so house building (the largest construction sector), will be heavily impacted. House building was...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... was already expected to slow towards the end of this year & into next year but now the house building fall is likely to be sharp as house builders are hit on both the demand & supply (cost rises hitting margin) side...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... In addition, the rates rises for those remortgaging means many households will be coming off low fixed-rates & finding mortgage payments rise sharply when real incomes are falling. Some households may be forced sellers but...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... a wider issue is households servicing higher mortgage payments by cutting discretionary, non-essential spending, i.e. sharp falls in private housing repair, maintenance & improvement, the 3rd largest construction sector...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... & a sector in which output has been falling since March already but output in the sector in July 2022 was still 15.5% higher than pre-pandemic so it has a long way further to fall. Looking to...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... other areas affected on the demand side, commercial (offices, retail, leisure), the 4th largest construction sector, is reliant large, upfront investment (from international investors) for a long-term rate of return that is...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... now under threat as investors have suddenly become risk-averse to major new investment in commercial towers at a time when costs are also spiralling so projects will be paused (for repricing), pushed back or cancelled. Theoretically,...

#ukconstruction #construction

#ukconstruction #construction

... infrastructure, the 2nd largest construction sector, is the least affected as finance (central government/local authorities & regulated sector firms) is more stable. However, the sharp cost rises mean that...

#ukconstruction #construction #ukinfrastructure #infrastructure

#ukconstruction #construction #ukinfrastructure #infrastructure

... with constrained finances set in November 2021's 3 year Spending Review & 5 year spending plans for regulated sectors respectively, what we will see near-term is the value spent but falls in volume & then...

#ukconstruction #construction #ukinfrastructure #infrastructure

#ukconstruction #construction #ukinfrastructure #infrastructure

... in the medium-term projects towards the end of Spending Review & regulated sector spending plans will get pushed back into the next ones due to lack of finance whilst local authorities, which are already...

#ukconstruction #construction #ukinfrastructure #infrastructure

#ukconstruction #construction #ukinfrastructure #infrastructure

... financially-constrained, will be cutting new projects to divert finance towards rising costs in basic repairs & maintenance.

#ukconstruction #construction #ukinfrastructure #infrastructure

#ukconstruction #construction #ukinfrastructure #infrastructure

• • •

Missing some Tweet in this thread? You can try to

force a refresh