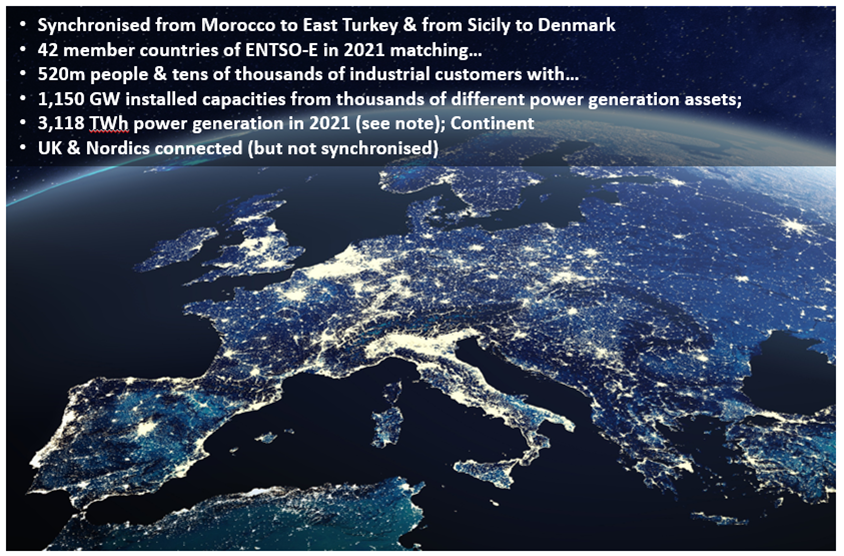

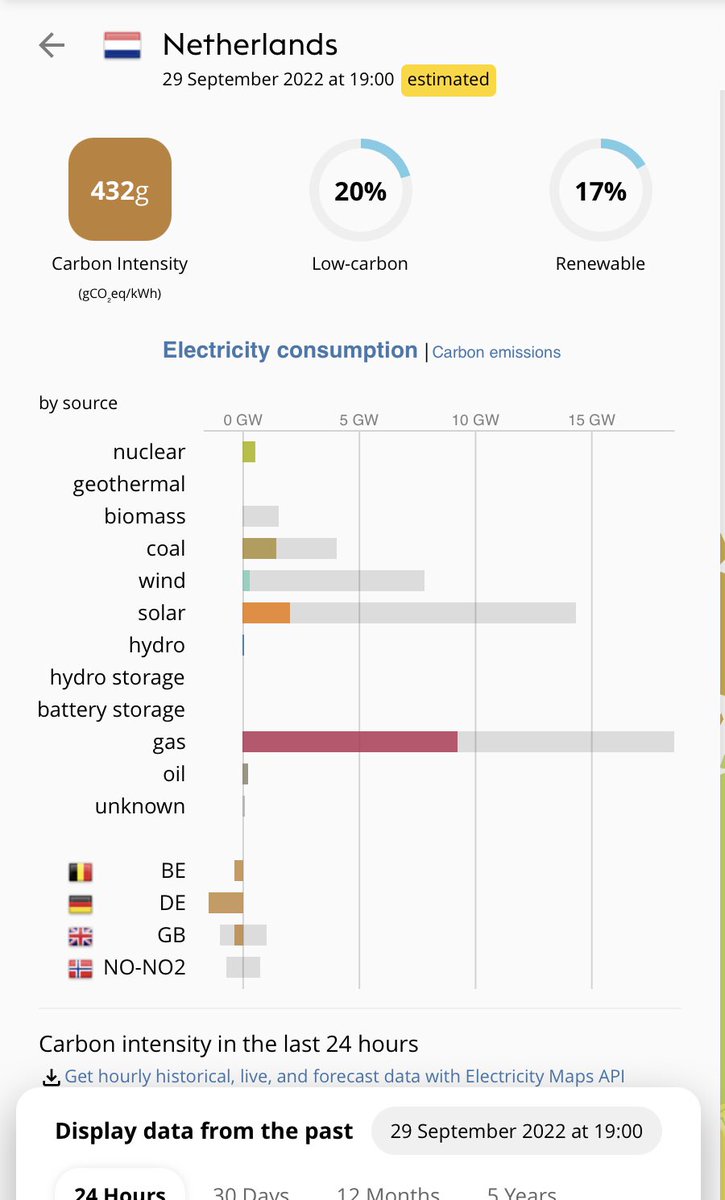

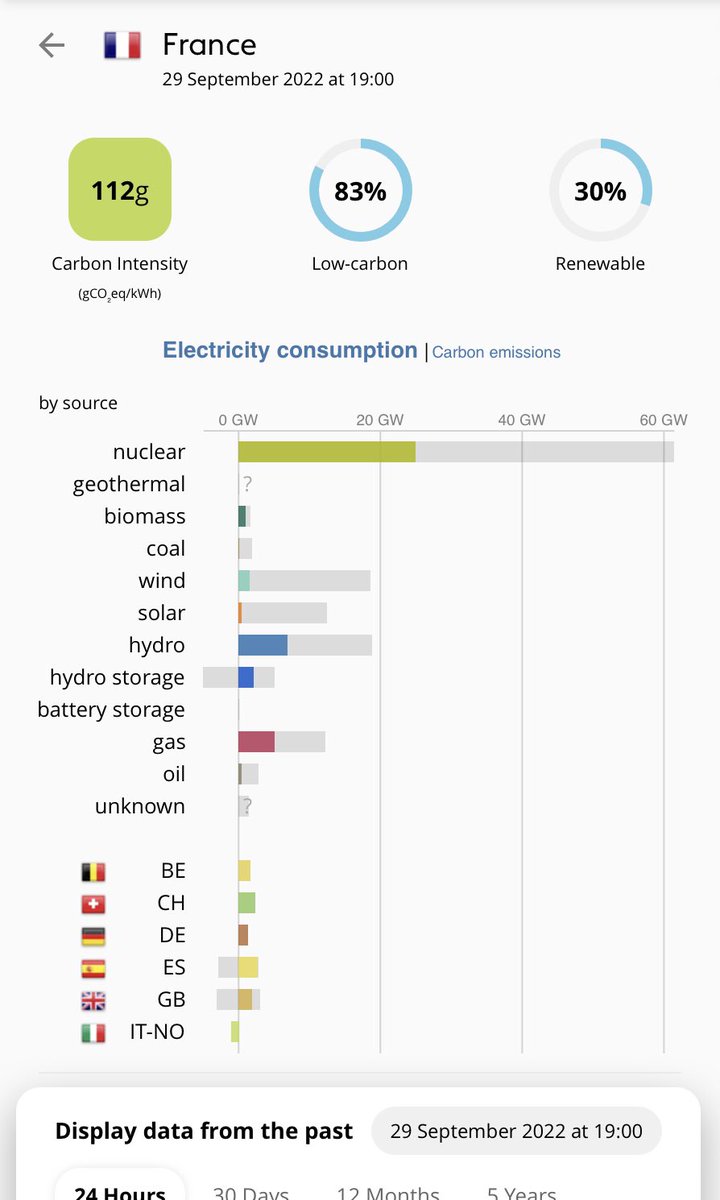

When it applies it is typically true for all of Northern Europe for those of u who read somewhere not to worry as in the future wind power will be imported from neighbouring countries. It won’t.

• • •

Missing some Tweet in this thread? You can try to

force a refresh