September was an interesting month to understand the challenges of Germany's so called "Energiewende".

At first, it may not look unusual. Germany was able to export 2,076 GWh of electricity for the month and covered peak loads most of the times.

1/n #Electricity

At first, it may not look unusual. Germany was able to export 2,076 GWh of electricity for the month and covered peak loads most of the times.

1/n #Electricity

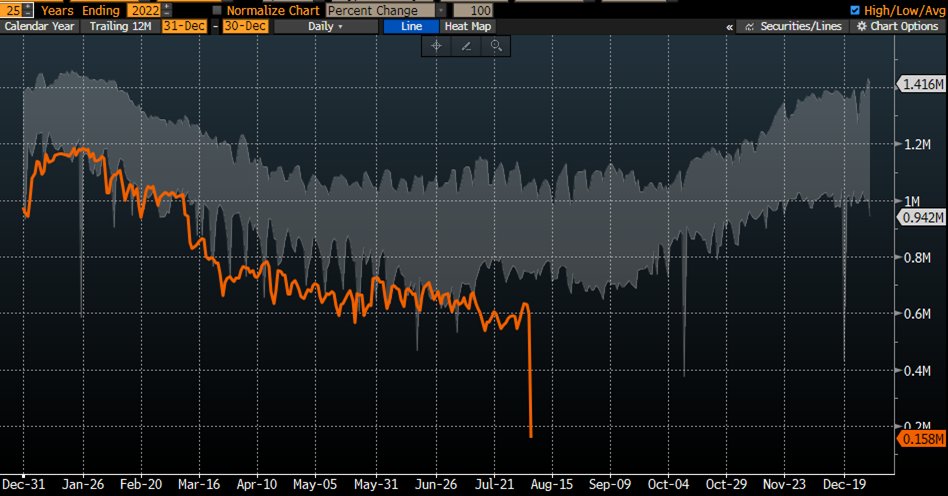

Isolating its wind & solar generation (RES) for the month of Sept however reveals future challenges.

GER had 9 days in Sept with little #wind. Not just Germany, all of Europe. On avg, GER used 2.7GW of its 62GW wind cap.

That is a capacity factor of 4.5%. Ouch!

2/n

GER had 9 days in Sept with little #wind. Not just Germany, all of Europe. On avg, GER used 2.7GW of its 62GW wind cap.

That is a capacity factor of 4.5%. Ouch!

2/n

While Sept turned GER into an importer for 2d (from CZE, SWE & DK) to cover consumption (FRA couldn't help; coal maxed out), RES also required it to export excesses during 15d.

Its Energiewende already turned GER into an imp/export "junky" as d-s are tough to match.

3/

Its Energiewende already turned GER into an imp/export "junky" as d-s are tough to match.

3/

So what?

Well, GER is scheduled to turn off all coal assets by 2035 (nukes by 2022; ex grid reserve) & replace it with wind & solar.

Only NatGas is permitted to complement intermittant RES in coming years - such are the directives of Germany's green energy laws today.

4/n

Well, GER is scheduled to turn off all coal assets by 2035 (nukes by 2022; ex grid reserve) & replace it with wind & solar.

Only NatGas is permitted to complement intermittant RES in coming years - such are the directives of Germany's green energy laws today.

4/n

Many "experts" claim that this is a good thing, both for the climate and the consumer.

That is because RES will basically bring prices of electricity near-zero.

I kid you not - that is an official claim, among other, by its renewable lobby.

5/n

That is because RES will basically bring prices of electricity near-zero.

I kid you not - that is an official claim, among other, by its renewable lobby.

5/n

GER's Energiewende would require many conditions for it to work - none of which will be met by 2035, if ever.

One such condition is higher cross-border cap. In Sept it would have required 720GWh/d of imports (ex coal & nuclear) to cover its load. It has 52GW imp cap today.

6/

One such condition is higher cross-border cap. In Sept it would have required 720GWh/d of imports (ex coal & nuclear) to cover its load. It has 52GW imp cap today.

6/

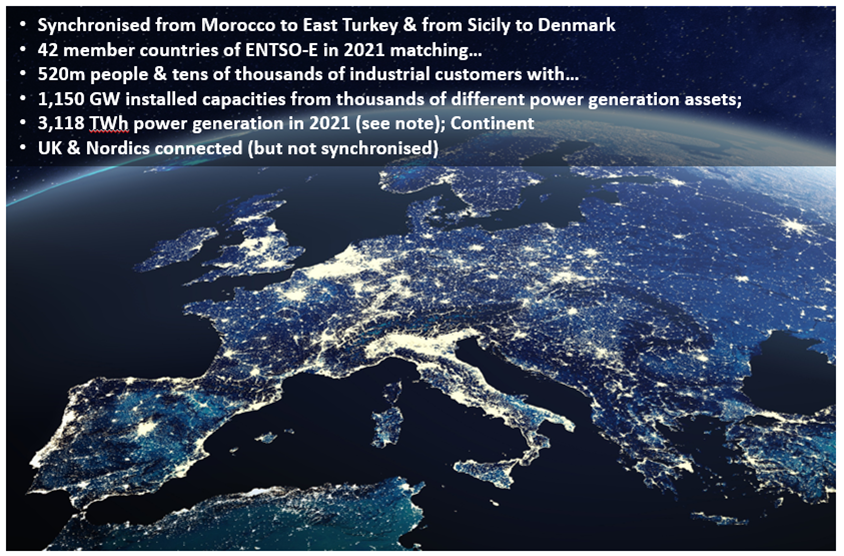

Did neighbours agree to increase cross-border cap with GER (future storage & transmissions should reduce total need) or is it uncoordinated?

Will neighbours have excess generation cap ex RES (same climate) to match future peaks? Today's c-border balancing doesn't suggests so!

Will neighbours have excess generation cap ex RES (same climate) to match future peaks? Today's c-border balancing doesn't suggests so!

U see, electricity was never only about energy assets (or their emissions) & always about timing & location too.

Wind will primarily be located offshore (north). Much of it will have to be transported south (industry). That will require a doubling of transmission lines.

7/

Wind will primarily be located offshore (north). Much of it will have to be transported south (industry). That will require a doubling of transmission lines.

7/

I'm afraid this target too will prove impossible to achieve by 2035 (despite a grid acceleration law since 2016) as nobody wants a new transmission line in the backyard.

At the current pace, GER would complete 50% of its grid expansion by 2035.

8/

At the current pace, GER would complete 50% of its grid expansion by 2035.

8/

We covered, among others, the challenges for more chemical storage in our thread here.

GER will require >15TWh of c-storage to cover so called "Dunkelflauten" - prolonged periods without wind or sunshine in Jan/Feb. It has a few MWh today.

9/

GER will require >15TWh of c-storage to cover so called "Dunkelflauten" - prolonged periods without wind or sunshine in Jan/Feb. It has a few MWh today.

9/

https://twitter.com/BurggrabenH/status/1567929340737863680?s=20&t=3fwtB8ar6UebZWgkvpKp3g

What went wrong?

For past 20y GER energy policy wasn't about emission.

Instead, ideology (Greens), campaign panic (CDU/CSU; Merkel’s nuclear exit post Fukushima) or personal entanglements (SPD; Schörder’s push for Russian gas) dominated decision making. Blame them all.

10/

For past 20y GER energy policy wasn't about emission.

Instead, ideology (Greens), campaign panic (CDU/CSU; Merkel’s nuclear exit post Fukushima) or personal entanglements (SPD; Schörder’s push for Russian gas) dominated decision making. Blame them all.

10/

For that purpose, the GER public was told that nuclear is an uncontrollable risk - a lie!

Its Energiewende, however, risks an "economic meltdown" if it doesn't allow for a nuclear renaissance to meet its de-carbonisation targets - a fact!

11/ Thx

ourworldindata.org/safest-sources…

Its Energiewende, however, risks an "economic meltdown" if it doesn't allow for a nuclear renaissance to meet its de-carbonisation targets - a fact!

11/ Thx

ourworldindata.org/safest-sources…

For my German speaking audience, here is a recent clip which discusses the issues at hand in a most relevant and factual manner.

#Atomkraft

#Atomkraft

• • •

Missing some Tweet in this thread? You can try to

force a refresh