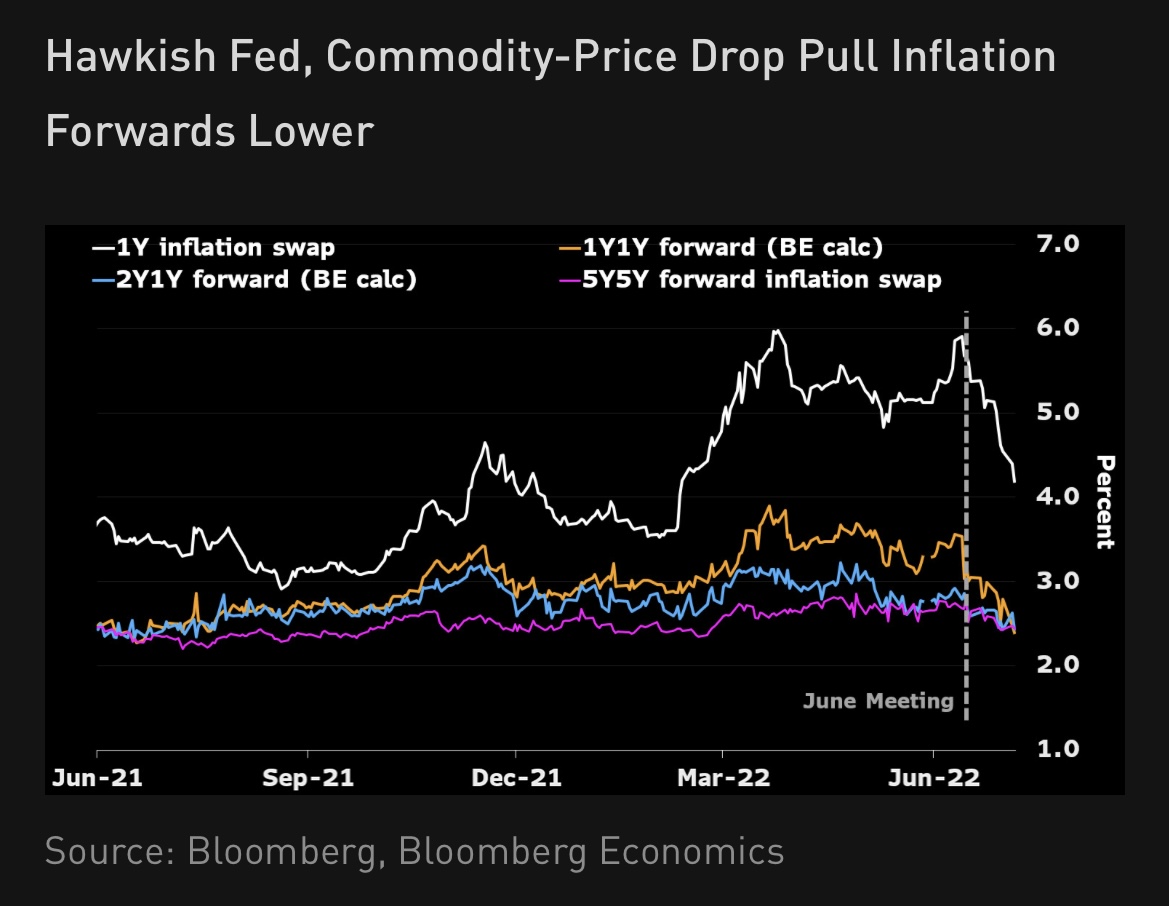

1) SF Fed paper "finds national homeowners’ shelter prices rose 4.3% Y/Y in July 2022, compared with 5.8% in the CPI measure" based on actual payments.

- OER based on the “implied rent” that owners indirectly pay to ...

$SPY $NDX $TLT $GLD #Commodities

frbsf.org/economic-resea…

- OER based on the “implied rent” that owners indirectly pay to ...

$SPY $NDX $TLT $GLD #Commodities

frbsf.org/economic-resea…

2) live in their homes. Implied rent cannot be observed, so the CPI uses an estimate (i.e. very imperfect, lagged and difficult to model as I've discussed).

Magnitude of shelter #CPI has surprised most, including Nobel laureates, Harvard professors, GS economists (who today ...

Magnitude of shelter #CPI has surprised most, including Nobel laureates, Harvard professors, GS economists (who today ...

3) adjusted their model and increased '23 shelter inflation estimate).

Here are a few threads/debates:

Then an empirical data set with what's actually being paid for shelter is ...

nytimes.com/2022/10/14/opi…

Here are a few threads/debates:

https://twitter.com/LHSummers/status/1581044985444855809

https://twitter.com/jasonfurman/status/1581036087333396481

https://twitter.com/paulkrugman/status/1582038913153388550

Then an empirical data set with what's actually being paid for shelter is ...

nytimes.com/2022/10/14/opi…

4) lower than CPI?

As author states "an advantage of this method is that the payments measure uses actual homeowner costs, rather than estimated implicit rent. This sidesteps issues that could arise in the CPI’s rent-based measure resulting from differing shelter price ...

As author states "an advantage of this method is that the payments measure uses actual homeowner costs, rather than estimated implicit rent. This sidesteps issues that could arise in the CPI’s rent-based measure resulting from differing shelter price ...

5) dynamics for renter- and owner-occupied units and from the lag caused by the tendency for rents to change only annually. While the CPI is available for only 23 metro areas, the payments measure covers nearly all counties and metro areas. This is an advantage because, as a ...

6) non-traded service, shelter prices show more geographic variation than prices in other CPI categories.

• • •

Missing some Tweet in this thread? You can try to

force a refresh