How long will EU gas prices and with it EU power prices and likely the Euro, inflation expectations and European rates get a break?

Anwer: It (mainly) depends on weather. So what is the forecast?

1/n #TTF #NBP #EUR

Anwer: It (mainly) depends on weather. So what is the forecast?

1/n #TTF #NBP #EUR

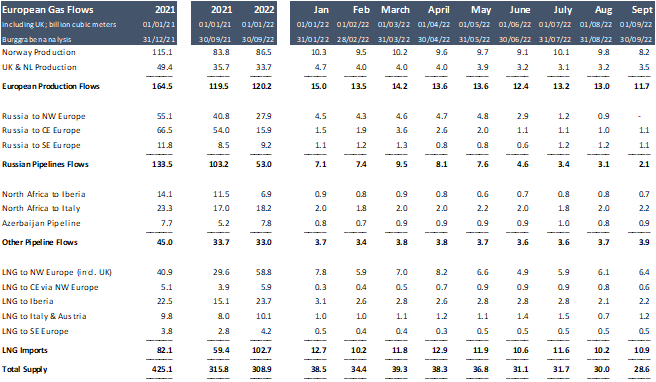

The main consumers of gas is North West, Central & South East EU. We disregard Nordics which consumes little.

North West temps are currently 6% higher than its 30-y normal - a lot!

Temps are forecast to stay above normal into Dec. However, post 10 Nov only by 1.5%.

2/n

North West temps are currently 6% higher than its 30-y normal - a lot!

Temps are forecast to stay above normal into Dec. However, post 10 Nov only by 1.5%.

2/n

Both South East & Central Europe are 5% above 30-year normal temps too. Both regions are forecast to normalise after 10 November.

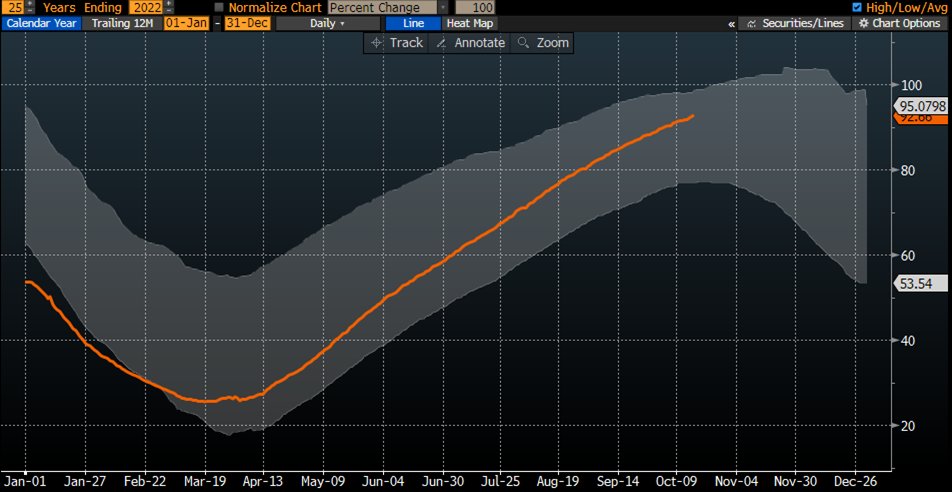

That will leave gas storages constrained well into Dec.

My hunch is that gas prices will not recover much until storages go < 55% (Jan/Feb).

3/n

That will leave gas storages constrained well into Dec.

My hunch is that gas prices will not recover much until storages go < 55% (Jan/Feb).

3/n

The risk to this forecast is that...

(a) above temp forecast is wrong;

(b) that Kremlin will turn off additional flows (into Velke = 15bcm annualised; LNG = 20bcm annualised).

(c) there is a NOR pipe sabotage.

All very possible.

4/n

(a) above temp forecast is wrong;

(b) that Kremlin will turn off additional flows (into Velke = 15bcm annualised; LNG = 20bcm annualised).

(c) there is a NOR pipe sabotage.

All very possible.

4/n

Finally, let me explain again why volatility is here to stay:

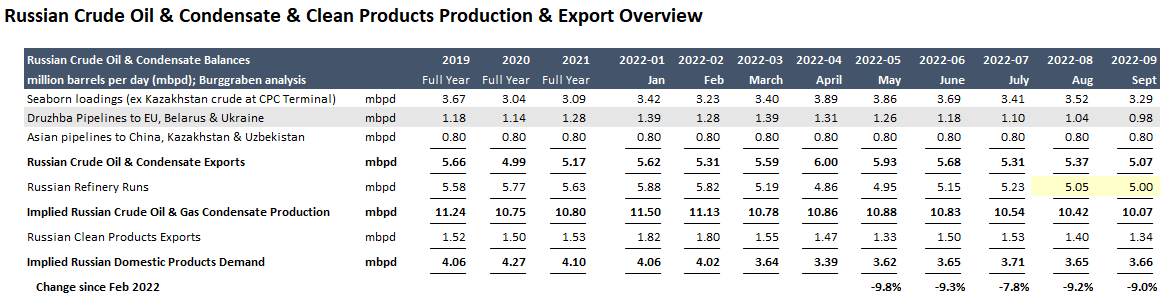

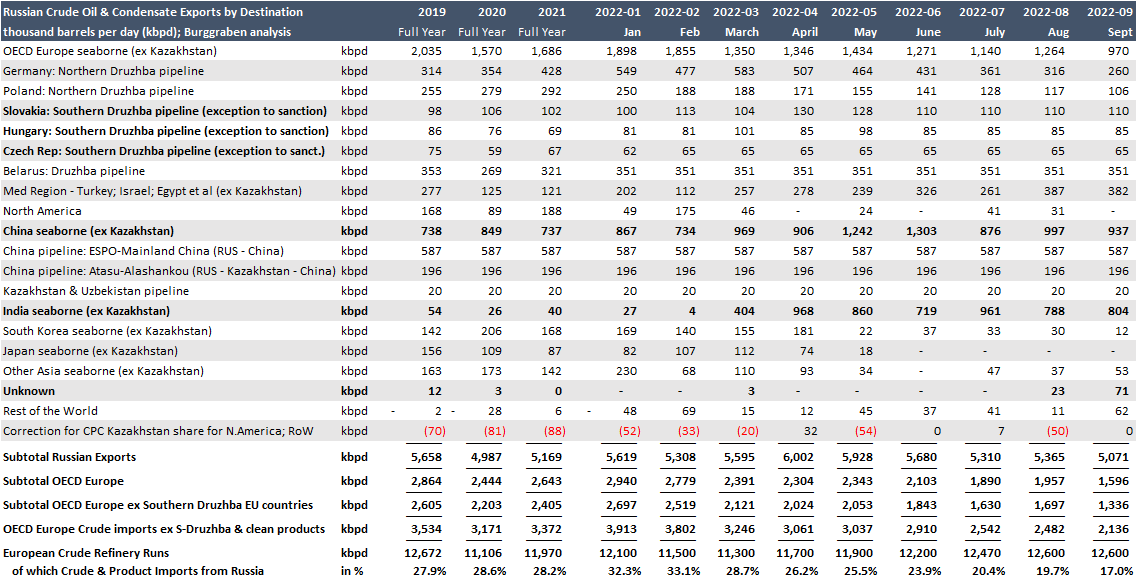

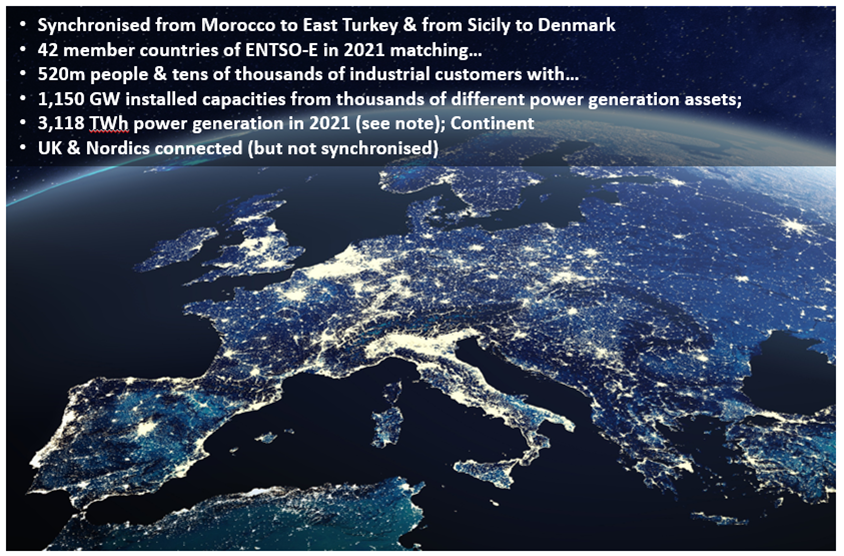

1) Europe is in a rotation, away from RUS pipe flows towards LNG imports;

2) For that, Europe expands its LNG regas import capacities and de-bottlenecks its infrastructure;

5/n

1) Europe is in a rotation, away from RUS pipe flows towards LNG imports;

2) For that, Europe expands its LNG regas import capacities and de-bottlenecks its infrastructure;

5/n

https://twitter.com/BurggrabenH/status/1584278508062224384?s=20&t=o8EeFcPhvZZu_NhcuSfu2w

but...

4) The European industry (mainly utilities) does NOT (currently) replace long-term Nord-Stream; Yamal; Brotherhood contracts with NEW long-term contracts in Qatar, Africa or the USA;

6/n @kittysquiddy

4) The European industry (mainly utilities) does NOT (currently) replace long-term Nord-Stream; Yamal; Brotherhood contracts with NEW long-term contracts in Qatar, Africa or the USA;

6/n @kittysquiddy

5) Instead the industry bought LNG on the SPOT market, away from Asia (while China bought less due to Covid measures);

6) Buying (or not buying) spot LNG bids up (or down) LNG cargos but does NOT underpin investments into UPSTREAM gas activity by producers (Qatar et al);

7/n

6) Buying (or not buying) spot LNG bids up (or down) LNG cargos but does NOT underpin investments into UPSTREAM gas activity by producers (Qatar et al);

7/n

7) Yes, certain US exporters like Cheniere invest into more LNG export capacities which may trigger some US producers to produce more;

8) But not Qatar or African producers. They will not help Europe source additional 60-80Mt of new LNG (which is what Europe needs pa);

8/n

8) But not Qatar or African producers. They will not help Europe source additional 60-80Mt of new LNG (which is what Europe needs pa);

8/n

9) Qatar instead needs a long-term commitments to invest into additional (upstream & terminal) capacities to earn back their capital. They won't gamble on EU's future needs;

10) Of course, at the margin Trafigura or Shell buy some l-t contracts to speculate on future demand;

9/

10) Of course, at the margin Trafigura or Shell buy some l-t contracts to speculate on future demand;

9/

11) But such speculation means they will try and sell it to the highest bidder by definition.

12) For the European industry to have price stability, European utilities need to invest into l-t LNG contracts globally themselves (for which they get "cost +" prices);

10/n

12) For the European industry to have price stability, European utilities need to invest into l-t LNG contracts globally themselves (for which they get "cost +" prices);

10/n

13) We are seeing none of that now. But only that would create a stable l-term basis for Europe's industry.

14) Utilities have to comply with EU climate laws which requires them to be net-zero by 2050. So they do not have the legal framework to make l-t commitments.

11/n

14) Utilities have to comply with EU climate laws which requires them to be net-zero by 2050. So they do not have the legal framework to make l-t commitments.

11/n

15) Therein lies the task of the EU Commission. They must adapt such laws are risk being the source of a long-term gas and power crisis in Europe - and with it the de-industrialisation of heavy gas users such as the chemical industry;

12/n Thx

12/n Thx

• • •

Missing some Tweet in this thread? You can try to

force a refresh