Touched All time high today!

More highs to come in this stock? ⚡

JASCH INDUSTRIES LTD.

[A brief analysis] 🧵🧵

This came to attention after @safiranand sir wrote about it & what a pick it has been!

#investing #jasch #StockMarketindia #pennystocks

(1/24)

More highs to come in this stock? ⚡

JASCH INDUSTRIES LTD.

[A brief analysis] 🧵🧵

This came to attention after @safiranand sir wrote about it & what a pick it has been!

#investing #jasch #StockMarketindia #pennystocks

(1/24)

We will analyze: 👇🏻

- BACKGROUND

- MANAGEMENT

- BUSINESS SEGMENTS & REVENUE SPLIT

- CUSTOMERS

- MANUFACTURING FACILITIES

- STRENGTH & WEAKNESSES

- KEY FINANCIAL METRICS

- CONCLUSION

(2/24)

- BACKGROUND

- MANAGEMENT

- BUSINESS SEGMENTS & REVENUE SPLIT

- CUSTOMERS

- MANUFACTURING FACILITIES

- STRENGTH & WEAKNESSES

- KEY FINANCIAL METRICS

- CONCLUSION

(2/24)

• BACKGROUND:

Jasch industries Ltd manufactures PU/PVC Coated Fabrics (also known as synthetic Leather or Artificial Leather) and Polyurethane Resin in Coated Fabrics Division. ✔

In 2000, it opened an industrial gauge division -

(3/24)

Jasch industries Ltd manufactures PU/PVC Coated Fabrics (also known as synthetic Leather or Artificial Leather) and Polyurethane Resin in Coated Fabrics Division. ✔

In 2000, it opened an industrial gauge division -

(3/24)

It specializes in on-line measurement & control systems for flat sheet products, instruments such as thickness/coating thickness gauge, paint thickness gauge, and basis weight, ash, and moisture measurement gauges. Used by COs in paper, plastic films, & steel industries.

(4/24)

(4/24)

• MANAGEMENT:

MD & CHAIRMAN: MR JAI KISHAN GARG

The Management is continuously upgrading the company’s technology and modernizing plant & machinery to maintain competitive edge in the market. 🎯

(5/24)

MD & CHAIRMAN: MR JAI KISHAN GARG

The Management is continuously upgrading the company’s technology and modernizing plant & machinery to maintain competitive edge in the market. 🎯

(5/24)

It has also recently modified company’s production lines, which has resulted in development of some new products with significant saving in power and fuel.

Manag. has been concentrating on production of PU resin and PU Synthetic Leather where the competition is less.

(6/24)

Manag. has been concentrating on production of PU resin and PU Synthetic Leather where the competition is less.

(6/24)

• BUSINESS SEGEMENTS:

- PU/PVC Coated Fabrics & PU Resin:

PU/PVC Coated fabrics are mostly used in footwear (as raw material for shoe–upper, shoe-line, shoe-insole, chappal, sandal straps), in garment industry (as lining material) and in automobiles (as seat covers).

(7/24)

- PU/PVC Coated Fabrics & PU Resin:

PU/PVC Coated fabrics are mostly used in footwear (as raw material for shoe–upper, shoe-line, shoe-insole, chappal, sandal straps), in garment industry (as lining material) and in automobiles (as seat covers).

(7/24)

These are also used in furniture upholstery material, ladies and gents’ purses, bags, luggage and also in the manufacture of sports goods accessories. 🎒

(8/24)

(8/24)

- Electronic Gauges:

Radiation-based Gauging Systems are used for on-line measurement of thickness, grammage, moisture & ash contents in paper industry, on-line measurement of thickness & coating weight in plastics, steel, sheet rolling, galvanizing, aluminium foil,etc.

(9/24)

Radiation-based Gauging Systems are used for on-line measurement of thickness, grammage, moisture & ash contents in paper industry, on-line measurement of thickness & coating weight in plastics, steel, sheet rolling, galvanizing, aluminium foil,etc.

(9/24)

• SEGMENT WISE REVENUE SPLIT: 📏

- PU/PVC COATED FABRICS & PU RESIN:

71.46% OF TOTAL REVENUE OR 154.42 CR OF TOTAL 216.08 CR REVENUE GENERATED.

- ELECTRONIC GAUGES:

28.54% OF TOTAL REVENUE OR 61.66 CR OF TOTAL 216.08 CR REVENUE GENERATED.

(10/24)

- PU/PVC COATED FABRICS & PU RESIN:

71.46% OF TOTAL REVENUE OR 154.42 CR OF TOTAL 216.08 CR REVENUE GENERATED.

- ELECTRONIC GAUGES:

28.54% OF TOTAL REVENUE OR 61.66 CR OF TOTAL 216.08 CR REVENUE GENERATED.

(10/24)

CUSTOMERS & MARKETS:

Major clients of CO - Puma, Red Tape, Bata, Mahindra, Walmart, etc. CO has entered into a technical collaboration agreement with Duksung Company Ltd, Korea for updating of technology and development of new products as well as input cost savings.

(11/24)

Major clients of CO - Puma, Red Tape, Bata, Mahindra, Walmart, etc. CO has entered into a technical collaboration agreement with Duksung Company Ltd, Korea for updating of technology and development of new products as well as input cost savings.

(11/24)

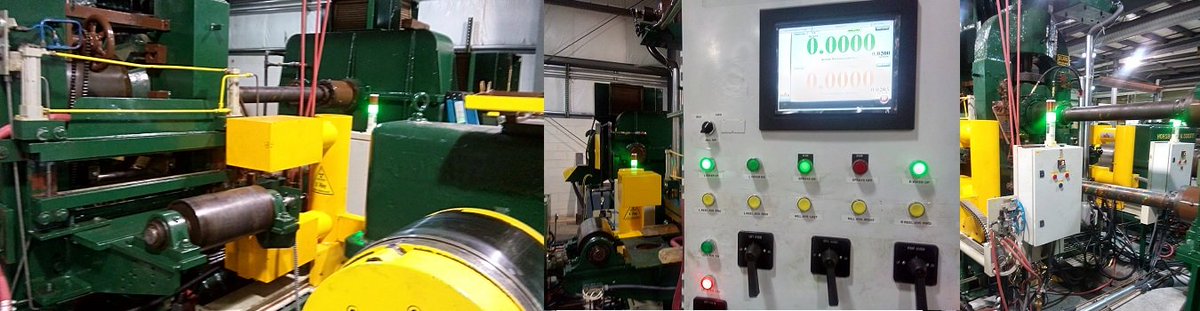

• MANUFACTURING FACILITIES:

The company’s manufacturing facility is located at Sonipat, Haryana. 📍

(12/24)

The company’s manufacturing facility is located at Sonipat, Haryana. 📍

(12/24)

During FY21, the Company was able to improve the drying speed of PVC coated fabrics in its existing ovens, as a result of which the installed capacity of PVC coated fabrics being manufactured has increased from 78 lakh metres to 94 lakh metres p.a. 📈📈

(13/24)

(13/24)

• STRENGHTS:

Company has been able to withstand competition, both domestic and from abroad, as it is also an integrated player with inhouse manufacturing facility for PU Resin, which is the main raw material for PU coated Fabrics. 💪🏻

(14/24)

Company has been able to withstand competition, both domestic and from abroad, as it is also an integrated player with inhouse manufacturing facility for PU Resin, which is the main raw material for PU coated Fabrics. 💪🏻

(14/24)

Besides captive consumption of PU resin, the CO also sells surplus PU Resin to outside parties for adhesive & coating applications.

Further, the CO is continuously upgrading its technology and modernizing plant & machinery to maintain competitive edge in the market.

(15/24)

Further, the CO is continuously upgrading its technology and modernizing plant & machinery to maintain competitive edge in the market.

(15/24)

Strong operational performance over the past five fiscals and prudent funding of capital expenditure through debt and equity have helped to strengthen the balance sheet. 💯

(16/24)

(16/24)

WEAKNESSES AND THREATS: ⚠

Several unorganised players and imports from China and Taiwan cater to majority of demand in the synthetic leather industry.

Hence, despite operating income increasing to Rs 177 crore in fiscal 2019, scale of operations remains modest.

(17/24)

Several unorganised players and imports from China and Taiwan cater to majority of demand in the synthetic leather industry.

Hence, despite operating income increasing to Rs 177 crore in fiscal 2019, scale of operations remains modest.

(17/24)

Commoditised product makes demand sensitive to price fluctuations.

Since key raw materials (PU, PVC) are derivatives of crude oil, their prices vary with the fluctuation in international crude oil prices.

(18/24)

Since key raw materials (PU, PVC) are derivatives of crude oil, their prices vary with the fluctuation in international crude oil prices.

(18/24)

Operating margin also remains susceptible to volatility in the value of the Indian rupee as the group is a net importer. ⚠

While around 50% of total raw material requirement is imported, only 15-20% of the revenue from the industrial gauge unit is from exports.

(19/24)

While around 50% of total raw material requirement is imported, only 15-20% of the revenue from the industrial gauge unit is from exports.

(19/24)

• FINANCIALS & METRICS:

The company has a market cap of ~ Rs. 245 Crores. Stock P/E is 11 compared to industry’s P/E of 28.7 which enables a space for the company to grow. ✅

(20/24)

The company has a market cap of ~ Rs. 245 Crores. Stock P/E is 11 compared to industry’s P/E of 28.7 which enables a space for the company to grow. ✅

(20/24)

CO has a ROE and ROCE of 25.6% and 33.4% which is better than other players in the same industry. Company’s OPM is declining on a quarterly basis. Company’s EV/ EBIT is 6.57 and company has a EVEBITDA of 5.99.

Also, this company is almost Debt free.

(21/24)

Also, this company is almost Debt free.

(21/24)

• CONCLUSION:

We believe that CO will continue to benefit from its established market position and diversified product portfolio.

CO can do better if revenue & profitability increase while stable capital structure and working capital cycle is managed. 📈

(22/24)

We believe that CO will continue to benefit from its established market position and diversified product portfolio.

CO can do better if revenue & profitability increase while stable capital structure and working capital cycle is managed. 📈

(22/24)

And, that's a wrap.

If you liked the analysis, make sure to like and retweet to show support and share with maximum investors! ♻

Do share your views in the comments below. 📩

(23/24)

If you liked the analysis, make sure to like and retweet to show support and share with maximum investors! ♻

Do share your views in the comments below. 📩

(23/24)

Disclaimer: This twitter thread is for educational and knowledge sharing purposes only. We are not associated with the company in any form. This is not a buy/sell/hold recommendation of any kind. Kindly consult with your financial advisor before taking any actions.

(24/24)

(24/24)

• • •

Missing some Tweet in this thread? You can try to

force a refresh