Thread on how much money clubs have already received after the Champions League 2022/23 group stage. Also includes estimates for English clubs in Europa League and Europa Conference League. Some assumptions made about the TV pool, but the figures should be reasonably accurate.

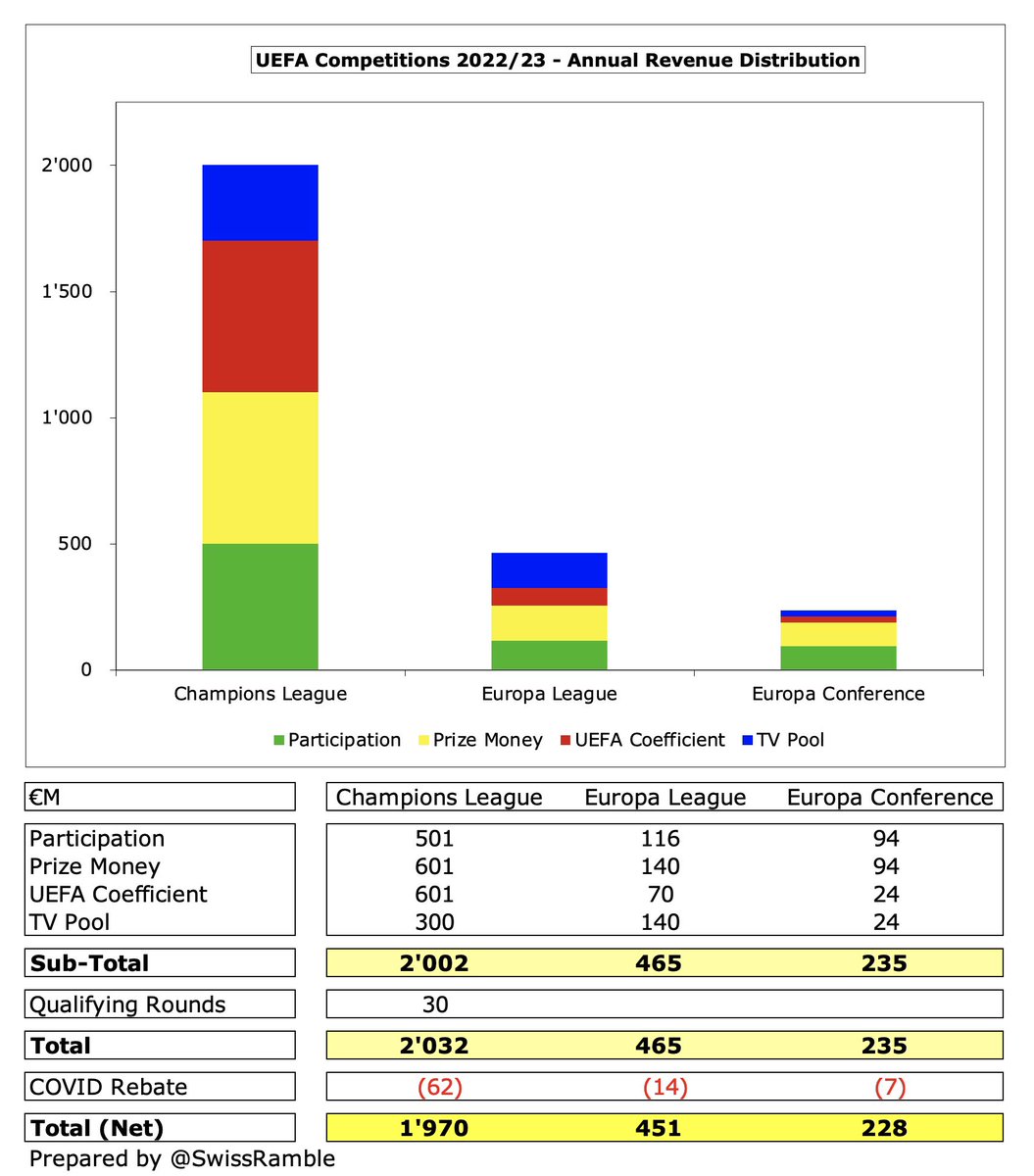

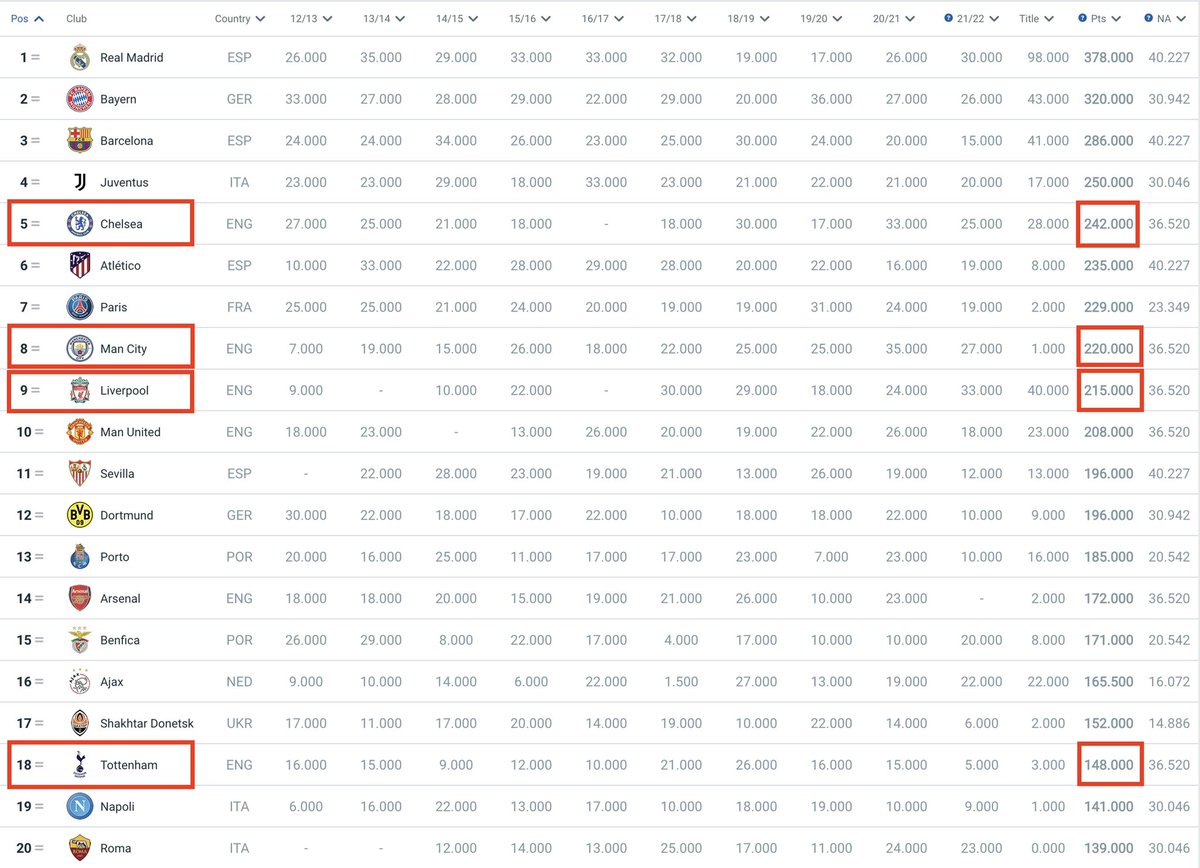

The Champions League accounts for the lion’s share of UEFA revenue with its €2.032 bln being nearly 3 times as much as the Europa League and Europa Conference combined (€700m). The difference is particularly stark in the UEFA coefficient (based on 10-year rankings).

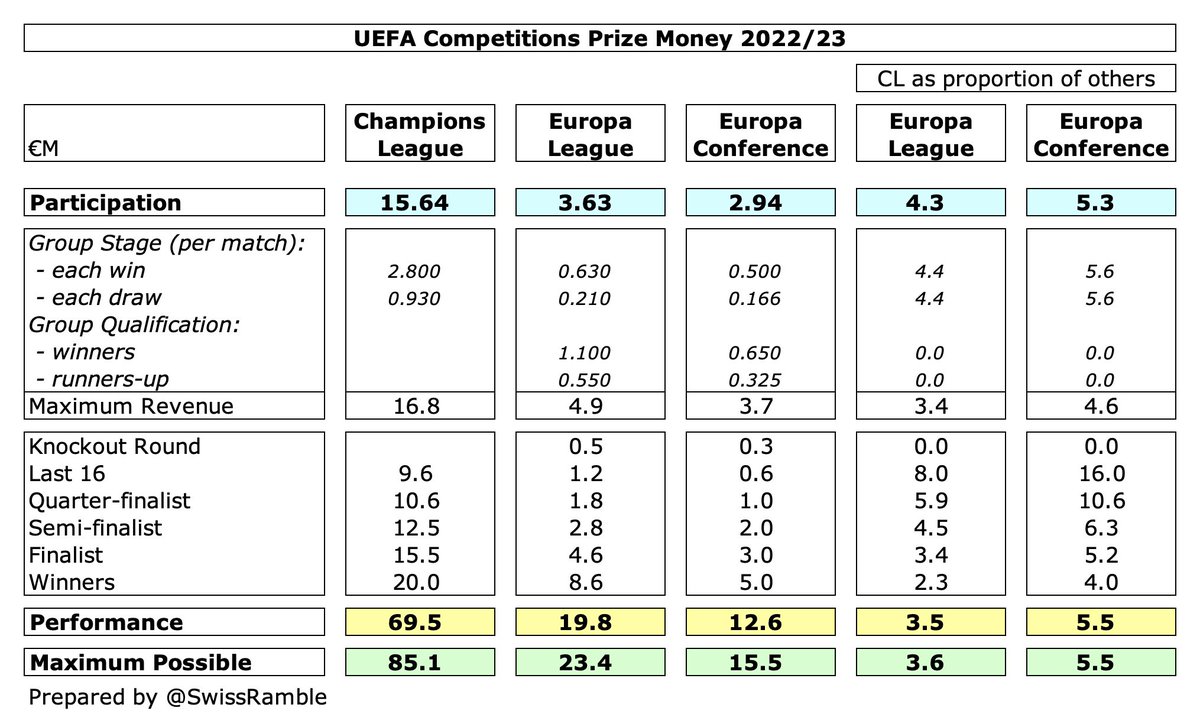

Champions League overall prize money is 3.6 times the Europa League and 5.5 times the Europa Conference, but this varies by round. In general, the difference becomes smaller the further a club progresses, e.g. last 16 it’s 8x and 16x, while for the winners it’s only 2.3x and 4x.

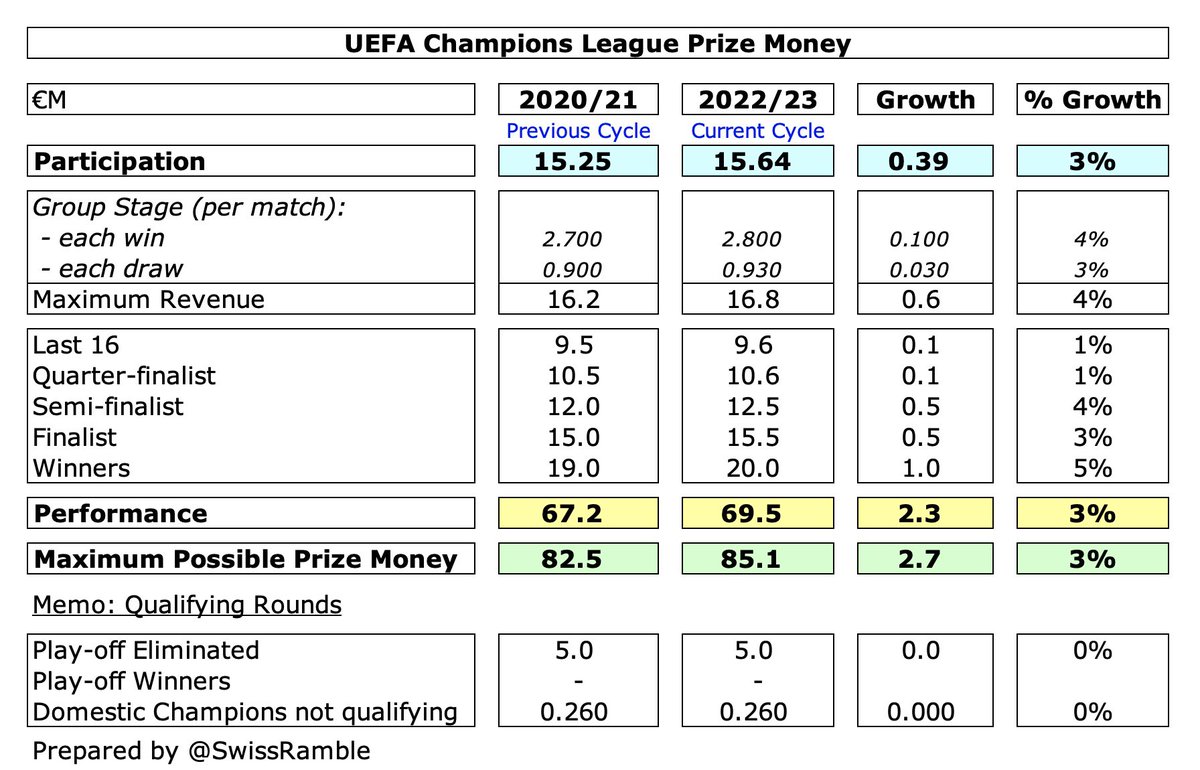

In 2022/23 each of the 32 clubs qualifying for Champions League group stage gets €15.64m plus €2.8m for a win and €930k for a draw. Additional prize money for each further stage reached: last 16 €9.6m, quarter-final €10.6m, semi-final €12.5m, final €15.5m & winners €20m.

Each club in the Europa League group stage get €3.63m plus €630k for a win and €210k for a draw. Additional prize money: win group €1.1m (runners-up €550k), knockout round €500k, last 16 €1.2m, quarter-final €1.8m, semi-final €2.8m, final €4.6m and winners €8.6m.

Each club in the Europa Conference group stage get €2.94m plus €500k for a win and €166k for a draw. Additional prize money: win group €650k (runners-up €325k), knockout round €300k, last 16 €600k, quarter-final €1m, semi-final €2m, final €3m and winners €5m.

As a result of COVID, revenue in 2019/20 was reduced by €531m with €416.5m impact on participating clubs. This will be deducted in equal shares over five seasons (from 2019/20 to 2023/24) in proportion to each competition. This works out to around 3% of each club’s earnings.

All numbers in this analysis are certain except the TV pool, which is split into two: (a) half based on position in previous season’s domestic league (known); (b) progress in this season’s European competition (will change). Estimated based on 2020/21 actuals and media reports.

My calculations suggest that 6 clubs have already earned more than €80m from the 2022/23 Champions League. #PSG lead the way with €98m, followed by #FCBayern €93m and #RealMadrid €93m, then 3 English clubs: #MCFC €84m, #LFC €82m and #CFC €81m.

Looking at how Champions League revenue is now distributed, the importance of the UEFA coefficient is evident with the TV pool being much less significant than it was before. This rewards historically successful clubs rather than those with larger national TV rights deals.

Right off the bat, each of the 32 clubs that qualified for the Champions League group stage received a participation fee of €15.64m, which is up 3% from the previous cycle’s €15.25m.

#FCBayern have earned most prize money to date with €27.8m, as they won all 6 games in the group stage, worth €16.8m (€2.8m for each win), €1.4m for share of money left on the table after draws and €9.6m for reaching the last 16. Next best with 5 wins: #LFC and #SSCNapoli.

Coefficient payment based on performances in UEFA tournaments over past 10 years, including bonus for winning a trophy, so benefits traditional big clubs like #RealMadrid €36m, #FCBayern €35m & #FCBarcelona €34m. English clubs: #CFC €32m, #MCFC €28m, #LFC €27m & #THFC €19m

Clubs in the Champions League clearly benefit most from UEFA coefficient payments, as these are significantly lower in the Europa League, e.g. #MUFC €4.2m and #AFC €4.1m, and the Europa Conference, e.g. #WHUFC €1.0m.

Highest TV pool payment is #PSG €33m, followed by Marseille €26m, #RealMadrid €21m and #MCFC €20m. French clubs benefit from their TV pool only being divided between 2 clubs, whereas the German money is split between 5 clubs this season.

All 4 English clubs have reached the last 16, so there is little difference in the revenue distribution for #MCFC €84m, #LFC €82m and €81m. However, #THFC €64m is a fair bit less, mainly because of a much lower UEFA coefficient and TV pool.

#LFC have earned the most prize money of the English clubs to date with €24.7m, thanks to their 5 wins in the group. Each club received €9.6m for reaching the last 16.

#CFC have the highest UEFA coefficient over the 10-year period, though their victory in the 2012-13 Champions League will drop out next season, when they are likely to be overtaken by #MCFC and #LFC.

#MCFC have the highest share of the TV pool with €19.8m, as they won last season’s Premier League. This means they receive 40% of the first half of the pool. English pool is reduced this season by 10%, as this amount has been allocated to Scottish clubs.

These figures will change depending on how teams progress. For example, if #MCFC were to win the Champions League (and the other English clubs were eliminated in the last 16), then they would earn a massive €129m.

Revenue is much smaller in the Europa League, where #AFC have earned €29m to date, including €1.1m bonus for winning their group and €1.2m reaching last 16, while #MUFC have €28m. TV pool is very important to earnings here (this is a modeled figure based on 2020/21 actuals).

Similarly, I have estimated that #WHUFC will only receive €13m from the Europa Conference League, though prize money was boosted by winning all 6 group games plus €650k for winning the group.

The comparison between English clubs across the three European competitions highlights the large disparity with the Champions League clubs earning €64-84m to date, compared to around €28m for the Europa League clubs, who are in turn twice as much as Europa Conference €13m.

The return of Scottish clubs to CL group stage led to €29m earnings for #CelticFC and €20m for #RangersFC. Main difference is UEFA 10-year coefficient, where Rangers suffer from not qualifying for Europe for first half of period. Highest amounts from €15.6m participation fee.

Scotland is allocated 10% (€6.8m) of UK TV pool, based on population. #CelticFC receive slightly more as the first half is split on final position in last season’s Premiership. #RangersFC lost all 6 group matches, so receive no prize money, while Celtic get €1.9m for 2 draws.

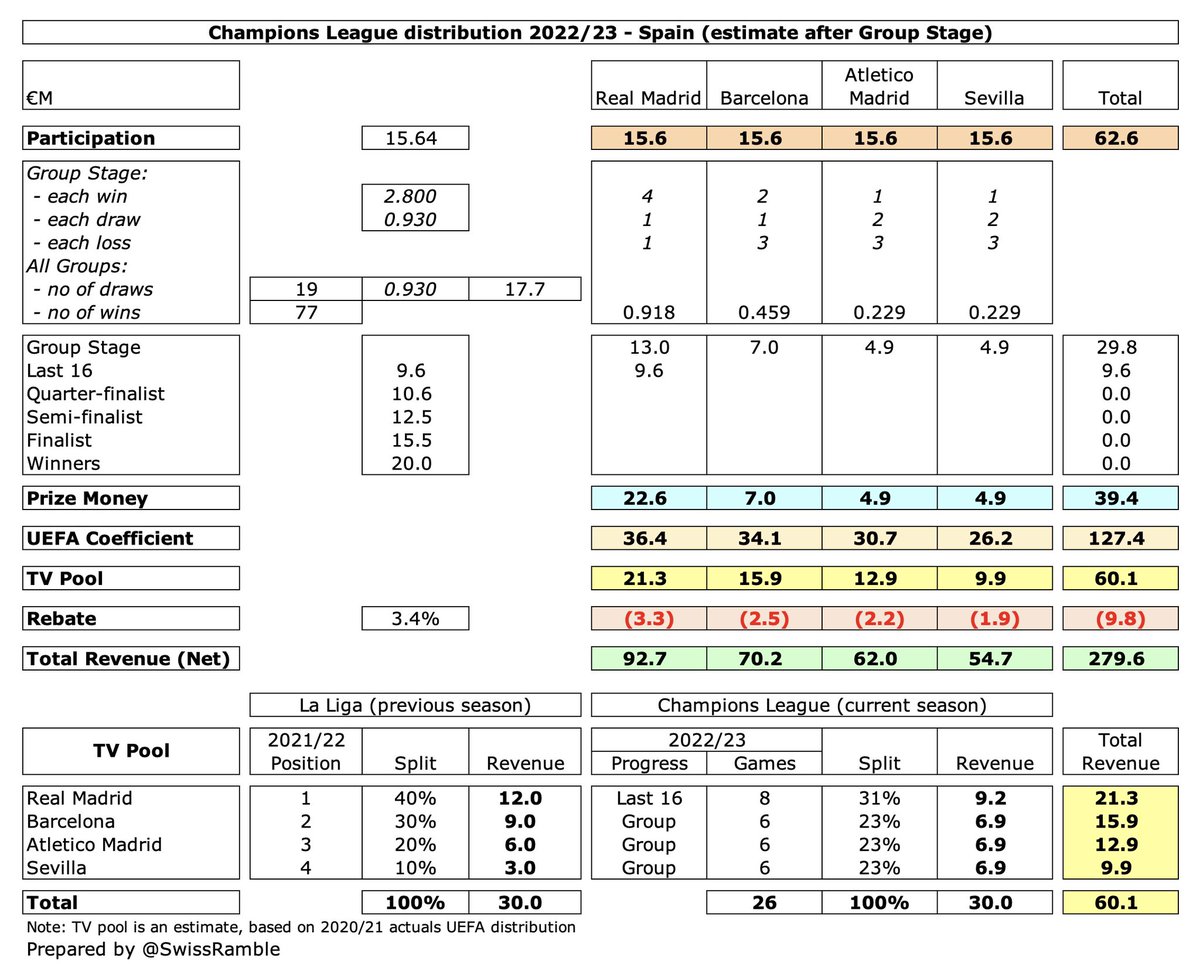

#RealMadrid have the highest Spanish clubs’ Champions League 2022/23 revenue to date with €93m, due to having the best UEFA coefficient (highest in Europe), the most prize money and the highest TV pool. Followed by #FCBarcelona €70m, #Atleti €62m and #SevillaFC €55m.

Spain have benefited from UEFA coefficient payment, thanks to a very successful record in Europe with their clubs filling 3 of the top 6 rankings. Prize money is lower than usual, as 3 of the 4 Spanish clubs were eliminated at the Group Stage with only #RealMadrid advancing.

#FCBayern €93m is the highest German clubs’ Champions League 2022/23 revenue to date, due to earning the most prize money, having the best UEFA coefficient and highest TV pool. There is then a big gap to #BVB €71m, RB Leipzig €56m, Frankfurt €50m and Leverkusen €46m.

German clubs prize money boosted by 4 clubs reaching the last 16. Frankfurt €50m revenue restricted, because receive nothing from first half of TV pool, as qualified by winning Europa League. TV pool reportedly up 70% following new deals with DAZN, Amazon & ZDF (replacing Sky).

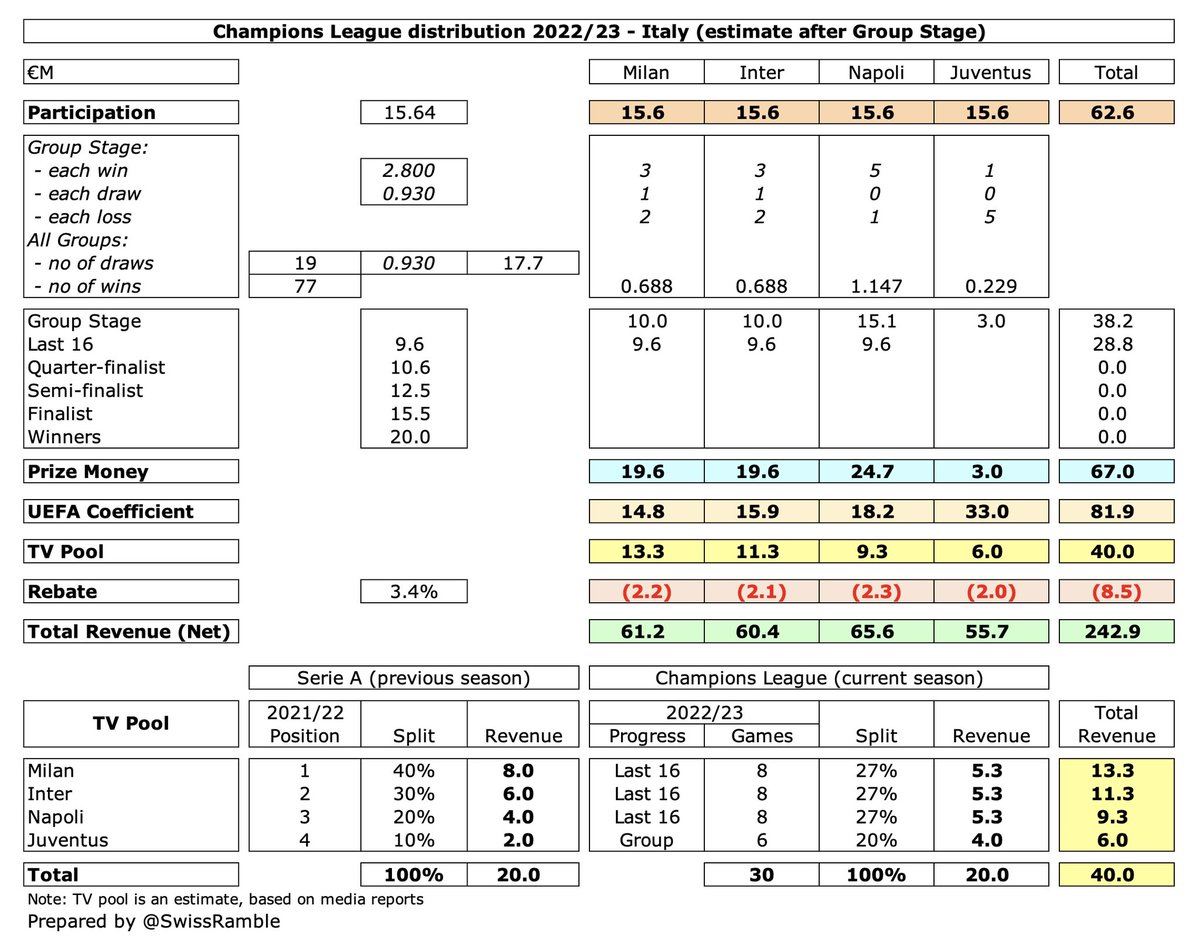

The 3 Italian clubs who have reached the last 16 have earned most from 2022/23 Champions League: #SSCNapoli €66m, #Milan €61m and #Inter €60m. #Juventus still received €56m, despite elimination at group stage and only winning 1 game, due to their high UEFA coefficient €33m.

#SSCNapoli prize money boosted by winning 5 games, while #Milan earn slightly more than #Inter, despite same results in group stage, thanks to TV pool (finished higher in last season’s Serie A), partly offset by lower UEFA coefficient. TV pool reportedly down from €50m to €40m.

#PSG have the highest revenue of all clubs in Champions League 2022/23 to date with €98m, earning almost twice as much as the other French representative Marseille €50m. In France they had highest prize money, UEFA coefficient and TV pool (after winning Ligue 1 last season).

French clubs’ earnings boosted by only having to split TV pool between 2 clubs after Monaco were eliminated in 3rd qualifying round, whereas other countries have to share between 4-5 clubs. Marseille earnings included only €5m UEFA coefficient, compared to hefty €30m for #PSG.

Two Portuguese clubs reached last 16 with Benfica €61m earning slightly more than Porto €60m, as unbeaten in the group stage (higher prize money), partly offset by lower UEFA coefficient. Sporting €34m a fair bit lower, as eliminated in group, exacerbated by lower coefficient.

Portuguese clubs suffer from having a very low TV pool. Eleven/TVI deal extended to 2024, but I could not find details of an increase, so have used 20/21 figures. On the other hand, benefited from introduction of the UEFA coefficient: Porto €24m, Benfica €23m & Sporting €13m.

Smaller sums received by clubs in countries outside Big Six leagues, but still drive big revenue gap between Champions League representatives and domestic rivals. Four clubs had earnings above €35m: #Ajax €44m, Club Brugge €42m, Shakhtar Donetsk €41m, & RB Salzburg €36m.

The other 4 clubs in the Champions League group stage received between €19m and €28m, due to low UEFA coefficient, TV pool and prize money. Revenue for 2022/23: FC Copenhagen €28m, Dinamo Zagreb €26m, Maccabi Haifa €22m and Viktoria Plzen €19m.

It should be emphasised that these are only estimates, including assumptions around TV pools, while final revenue will depend on progress in this season’s competition, but hopefully the analysis gives a good idea of the money that can be earned in the Champions League.

• • •

Missing some Tweet in this thread? You can try to

force a refresh