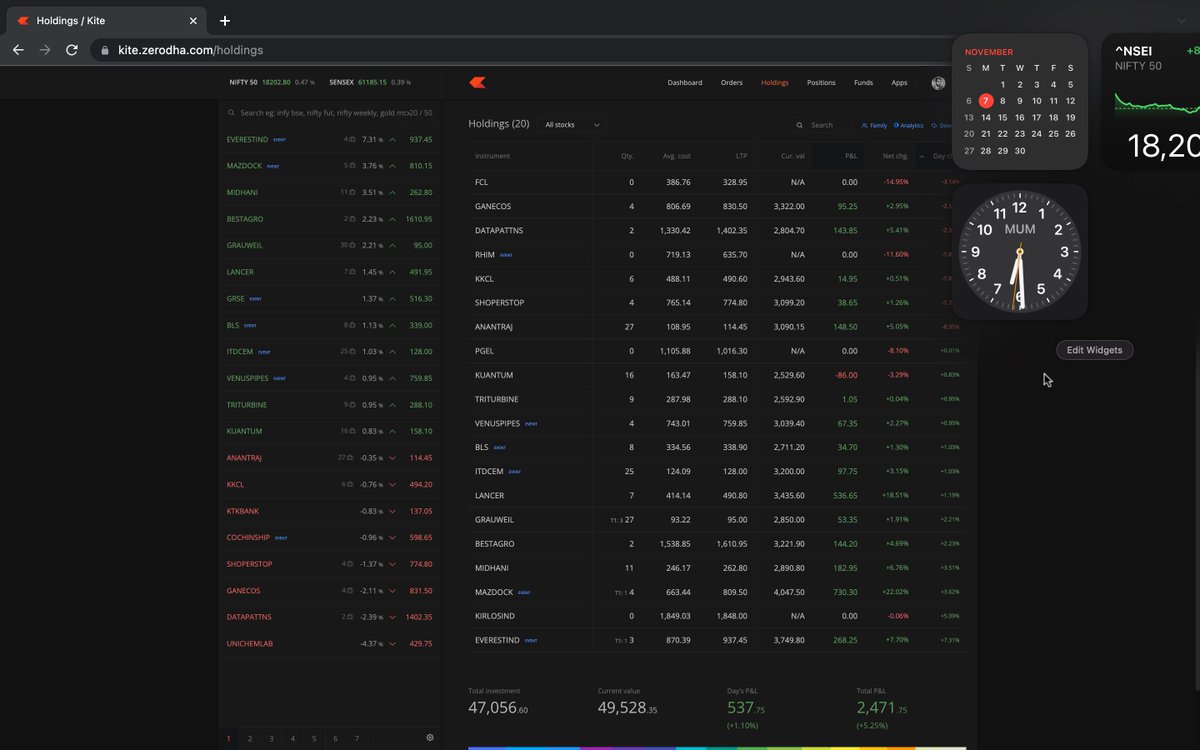

07-11-2022: #MostlyMomentum- Flexi Cap Daily Update

NO RECOMMENDATIONS!

PORTFOLIO CHANGE: 0.80% 💚

Top 3 Gainers💚:

#EVERESTIND: 7.31%

#MAZDOCK: 3.76%

#MIDHANI: 3.51%

Top 3 Losers❤️:

#UNICHEMLAB: -4.37%

#DATAPATTNS: -2.39%

#GANECOS: -2.11%

#StockMarket #Investing #Stocks

NO RECOMMENDATIONS!

PORTFOLIO CHANGE: 0.80% 💚

Top 3 Gainers💚:

#EVERESTIND: 7.31%

#MAZDOCK: 3.76%

#MIDHANI: 3.51%

Top 3 Losers❤️:

#UNICHEMLAB: -4.37%

#DATAPATTNS: -2.39%

#GANECOS: -2.11%

#StockMarket #Investing #Stocks

Current Holdings and weights:

#MAZDOCK: 6.78%

#EVERESTIND: 6.28%

#LANCER: 5.77%

#GANECOS: 5.57%

#BESTAGRO: 5.39%

#ITDCEM: 5.36%

#SHOPERSTOP: 5.19%

#ANANTRAJ: 5.17%

#VENUSPIPES: 5.09%

#KKCL: 4.96%

#MIDHANI: 4.84%

#GRAUWEIL: 4.77%

#DATAPATTNS: 4.70%

#BLS: 4.54%

#KTKBANK: 4.36%

#MAZDOCK: 6.78%

#EVERESTIND: 6.28%

#LANCER: 5.77%

#GANECOS: 5.57%

#BESTAGRO: 5.39%

#ITDCEM: 5.36%

#SHOPERSTOP: 5.19%

#ANANTRAJ: 5.17%

#VENUSPIPES: 5.09%

#KKCL: 4.96%

#MIDHANI: 4.84%

#GRAUWEIL: 4.77%

#DATAPATTNS: 4.70%

#BLS: 4.54%

#KTKBANK: 4.36%

#TRITURBINE: 4.34%

#GRSE: 4.32%

#UNICHEMLAB: 4.32%

#KUANTUM: 4.24%

#COCHINSHIP: 4.01%

AGAIN: NO RECOMMENDATIONS, JUST SHARING MY JOURNEY!

#MostlyMomentum #StockMarket #Investing #Stocks

#GRSE: 4.32%

#UNICHEMLAB: 4.32%

#KUANTUM: 4.24%

#COCHINSHIP: 4.01%

AGAIN: NO RECOMMENDATIONS, JUST SHARING MY JOURNEY!

#MostlyMomentum #StockMarket #Investing #Stocks

• • •

Missing some Tweet in this thread? You can try to

force a refresh