Amid the election today it is easy to forget we get the Oct #CPI Thursday.

#CPI is the most important economic report this week.

So where will the Oct figure print?

A thread.

1/8

#CPI is the most important economic report this week.

So where will the Oct figure print?

A thread.

1/8

In prior months my estimates were ahead of both consensus and the Cleveland #Fed.

They also turned out to be more optimistic than the actual numbers.

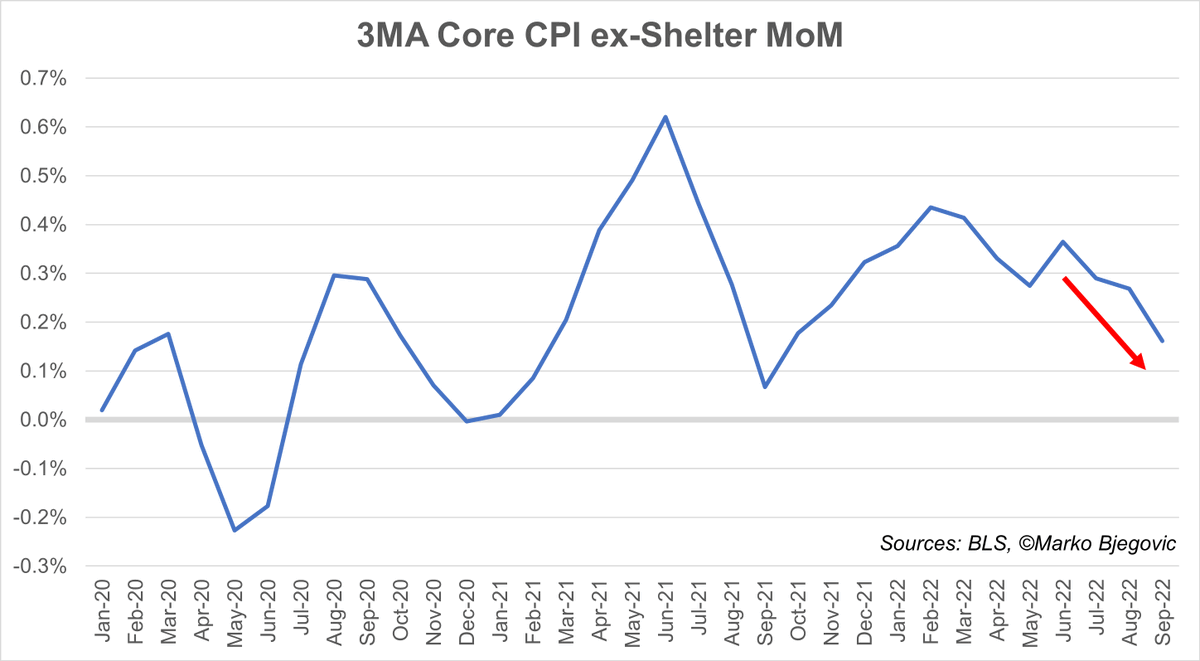

Non #CPI/#PCE indicators are showing a clear #disinflation, even MoM rent #deflation:

2/8

They also turned out to be more optimistic than the actual numbers.

Non #CPI/#PCE indicators are showing a clear #disinflation, even MoM rent #deflation:

https://twitter.com/MBjegovic/status/1582900236435206145?s=20&t=xpY86KxXCb0KfgLR3qRyLA

2/8

Rents make 32% of the #CPI (about 40% of the core #CPI) and are therefore the crucial component.

Even if we seasonally adjust them, rents are showing clear declines, the largest in at least 5 yrs:

3/8

Even if we seasonally adjust them, rents are showing clear declines, the largest in at least 5 yrs:

https://twitter.com/MBjegovic/status/1587510489579495426?s=20&t=S-kGvNgDMU6sW3MRZ6GHBA

3/8

But these rent declines have not been reflected in the #CPI.

#CPI rents can lag more than 1yr after the real rents.

Therefore #CPI is an extremely lagging indicator and it's tough to correctly predict when it will start reflecting what is already happening on the ground.

4/8

#CPI rents can lag more than 1yr after the real rents.

Therefore #CPI is an extremely lagging indicator and it's tough to correctly predict when it will start reflecting what is already happening on the ground.

4/8

If the #Fed is led by such an extremely lagging indicator like #CPI that in some ways reflects what happened 12M+ ago, it is certain they will overdo it.

And they already hiked too much just like last yr they waited too long after following the same lagging #CPI.

5/8

And they already hiked too much just like last yr they waited too long after following the same lagging #CPI.

5/8

This month my estimates are closer to consensus and the Cleveland #Fed estimates, although still a tad lower than both.

If the #CPI comes in higher than expected, I don't think that would have much impact on the #Fed's decision in Dec.

6/8

If the #CPI comes in higher than expected, I don't think that would have much impact on the #Fed's decision in Dec.

6/8

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

7/8

If you like the content, please love and retweet to help me spread the message.

7/8

If the #CPI comes in lower than expected, say below 8%, and especially if the core comes better than 6.5%, this may force the #Fed to think about a slower hike in Dec.

Worth to note they will get one more #CPI report (Nov) before they meet in Dec.

8/8

Worth to note they will get one more #CPI report (Nov) before they meet in Dec.

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh