🧵1/Ω

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

The Seven¹ Seals of #TheCryptocalypse

The signs are all around us. Read on below.

Have doubts? At least make sure you know what's actually happening out there.

RT/QT for great justice.

🂇 🂁 🔜 🁡 🁡 🁡

¹ maybe more than 7

📜👇Ω👇📜

cryptadamus.substack.com/p/the-seven-se…

🧵2/Ω

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.

I. @GenesisTrading, by far the biggest portal between Wall St. money and the crypto verse and the biggest trading desk handling the off market trading of very large amounts of money for very large amounts of crypto, is going to declare bankruptcy on Monday at 10 A.M.

🧵4/Ω

III. @Gemini, a regulated on-shore American crypto exchange considered “safe”, froze some of its users’ assets.

III. @Gemini, a regulated on-shore American crypto exchange considered “safe”, froze some of its users’ assets.

🧵5/Ω

IV. #Silvergate, one of the biggest crypto friendly banks by assets under management, is about to implode.

$SI #SilvergateBank #CryptoBank

IV. #Silvergate, one of the biggest crypto friendly banks by assets under management, is about to implode.

$SI #SilvergateBank #CryptoBank

🧵6/Ω

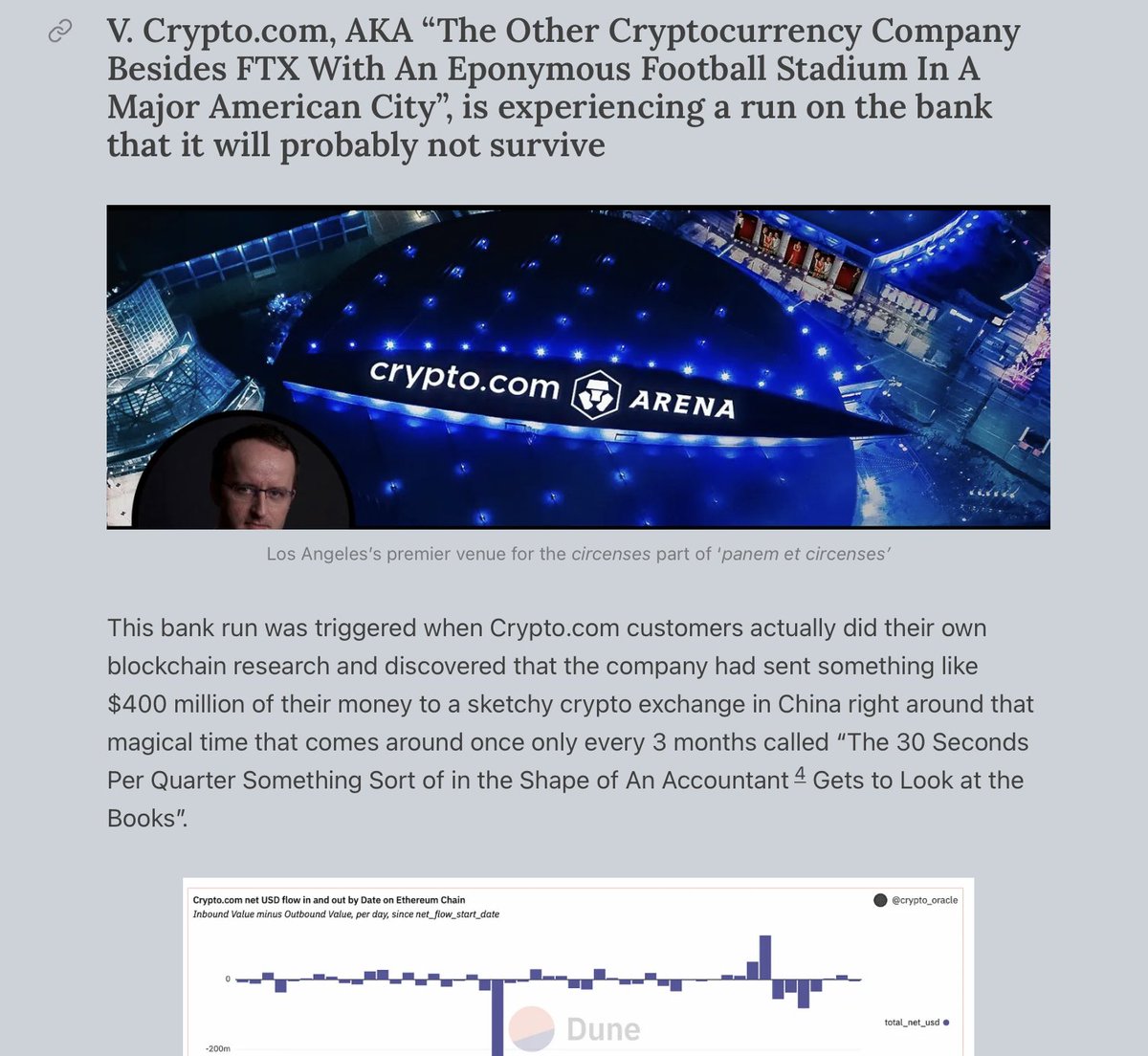

V. #Cryptocom, AKA “The Other Cryptocurrency Company Besides FTX With An Eponymous Football Stadium In A Major American City”, is experiencing a run on the bank that it will probably not survive. #Cryptodotcom

V. #Cryptocom, AKA “The Other Cryptocurrency Company Besides FTX With An Eponymous Football Stadium In A Major American City”, is experiencing a run on the bank that it will probably not survive. #Cryptodotcom

🧵7/Ω

VI. Now Even #Binance, Theoretically Backed By Almost $70 Billion (700,000 houses) of Capital, Is Headed For A #BankRun

VI. Now Even #Binance, Theoretically Backed By Almost $70 Billion (700,000 houses) of Capital, Is Headed For A #BankRun

🧵8/Ω

VII. Major Crypto Institutions Will Stop Lending To Each Other (If They Have Not Already). Both #CeFi and #DeFi will be affected

VII. Major Crypto Institutions Will Stop Lending To Each Other (If They Have Not Already). Both #CeFi and #DeFi will be affected

🧵9/Ω

VIII. Ontario Teacher’s Pension Fund #OTPP reported to have lost $95 million (950 houses) of retirees’ money in the #FTX debacle

#FTXScam #SBF_FTX

VIII. Ontario Teacher’s Pension Fund #OTPP reported to have lost $95 million (950 houses) of retirees’ money in the #FTX debacle

#FTXScam #SBF_FTX

🧵11/Ω

X. #SBF was the second biggest #Democratic donor in the country. #MitchMcConnell accepted $2.5 million (25 houses) in campaign contributions from #FTX’s #RyanSalame. Other Repubs took another $22.5 million. #Bipartisanship at its finest.

#FTXScam

X. #SBF was the second biggest #Democratic donor in the country. #MitchMcConnell accepted $2.5 million (25 houses) in campaign contributions from #FTX’s #RyanSalame. Other Repubs took another $22.5 million. #Bipartisanship at its finest.

#FTXScam

🧵12/Ω

#ElSalvador is headed towards default on its sovereign debt in January 2023.

But who is gonna bet against #TheWorldsCoolestDictator, @nayibbukele?

#ElSalvador is headed towards default on its sovereign debt in January 2023.

But who is gonna bet against #TheWorldsCoolestDictator, @nayibbukele?

🧵13/Ω

XII. A Message For Those Who Say “Nobody Could Have Known!” When Asked Why They Sold Their Souls to Psychopaths at a Discount Rate:

You ain't gang.

XII. A Message For Those Who Say “Nobody Could Have Known!” When Asked Why They Sold Their Souls to Psychopaths at a Discount Rate:

You ain't gang.

🧵14/Ω

#TheCryptocalypse is at our doorsteps...

Read the whole thing (there's even more gory details) at Substack and strap yourself in for an historic event in the next couple months...

#OrMaybeMonday

cryptadamus.substack.com/p/the-seven-se…

#TheCryptocalypse is at our doorsteps...

Read the whole thing (there's even more gory details) at Substack and strap yourself in for an historic event in the next couple months...

#OrMaybeMonday

cryptadamus.substack.com/p/the-seven-se…

• • •

Missing some Tweet in this thread? You can try to

force a refresh