1/ What is LandX ($LNDX)? How does it work? How does it bring sustainable yields, and how does it overall increase financial inclusivity? Today’s #visualguide, in collaboration with @landxfinance, will answer all the above questions.

#DeFi #RealYield #RealFi #Agriculture

#DeFi #RealYield #RealFi #Agriculture

2/ You’re probably not that familiar with the problems of traditional farmland financing. The difficulty and opaqueness of the process hinders the farmer’s maximum productivity.

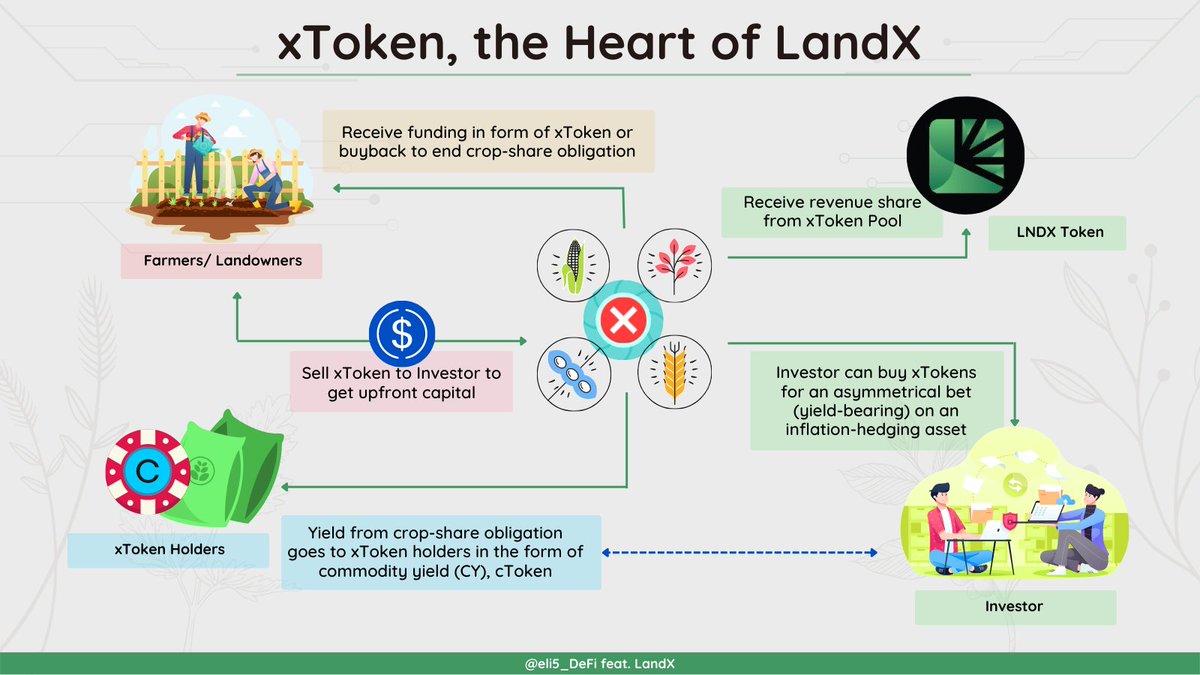

3/ @landxfinance involves three main actors: (1) investors, (2) validators and (3) farmers/landowners. Validators act as a bridge between (1) and (3), investors are those who seek exposure to yield-bearing commodities.

4/ The perpetual #commodity vault. As long as you keep your xTokens staked, you will receive yield on it. Perpetually.

5/ Holding 1 xToken would #yield you 1kg of the underlying commodity (1 cToken) within a year. When you redeem your cTokens, it automatically gets converted into $USDC. The yield is there, from the #crop, secured via a lien.

7/ Upon agreement, farmers receive a tokenized version (#NFT) of their lien. This NFT can be redeemed into xTokens (equivalent to annual #yield amount), vice versa. Farmers receive a salable #token (capital) within a few steps.

8/ Validators are the key bridge between the #crypto-realm and the real-world. They assist in the whole bridging process: sourcing, vetting, originations, etc.

9/ As a yield-bearing asset that happens to be inflation-hedging, holding xTokens’ #yield would increase upside whilst protecting downside, an asymmetrical bet.

11/ They’re en route to releasing their own stablecoin, xUSD. It would be collateralized by xBasket (index of supported commodities) with a $USDC reserve. The yield-bearing nature of xBasket enables #revenue-sharing and strengthens the collateral ratio.

13/ Tagged fellow #RealYield #DeFi Farmers:

@NickDrakon

@blocmatesdotcom

@DAdvisoor

@ViktorDefi

@cyrilXBT

@crypto_linn

@crypthoem

@kindahangry

@0xWalker00

@DeFi_Dad

@TokenBrice

@DaoChemist

@Abrahamchase09

@takegreenpill

@NickDrakon

@blocmatesdotcom

@DAdvisoor

@ViktorDefi

@cyrilXBT

@crypto_linn

@crypthoem

@kindahangry

@0xWalker00

@DeFi_Dad

@TokenBrice

@DaoChemist

@Abrahamchase09

@takegreenpill

14/ Also tagged amazing #DeFi educator account

@byChadManDan

@blocmatesdotcom

@archipelabro

@apolynya

@SalomonCrypto

@shivsakhuja

@mimiLFG

@ManoppoMarco

@Dynamo_Patrick

@rektdiomedes

@knowerofmarkets

@MeetWawa

@CryptoDragonite

@BarryFried1

@The_ReadingApe

@VirtualKenji

@byChadManDan

@blocmatesdotcom

@archipelabro

@apolynya

@SalomonCrypto

@shivsakhuja

@mimiLFG

@ManoppoMarco

@Dynamo_Patrick

@rektdiomedes

@knowerofmarkets

@MeetWawa

@CryptoDragonite

@BarryFried1

@The_ReadingApe

@VirtualKenji

@byChadManDan @blocmatesdotcom @archipelabro @apolynya @SalomonCrypto @shivsakhuja @mimiLFG @ManoppoMarco @Dynamo_Patrick @rektdiomedes @knowerofmarkets @MeetWawa @CryptoDragonite @BarryFried1 @The_ReadingApe @VirtualKenji If you love our thread please like, retweet and turn on the notifications. Thank you and see you in the next #visualguide!

https://twitter.com/eli5_defi/status/1594929013566615552?s=20&t=qVGYgUEIfRrWnI2kpziNNQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh