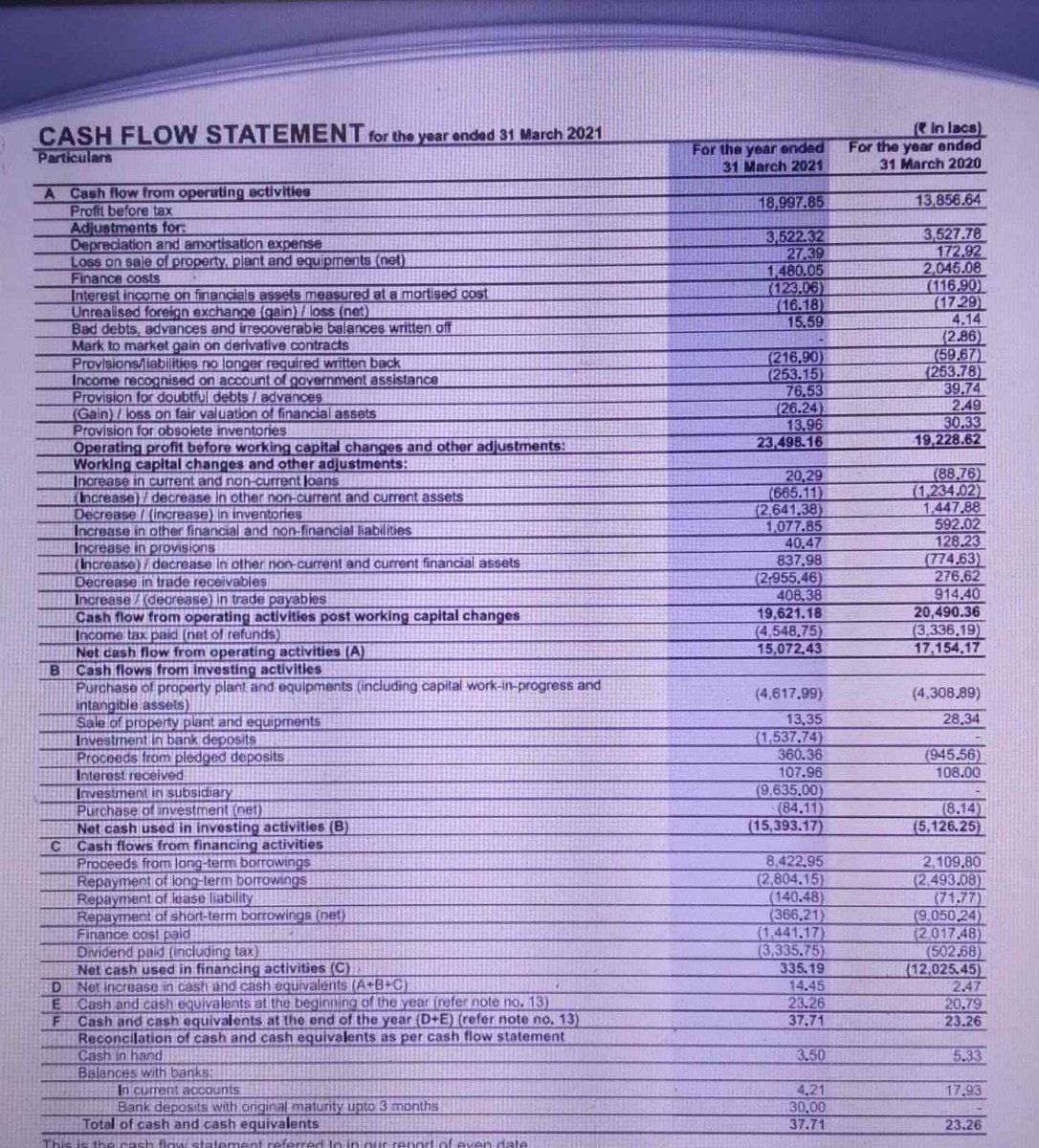

Cash Flow Statement Analysis in Simple language.

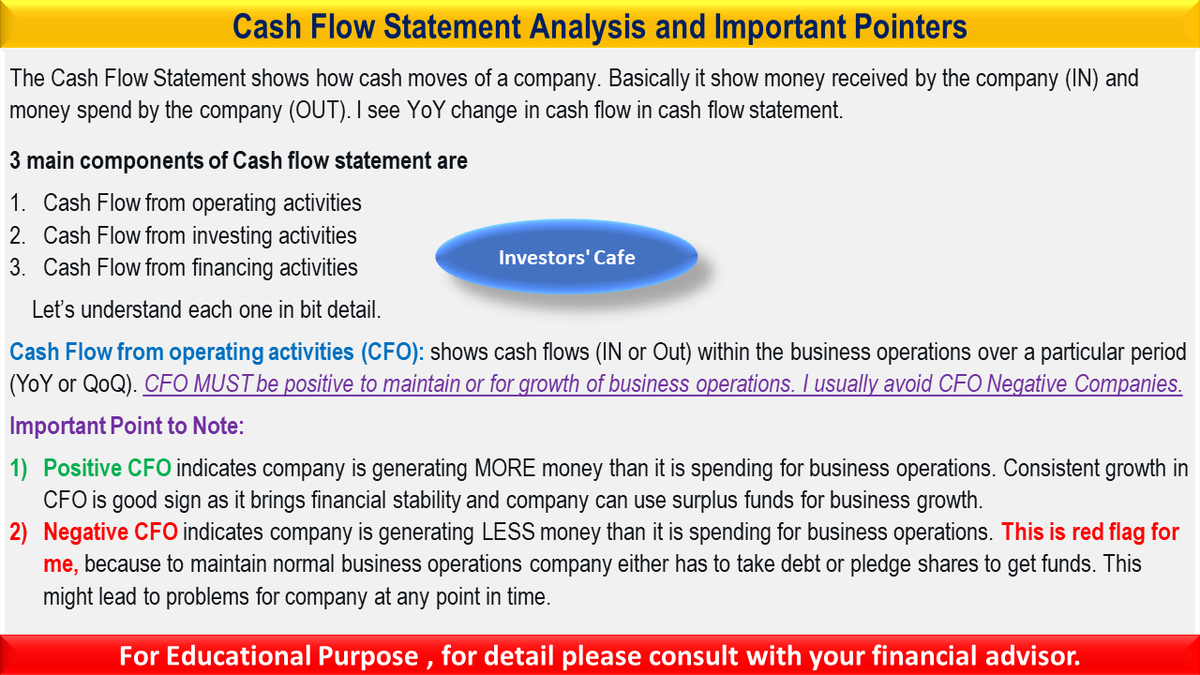

Types of Cash Flow, Cash Flow From Operating Activities and Important Pointers for Investors👇

1/5 , 🧵🧵🧵🧵🧵Thread of 5 tweets, read all , 🏁🏁RT for others

#StockMarket #investing #StocksToBuy #StockMarketindia #stocks

Types of Cash Flow, Cash Flow From Operating Activities and Important Pointers for Investors👇

1/5 , 🧵🧵🧵🧵🧵Thread of 5 tweets, read all , 🏁🏁RT for others

#StockMarket #investing #StocksToBuy #StockMarketindia #stocks

Cash Flow From Financing Activities and

Free Cash Flow and Important Pointers for investors

Where to See Company's Cash Flow Statement 👇

3/5

Free Cash Flow and Important Pointers for investors

Where to See Company's Cash Flow Statement 👇

3/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh