This week we get the 2 most important things that will end this year:

1) FOMC meeting on Wednesday

2) November #CPI report tomorrow that will likely determine what we'll hear by the #Fed on Wednesday

Can Nov #CPI make the #Fed go sub-50 this week?

A thread.

1/11

1) FOMC meeting on Wednesday

2) November #CPI report tomorrow that will likely determine what we'll hear by the #Fed on Wednesday

Can Nov #CPI make the #Fed go sub-50 this week?

A thread.

1/11

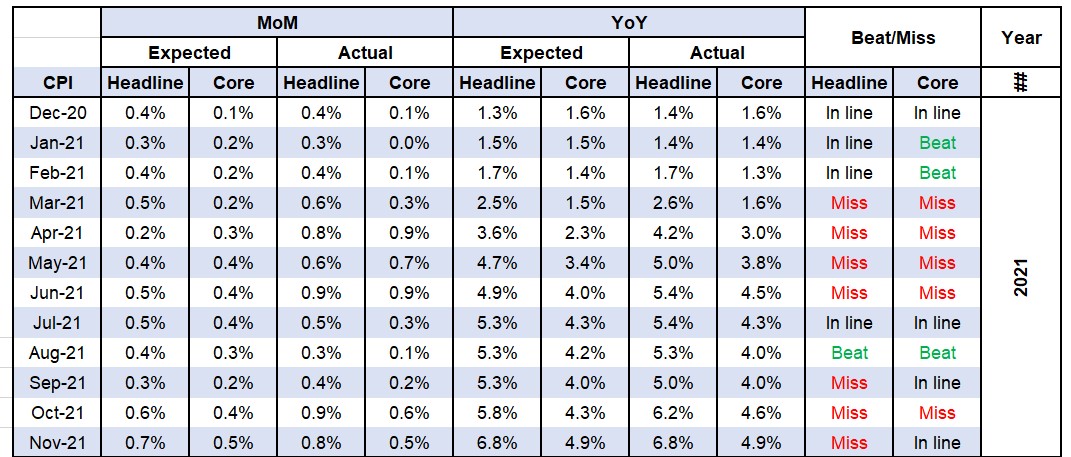

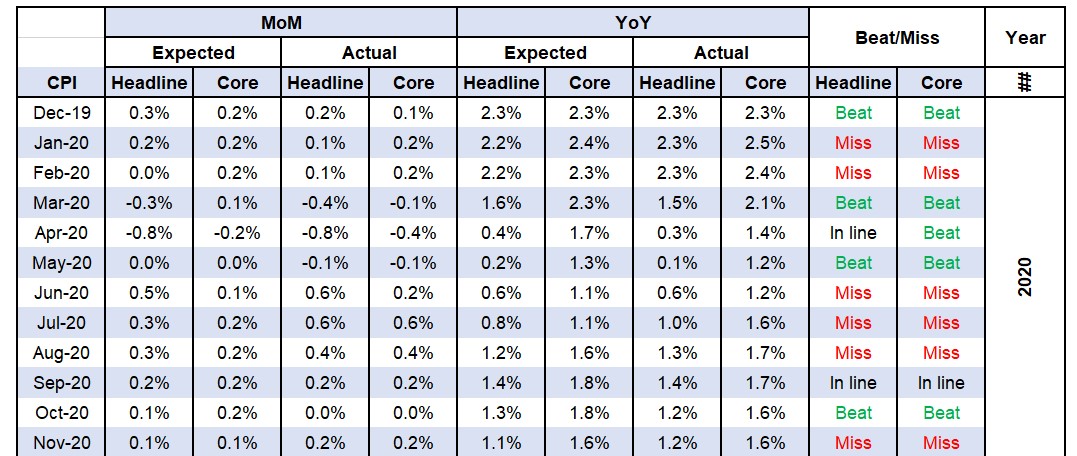

We had a better-than-expected #CPI in Oct which was only the 2nd beat on the headline, and 3rd beat on the core this yr.

Since beats on the #CPI have been so rare, many (among which @biancoresearch) have been using it as an argument against potential beat again in Nov.

2/11

Since beats on the #CPI have been so rare, many (among which @biancoresearch) have been using it as an argument against potential beat again in Nov.

2/11

OTOH rare beats look more like an argument FOR rather than an argument against another beat.

Just based on this, now odds are stacked for the #CPI to come better-than-expected in the coming months.

But does that include Nov?

3/11

Just based on this, now odds are stacked for the #CPI to come better-than-expected in the coming months.

But does that include Nov?

3/11

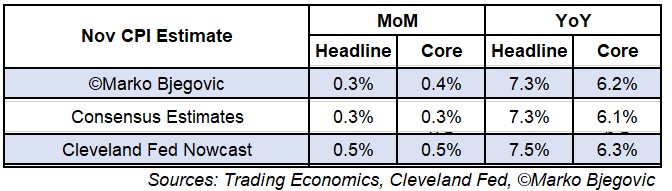

Given the beat in Oct, consensus estimates are pushed lower in Nov.

For the first time since disinflationary process began in June this yr, I have higher core #CPI estimates (+0.4%) than consensus (+0.3%).

My headline #CPI estimates are in line with consensus (+0.3%).

4/11

For the first time since disinflationary process began in June this yr, I have higher core #CPI estimates (+0.4%) than consensus (+0.3%).

My headline #CPI estimates are in line with consensus (+0.3%).

4/11

Still, there is room for the #CPI to come better than my expectations.

If we see one, a positive surprise would probably come in the core components like:

1) Apparel - I project a swift return to positive MoM after -0.6% in Oct and continued decline would be a surprise

5/11

If we see one, a positive surprise would probably come in the core components like:

1) Apparel - I project a swift return to positive MoM after -0.6% in Oct and continued decline would be a surprise

5/11

2) Alcoholic beverages - sharp rise to +0.8% MoM in Oct (+0.1% in Sep); I expect the MoM gain to continue but a lower gain/decline would be a surprise

3) Medical care services - a sharp expected decline of -0.5% MoM in Oct but higher decline in Nov would be a surprise

6/11

3) Medical care services - a sharp expected decline of -0.5% MoM in Oct but higher decline in Nov would be a surprise

6/11

4) Transportation services - I expect the strong gains to continue but any sub-1% gain/decline would be a surprise

With possible surprises we could easily see only +0.2% for the core and +0.1% MoM for the headline #CPI.

So what does all that mean for the #Fed?

7/11

With possible surprises we could easily see only +0.2% for the core and +0.1% MoM for the headline #CPI.

So what does all that mean for the #Fed?

7/11

Most keep saying 50 bps hike this week is baked in.

50 is baked in only if the #CPI comes in line or higher than expected.

This is where I expect it to be (in line for the headline and slightly higher for the core).

8/11

50 is baked in only if the #CPI comes in line or higher than expected.

This is where I expect it to be (in line for the headline and slightly higher for the core).

8/11

That being said, there is certainly a viable possibility for the #CPI to surprise on the downside for the 2nd time in a row.

In that case the #Fed could consider a lower 25 bps hike at this week's meeting.

Would that be the end of the #Fed's hiking and intro to a #pivot?

9/11

In that case the #Fed could consider a lower 25 bps hike at this week's meeting.

Would that be the end of the #Fed's hiking and intro to a #pivot?

9/11

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

10/11

If you like the content, please love and retweet to help me spread the message.

10/11

I don't think the #Fed is worried by #inflation but is using it to cover some other agenda.

I'm gonna talk more about that agenda, how to know when the #Fed will #pivot and where economy and mkts are headed in the 2023 in my

2nd workshop this Thursday Dec 15 at 11 am ET.

11/11

I'm gonna talk more about that agenda, how to know when the #Fed will #pivot and where economy and mkts are headed in the 2023 in my

2nd workshop this Thursday Dec 15 at 11 am ET.

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh