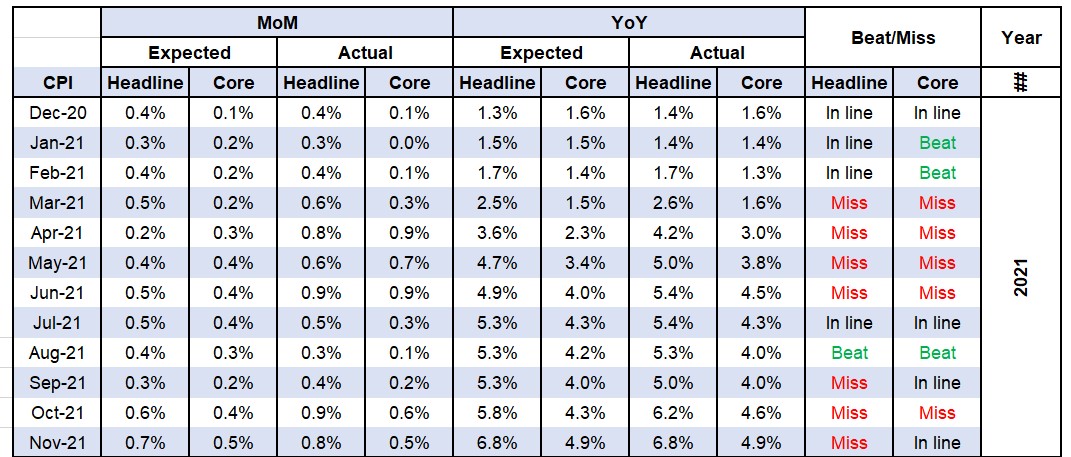

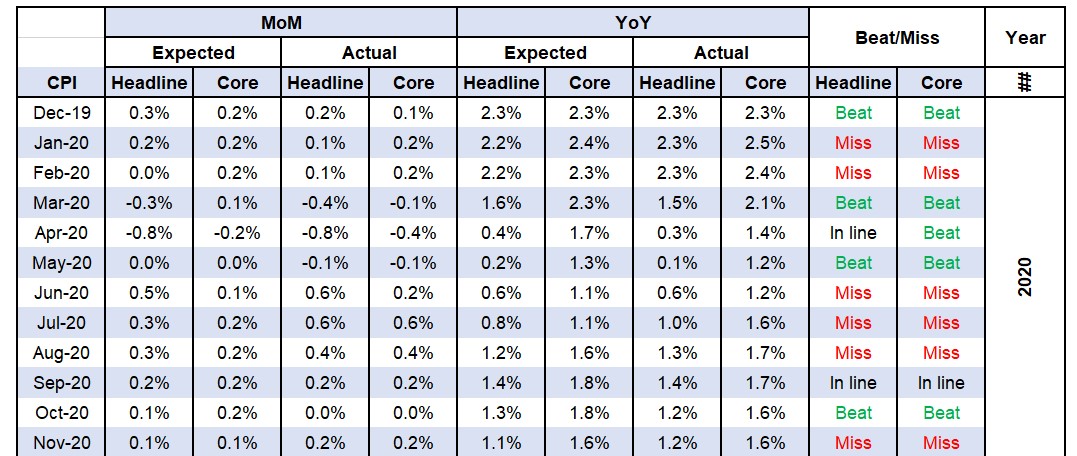

Nov #CPI was the 2nd better-than-expected report in a row.

The last time that happened was, prepare yourself, in Oct 2018!

It didn't even happen during the lockdowns in 2020 making this report all the more significant.

Let's delve deeper.

A thread.

1/15

The last time that happened was, prepare yourself, in Oct 2018!

It didn't even happen during the lockdowns in 2020 making this report all the more significant.

Let's delve deeper.

A thread.

1/15

On an unadjusted basis headline #CPI was down -0.1% MoM, the lowest MoM reading since April 2020!

Back then the economy was on forced lockdown and this is only second to that lowest 2 readings (Mar-Apr 2020) in the recent history.

2/15

Back then the economy was on forced lockdown and this is only second to that lowest 2 readings (Mar-Apr 2020) in the recent history.

2/15

3M moving average of headline #CPI (MoM unadjusted) is 0.17% which is 2.1% annualized, well BELOW the #Fed's #inflation target.

I already explained this but for the ones that are reading this for the first time, yes, you read that right - 2.1% #CPI is way below the target

3/15

I already explained this but for the ones that are reading this for the first time, yes, you read that right - 2.1% #CPI is way below the target

3/15

Before I explain it, let me say that 3M moving average of headline #CPI (MoM annualized) has been BELOW the #Fed's #inflation target SINCE Sep 2022.

Now, the #Fed targets 2% core #PCE, not #CPI like some have mistakenly thought, which is consistent with 3.3% #CPI (LT avg).

4/15

Now, the #Fed targets 2% core #PCE, not #CPI like some have mistakenly thought, which is consistent with 3.3% #CPI (LT avg).

4/15

In the details this report shows #disinflation/ #deflation) across the board. MoM unadjusted:

1) Food only +0.2% after +0.7% in Oct

2) Energy -2.5% after +1.0% in Oct:

a) gas -3.6% vs +3.1% in Oct

b) #electricity -1.2% vs -1.3% in Oct

c) #natgas -2.2% vs -4.0% in Oct

5/15

1) Food only +0.2% after +0.7% in Oct

2) Energy -2.5% after +1.0% in Oct:

a) gas -3.6% vs +3.1% in Oct

b) #electricity -1.2% vs -1.3% in Oct

c) #natgas -2.2% vs -4.0% in Oct

5/15

3) Apparel accelerated its decline from Oct (-0.6%) to -2.1%

4) New vehicles went up only marginally (+0.1% vs +0.5% in Oct)

5) Used vehicles and trucks - 2.8% vs -2.3% in Oct

6) Medical care commodities +0.2% vs -0.0% in Oct

7) Alcoholic beverages +0.6% vs +0.8% in Oct

6/15

4) New vehicles went up only marginally (+0.1% vs +0.5% in Oct)

5) Used vehicles and trucks - 2.8% vs -2.3% in Oct

6) Medical care commodities +0.2% vs -0.0% in Oct

7) Alcoholic beverages +0.6% vs +0.8% in Oct

6/15

8) Tobacco +0.7% vs +0.3% in Oct

9) Shelter +0.58% vs +0.66% in Oct

10) Medical services accelerated the decline from Oct (-0.5%) to -0.7%

11) Transportation services +0.3% vs +1.2% in Oct

Only Medical care commodities and Tobacco accelerated but they only make 2% of #CPI.

7/15

9) Shelter +0.58% vs +0.66% in Oct

10) Medical services accelerated the decline from Oct (-0.5%) to -0.7%

11) Transportation services +0.3% vs +1.2% in Oct

Only Medical care commodities and Tobacco accelerated but they only make 2% of #CPI.

7/15

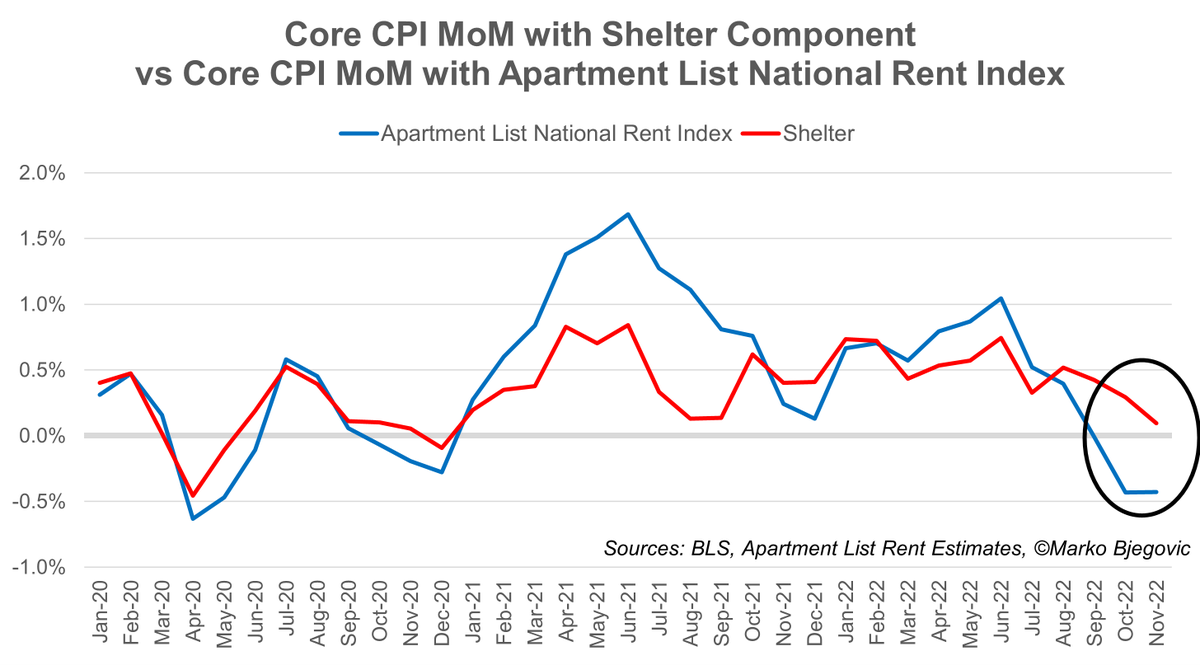

Shelter remains the most important component making 32.7% of the whole #CPI and 41.8% of the core #CPI.

Unadjusted MoM increase in Shelter (+0.58%) is the lowest since July (+0.56%).

But rent #inflation has actually been negative since Sep.

8/15

Unadjusted MoM increase in Shelter (+0.58%) is the lowest since July (+0.56%).

But rent #inflation has actually been negative since Sep.

https://twitter.com/MBjegovic/status/1597938566277267456?s=20&t=X8TV5Cv8lrITa92qfa9B6w

8/15

If we swap the #CPI shelter component with the Apartment List National Rent Index, adjusted core #CPI is DOWN -0.43% in Nov, the same as it was in Oct.

The same figure was -0.01% in Sep so this marks the 3rd consecutive M of negative adjusted core #CPI.

9/15

The same figure was -0.01% in Sep so this marks the 3rd consecutive M of negative adjusted core #CPI.

9/15

To recap, 3M moving average #CPI (MoM unadjusted) has been below the #Fed's target since Sep.

Also since Sep adjusted core #CPI (Shelter swapped with Apartment List National Rent Index) has been negative MoM.

This is why I'd been calling for the #Fed to pause in Sep.

10/15

Also since Sep adjusted core #CPI (Shelter swapped with Apartment List National Rent Index) has been negative MoM.

This is why I'd been calling for the #Fed to pause in Sep.

10/15

Now figures show the #Fed unnecessarily continued hiking in Sep and beyond (+150 bps so far and counting) only creating economic damage, with #inflation already being way down.

All of the mentioned calls for the #Fed to immediately cut at their meeting tomorrow.

11/15

All of the mentioned calls for the #Fed to immediately cut at their meeting tomorrow.

11/15

However I don't think they'll do what is needed but will probably do more damage by continued hiking.

With 2 better-than-expected #CPI reports in the row, I think we still have some chance for that lower 25 bps hike tomorrow (although that's not currently priced in).

12/15

With 2 better-than-expected #CPI reports in the row, I think we still have some chance for that lower 25 bps hike tomorrow (although that's not currently priced in).

12/15

That being said, I'll repeat the #Fed has had other agenda and has been using #inflation (and wrongly calling it "high" and "sticky") as and alibi to cover that agenda.

So what other agenda does the #Fed have?

13/15

So what other agenda does the #Fed have?

13/15

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

14/15

If you like the content, please love and retweet to help me spread the message.

14/15

I'm gonna talk about the #Fed's other agenda as well as how to know when the #Fed will actually #pivot and where the economy and the mkts are going in 2023 in my

2nd Workshop on Thursday Dec 15 at 11 am.

DM me to secure your spot!

15/15

2nd Workshop on Thursday Dec 15 at 11 am.

DM me to secure your spot!

15/15

I'd really use that edit button now, it's not Oct 2018 but Sep Oct!

• • •

Missing some Tweet in this thread? You can try to

force a refresh