@solana gets a lot of FUD – people say its centralized, tainted by SBF, etc…

I think that’s bullshit

The platform continues to build and it has one competitive advantage that NO ONE ELSE CAN MATCH

Here's why $SOL has the potential to 100x-1,000x

I think that’s bullshit

The platform continues to build and it has one competitive advantage that NO ONE ELSE CAN MATCH

Here's why $SOL has the potential to 100x-1,000x

2/

Solana is one of the largest #Layer1 s by market cap, TVL in #DeFi and #NFT sales (we will explain all these concepts in a bit)

It has a MC of $4.6BM, FDV of $6.7B, and its $SOL coin trades at $12.45

In 2021, the coin price hit $260.06

Solana is one of the largest #Layer1 s by market cap, TVL in #DeFi and #NFT sales (we will explain all these concepts in a bit)

It has a MC of $4.6BM, FDV of $6.7B, and its $SOL coin trades at $12.45

In 2021, the coin price hit $260.06

3/

This thread will cover the following:

• What is a Layer1?

• What problem does #Solana solve?

• How does it work?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of #SOL?

This thread will cover the following:

• What is a Layer1?

• What problem does #Solana solve?

• How does it work?

• Who are the key players in the ecosystem?

• What are its #tokenomics?

• What’s the potential value of #SOL?

4/

🔶 What are Layer 1s?

Layer 1s (L1s) are the computers that run #Web3

Like most computers, they can run programs and host applications

Unlike traditional computer networks, they i) can’t be shut down, ii) aren’t controlled by any one entity and iii) anyone can use them

🔶 What are Layer 1s?

Layer 1s (L1s) are the computers that run #Web3

Like most computers, they can run programs and host applications

Unlike traditional computer networks, they i) can’t be shut down, ii) aren’t controlled by any one entity and iii) anyone can use them

5/

🔶 Problem

Ethereum is the dominant Layer 1, but it has a major problem – it’s slow and expensive

For much of 2022, average fees were in the range of $10 — $30 per transaction (and sometimes were in the thousands!)

🔶 Problem

Ethereum is the dominant Layer 1, but it has a major problem – it’s slow and expensive

For much of 2022, average fees were in the range of $10 — $30 per transaction (and sometimes were in the thousands!)

6/

🔶 Solution

As such, in 2021 a set of “alternative L1s” started to emerge to challenge Ethereum’s dominance with higher throughput, faster speeds and cheaper transactions

Some of the most prominent include BNB, Avalanche, Cardano, Polkadot and – of course – Solana

🔶 Solution

As such, in 2021 a set of “alternative L1s” started to emerge to challenge Ethereum’s dominance with higher throughput, faster speeds and cheaper transactions

Some of the most prominent include BNB, Avalanche, Cardano, Polkadot and – of course – Solana

7/

🔶 Protocol Overview

Founded by former Qualcomm, Intel, and Dropbox engineers in 2017, #Solana is a single-chain, dPoS protocol whose focus is on delivering scalability without sacrificing decentralization or security

It is currently the 6th largest #L1 by market cap

🔶 Protocol Overview

Founded by former Qualcomm, Intel, and Dropbox engineers in 2017, #Solana is a single-chain, dPoS protocol whose focus is on delivering scalability without sacrificing decentralization or security

It is currently the 6th largest #L1 by market cap

8/

Like most Layer1s, the $SOL “computer” can handle a variety of functions including:

• #NFT trading

• #DeFi

• Payments

• Gaming

• #DAO s

Let’s look at each

Like most Layer1s, the $SOL “computer” can handle a variety of functions including:

• #NFT trading

• #DeFi

• Payments

• Gaming

• #DAO s

Let’s look at each

9/

🔹 NFTs

#SOL currently hosts over 20M #NFTs with a combined value of nearly $1B.

Notable projects include @DegenApeAcademy, @cryptokickers and @SolanaMBS

Key marketplaces on Solana include @MagicEden, @SolanartNFT and @SolSeaNFT

🔹 NFTs

#SOL currently hosts over 20M #NFTs with a combined value of nearly $1B.

Notable projects include @DegenApeAcademy, @cryptokickers and @SolanaMBS

Key marketplaces on Solana include @MagicEden, @SolanartNFT and @SolSeaNFT

10/

🔹 DeFi

At its peak, the protocol currently held over $11B locked in #DeFi, generated an average of 430M of volume every 24 hours and boasted an average transaction fee of $0.18

#SOL has over 156 DeFi protocols including @MarinadeFinance, @orca_so and @RaydiumProtocol

🔹 DeFi

At its peak, the protocol currently held over $11B locked in #DeFi, generated an average of 430M of volume every 24 hours and boasted an average transaction fee of $0.18

#SOL has over 156 DeFi protocols including @MarinadeFinance, @orca_so and @RaydiumProtocol

11/

🔹 Payments

Solana’s high #TPS and low transaction fees ($0.00025) make it an ideal fit as a payments channel

There is over $4B in USDC in circulation on the network and > 280K active accounts

Solana’s payment channel is used by @Checkout, @circle, @Kytpay and others

🔹 Payments

Solana’s high #TPS and low transaction fees ($0.00025) make it an ideal fit as a payments channel

There is over $4B in USDC in circulation on the network and > 280K active accounts

Solana’s payment channel is used by @Checkout, @circle, @Kytpay and others

12/

🔹 Gaming

$SOL is building a robust presence in gaming. Notable titles include:

• @zepeto_official

• @MiniNations

• @staratlas

• @AuroryProject

• @panzerdogs

🔹 Gaming

$SOL is building a robust presence in gaming. Notable titles include:

• @zepeto_official

• @MiniNations

• @staratlas

• @AuroryProject

• @panzerdogs

13/

🔹 DAOs

#SOL 's high throughput, low latency and low fees ($0.0025) make it an ideal fit for decentralized governance

To date, 140 DAOs have been created on Solana with $1B in AUM

Major DAOs include Star Atlas DAO, Mango DAO and @MonkeDAO

🔹 DAOs

#SOL 's high throughput, low latency and low fees ($0.0025) make it an ideal fit for decentralized governance

To date, 140 DAOs have been created on Solana with $1B in AUM

Major DAOs include Star Atlas DAO, Mango DAO and @MonkeDAO

14/

🔶 How does it work?

#Solana is a “monochain” network - it executes all of the major functions of an #L1 on a single blockchain:

• Security

• Data

• Execution

Most L1s have abandoned monochain structures in favor of “modular” ones as they’re considered faster

🔶 How does it work?

#Solana is a “monochain” network - it executes all of the major functions of an #L1 on a single blockchain:

• Security

• Data

• Execution

Most L1s have abandoned monochain structures in favor of “modular” ones as they’re considered faster

15/

Like adding lanes to a highway, splitting a blockchain into multiple chains allows it to handle a lot more transactions and therefore run at a much faster speed

That’s why nearly every #L1 today uses a modular structure, and Ethereum is migrating to one as well

Like adding lanes to a highway, splitting a blockchain into multiple chains allows it to handle a lot more transactions and therefore run at a much faster speed

That’s why nearly every #L1 today uses a modular structure, and Ethereum is migrating to one as well

16/

Solana has taken a different approach though, using a concept known as “Proof-of-History”

#PoH acts as a “decentralized clock”, automatically ordering all transactions

(arranging transactions correctly is one of the hardest things for a decentralized network to do)

Solana has taken a different approach though, using a concept known as “Proof-of-History”

#PoH acts as a “decentralized clock”, automatically ordering all transactions

(arranging transactions correctly is one of the hardest things for a decentralized network to do)

17/

Proof of History allows Solana to be unbelievably fast and cheap - boasting a theoretical TPS of 65,000 to 710,000 and fees under $0.00019 - WITHOUT sacrificing its monochain architecture

As we will soon see, this may prove to be a major long-term competitive advantage

Proof of History allows Solana to be unbelievably fast and cheap - boasting a theoretical TPS of 65,000 to 710,000 and fees under $0.00019 - WITHOUT sacrificing its monochain architecture

As we will soon see, this may prove to be a major long-term competitive advantage

18/

🔶 Competitive Advantage

#Solana boasts several unique benefits including

• Cost

• Speed

• Scalability

• Composability

• Decentralization

Let’s explore each

🔶 Competitive Advantage

#Solana boasts several unique benefits including

• Cost

• Speed

• Scalability

• Composability

• Decentralization

Let’s explore each

19/

🔹 Cost

$SOL is the cheapest major chain with average transaction fees of $0.00019

This makes it an ideal #blockchain for high-volume use cases such as:

• Micropayments

• Remittance payments

• Gaming

🔹 Cost

$SOL is the cheapest major chain with average transaction fees of $0.00019

This makes it an ideal #blockchain for high-volume use cases such as:

• Micropayments

• Remittance payments

• Gaming

20/

🔹 Speed

#SOL 's maximum TPS is estimated to be anywhere from 65K to 750K and it has consistently proven real world speeds of 3,500

Unlike ETH, transactions on Solana are almost instantaneous (400ms)

This seamless UX is essential to recreating the Web 2.0 feel on Web3

🔹 Speed

#SOL 's maximum TPS is estimated to be anywhere from 65K to 750K and it has consistently proven real world speeds of 3,500

Unlike ETH, transactions on Solana are almost instantaneous (400ms)

This seamless UX is essential to recreating the Web 2.0 feel on Web3

21/

🔹 Scalability

Solana has proven its ability to scale

The network processes more transactions than all other L1s combined

Even when voting transactions are removed, Solana is doing 7x more transactions than its closest competitor

🔹 Scalability

Solana has proven its ability to scale

The network processes more transactions than all other L1s combined

Even when voting transactions are removed, Solana is doing 7x more transactions than its closest competitor

22/

🔹 Composability

Solana is unique among L1s in that it has chosen to retain its single-chain structure

While critics argue that so called monochains are inferior and risk becoming irrelevant, this might ultimately prove to be Solana’s biggest long-term advantage

🔹 Composability

Solana is unique among L1s in that it has chosen to retain its single-chain structure

While critics argue that so called monochains are inferior and risk becoming irrelevant, this might ultimately prove to be Solana’s biggest long-term advantage

23/

Monochains allow for very efficient communication between dapps and may be able to support products and uses cases - such as flash loans – that wouldn’t be possible in a modular architecture

Monochains allow for very efficient communication between dapps and may be able to support products and uses cases - such as flash loans – that wouldn’t be possible in a modular architecture

24/

🔹 Decentralization

While #SOL is often criticized as being a “centralized” chain due to high ownership by VCs, its Nakamoto Coefficient is actually one of the highest of all L1s

(the Nakamoto Coefficient measures the minimum # of validators required to halt the network)

🔹 Decentralization

While #SOL is often criticized as being a “centralized” chain due to high ownership by VCs, its Nakamoto Coefficient is actually one of the highest of all L1s

(the Nakamoto Coefficient measures the minimum # of validators required to halt the network)

25/

The network is also becoming more decentralized over time

The cost of running a node has decreased significantly, allowing $SOL to continue to add validators

The network is also becoming more decentralized over time

The cost of running a node has decreased significantly, allowing $SOL to continue to add validators

26/

🔶 Traction

#Solana has achieved significant traction across a variety of metrics:

• Robust ecosystem of dapps

• High market share in NFTs

• Strong community

• High developer activity

• Significant mindshare

Let’s explore each below:

🔶 Traction

#Solana has achieved significant traction across a variety of metrics:

• Robust ecosystem of dapps

• High market share in NFTs

• Strong community

• High developer activity

• Significant mindshare

Let’s explore each below:

27/

🔹 Robust Ecosystem of dApps

Solana has built a robust ecosystem of over 500 dapps across a variety of use cases

While growth and market share has recently declined, the project showed incredible transaction in 2021, growing to almost $12B in TVL

🔹 Robust Ecosystem of dApps

Solana has built a robust ecosystem of over 500 dapps across a variety of use cases

While growth and market share has recently declined, the project showed incredible transaction in 2021, growing to almost $12B in TVL

28/

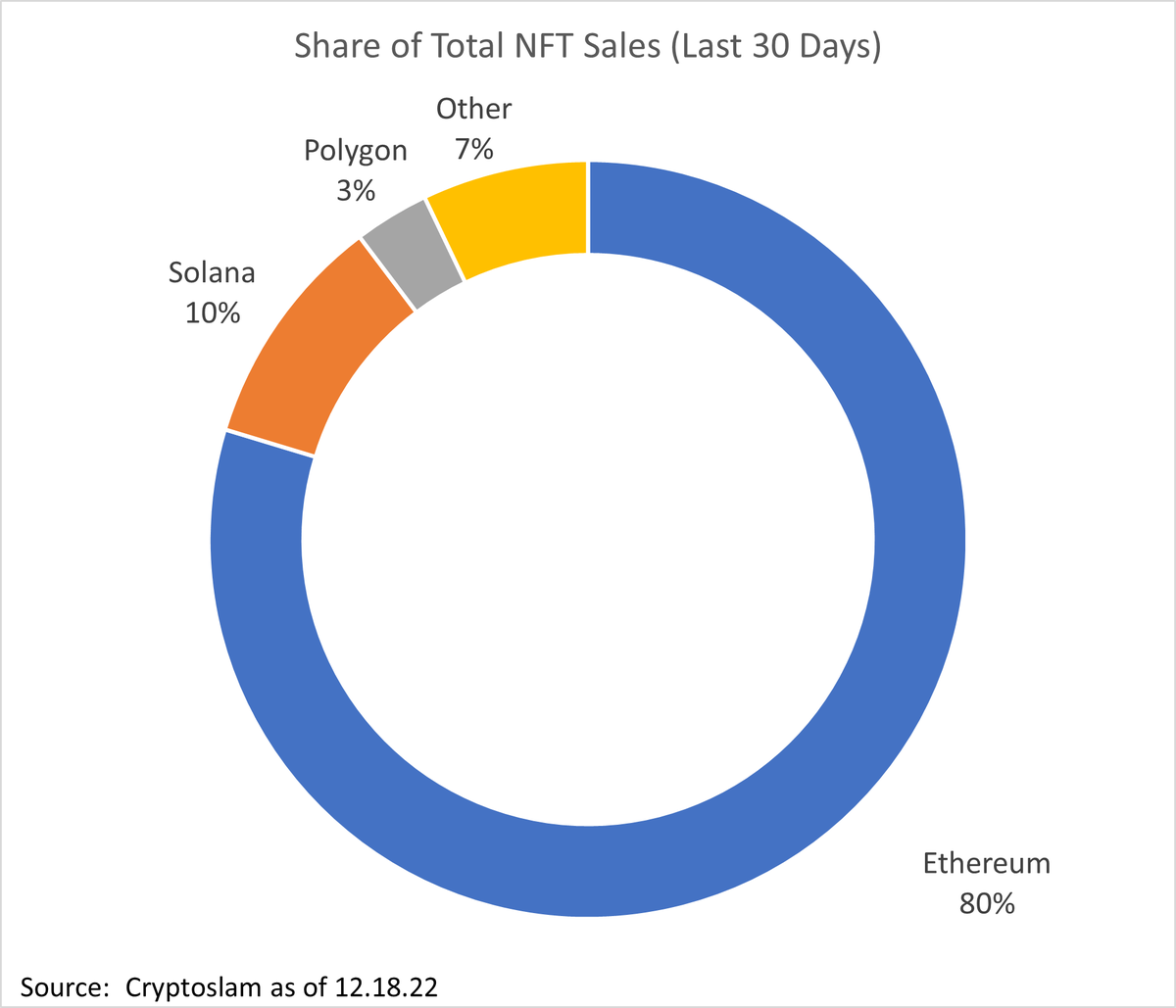

🔹 High Share in the NFT Space

Solana is currently the second largest chain in the #NFT space by a wide margin. Over the last 30 days, it accounted for 10% of all NFT sales (3x its closest competitor)

🔹 High Share in the NFT Space

Solana is currently the second largest chain in the #NFT space by a wide margin. Over the last 30 days, it accounted for 10% of all NFT sales (3x its closest competitor)

29/

In addition, #Solana has partnered with several high profile personalities such as Michael Jordan and Snoop Dogg

In addition, #Solana has partnered with several high profile personalities such as Michael Jordan and Snoop Dogg

https://twitter.com/snoopdogg/status/1468208757914025988

30/

🔹 Strong Community

The protocol has over 2M Twitter followers, 160K reddit subscribers and 135K members on its Discord

It also has one of the fastest growing communities, with Reddit subscribers growing at~ 20% per month over the last 2 years

🔹 Strong Community

The protocol has over 2M Twitter followers, 160K reddit subscribers and 135K members on its Discord

It also has one of the fastest growing communities, with Reddit subscribers growing at~ 20% per month over the last 2 years

31/

🔹 High Developer Activity

$SOL consistently ranks as one of the most active chains by developer activity

According to a recent report by Alchemy, over the last year they have seen:

• >1,000% growth in active developer teams

• 500% growth in API consumption

🔹 High Developer Activity

$SOL consistently ranks as one of the most active chains by developer activity

According to a recent report by Alchemy, over the last year they have seen:

• >1,000% growth in active developer teams

• 500% growth in API consumption

32/

🔹 Significant mindshare

According to @LunarCrush, Solana is the 4th most popular cryptocurrency in terms of social engagement behind Bitcoin, Ethereum and Dogecoin

🔹 Significant mindshare

According to @LunarCrush, Solana is the 4th most popular cryptocurrency in terms of social engagement behind Bitcoin, Ethereum and Dogecoin

🔶 Team

#SOL has built a strong team. The protocol lists over 230 employees on LinkedIn.

Team members include:

• CEO: @aeyakovenko

• COO: @rajgokal

• CTO: @garious14

• CBO: @mattwyndowe

• Head of Growth: @mattytay

#SOL has built a strong team. The protocol lists over 230 employees on LinkedIn.

Team members include:

• CEO: @aeyakovenko

• COO: @rajgokal

• CTO: @garious14

• CBO: @mattwyndowe

• Head of Growth: @mattytay

34/

🔶 Investors

It’s also backed by an impressive slate of investors including @a16z, @multicoincap, @polychaincap, @jumpcapital and @lightspeedvp

🔶 Investors

It’s also backed by an impressive slate of investors including @a16z, @multicoincap, @polychaincap, @jumpcapital and @lightspeedvp

35/

🔶 Tokenomics

$SOL is the native coin of the Solana network

It has a circulating supply of 367M and total supply of 536M

$SOL is inflationary, but has a defined target

Below we will cover $SOL’s:

• Usage

• Initial distribution

• Emissions schedule

🔶 Tokenomics

$SOL is the native coin of the Solana network

It has a circulating supply of 367M and total supply of 536M

$SOL is inflationary, but has a defined target

Below we will cover $SOL’s:

• Usage

• Initial distribution

• Emissions schedule

36/

🔹 Coin Usage

$SOL is a “utility” coin with two primary uses:

• Transaction Fees: $SOL is required to use the network (e.g. sending transactions, running smart contracts)

• Staking: As a PoS network, validators are required to stake $SOL and receive rewards in $SOL

🔹 Coin Usage

$SOL is a “utility” coin with two primary uses:

• Transaction Fees: $SOL is required to use the network (e.g. sending transactions, running smart contracts)

• Staking: As a PoS network, validators are required to stake $SOL and receive rewards in $SOL

37/

🔹 Initial Distribution

The #Solana network held several private investment rounds in 2019 and launched its public sale in 2020 with the following breakdown:

• 37.0% to initial investors

• 12.5% to the team

• 12.5% to the Solana Foundation

• 38.0% to the community

🔹 Initial Distribution

The #Solana network held several private investment rounds in 2019 and launched its public sale in 2020 with the following breakdown:

• 37.0% to initial investors

• 12.5% to the team

• 12.5% to the Solana Foundation

• 38.0% to the community

38/

🔹 Emissions Schedule

$SOL is designed to be permanently inflationary

That said, the protocol has plans to decrease the inflation rate by approximately 15% per year to reach a long-term target of 1.5% per year

This is expected to occur around 2031

🔹 Emissions Schedule

$SOL is designed to be permanently inflationary

That said, the protocol has plans to decrease the inflation rate by approximately 15% per year to reach a long-term target of 1.5% per year

This is expected to occur around 2031

39/

Given the above schedule, there should be somewhere between 750M and 800M coins at the end of 2032

Given the above schedule, there should be somewhere between 750M and 800M coins at the end of 2032

40/

🔶 Valuation

$SOL has been hit particularly hard by the bear market, and has dropped almost 90% to a FDV of $6.7B

At this valuation, I think 100x is definitely possible given the follow assumptions

• TAM of $138T

• SOM of $35T

• 3% market share

Let’s explore each…

🔶 Valuation

$SOL has been hit particularly hard by the bear market, and has dropped almost 90% to a FDV of $6.7B

At this valuation, I think 100x is definitely possible given the follow assumptions

• TAM of $138T

• SOM of $35T

• 3% market share

Let’s explore each…

41/

Per my prior analysis, I believe that the market opportunity for L1 coins is immense

In short, they can function as a replacement for traditional money and, as such, have a TAM of $138T and SOM of $35T

Per my prior analysis, I believe that the market opportunity for L1 coins is immense

In short, they can function as a replacement for traditional money and, as such, have a TAM of $138T and SOM of $35T

https://twitter.com/MTorygreen/status/1603434783807193088

42/

Assuming 3% market capture, #Solana 's FDV could exceed $1T

Projecting 800M coins yields a price of $1,293 per coin (a 104x return over today)

(3% is based on Solana’s average share of TVL in DeFi for 2022 – using its 10% NFT share would yield a higher valuation)

Assuming 3% market capture, #Solana 's FDV could exceed $1T

Projecting 800M coins yields a price of $1,293 per coin (a 104x return over today)

(3% is based on Solana’s average share of TVL in DeFi for 2022 – using its 10% NFT share would yield a higher valuation)

43/

🔶 The Big Picture: A Global Currency

Given $SOL 's potential to act as a global currency, a 100x return may even be conservative

If we believe that #cryptocurrencies can capture a significant share of global M3, then there’s an enormous opportunity

🔶 The Big Picture: A Global Currency

Given $SOL 's potential to act as a global currency, a 100x return may even be conservative

If we believe that #cryptocurrencies can capture a significant share of global M3, then there’s an enormous opportunity

44/

And as we move into a multi-chain world, it’s looking like several protocols could share this opportunity

(check out the thread below for why it’s likely that we will see a multi-chain world)

And as we move into a multi-chain world, it’s looking like several protocols could share this opportunity

(check out the thread below for why it’s likely that we will see a multi-chain world)

https://twitter.com/MTorygreen/status/1603797185585242113

45/

In mature markets, the #2 players tend to achieve market shares between 15% and 30%

So while ETH is currently best positioned to be the market leader, there’s still room for a “Mastercard” of the #L1 world

In mature markets, the #2 players tend to achieve market shares between 15% and 30%

So while ETH is currently best positioned to be the market leader, there’s still room for a “Mastercard” of the #L1 world

46/

Given its robust performance, strong traction and unique monochain archicture, $SOL is a legitimate contender for the #2 position and the 30% market share that may yield

If this happens a $10T FDV (1,000x return) is within the realm of possibility

Given its robust performance, strong traction and unique monochain archicture, $SOL is a legitimate contender for the #2 position and the 30% market share that may yield

If this happens a $10T FDV (1,000x return) is within the realm of possibility

47/

If you want to learn more about @solana, check out these accounts:

@aeyakovenko

@j_finer

@meta_hess

@MrSolanaGod

@rajgokal

@SolanaPrincess

@solanians_

@SOLBigBrain

@SolLunix

@SOLPlayboy

@SolProfessor565

@TeamSolHQ

@TusharJain_

If you want to learn more about @solana, check out these accounts:

@aeyakovenko

@j_finer

@meta_hess

@MrSolanaGod

@rajgokal

@SolanaPrincess

@solanians_

@SOLBigBrain

@SolLunix

@SOLPlayboy

@SolProfessor565

@TeamSolHQ

@TusharJain_

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1604884293251043328

• • •

Missing some Tweet in this thread? You can try to

force a refresh