Ever since the #Fed meeting last week 2YR has been below the FFR.

2YR has long served as a proxy for the mkt perceived terminal FFR.

Hence the mkt doesn't trust the #Fed's estimates of 5%+ rates but thinks this is THE terminal rate.

What will the #Fed do?

A thread.

1/14

2YR has long served as a proxy for the mkt perceived terminal FFR.

Hence the mkt doesn't trust the #Fed's estimates of 5%+ rates but thinks this is THE terminal rate.

What will the #Fed do?

A thread.

1/14

https://twitter.com/biancoresearch/status/1604582624781017089

In the last 46 yrs there were quite a few instances with negative 2YR-FFR spread, 17 to be exact.

Interestingly enough, almost every time the spread went negative, the #Fed actually cut rates.

Let's take a closer look.

2/14

Interestingly enough, almost every time the spread went negative, the #Fed actually cut rates.

Let's take a closer look.

2/14

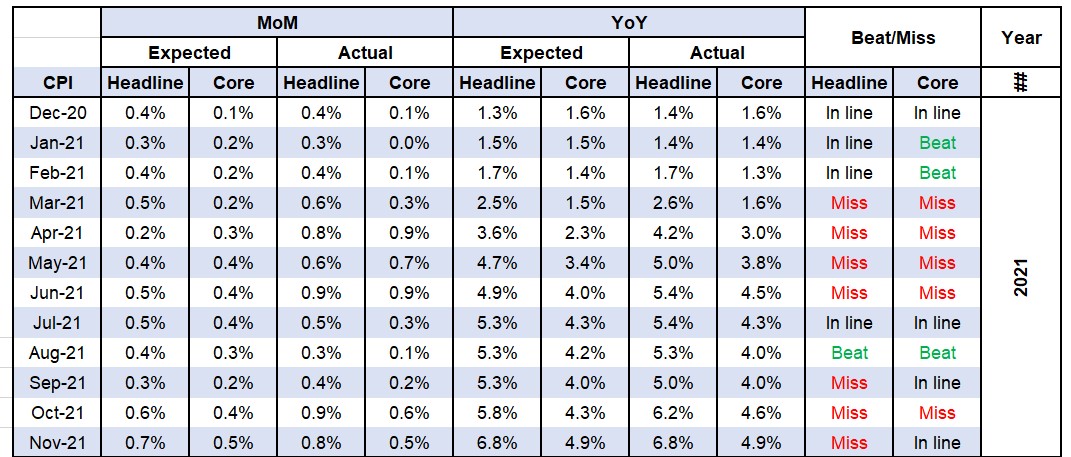

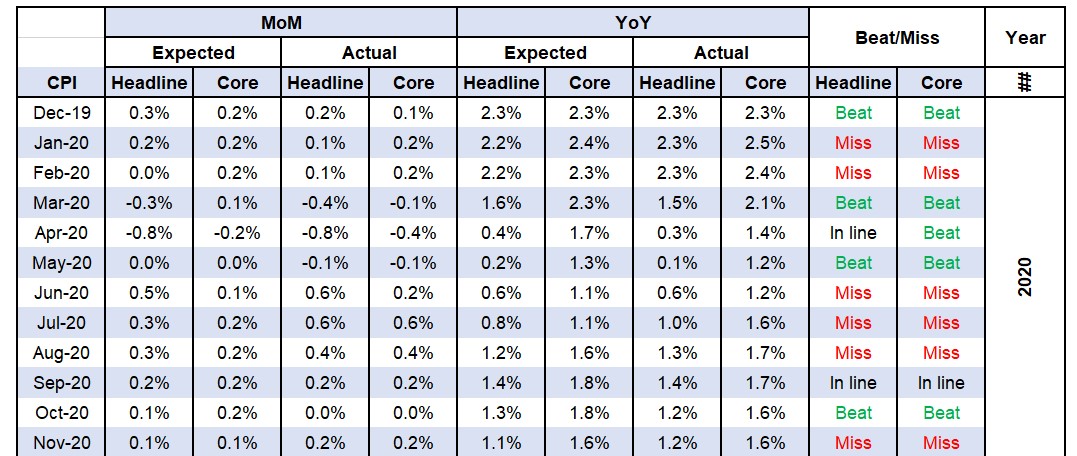

Not counting the current one there were 16 instances with negative 2YR-FFR spread.

Only once out of 16 times the #Fed hiked FFR and that was from Oct 1978.

However, at one point the #Fed started cutting and altogether FFR was unchanged in a period of 23M through Aug 1980.

3/14

Only once out of 16 times the #Fed hiked FFR and that was from Oct 1978.

However, at one point the #Fed started cutting and altogether FFR was unchanged in a period of 23M through Aug 1980.

3/14

In other words, there is a 93.75% chance the #Fed will cut rates when 2YR-FFR spread turns negative.

The magnitude of cuts can vary from insignificant 5 bps to a whopping almost 700 bps.

Average rate cut is -280 bps.

4/14

The magnitude of cuts can vary from insignificant 5 bps to a whopping almost 700 bps.

Average rate cut is -280 bps.

4/14

Most of the time the #Fed cut right away when the 2YR-FFR spread turned negative but there can be a delay of 2M-13M.

All 4 of the most recent instances since 1998 had delays and in July 2006 the FFR was unchanged for 13M before the #Fed started cutting in Jul 2007.

5/14

All 4 of the most recent instances since 1998 had delays and in July 2006 the FFR was unchanged for 13M before the #Fed started cutting in Jul 2007.

5/14

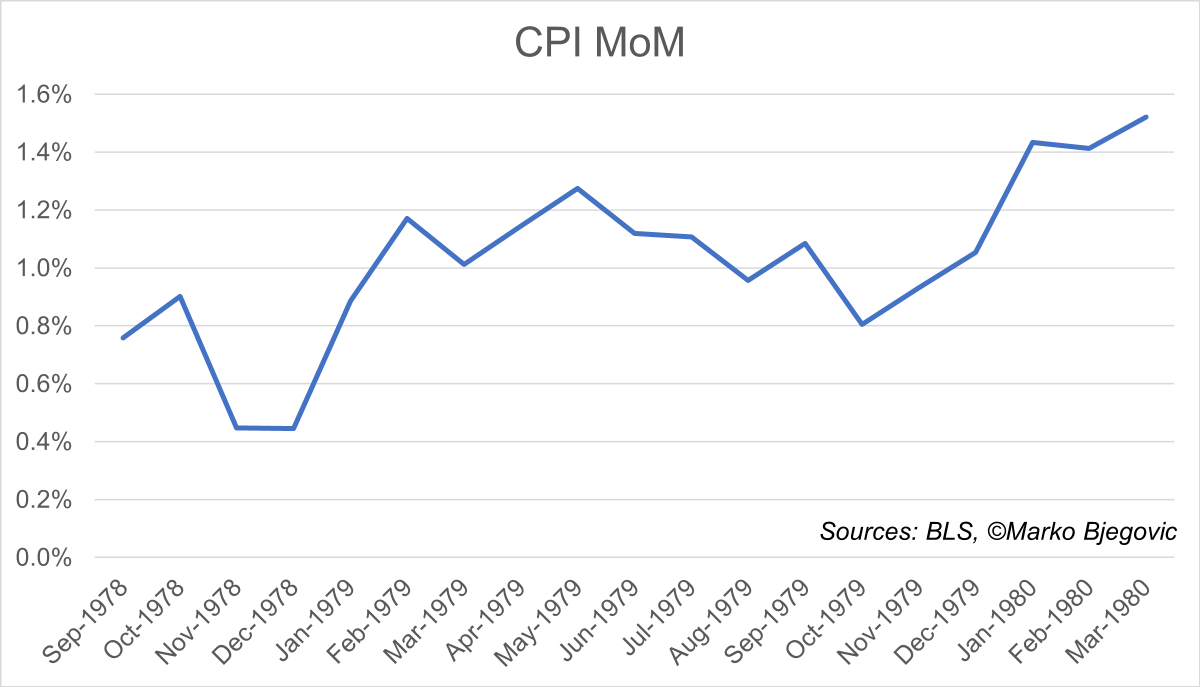

Let's now take a look at what happened in Oct 1978 when the #Fed didn't cut rates after the 2YR-FFR spread turned negative.

The #Fed hiked instead due to a surge in #CPI.

#CPI started +0.9% MoM, eased a bit to +0.4% and then kept surging until it reached +1.5% peak.

6/14

The #Fed hiked instead due to a surge in #CPI.

#CPI started +0.9% MoM, eased a bit to +0.4% and then kept surging until it reached +1.5% peak.

6/14

In other words, this episode from late 1978-early 1980 can be described as the only time when the mkt got the #inflation wrong thinking it would finally fall but it kept surging.

In all of the other 15 instances it was the #Fed who actually got the #inflation wrong.

7/14

In all of the other 15 instances it was the #Fed who actually got the #inflation wrong.

7/14

Today situation is quite different than what it was back in the 1978.

#inflation is practically nonexistent.

Here is why:

8/14

#inflation is practically nonexistent.

Here is why:

https://twitter.com/MBjegovic/status/1602720725160321025?s=20&t=RSXnPLGtjwKbs6gdg19jOA

8/14

3M moving average of unadjusted headline CPI is below the #Fed's #inflation target.

Here is more on that:

9/14

Here is more on that:

https://twitter.com/MBjegovic/status/1602720730147430402?s=20&t=RSXnPLGtjwKbs6gdg19jOA

9/14

Core #CPI where Shelter component is swapped with Apartment List National Rent Index has been NEGATIVE MoM for the last 3 months.

10/14

https://twitter.com/MBjegovic/status/1602720760702926850?s=20&t=RSXnPLGtjwKbs6gdg19jOA

10/14

If you haven't already, check out this whole thread for a comprehensive overview of the latest #CPI:

11/14

https://twitter.com/MBjegovic/status/1602720721628692481?s=20&t=RSXnPLGtjwKbs6gdg19jOA

11/14

To recap, negative 2YR-FFR spread means the #Fed will cut rates.

The #Fed #pivot will happen.

Still 2 important Qs remain:

1) Will there be a delay and how long will it be?

2) By how much would the #Fed cut?

12/14

The #Fed #pivot will happen.

Still 2 important Qs remain:

1) Will there be a delay and how long will it be?

2) By how much would the #Fed cut?

12/14

These threads take a lot of time and effort to write.

If you like the content, please love and retweet to help me spread the message.

13/14

If you like the content, please love and retweet to help me spread the message.

13/14

I will answer these 2 important Qs about the #Fed #pivot and many more about the economy and mkts in my next

Pick Marko's Brain workshop.

Stay tuned.

14/14

Pick Marko's Brain workshop.

Stay tuned.

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh