🚨.@GenesisTrading laid off 30% of its employees and is "considering" filing for bankruptcy according to @WSJ.

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

Now, Who is #Genesis?

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

But #Genesis is not independent, it is under the control of @DCGco and @BarrySilbert.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

If you don't know the Gemini story👇:

It's Simple

1. Gemini Earn (GE) users give money to GE for ~8% APY.

2. GE lends the money to #Genisis at a higher APY.

3. GE User want their principals back

4. GE asks Genesis for principal

5. Genesis stops withdraw

6. So GE stops withdraw

It's Simple

1. Gemini Earn (GE) users give money to GE for ~8% APY.

2. GE lends the money to #Genisis at a higher APY.

3. GE User want their principals back

4. GE asks Genesis for principal

5. Genesis stops withdraw

6. So GE stops withdraw

So where did #Genesis's money go?

We said before that #Genesis also needs to lend money to others to profit.

So who's his client?

#3AC,#Alameda,#BlockFi etc.

They all file for bankruptcy in 2022.

So the answer is clear, big hole on the #Genesis balance sheet.

We said before that #Genesis also needs to lend money to others to profit.

So who's his client?

#3AC,#Alameda,#BlockFi etc.

They all file for bankruptcy in 2022.

So the answer is clear, big hole on the #Genesis balance sheet.

What's more interesting is why 3ACs lend Genesis money, for two reasons:

1. Genesis does have some "fame" in the business

2. Genesis's relationship with #GrayScale made it the major GBTC broker.

About GBTC, it's basically a story of how greedy destroy 3ACs.

1. Genesis does have some "fame" in the business

2. Genesis's relationship with #GrayScale made it the major GBTC broker.

About GBTC, it's basically a story of how greedy destroy 3ACs.

What is GBTC (GrayScale Bitcoin)?

The finance terms are boring so here is all you need to know:

1. You can exchange 1 BTC for 1000 GBTC

2. After at least 6 months, you can sell GBTC on the US security market

3. You can't exchange GBTC for BTC back.

4. GBTC price!= BTC price

The finance terms are boring so here is all you need to know:

1. You can exchange 1 BTC for 1000 GBTC

2. After at least 6 months, you can sell GBTC on the US security market

3. You can't exchange GBTC for BTC back.

4. GBTC price!= BTC price

The more important one is 4.

So what if 1000GBTC price > 1 BTC price?

Yes, arbitrage!

1. Buy 1 $BTC

2. Exchange for 1000GBTC

3. Sell 1000 GBTC for $USD after 6 months

4. Now you can buy 1+ $BTC back!

So what if 1000GBTC price > 1 BTC price?

Yes, arbitrage!

1. Buy 1 $BTC

2. Exchange for 1000GBTC

3. Sell 1000 GBTC for $USD after 6 months

4. Now you can buy 1+ $BTC back!

So here's what 3ACs do:

1. Lend $BTC from #Genesis

2. Exchange BTC for GBTC

3. Use GBTC as collateral to lend USD from #Genesis

4. Waiting for 6 months to get "free money" while having enough liquidity to pump altcoins.

1. Lend $BTC from #Genesis

2. Exchange BTC for GBTC

3. Use GBTC as collateral to lend USD from #Genesis

4. Waiting for 6 months to get "free money" while having enough liquidity to pump altcoins.

This is supposed to be a perfect cycle that #3ACs, #Genesis, #GrayScale, #Gemini Earn, and its users all happily enjoy a nice profit.

But all this requires one thing:

People are willing to buy GBTC at a positive premium.

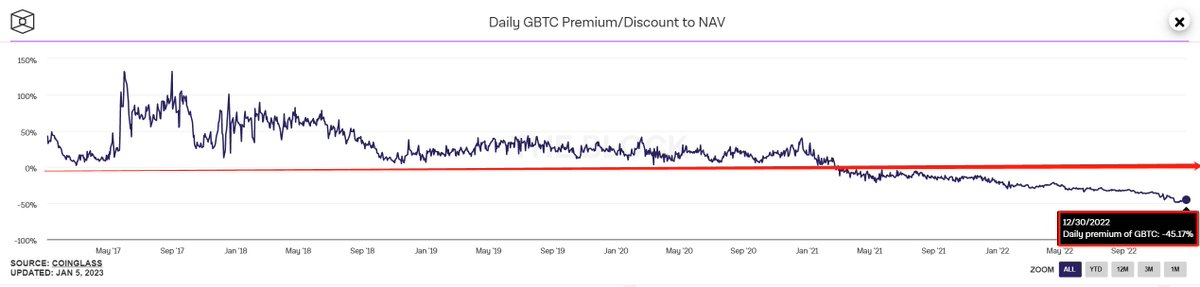

So what's GBTC's premium now?

-45%

But all this requires one thing:

People are willing to buy GBTC at a positive premium.

So what's GBTC's premium now?

-45%

So clearly this game doesn't work, but it's 2021 when GBTC first goes negative premium, we are in a bull market, who cares?

What? I need to put more collateral to maintain the position cause the GBTC value dropped?

That's okay, take my altcoins, and here's some $LUNA!

What? I need to put more collateral to maintain the position cause the GBTC value dropped?

That's okay, take my altcoins, and here's some $LUNA!

🚨It's nice, but entering 2022, we all know what happened, the whole market goes down, $LUNA crashed, the $stETH crisis and #3AC filed for bankruptcy.

A lot of people guessing that the reason why Genesis got through the 3AC default is DCG's aid.

A lot of people guessing that the reason why Genesis got through the 3AC default is DCG's aid.

Rumor said #DCG used the money they borrowed from Genesis to "buy" the debt of #3AC.

If this is true, basically #Genesis uses its own money to pay its own money.

Barry "nailed" it.

If this is true, basically #Genesis uses its own money to pay its own money.

Barry "nailed" it.

If the market goes up after 3AC and nothing else happened, #Genesis would have gone through it, but SBF takes the final strike to them.

#FTX and #Alameda's death make the hole of Genesis impossible to handle by themself.

#FTX and #Alameda's death make the hole of Genesis impossible to handle by themself.

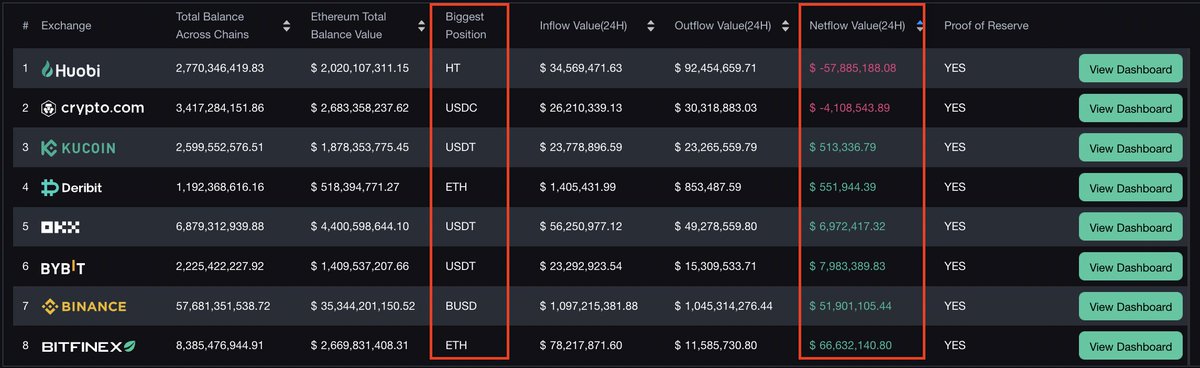

So the status:

Genesis has billions of bad debts so they can't pay their creditors including #Gemini.

The potential solutions:

1. DCG's GrayScale sells their BTC/ETC etc to fill the hole & Genesis liquidating collaterals.

2. DCG sells its shares to get money from investors.

Genesis has billions of bad debts so they can't pay their creditors including #Gemini.

The potential solutions:

1. DCG's GrayScale sells their BTC/ETC etc to fill the hole & Genesis liquidating collaterals.

2. DCG sells its shares to get money from investors.

If solution 1:

Market shake and bloodshed are foreseeable, and it's hard to say if they can successfully fill the hole even if they dump everything.

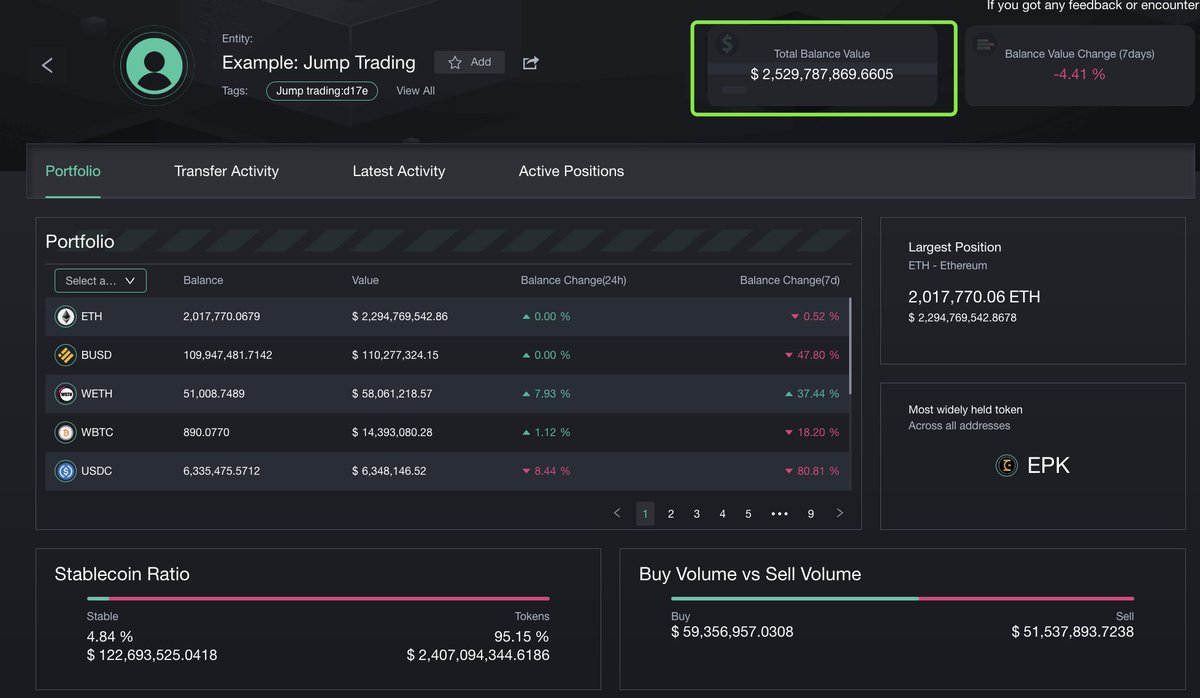

Our Genesis entity shows their Ethereum portfolio value is around $470M, a long way to reach billions.

Market shake and bloodshed are foreseeable, and it's hard to say if they can successfully fill the hole even if they dump everything.

Our Genesis entity shows their Ethereum portfolio value is around $470M, a long way to reach billions.

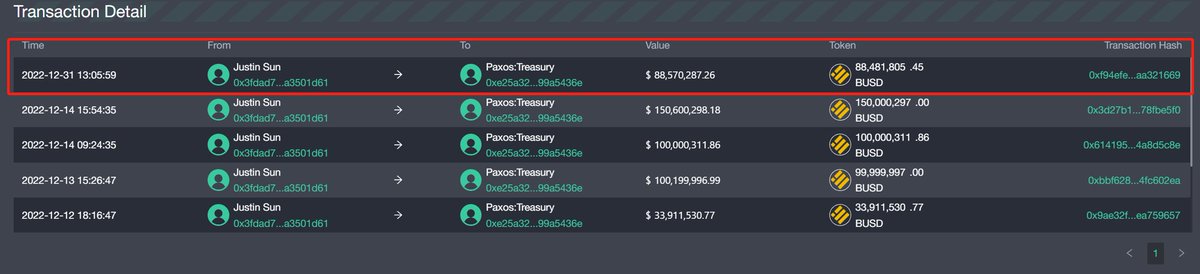

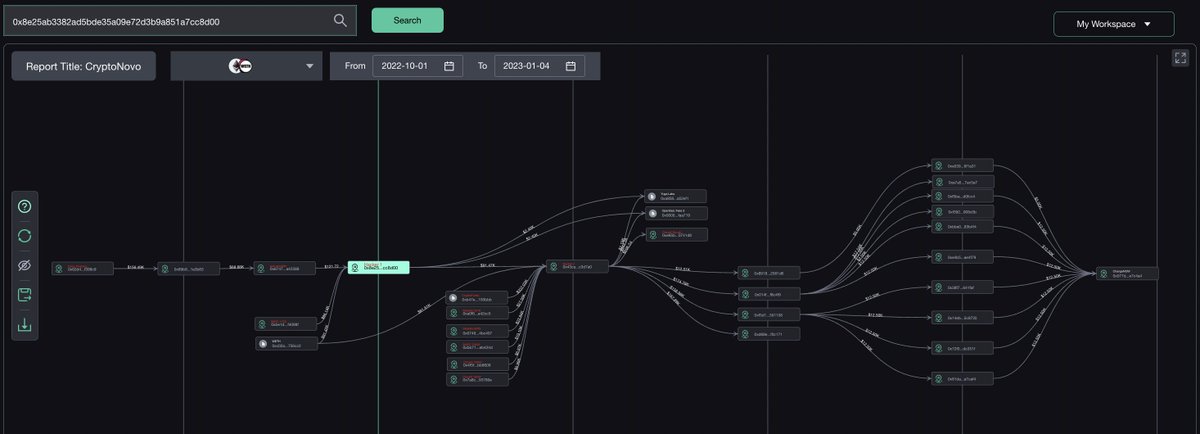

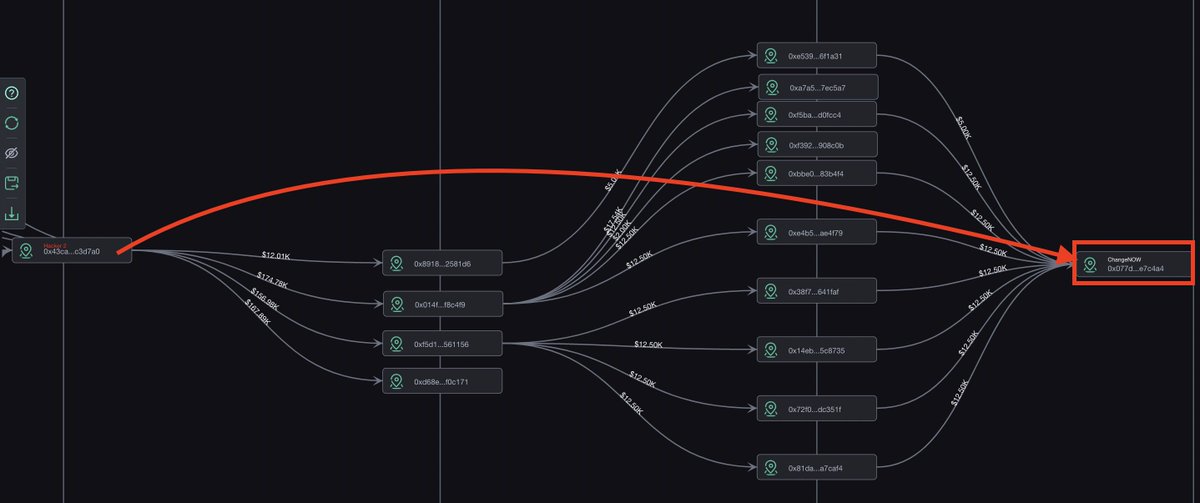

And the liquidation seems already start, our previous research shows Gemini may have already taken some of Genesis's $ETH collateral.

https://twitter.com/ScopeProtocol/status/1610476381003218944

So we better hope @BarrySilbert can find some people to save them to avoid something we all don't want to see.

All the above we talking about institutions, but in the worst case, regular people or retail investors are all the people who suffered the most.

1. Gemini Earn users.

2. People who lend money to Genesis's creditors.

Just like FTX users, they are likely to lose life savings.

1. Gemini Earn users.

2. People who lend money to Genesis's creditors.

Just like FTX users, they are likely to lose life savings.

The credit crisis has always been a sword hanging on every member of the financial market, we are supposed to hope for crypto to avoid this.

But CeFis like FTX and Genesis in 2022 show us what we really need may not be tokens, it's #transparency and #decentralization.

⚖️

But CeFis like FTX and Genesis in 2022 show us what we really need may not be tokens, it's #transparency and #decentralization.

⚖️

Resources:

Genesis Entity Dashboard:

watchers.pro/#/newEntityDas…

The Chinese version of this thread:

Like the content?

(🪬.🪬) with us!

Genesis Entity Dashboard:

watchers.pro/#/newEntityDas…

The Chinese version of this thread:

https://twitter.com/0xlukaL/status/1610543792352038916

Like the content?

(🪬.🪬) with us!

• • •

Missing some Tweet in this thread? You can try to

force a refresh