Detailed review of the Deloitte Money League 2021/22 can be found on my Substack, but some snippets in this short thread.

swissramble.substack.com/p/money-league…

swissramble.substack.com/p/money-league…

#MCFC £619m reported the highest revenue, just ahead of #RealMadrid £605m with #LFC £594m up to 3rd, overtaking #MUFC £583m, #PSG £554m, #FCBayern £554m and #FCBarcelona £540m.

8 of the 9 highest revenue increases over 2020/21 came from English clubs. #LFC led the way with an impressive £106m, followed by #MUFC £89m and #THFC £82m. The biggest reductions were at two Italian clubs, troubled Juventus £44m and Inter £32m.

Despite both Spanish giants growing revenue, they were still far below pre-pandemic levels. #RealMadrid were down €44m (6%), while #FCBarcelona have fallen a massive €203m (24%) from their Money League all-time high of €841m in 2019 (even before pulling economic levers).

Revenue for the Top 20 clubs rose €1.0 bln (13%) from €8.2 bln to €9.2 bln, which is marginally lower than the 2019 peak of €9.3 bln, though still the second highest ever total in the Money League.

3 clubs had match day revenue above £100m, namely #PSG £112m, #MUFC £107m and #THFC £106m, closely followed by #LFC £95m. At the other end of the spectrum, 3 English clubs had revenue less than £25m: #LUFC £24m, #LCFC £21m and #EFC £15m.

#LFC reported the highest broadcasting income of £266m, thanks to good sporting performance. The importance of European qualificatioin is clear.

Highest commercial revenue generated by #PSG £324m, just ahead of #FCBayern £320m and #MCFC £316m. Largest growth since the pandemic came from City and #LFC.

#MCFC £619m were £25m ahead of #LFC £594m, even though they were behind the Reds in both match day £41m and broadcasting £17m. These shortfalls were more than offset by commercial, where City report £83m more.

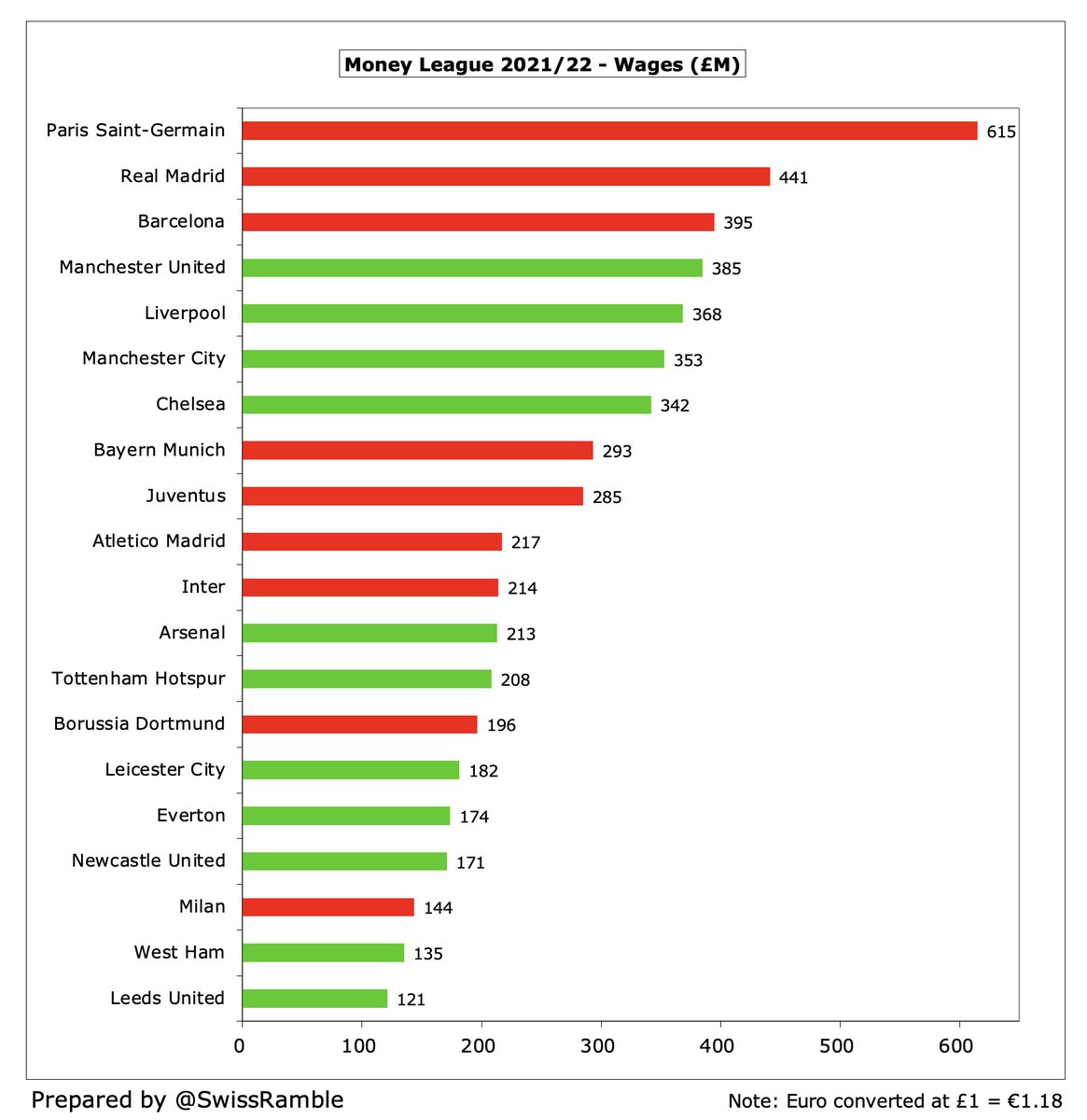

#PSG wage bill is easily the highest of the Money League clubs at a massive £615m, followed by #RealMadrid £441m and #FCBarcelona £395m. Highest placed English club is #MUFC £385m, followed by #LFC £368m, #MCFC £353m and #CFC £342m.

Highest wages to turnover ratio is at #PSG with 111%, followed by three English clubs: #EFC 96%, #NUFC 95% and #LCFC 85%. This helps explain recent financial constraints at Everton and Leicester, while Newcastle are clearly in investment mode.

• • •

Missing some Tweet in this thread? You can try to

force a refresh