📸 #Snap releases Q4 #earnings after US markets close today.

A conference call is scheduled at 1430 PT (1730 ET).

Here is a 🧵 on what to expect...

A conference call is scheduled at 1430 PT (1730 ET).

Here is a 🧵 on what to expect...

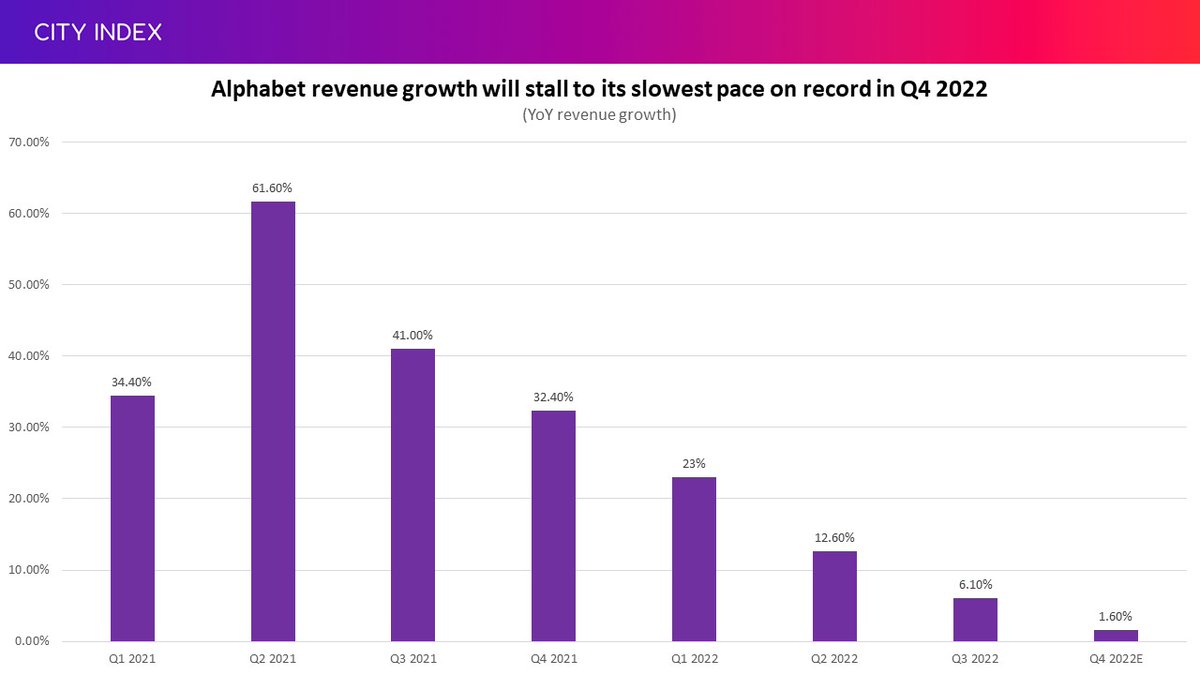

🐦 #Snap was the canary in the coal mine last earnings season, when growth stalled to its slowest pace on record.

👁️ That was followed by disappointing results from fellow #advertising stocks like #Meta and #Alphabet - with both #stocks due to report later this week.

👁️ That was followed by disappointing results from fellow #advertising stocks like #Meta and #Alphabet - with both #stocks due to report later this week.

🐌 The slowdown will continue this quarter, with revenue set to grow just 0.5% - marking the slowest pace since Snap went public back in 2017.

The topline will only grow because Snap continues to grow its user base, countering lower revenue from each user - with ARPU set to be down 14% YoY as ad pricing comes under pressure.

Snap forecast to add 15.5m users in Q4 - and keep an eye on Snapchat+ subscriber numbers.

Snap forecast to add 15.5m users in Q4 - and keep an eye on Snapchat+ subscriber numbers.

Snap remains in the red and won't turn to profit for years to come, according to Wall St.

Valuation is geared to growth, but prospects look subdued.

✂️ That could make cost control key going forward. Snap has already cut 6,000 jobs, equal to around 20% of workforce

Valuation is geared to growth, but prospects look subdued.

✂️ That could make cost control key going forward. Snap has already cut 6,000 jobs, equal to around 20% of workforce

💰 Liquidity remains strong with billions in cash and, although cashflow has been under pressure, it should stay positive in 2023.

💪 The strength of the balance sheet was demonstrated by the $500m buyback being launched last quarter despite a much tougher outlook.

💪 The strength of the balance sheet was demonstrated by the $500m buyback being launched last quarter despite a much tougher outlook.

🔍 What does Wall St expect from Snap in 2023?

📈 DAUs are to continue growing rapidly and revenue plus earnings growth will accelerate as Snap comes up against easier comparatives this year.

💵 Cashflow should also hit record levels

📈 DAUs are to continue growing rapidly and revenue plus earnings growth will accelerate as Snap comes up against easier comparatives this year.

💵 Cashflow should also hit record levels

Quick look at $SNAP before the results:

📉 Stuck in $8 to $13 range for 8 months

🥅 Recently recaptured 50-day and 100-day MAs

❓ Will #earnings provide catalyst to push it out of range?

🚨 RSI approaching overbought territory

🔍 Brokers see just 5% upside from here

📉 Stuck in $8 to $13 range for 8 months

🥅 Recently recaptured 50-day and 100-day MAs

❓ Will #earnings provide catalyst to push it out of range?

🚨 RSI approaching overbought territory

🔍 Brokers see just 5% upside from here

👍 That's it, you're all set and ready for the earnings later.

Happy trading!

You can find out more about the result, including what consensus numbers to look out for today, in our full earnings preview below 👇

ms.spr.ly/60135DMpf

Happy trading!

You can find out more about the result, including what consensus numbers to look out for today, in our full earnings preview below 👇

ms.spr.ly/60135DMpf

• • •

Missing some Tweet in this thread? You can try to

force a refresh