I'm seeing a lot of chatter about this $SWTH token.

I dug through their tokenomics, and what I found surprised me.

Here's why $SWTH has grade-A real-yield tokenomics, and is one of the best in #crypto.

tldr at the end;

🧵

#realyield #cosmos #perp #dex #carbon #kuji #sei #osmo

I dug through their tokenomics, and what I found surprised me.

Here's why $SWTH has grade-A real-yield tokenomics, and is one of the best in #crypto.

tldr at the end;

🧵

#realyield #cosmos #perp #dex #carbon #kuji #sei #osmo

$SWTH is the governance token of @0xcarbon, which is a DeFi-focused L1 chain on Cosmos, with built-in DeFi modules like orderbooks, CDP (money markets), perpetual, flexi network fees, etc.

They are tailored for DeFi dApps, offering the best DeFi experience for users.

They are tailored for DeFi dApps, offering the best DeFi experience for users.

Dem.exchange is one such DeFi dApps currently live on the Carbon network.

It is a frontend UI for users to easily interact with Carbon's inbuilt DeFi modules.

Demex is an all-in-one DeFi hub that offers a frictionless trading experience that rivals CEXs.

It is a frontend UI for users to easily interact with Carbon's inbuilt DeFi modules.

Demex is an all-in-one DeFi hub that offers a frictionless trading experience that rivals CEXs.

How do their tokenomics work?

They have a 5-year inflation schedule, and fortunately for new investors, it's about 3 years in and 80% of the supply is out.

The current inflation is 6%, and goes towards 0% by 2025.

Low to no inflation ✅

More info:

guide.carbon.network/swth/tokenomics

They have a 5-year inflation schedule, and fortunately for new investors, it's about 3 years in and 80% of the supply is out.

The current inflation is 6%, and goes towards 0% by 2025.

Low to no inflation ✅

More info:

guide.carbon.network/swth/tokenomics

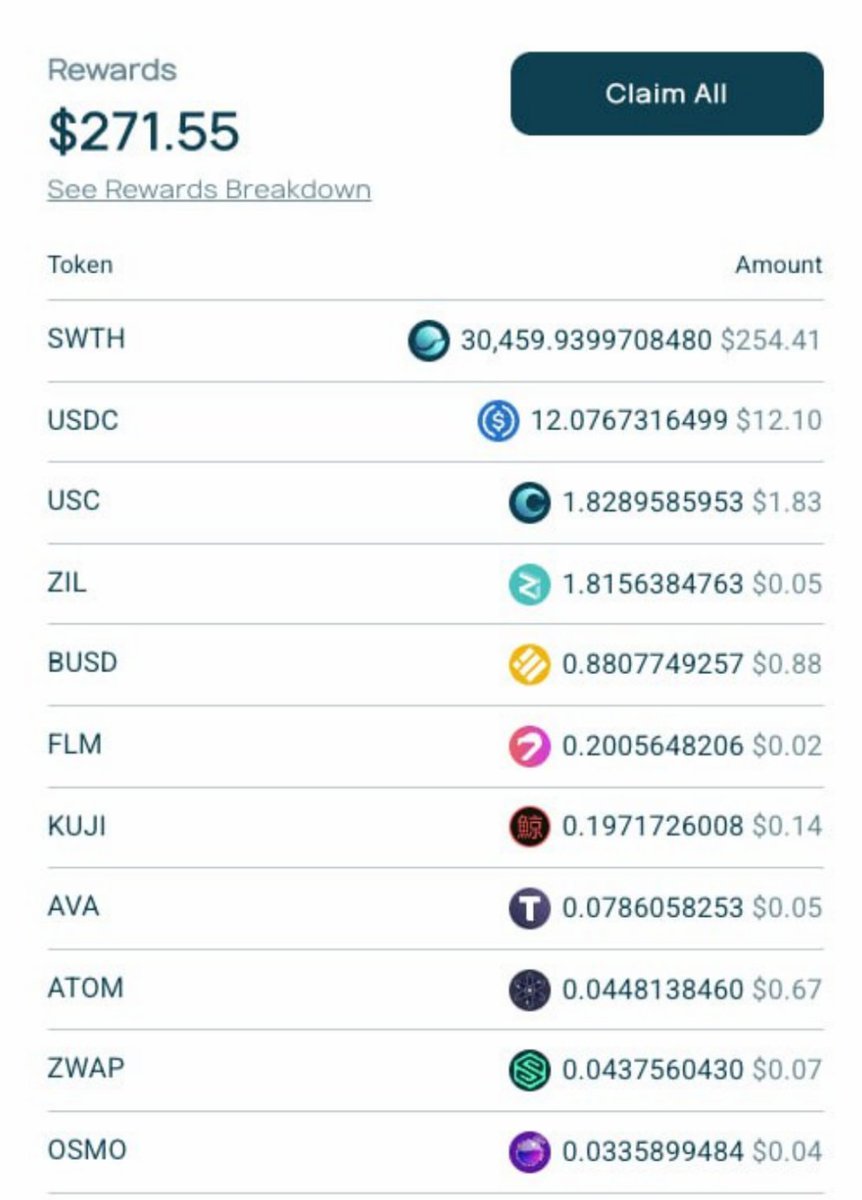

When users trade on Carbon (via Demex), transaction and trading fees are incurred, of which:

- 50% goes to $SWTH stakers

- 40% to LP providers determined by the community

- 10% goes to SDF (Switcheo Development Fund).

Real-yield ✅

Reward page screenshot:

- 50% goes to $SWTH stakers

- 40% to LP providers determined by the community

- 10% goes to SDF (Switcheo Development Fund).

Real-yield ✅

Reward page screenshot:

What about validators?

Validators are paid a percentage of the revenue to $SWTH stakers, so their funds come from the stakers' revenue. Many are around 5% of stakers revenue.

As volume on Carbon (via Demex) increases, validators continue to earn more real-yield as well.

Validators are paid a percentage of the revenue to $SWTH stakers, so their funds come from the stakers' revenue. Many are around 5% of stakers revenue.

As volume on Carbon (via Demex) increases, validators continue to earn more real-yield as well.

What about utility?

Apart from staking to get real-yield...

$SWTH can be used to provide liquidity, and also be deposited on Demex's money market to mint Carbon's stablecoin $USC.

Staking $SWTH will soon give you trading discounts as well.

Read more:

blog.switcheo.com/top-use-cases-…

Apart from staking to get real-yield...

$SWTH can be used to provide liquidity, and also be deposited on Demex's money market to mint Carbon's stablecoin $USC.

Staking $SWTH will soon give you trading discounts as well.

Read more:

blog.switcheo.com/top-use-cases-…

Summary:

1. $SWTH supply cap is fixed.

Tokenomics were designed to transition to increasing real-yield revenue which replaces decreasing staking rewards overtime as the platform matures and trading volume goes up.

Buy-back and burn is being discussed to turn $SWTH deflationary.

1. $SWTH supply cap is fixed.

Tokenomics were designed to transition to increasing real-yield revenue which replaces decreasing staking rewards overtime as the platform matures and trading volume goes up.

Buy-back and burn is being discussed to turn $SWTH deflationary.

2. The revenue comes legitimately from trading activities.

All revenue is paid back to Carbon's supporters which are made up of stakers and liquidity providers via decreasing staking rewards & increasing real-yield rewards, and to developers via the Switcheo development grants.

All revenue is paid back to Carbon's supporters which are made up of stakers and liquidity providers via decreasing staking rewards & increasing real-yield rewards, and to developers via the Switcheo development grants.

3. It can not be overstated how important it is for legitimate token valuation to be backed by real revenue and utility.

Carbon/Demex/Nitron revenue is real, growing, and should be sustainable long-term as long as it continues to launch new features that increase trading volume.

Carbon/Demex/Nitron revenue is real, growing, and should be sustainable long-term as long as it continues to launch new features that increase trading volume.

Tokenomics tldr;

- Fixed Supply with 80% out ✅

- Low inflation at 6% yearly going to 0% by 2025 ✅

- Real-yield rewards from trading volume ✅

- Sustainable rewards if trading volume goes up ✅

- All fees go back to supporters ✅

- No 'hidden team wallet' redirecting fees ✅

- Fixed Supply with 80% out ✅

- Low inflation at 6% yearly going to 0% by 2025 ✅

- Real-yield rewards from trading volume ✅

- Sustainable rewards if trading volume goes up ✅

- All fees go back to supporters ✅

- No 'hidden team wallet' redirecting fees ✅

Disclaimer: I also work here but this post is not sponsored.

• • •

Missing some Tweet in this thread? You can try to

force a refresh