Can 𝐀𝐝𝐚𝐧𝐢 𝐆𝐫𝐨𝐮𝐩 collapse trigger a 𝐑𝐞𝐜𝐞𝐬𝐬𝐢𝐨𝐧❓

Examining the Impact of India's Gigantic Conglomerate.

🧵👇

Examining the Impact of India's Gigantic Conglomerate.

🧵👇

What is #FPO ?

🔶FPO, "Follow-on Public Offer," is a process in which a company that is already publicly traded issues shares to existing shareholders or new investors.

🔶FPO, "Follow-on Public Offer," is a process in which a company that is already publicly traded issues shares to existing shareholders or new investors.

Why do companies do FPO ?

The reason behind the company's FPO is:

🔶To reduce the debt that already exists in a company.

🔶To raise additional capital for a company.

The reason behind the company's FPO is:

🔶To reduce the debt that already exists in a company.

🔶To raise additional capital for a company.

🔶Adani Enterprises Ltd. (AEL) unexpectedly called off its $2.5 billion FPO on Wednesday evening, a day after the company closed the offer successfully.

🔶Gautam Adani, Owner of the company said Due to market volatility, the FPO was withdrawn as it was not morally correct to proceed.

🔶But the other side of the story is that the price of #Adani Enterprises' share was 31.6% below the lower end of the FPO price band of 3,112—3,276 a piece.

Now we know that Adani Enterprises called off the FPO.

What impact it will have on the company?

Now they have to raise money in different ways.

🔶They can restructure debt.

🔶They can liquidate some of their assets to repay loans.

What impact it will have on the company?

Now they have to raise money in different ways.

🔶They can restructure debt.

🔶They can liquidate some of their assets to repay loans.

🔶They can't repay their existing debt easily, which is why they raised money from the FPO.

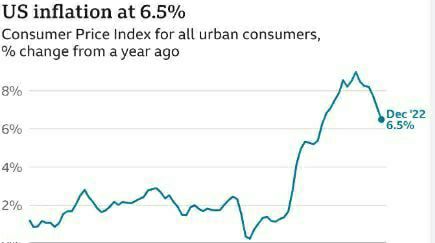

🔶Getting debt is not easy for #AdaniEnterprises because the debt market is quite expensive due to high interest rate.

🔶Getting debt is not easy for #AdaniEnterprises because the debt market is quite expensive due to high interest rate.

Recent news regarding Adani group

🔶#CreditSuisse has already stopped accepting Adani bonds as collateral.

🔶#CreditSuisse has already stopped accepting Adani bonds as collateral.

🔶#Citigroup wealth arm stops accepting Adani securities as collateral for margin loans.

What effect will it have on banks?

🔶Almost every Indian bank has exposure to Adani debt, and we all know banks lend customers' money to big companies.

🔶If Adani Group will not pay the debt, it can cause a bank run on major banks.

🔶Almost every Indian bank has exposure to Adani debt, and we all know banks lend customers' money to big companies.

🔶If Adani Group will not pay the debt, it can cause a bank run on major banks.

🔶LIC's total holding in Adani Group of companies under equity and debt was Rs 35,917 crore at the end of December.

🔶People keep their life savings and retirement funds in LIC.

🔶If the Adani Group collapses, then it will be a disaster for middle class people.

🔶People keep their life savings and retirement funds in LIC.

🔶If the Adani Group collapses, then it will be a disaster for middle class people.

🔶Gautam Adani’s personal net worth is down to $65.3 billion, pushing him to No. 16 on the #Forbes billionaire list.

Conclusion

🔶If Adani Group falls, it can cause a 2008-type recession in India.

🔶Because every major bank has given a loan to the Adani Group, #LIC also holds shares in almost every company in the Adani Group; the same goes for mutual funds and other investment firms.

🔶If Adani Group falls, it can cause a 2008-type recession in India.

🔶Because every major bank has given a loan to the Adani Group, #LIC also holds shares in almost every company in the Adani Group; the same goes for mutual funds and other investment firms.

🔶If everybody starts withdrawing their money from banks, it will cause a bank run.

🔶The same thing happened in 2008, which triggered a global #recession.

#recession2023 #HindenbergResearch

🔶The same thing happened in 2008, which triggered a global #recession.

#recession2023 #HindenbergResearch

If you like this thread, hit like and follow @cillionaire_com 😍

Retweet the first tweet to help this thread reach more people

Retweet the first tweet to help this thread reach more people

• • •

Missing some Tweet in this thread? You can try to

force a refresh