🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

Macro Review 🧵

02/05/2023

1/9

The #macro market has been hyper focused on growth and inflation dynamics

We got a slew of data showing inflation under control.

Yet one data point on Friday raised havoc with my portfolio.

Let’s dig into the 🧮!

Macro Review 🧵

02/05/2023

1/9

The #macro market has been hyper focused on growth and inflation dynamics

We got a slew of data showing inflation under control.

Yet one data point on Friday raised havoc with my portfolio.

Let’s dig into the 🧮!

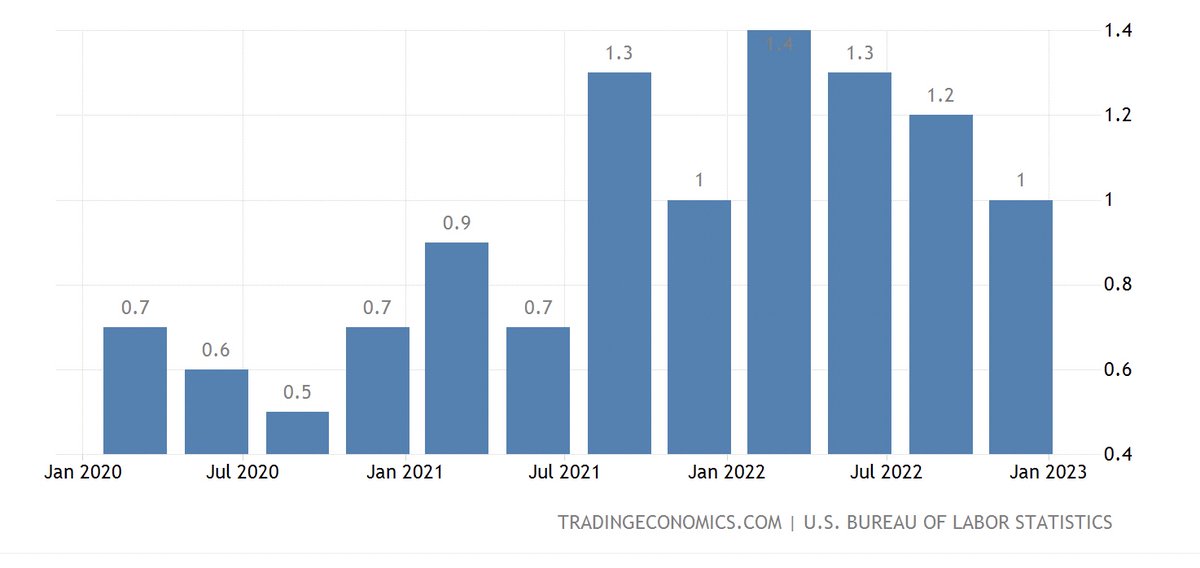

2a/9

The Employment Cost Index #ECI came out on Tuesday, just prior to the #FOMC meeting

#ECI +1% Q/Q represented a deceleration in employment costs

#Inflation 🔻

The Employment Cost Index #ECI came out on Tuesday, just prior to the #FOMC meeting

#ECI +1% Q/Q represented a deceleration in employment costs

#Inflation 🔻

2b/9

Home prices were also out on Tuesday.

At +8.2% y/y, housing costs continue to decline on an ROC basis

#Inflation 🔻

Home prices were also out on Tuesday.

At +8.2% y/y, housing costs continue to decline on an ROC basis

#Inflation 🔻

2c/9

ISM Manufacturing PMI was out on Fed Day.

At 47.4, the index showed a decal in manufacturing activity even as prices paid 🔺 44.5 from 39.5

#Inflation 🔺

ISM Manufacturing PMI was out on Fed Day.

At 47.4, the index showed a decal in manufacturing activity even as prices paid 🔺 44.5 from 39.5

#Inflation 🔺

2d/9

#JOLTs - a questionable metric - showed an increase in open positions to 11 million

The #FOMC increased the cost of money by 25 bps #Hawish25

#Inflation 🔺and the USD closed at 101.03, a fresh cycle low

#JOLTs - a questionable metric - showed an increase in open positions to 11 million

The #FOMC increased the cost of money by 25 bps #Hawish25

#Inflation 🔺and the USD closed at 101.03, a fresh cycle low

2e/9

On Thursday both the #BOE and #ECB increased rate by 50 bps, perceived as a #Dovish50.

Stateside, initial jobless claims continued to slide to 183,000.

Growth 💪

On Thursday both the #BOE and #ECB increased rate by 50 bps, perceived as a #Dovish50.

Stateside, initial jobless claims continued to slide to 183,000.

Growth 💪

2f/9

Nonfarm business sector labor productivity +3.0 percent in the fourth quarter of 2022 was also out on Thursday.

The USD put in a new low, but finished higher on the day. #Inflation 🔺

Nonfarm business sector labor productivity +3.0 percent in the fourth quarter of 2022 was also out on Thursday.

The USD put in a new low, but finished higher on the day. #Inflation 🔺

2g/9

#NFP showed a surprising surge in new jobs +517K

BUT unit labor cost +1.0% in Q4, +4.5% y/y (down from +5.2%)

Average Hourly Earnings +4.4% y/y, down from +4.8 and continuing to decel

#Inflation 🔻

#NFP showed a surprising surge in new jobs +517K

BUT unit labor cost +1.0% in Q4, +4.5% y/y (down from +5.2%)

Average Hourly Earnings +4.4% y/y, down from +4.8 and continuing to decel

#Inflation 🔻

2g/9

Then at 10:00AM, ISM Services PMI showed an acceleration to 55.2 from 49.2

All hell broke loose, and they unleashed the Kraken

$USD surged immediately on the news and upended my portfolio.

Then at 10:00AM, ISM Services PMI showed an acceleration to 55.2 from 49.2

All hell broke loose, and they unleashed the Kraken

$USD surged immediately on the news and upended my portfolio.

https://twitter.com/tdarling1/status/1621899688252243968?s=20&t=PRrtLfF0JOt11ae-PMcRmQ

3a/9

The $USD surged +1.02% on the week to close above the 50% retracement level of 102.12 but fell short of a buy signal n the weekly.

The $USD remains 🐻 Trend (T) = 3 months, but has my full attention.

The $USD surged +1.02% on the week to close above the 50% retracement level of 102.12 but fell short of a buy signal n the weekly.

The $USD remains 🐻 Trend (T) = 3 months, but has my full attention.

3b/9

In #FX, the $GBP -2.74% and the $AUD -2.67% took the brunt of the USD abuse

Chart: $GBP with a sell signal on the weekly

In #FX, the $GBP -2.74% and the $AUD -2.67% took the brunt of the USD abuse

Chart: $GBP with a sell signal on the weekly

4a/9

Metals also taken to the woodshed with $SILVER -5.12%, $COPPER -3.89% and $GOLD -2.74%

Chart: $COPPER with a weekly sell signal

Metals also taken to the woodshed with $SILVER -5.12%, $COPPER -3.89% and $GOLD -2.74%

Chart: $COPPER with a weekly sell signal

4b/9

Chart: $GOLD with a weekly sell signal.

I hedged my $GLD position with April 165 puts.

Vol cheap at 15.

Chart: $GOLD with a weekly sell signal.

I hedged my $GLD position with April 165 puts.

Vol cheap at 15.

5a/9

If this PMI number signaled a new uptick in #inflation, then why did hydrocarbons get spanked?

$WTIC -7.89% (w) -20.75% (T)

$GASO -10.42% (w) - 15.02% (T)

Chart: $GASO ⛽️ ↘️ to key support at 2.32

If this PMI number signaled a new uptick in #inflation, then why did hydrocarbons get spanked?

$WTIC -7.89% (w) -20.75% (T)

$GASO -10.42% (w) - 15.02% (T)

Chart: $GASO ⛽️ ↘️ to key support at 2.32

5b/9

$NATGAS -15.42% (w) -45.1% YTD

Chart: Natty is -75% since the August high.

Certainly this is NOT inflationary

$NATGAS -15.42% (w) -45.1% YTD

Chart: Natty is -75% since the August high.

Certainly this is NOT inflationary

6/9

Grains fared much better with $SUGAR +2.19%, SOYB +1.49%, WHEAT +0.9%, and $CORN -0.81%

Chart: $DBA +0.96% on last week’s by signal buy still neutral trend

Grains fared much better with $SUGAR +2.19%, SOYB +1.49%, WHEAT +0.9%, and $CORN -0.81%

Chart: $DBA +0.96% on last week’s by signal buy still neutral trend

7a/9

Yields were little changed on the week with the 2Y +11 bps and the 10Y +1 bps bringing the 10/2s to near cycle lows of -77 bps

Don’t get me started on 10Y3M which finished the week -117 bps with the MOVE 98.99 🔻

Chart: 10/2s

Yields were little changed on the week with the 2Y +11 bps and the 10Y +1 bps bringing the 10/2s to near cycle lows of -77 bps

Don’t get me started on 10Y3M which finished the week -117 bps with the MOVE 98.99 🔻

Chart: 10/2s

7b/9

Bond ETFs were little changed on the week with the notable exception of $TIP -0.85% and $IVOL -2.93%

Chart: $IVOL - Interest Rate Volatility EFT tied to TIP - punished

Bond ETFs were little changed on the week with the notable exception of $TIP -0.85% and $IVOL -2.93%

Chart: $IVOL - Interest Rate Volatility EFT tied to TIP - punished

8a/9

🇺🇸 equity indices continued to party with $IWM +3.91%, $COMPQ +3.31%, and $SPX +1.62%

Chart: The most watched chart on the planet, $SPX daily broke both the downtrend line and the 50% retracement level, but could not hold the fib

🇺🇸 equity indices continued to party with $IWM +3.91%, $COMPQ +3.31%, and $SPX +1.62%

Chart: The most watched chart on the planet, $SPX daily broke both the downtrend line and the 50% retracement level, but could not hold the fib

8b/9

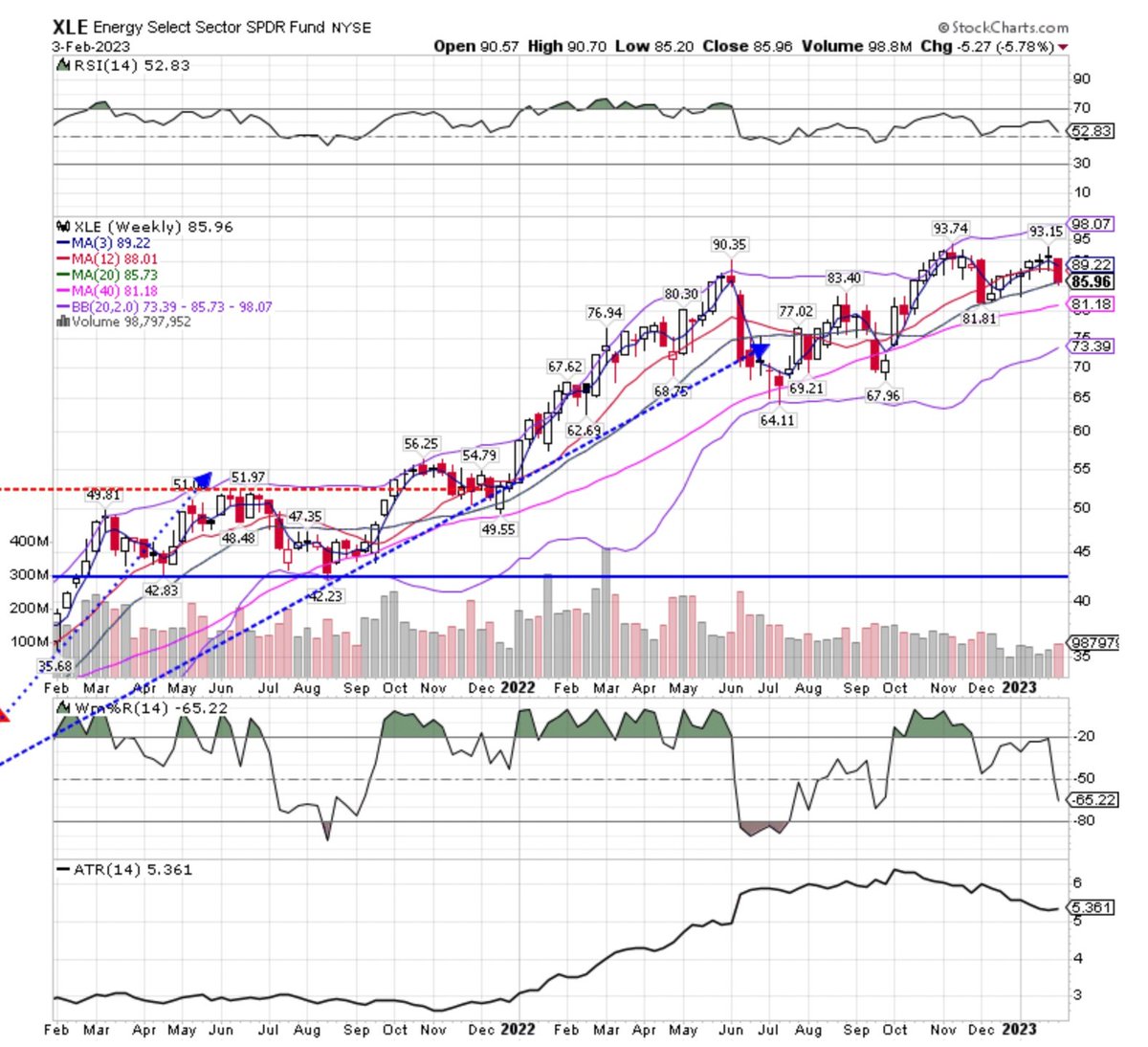

Beneath the surface in sector land, $XLC +5.26% and $XLK +3.71% (2022 laggards) led higher, while $XLE -4.41%

Chart: $XLE with a definitive “get out of Dodge” signal on the weekly

Beneath the surface in sector land, $XLC +5.26% and $XLK +3.71% (2022 laggards) led higher, while $XLE -4.41%

Chart: $XLE with a definitive “get out of Dodge” signal on the weekly

9/9

So, here we are with coincident and trailing data showing inflation 🔻 but the $ISM Services print giving cause for concern.

Will need to keep a sharp eye on the $USD as well as $TNX for the next move.

⚠️🚩 and have a super profitable 💰 week!

So, here we are with coincident and trailing data showing inflation 🔻 but the $ISM Services print giving cause for concern.

Will need to keep a sharp eye on the $USD as well as $TNX for the next move.

⚠️🚩 and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh